Anti-Money Laundering (AML) Market Size, Share Report, Analysis, Trends, Growth 2032

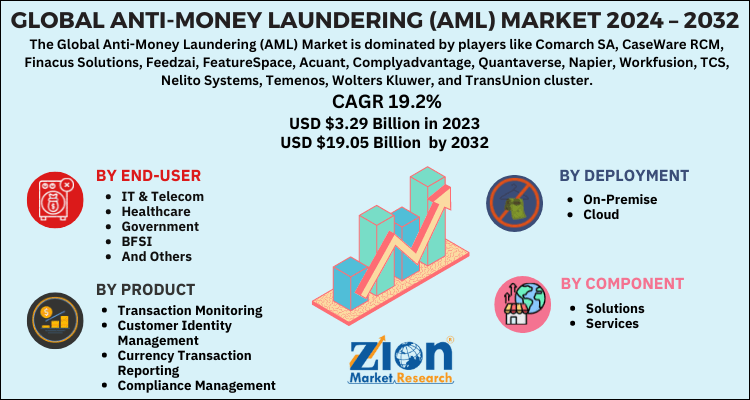

Anti-Money Laundering (AML) Market By end-user (IT & telecom, healthcare, government, BFSI, and others), By deployment (on-premise and cloud), By product (transaction monitoring, customer identity management, currency transaction reporting, and compliance management), By component (services and software) And By Region: - Global And Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts, 2024-2032

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 3.29 Billion | USD 19.05 Billion | 19.2% | 2023 |

Description

Anti-Money Laundering (AML) Market Insights

According to the report published by Zion Market Research, the global Anti-Money Laundering (AML) Market size was valued at USD 3.29 Billion in 2023 and is predicted to reach USD 19.05 Billion by the end of 2032. The market is expected to grow with a CAGR of 19.2% during the forecast period. The report analyzes the global Anti-Money Laundering (AML) Market's growth drivers, restraints, and impact on demand during the forecast period. It will also help navigate and explore the arising opportunities in the Anti-Money Laundering (AML) industry.

Global Anti-Money Laundering (AML) Market: Overview

Anti-money laundering solution assists banks and other financial institutions in examining the customer behaviors for suspected financial activities with advanced automation processes. Different types of anti-money laundering solutions include compliance management, customer identity management, currency transaction reporting, transaction monitoring, and several others. These software helps in conducting real-time monitoring of customer transactions.

Global Anti-Money Laundering (AML) Market: Growth Factors

The growing rules and regulations, along with increasing compliances for anti-money laundering, are likely to steer the growth of the global anti-money laundering (AML) market significantly in the forthcoming years. Government bodies all across the globe have implemented rules and laws to combat money laundering incidences and encounter terrorism funding. For instance, the financial action task force is an intergovernmental community that assists different countries to develop rules to combat these events. Owing to the high prevalence of money laundering cases all across the globe, the companies have started utilizing anti-money laundering solutions to check suspicious data and transactions.

Compliance professionals adopt these software to effectively comply with the rules and policies like the Bank secrecy act of the US, which helps in protecting money laundering-associated crimes. Such software with the help of data gathered from multiple resources also effectively help in managing financial transactions like ERP system and accounting software for lowering money laundering activities. These solutions further enhance the performance in resolving, monitoring, and visualizing suspicious activities and money laundering incidents. The advantages offered by the solutions include enhanced efficiency, faster processing, improved risk protection, and robust data analysis of such cases.

However, the ongoing technological advancements are likely to encourage the growth of the global anti-money laundering (AML) market in the forthcoming years. In addition, the integration of artificial intelligence technology in the solutions, along with the growing adoption of a cloud-based solution, is likely to create several lucrative growth opportunities in the market over the forecasted period. Also, the outbreak of the Covid-19 pandemic has positively impacted the trajectory of the global anti-money laundering (AML) market owing to the steep growth in online sales and payment solutions globally.

Global Anti-Money Laundering (AML) Market: Segmentation

The global anti-money laundering (AML) market can be segmented into end-user, deployment, product, component, and region.

By end-users, the market can be segmented into IT & telecom, healthcare, government, BFSI, and others. The BFSI segment accounts for the largest share in the global market. However, the BFSI sector includes wealth management institutes, digital banking, commercial banking, retail banking, among others. Banks are struggling with the higher risk of financial crimes and fraud stemming from the growing automation and digitalization of financial systems. Therefore, such a significant spike in the statistics of digitalization and online transactions segment is further likely to dominate the global anti-money laundering (AML) market in the forthcoming years.

By deployment, the market can be segmented into on-premise and cloud. The on-premise segment holds hegemony over others because it offers full control over system, data, platform, and applications solely to the organizations. Therefore, it can be easily managed by the in-house staff of the organization. However, the cloud segment is likely to register a significant growth rate over the forecast period as it helps in lowering the cost of the required IT infrastructure. Furthermore, it offers several other benefits like study improvements and flexibility in security features, which in turn is likely to widen the customer base in the near future.

By product, the market can be segmented into transaction monitoring, customer identity management, currency transaction reporting, and compliance management.

By component, the market can be segmented into services and software.

Anti-Money Laundering (AML) Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Anti-Money Laundering (AML) Market |

| Market Size in 2023 | USD 3.29 Billion |

| Market Forecast in 2032 | USD 19.05 Billion |

| Growth Rate | CAGR of 19.2% |

| Number of Pages | 207 |

| Key Companies Covered | Comarch SA, CaseWare RCM, Finacus Solutions, Feedzai, FeatureSpace, Acuant, Complyadvantage, Quantaverse, Napier, Workfusion, TCS, Nelito Systems, Temenos, Wolters Kluwer, and TransUnion cluster |

| Segments Covered | By End-User, By Deployment, By Product, By Component And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Global Anti-Money Laundering (AML) Market: Regional analysis

North America accounts for the largest share in the global anti-money laundering (AML) market due to the presence of key market players in the region. Also, the presence of large banks in the region will further fuel the adoption rate of these software to manage their accounting systems to protect organizations. In addition, the high adoption rate of inorganic strategies by anti-money laundering solution vendors in order to fuel the demand for IT solutions will further accelerate the growth of the regional market.

Europe is expected to be the fastest-growing region in the global anti-money laundering (AML) market due to the ongoing technological advancements along with the rapid upgrades in regulatory norms by the government.

Asia Pacific is also likely to grow fast in the forthcoming years due to the growing initiatives from the government to stop the growing money laundering incidents in the region.

Global Anti-Money Laundering (AML) Market: Competitive Players

Some of the significant players in the global anti-money laundering (AML) market are:

- Comarch SA

- CaseWare RCM

- Finacus Solutions

- Feedzai

- FeatureSpace

- Acuant

- Complyadvantage

- Quantaverse

- Napier

- Workfusion

- TCS

- Nelito Systems

- Temenos

- Wolters Kluwer

- TransUnion cluster.

The Global Anti-Money Laundering (AML) Market is segmented as follows:

By end-user

- IT & telecom

- healthcare

- government

- BFSI

- and others

By deployment

- on-premise

- cloud

By product

- transaction monitoring

- customer identity management

- currency transaction reporting

- compliance management

By component

- services

- software

Global Anti-Money Laundering (AML) Market: Regional Segment Analysis

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

What Reports Provides

- Full in-depth analysis of the parent market

- Important changes in market dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional markets

- Testimonials to companies in order to fortify their foothold in the market.

Table Of Content

Choose License Type

FrequentlyAsked Questions

The growing rules and regulations, along with increasing compliances for anti-money laundering, are likely to steer the growth of the global anti-money laundering (AML) market significantly in the forthcoming years. Government bodies all across the globe have implemented rules and laws to combat money laundering incidences and encounter terrorism funding.

Some of the significant players in the global anti-money laundering (AML) market are Comarch SA, CaseWare RCM, Finacus Solutions, Feedzai, FeatureSpace, Acuant, Complyadvantage, Quantaverse, Napier, Workfusion, TCS, Nelito Systems, Temenos, Wolters Kluwer, and TransUnion cluster.

North America accounts for the largest share in the global anti-money laundering (AML) market due to the presence of key market players in the region. Also, the presence of large banks in the region will further fuel the adoption rate of these software to manage their accounting systems to protect organizations.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed

-market-size.png)