Artificial Intelligence In Banking Market Size, Share Report, Analysis, Trends, Growth, 2032

Artificial Intelligence In Banking Market - By Technology (Deep Learning, Machine Learning, NLP, and Computer Vision), By Application (Customer Service, Financial Advisory, Back Office, Risk Management, and Compliance & Security), and By Region - Global Industry Perspective, Comprehensive Analysis, and Forecast, 2024 - 2032-

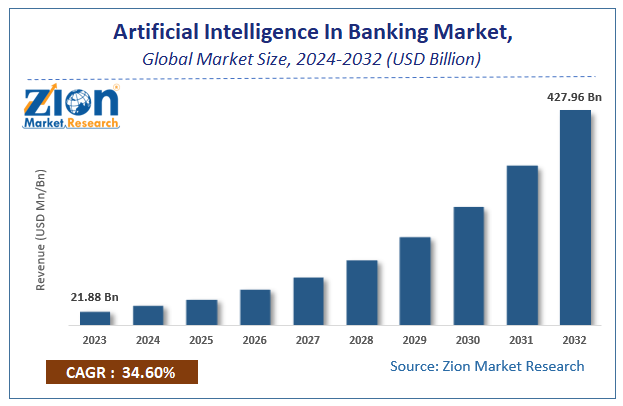

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 21.88 Billion | USD 427.96 Billion | 34.6% | 2023 |

Artificial Intelligence In Banking Market Insights

Zion Market Research has published a report on the global Artificial Intelligence In Banking Market, estimating its value at USD 21.88 Billion in 2023, with projections indicating that it will reach USD 427.96 Billion by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 34.6% over the forecast period 2024-2032. The report explores the factors fueling market growth, the hitches that could hamper this expansion, and the opportunities that may arise in the Artificial Intelligence In Banking Market industry. Additionally, it offers a detailed analysis of how these elements will affect market demand dynamics and market performance throughout the forecast period.

The report offers a valuation and analysis of Artificial Intelligence In Banking market on a global as well as regional level. The study offers a comprehensive assessment of the industry competition, limitations, sales estimates, avenues, current & emerging trends, and industry-validated market data. The report offers historical data from 2018 to 2022 along with a forecast from 2024 to 2032 based on value (USD Billion).

Artificial Intelligence (AI) in Banking Market: Overview

With AI making inroads in banking operations and increasing operational efficiency along with reducing the queues, the use of artificial intelligence in banking industry is going to accelerate over the forecast timespan. Reportedly, banks have started using AI tools for improving customer engagement as well as service personalization. The integration of AI with back-office operations will help banks deliver high-quality services at reduced costs. Apparently, the need for customized fraud identification, effective risk management solutions, and compliance are likely to influence the use of AI in the banking sector over the assessment period.

Artificial Intelligence (AI) in Banking Market: Growth Drivers

With digital disruption taking a front seat, various industries are trying to redefine their operations in line with technological breakthroughs influencing every sphere of business across the globe. Furthermore, the banking industry is no exception to this and hence the utilization of artificial intelligence (AI) in banking industry is projected to increase exponentially over the years ahead. Private and public banks are focusing on improving their service delivery apart from holding a dominant position and this is only possible through the use of new technologies such as AI.

Furthermore, the need for retaining customers, building customer loyalty, creating value for services, and getting new customers along with building effective customer relationships will drive the industry trends. COVID crises have brought a complete transformation in banking operations with banks focusing more on using new technologies such as AI for promoting cashless transactions to avoid physical presence in banks. Apart from this, the growing focus on improving CRM processes along with the adoption of new business models is projected to translate into humungous demand for artificial intelligence (AI) in banking industry over the forthcoming years.

In addition to this, the need for improving customer experience will embellish the size of artificial intelligence (AI) in banking market over the forecast timeline. Nonetheless, huge costs of AI-based solutions are predicted to restrict the expansion of artificial intelligence (AI) in banking industry during the projected timeframe.

However, AI tools help in increasing the revenues of banks by bringing an improvement in the personalization of banking services, reducing the rate of errors, optimizing resource utilization, and generating insights into huge volumes of data. This, in turn, will not only offset the negative impact of hindrances on market growth but will constantly add to the market profitability in the years ahead. The need for reinforcing core technology in financial institutions coupled with the building of strong data infrastructure will create ripples of growth for artificial intelligence (AI) in banking market over the forecasting period.

Artificial Intelligence In Banking Market: Report Scope

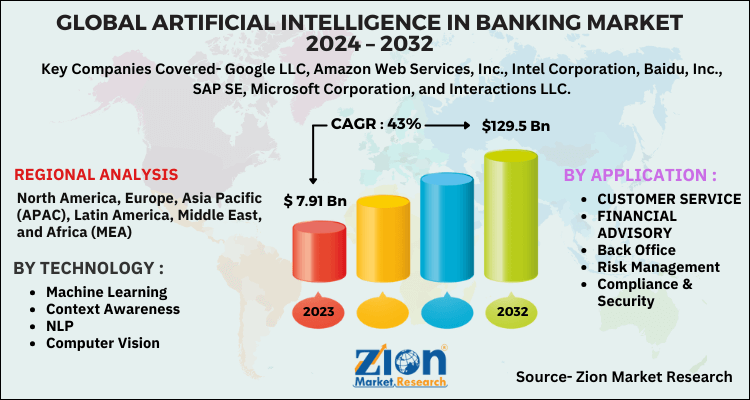

| Report Attributes | Report Details |

|---|---|

| Report Name | Artificial Intelligence In Banking Market Research Report |

| Market Size in 2019 | USD 7.91 Billion |

| Market Forecast in 2026 | USD 129.5 Billion |

| Growth Rate | CAGR of 43% |

| Number of Pages | 255 |

| Forecast Units | Value (USD Billion), and Volume (Units) |

| Key Companies Covered | Google LLC, Amazon Web Services, Inc., Intel Corporation, Baidu, Inc., SAP SE, Microsoft Corporation, and Interactions LLC. |

| Segments Covered | By Application, By Technology, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East and Africa (MEA) |

| Base Year | 2019 |

| Historical Year | 2016 to 2019 |

| Forecast Year | 2020 - 2026 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Artificial Intelligence In Banking Market: Regional Landscape

North America To Make Notable Contributions Towards Market Size By 2032

The growth of artificial intelligence (AI) in banking industry in North America over the assessment period is attributed to the high focus of the banking sector on the use of new technologies. Apart from this, the rise in the need for proficient risk management solutions will further drive the regional market surge over the predicted timeline.

Artificial Intelligence In Banking Market: Competitive Landscape

Key players profiled in the study and leveraging business growth are

- Google LLC

- Amazon Web Services. Inc.

- Intel Corporation

- Baidu. Inc.

- SAP SE

- Microsoft Corporation

- Interactions LLC.

The global Artificial Intelligence In Banking Market is segmented as follows:

By Application:

- CUSTOMER SERVICE

- FINANCIAL ADVISORY

- Back Office

- Risk Management

- Compliance & Security

By Technology:

- Machine Learning

- Computer Vision

- NLP

- Deep Learning

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

With digital disruption taking a front seat, various industries are trying to redefine their operations in line with technological breakthroughs influencing every sphere of business across the globe. Furthermore, banking industry is no exception to this and hence the utilization of artificial intelligence (AI) in banking industry is projected to increase exponentially over the years ahead. Private and public banks are focusing on improving their service delivery apart from holding a dominant position and this is only possible through use of new technologies such as AI.

According to Zion Market Research report, the global Artificial Intelligence In Banking Market, estimating its value at USD 21.88 Billion in 2023, with projections indicating that it will reach USD 427.96 Billion by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 34.6% over the forecast period 2024-2032.

North America is likely to make noteworthy contributions toward overall market revenue. The growth of the industry in the sub-continent over the estimated timespan is attributed high focus of the banking sector on use of new technologies. Apart from this, rise in the need for proficient risk management solutions will further drive the regional market surge over the predicted timeline.

The key players profiled in the report include are Google LLC, Amazon Web Services, Inc., Intel Corporation, Baidu, Inc., SAP SE, Microsoft Corporation, and Interactions LLC.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed