Application Container Market Size, Share, Trends, Growth and Forecast 2034

Application Container Market By Deployment Model (On-Premises and Cloud), By Organization Size (Small and Medium Enterprises and Large Enterprises), By Industry Vertical (IT and Telecommunication, BFSI, Healthcare, Retail, Manufacturing, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

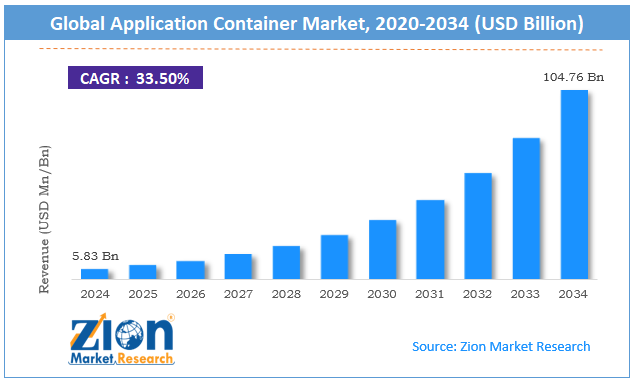

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 5.83 Billion | USD 104.76 Billion | 33.50% | 2024 |

Application Container Industry Prospective:

The global application container market was valued at approximately USD 5.83 billion in 2024 and is expected to reach around USD 104.76 billion by 2034, growing at a compound annual growth rate (CAGR) of roughly 33.50% between 2025 and 2034.

Application Container Market: Overview

Application containers are lightweight, standalone, executable software packages that include everything needed to run an application, like code, runtime, system tools, system libraries, and settings. Containers isolate software from its surrounding environment and ensure that it works uniformly despite differences in development and staging environments.

Unlike traditional virtualization, containers share the host operating system kernel, so they are much more efficient regarding system resources. This allows developers to build once and deploy anywhere, which means huge efficiency gains in development, application portability, and deployment speed.

The container system includes tools like Docker to run containers, Kubernetes to manage many containers, and other tools like Aqua Security to handle security and updates.

The increasing adoption of microservices architecture, the shift toward cloud-native development approaches, and the growing need for efficient resource utilization in IT infrastructure are expected to drive substantial growth in the application container industry over the forecast period.

Key Insights:

- As per the analysis shared by our research analyst, the global application container market is estimated to grow annually at a CAGR of around 33.50% over the forecast period (2025-2034)

- In terms of revenue, the global application container market size was valued at around USD 5.83 billion in 2024 and is projected to reach USD 104.76 billion by 2034.

- The application container market is projected to grow significantly due to the increasing adoption of DevOps practices, the rise of microservices architecture, cloud-native development approaches, and the need for application modernization across industries.

- Based on the deployment model, cloud-based containers lead the segment and will continue to lead the global market.

- Based on organization size, large enterprises are anticipated to command the largest market share.

- Based on industry verticals, IT and telecommunication are expected to lead the market during the forecast period.

- Based on region, North America is projected to lead the global market during the forecast period.

Application Container Market: Growth Drivers

Increasing adoption of microservices architecture and DevOps practices

The global application container market is growing fast as microservices and DevOps are adopted across industries. Organizations that containerize with DevOps deploy faster and recover faster from incidents. The move from monolithic to microservices has created a big demand for container technology supporting this modular development.

Big enterprises are seeing a reduction in development cycles after containerizing microservices. This architectural change and the need for Continuous Integration/Continuous Deployment (CI/CD) pipelines drive container adoption as organizations want to be more agile, scalable, and operationally efficient in application development and deployment.

Cost efficiency and resource optimization benefits

Container technology delivers significant cost savings and resource optimization advantages that drive the expansion of the application container industry. Containerized applications get 50-80% higher server utilization than traditional deployment methods. That means big cost savings on infrastructure spend after moving to containerized deployments.

Containers allow multiple applications to run on the same infrastructure without the overhead of multiple operating systems so that workloads can be consolidated better. The lightweight nature of containers also means faster scaling and less resource waste during varying workload demands.

As organizations continue to prioritize IT budget optimization while maintaining performance, the economics of containerization are the primary growth driver of the market.

Application Container Market: Restraints

Security and compliance concerns

Despite growing adoption, the application container market faces significant challenges related to security vulnerabilities and compliance complexities. Container deployments introduce unique security considerations, including container escape vulnerabilities, shared kernel risks, and container image integrity issues. Security is a primary concern when adopting container technologies.

The dynamic nature of containerized environments, where containers are being created and destroyed all the time, makes traditional security monitoring approaches difficult.

Organizations in highly regulated industries face challenges ensuring compliance with data privacy regulations like GDPR, HIPAA, and PCI-DSS in containerized environments. These are barriers to adoption, especially in sensitive industries like financial services and healthcare, where organizations need to balance innovation with security and compliance requirements.

Application Container Market: Opportunities

Edge computing expansion

The application container industry is experiencing opportunities with the expansion of edge computing architectures across various sectors. The global edge computing market grows annually, creating demand for lightweight, efficient application deployment solutions.

Containers are well-suited for edge environments due to their minimal resource requirements, rapid startup times, and consistent operation across diverse hardware platforms. Major telecommunications providers report that containerized applications at the network edge improved performance for latency-sensitive applications.

Industries, including manufacturing, retail, telecommunications, and healthcare, are increasingly deploying containerized applications at edge locations to process data closer to its source, reduce latency, optimize bandwidth usage, and enable new use cases like real-time analytics, IoT data processing, and customer experiences that were previously infeasible with centralized cloud computing models.

Application Container Market: Challenges

Complexity of container orchestration and management

The application container market faces challenges related to the complexity of container orchestration, particularly in large-scale enterprise deployments. Complexity is a significant barrier to container adoption at scale.

While containerization simplifies application deployment, managing hundreds or thousands of containers across distributed environments is a big operational challenge. Organizations struggle to implement monitoring, logging, networking, persistent storage, and security practices in dynamic containerized environments.

The steep learning curve of container orchestration platforms like Kubernetes creates skill gaps, with industry surveys showing that over 70% of organizations are having trouble finding and retaining talent with container expertise. Organizations must invest in technology and workforce development to overcome these operational complexities and build mature container management practices.

Application Container Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Application Container Market |

| Market Size in 2024 | USD 5.83 Billion |

| Market Forecast in 2034 | USD 104.76 Billion |

| Growth Rate | CAGR of 33.50% |

| Number of Pages | 214 |

| Key Companies Covered | Docker Inc., Red Hat Inc., Google LLC (Google Cloud), Microsoft Corporation, Amazon Web Services, IBM Corporation, VMware Inc., Cisco Systems Inc., Rancher Labs, SUSE, Canonical Ltd., Mirantis Inc., Container Solutions Inc., Portworx (Pure Storage), Enterprise Container Systems, HashiCorp, D2iQ, Platform9 Systems, Distributed Computing Technologies, Mesosphere Inc., and others. |

| Segments Covered | By Deployment Model, By Organization Size, By Industry Vertical, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Application Container Market: Segmentation

The global application container market is segmented into deployment model, organization size, industry vertical, and region.

Based on the deployment model, the market is segregated into on-premises and cloud. Cloud-based containers lead the market due to their flexibility, scalability, and alignment with modern cloud-native development approaches.

Based on organization size, the market is divided into small and medium enterprises and large enterprises. Large enterprises are expected to lead the market during the forecast period due to their greater resources for implementing and managing container technologies at scale.

Based on industry vertical, the application container industry is categorized into IT and telecommunication, BFSI, Healthcare, Retail, Manufacturing, and Others. IT and telecommunication are expected to lead the market due to the inherent alignment between container technologies and software development operations in these sectors.

Application Container Market: Regional Analysis

North America to lead the market

North America leads the global application container market due to its advanced technology ecosystem, high rate of cloud adoption, and presence of major container technology vendors and cloud service providers. The U.S. accounts for around 45% of the global market share, as it was the first to adopt DevOps and has invested heavily in digital transformation across industries.

The region has strong venture capital funding for container-related startups and advanced research programs at major tech companies and academic institutions, which continues to drive innovation in container technology.

Major cloud providers in the region are expanding their container-related services, further strengthening North America’s leadership in this fast-evolving technology space. Additionally, favorable government initiatives supporting cloud-native infrastructure and cybersecurity frameworks have accelerated enterprise-level container adoption across North America's public and private sectors.

As of early 2025, over 60% of Fortune 500 companies in North America have adopted Kubernetes-based container orchestration platforms, reflecting a substantial enterprise shift toward scalable and resilient cloud-native architectures.

Asia Pacific is set to grow significantly.

The Asia Pacific is the fastest-growing region in the application container industry, driven by digital transformation, cloud infrastructure growth, and technology investments in developing economies. Countries like China, India, Singapore, and Japan are leading the charge with significant government and private sector investments in technology modernization. Container adoption in APAC is growing faster than the global average.

The region’s growing software development industry, expanding startup ecosystem, and established enterprises modernizing applications create a huge demand for container technology.

Government initiatives for cloud adoption and digital infrastructure development add to the market momentum. The combination of rapidly growing digital economies, increasing cloud penetration, and growing DevOps maturity, creates a perfect storm for growth across this diverse region.

Recent Market Developments:

- In January 2025, In January 2025, Docker, Inc. announced the appointment of Don Johnson as its new Chief Executive Officer, succeeding Scott Johnston. This leadership change is anticipated to steer Docker's strategic initiatives in containerization and cloud-native technologies.

- In January 2025, In January 2025, Flexera announced its agreement to acquire Spot FinOps and Cloud Infrastructure Products from NetApp, including SpotInst, CloudCheckr, and Fylamynt. The acquisition was completed in early March 2025, enhancing Flexera's cloud management capabilities.

Application Container Market: Competitive Analysis

The global application container market is led by players like:

- Docker Inc.

- Red Hat Inc.

- Google LLC (Google Cloud)

- Microsoft Corporation

- Amazon Web Services

- IBM Corporation

- VMware Inc.

- Cisco Systems Inc.

- Rancher Labs

- SUSE

- Canonical Ltd.

- Mirantis Inc.

- Container Solutions Inc.

- Portworx (Pure Storage)

- Enterprise Container Systems

- HashiCorp

- D2iQ

- Platform9 Systems

- Distributed Computing Technologies

- Mesosphere Inc.

The global application container market is segmented as follows:

By Deployment Model

- On-Premises

- Cloud

By Organization Size

- Small and Medium Enterprises

- Large Enterprises

By Industry Vertical

- IT & Telecommunication

- BFSI

- Healthcare

- Retail

- Manufacturing

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Application containers are lightweight, standalone, executable software packages that include everything needed to run an application, like code, runtime, system tools, system libraries, and settings.

The application container market is expected to be driven by the increasing adoption of microservices architecture, DevOps practices, cloud-native development approaches, application modernization, edge computing expansion, and the growing demand for efficient resource utilization in IT infrastructure.

According to our study, the global application container market was worth around USD 5.83 billion in 2024 and is predicted to grow to around USD 104.76 billion by 2034.

· The CAGR value of the application container market is expected to be around 33.50% during 2025-2034.

· The global application container market will register the highest growth in North America during the forecast period.

Key players in the application container market include Docker Inc., Red Hat Inc., Google LLC (Google Cloud), Microsoft Corporation, Amazon Web Services, IBM Corporation, VMware Inc., Cisco Systems Inc., Rancher Labs, SUSE, Canonical Ltd., Mirantis Inc., Container Solutions Inc., Portworx (Pure Storage), Enterprise Container Systems, HashiCorp, D2iQ, Platform9 Systems, Distributed Computing Technologies, and Mesosphere Inc.

The report comprehensively analyzes the application container market, including an in-depth discussion of market drivers, restraints, emerging trends, regional dynamics, and future growth opportunities. It also examines competitive dynamics, technological innovations, deployment models, and industry-specific applications shaping the container ecosystem.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed