Athletic Apparel Market Size, Share, Trends, Growth and Forecast 2032

Athletic Apparel Market By Sport/Activity Type (Running Apparel, Yoga & Pilates Wear, Fitness & Gym Apparel, Outdoor & Adventure Sports, and Apparel Team Sports Apparel), By Distribution Channel (Online Retail, Offline Retail, Specialty Sports Stores, and Departmental Stores), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

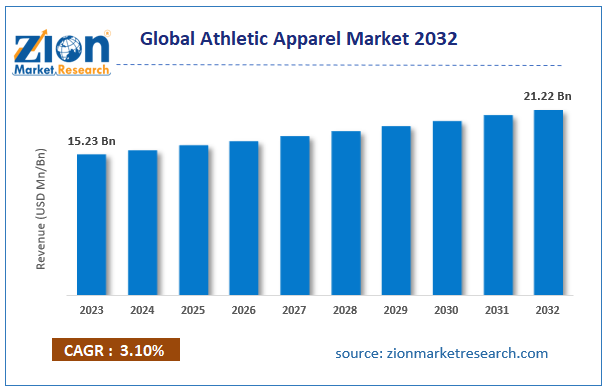

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 15.23 Billion | USD 21.22 Billion | 3.1% | 2023 |

Athletic Apparel Industry Prospective:

The global athletic apparel market size was worth around USD 15.23 billion in 2023 and is predicted to grow to around USD 21.22 billion by 2032 with a compound annual growth rate (CAGR) of roughly 3.1% between 2024 and 2032.

Athletic Apparel Market: Overview

Athletic clothing has gained lots of attention in the last few years as it progressed beyond its traditional uses to a major style phenomenon and cultural fashion. Brands like Nike, Adidas, and Lululemon are playing a major role in transforming sportswear into a lifestyle statement. With the continuous focus on performance, innovation, and style athletic clothing has successfully spanned the gap between sportswear and regular fashion.

Furthermore, the growing trend of athleisure has swiftly moved athletic clothes from health clubs to casual settings. This has also fueled the market expansion in developing countries. Moreover, growing disposable income in developing countries and increasing consumers priority for health and well-being have also driven the desire for versatile, comfortable, and attractive activewear that represents both an active lifestyle and a fashion-forward mindset.

Key Insights

- As per the analysis shared by our research analyst, the global athletic apparel industry is estimated to grow annually at a CAGR of around 3.1% over the forecast period (2024-2032).

- In terms of revenue, the global athletic apparel Market size was valued at around USD 15.23 billion in 2023 and is projected to reach USD 21.22 billion, by 2032.

- The global athletic apparel is projected to grow at a significant rate due to a combination of shifting consumer lifestyles and a growing emphasis on health and wellness.

- Based on sport/activity type segmentation, running apparel was predicted to hold maximum market share in the year 2023.

- Based on distribution channel segmentation, online retail was the leading revenue generator in 2023.

- On the basis of region, Asia Pacific was the leading revenue generator in 2023.

Athletic Apparel Market: Growth Drivers

Combination of shifting consumer lifestyles and a growing emphasis on health and wellness fulling the market expansion.

The athletic apparel industry is expected to be fueled by a combination of shifting consumer lifestyles and the growing athleisure trend. A large number of individuals are shifting towards a lifestyle that is more active and fitness-oriented, and this factor driving the demand for athletic gear that offers overall high performance. For instance, worldwide spending on health and wellness recorded around USD 4.8 trillion in 2022, growing at a rate of 6.4%. Moreover, a report published by the International Health, Racquet & Sportsclub Association (IHRSA) stated that in 2019, the global fitness industry generated USD 94 billion in revenue, with over 184 million members worldwide.

Furthermore, the growing athleisure movement is significantly expanding the athletic apparel industry by breaking down conventional barriers between sportswear and casual clothing. For instance, brands like Nike and Lululemon, have excelled in developing innovative designs that support the desire of modern consumers for flexible, cushy, and visually attractive sportswear. In addition to this, a combination of fashion and function, coupled with social media influence and celebrity endorsements has propelled the sportswear sector ahead. With the growing trend of an active lifestyle, the market is expected to see steady expansion during the forecast period.

Athletic Apparel Market: Restraints

Potential oversaturation and intense competition among brands may limit the market growth.

The athletic apparel industry growth may slow due to the oversaturation and intense rivalry among manufacturers. In the last few years market has seen a tremendous surge in new entrants and cooperation, resulting in increased competition to offer budget-friendly apparel. This growing saturation poses difficulties for both established and emerging businesses to stand out and differentiate themselves in the market. This is also affecting earnings margins and the market share of the established players. Furthermore, the advancements in the clothing industry and the changing fashion sense of buyers in the fashion business force manufacturers to be more responsive.

Another restrain is the environmental and ethical concerns linked with the manufacture of sporting apparel. Most sports apparel manufacturers rely on synthetic compounds that require extensive power. At the same time, customers global level is increasingly asking for green and ethically manufactured products. However, companies that fail to address these issues are at risk of losing their brand and customer trust. As sustainably manufactured products become the key factor in the industry, it becomes more important to adopt more sustainable practices in the supply chain and communicate transparently with environmentally conscious consumers.

Athletic Apparel Market: Opportunities

Growing demand for sustainable and eco-friendly products to provide growth opportunities

The growing desire for sustainable and environmentally friendly products opens up promising prospects in the sportswear industry. As consumers become more aware of environmental issues, there is a growing trend to adopt environmentally friendly techniques and materials in fashion, including sports equipment. Brands that market sustainability through recycled ingredients, reduced manufacturing waste and use of clean production methods will likely benefit from these shifting priorities. This allows companies to meet and exceed customer expectations for ethically created products, while also standing out in a crowded marketplace, thereby expanding their customer base.

Furthermore, sports apparel companies have a substantial opportunity due to the expansion of e-commerce and direct-to-customer channels. Purchase through the internet and the ability to connect with clients swiftly using virtual platforms provide organizations with novel paths to feature their goods, cultivate brand devotion, and acquire important information about customer desires. Brands that put money into a simple online shopping experience, individualized marketing tactics, and inventive digital communication are well-situated to seize the attention of a diverse and worldwide clientele, producing income and enlarging their market influence.

Athletic Apparel Market: Challenges

Rapid pace of changing consumer preferences and trends to challenge market growth

The rapid shifts in consumer preferences and traits pose an exceptional challenge for the athletic apparel industry. This industry is particularly susceptible to fluctuations in fashion and lifestyle decisions, making it difficult for companies to stay ahead of transforming tendencies. This persistent need to assume and react to emerging trends demands adaptability and plasticity, developing a notable test for enterprises aiming to preserve applicability in an unpredictable market.

Inaccurately gauging and pairing merchandise with modifying buyer selections can lead to surplus inventory, reduced earnings margins, and an inability to maintain market share. This highlights the necessity of staying tuned into the consistently evolving landscape of consumer desires.

Athletic Apparel Market: Segmentation

The global athletic apparel market is segmented based on sport/activity type, distribution channel, and region.

Based on sport/activity type, the global market segments are running apparel, yoga & pilates wear, fitness & gym apparel, outdoor & adventure sports, and apparel team sports apparel. The running apparel sector presently dominates the global market. Some of the key factors such as worldwide health and wellness trends, with a rising number of people choosing running as their preferred form of exercise. Running clothing, which is distinguished by specific designs for performance and comfort, is in high demand as people emphasize active lives.

Based on distribution channel the global athletic apparel market is categorized as online retail, offline retail, specialty sports stores, and departmental stores. Because of the expanding trend of e-commerce and customer preference for online purchasing, online retail leads the global sports apparel market distribution channels. The ease, accessibility, and variety of options provided by online platforms have all contributed greatly to their supremacy.

Athletic Apparel Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Athletic Apparel Market |

| Market Size in 2023 | USD 15.23 Billion |

| Market Forecast in 2032 | USD 21.22 Billion |

| Growth Rate | CAGR of 3.1% |

| Number of Pages | 215 |

| Key Companies Covered | Nike Inc., Adidas AG, Under Armour Inc., Puma SE, Lululemon Athletica Inc., ASICS Corporation, Columbia Sportswear Company, VF Corporation (owns brands like The North Face, Vans, and Timberland), New Balance Athletics Inc., Skechers USA Inc., and others. |

| Segments Covered | By Sport/Activity Type, By Distribution Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Athletic Apparel Market: Regional Analysis

Asia Pacific to lead the market during the forecast period

Asia Pacific is anticipated to take the lead in the athletic clothing industry during the forecast period. This is mainly because of strong economic growth, changing lifestyles, and a growing emphasis on health and fitness throughout the region. Countries such as China, India, and Southeast Asia are experiencing huge increases in disposable income, urbanization, and a rising awareness of the need for an active lifestyle. This has resulted in an increased demand for athletic clothing as buyers embrace sportswear not just for exercise but also as a fashion statement. Key global sports gear manufacturers are deliberately expanding their presence in the Asia Pacific region to get into this lucrative market, offering a diverse range of products.

Furthermore, the rise of e-commerce and virtual systems has aided the market's expansion in Asia Pacific. The ease of online shopping and the rising accessibility of global brands via virtual channels have made sports clothing more readily available to buyers all over the world. As the middle-class population grows and consumer preferences develop, Asia Pacific is likely to continue its lead in influencing the trajectory of the global sports apparel industry, providing several possibilities for both local and international players.

China is presently the world's second-largest sports gear market, and it is predicted to overtake the United States by 2027. Domestic brands such as Li-Ning and Peak are gaining ground alongside multinational behemoths. The activewear market in India is expected to reach USD 10 billion by 2025, thanks to rising fitness awareness and the growing popularity of cricket and other sports.

Key Developments

- In October 2023, Adidas launched a collaboration effort with NBA player Donovan Mitchell to promote sustainable techniques in athletic gear manufacturing. Mitchell's influence and Adidas' knowledge are combined in this strategic relationship to create eco-friendly garment lines, raise awareness about environmental challenges, and encourage responsible consumer choices.

- in August 2023, under Armour, known for its performance-driven gear, bought MapMyRun, a famous running and fitness tracking software. Under Armour will be able to combine its gear technology with MapMyRun's data and monitoring capabilities, resulting in a linked fitness ecosystem for runners and fitness aficionados. Under Armour users may benefit from individualized training regimens, performance data, and seamless wearables integration.

- In September 2023, Nike released the next iteration of its self-lacing HyperAdapt sneakers with even more features.

Athletic Apparel Market: Competitive Analysis

The global athletic apparel market is dominated by players like:

- Nike, Inc.

- Adidas AG

- Under Armour, Inc.

- Puma SE

- Lululemon Athletica Inc.

- ASICS Corporation

- Columbia Sportswear Company

- VF Corporation (owns brands like The North Face, Vans, and Timberland)

- New Balance Athletics, Inc.

- Skechers USA, Inc.

The global athletic apparel market is segmented as follows:

By Sport/Activity Type

- Running Apparel

- Yoga & Pilates Wear

- Fitness & Gym Apparel

- Outdoor & Adventure Sports

- Apparel Team Sports Apparel

By Distribution Channel

- Online Retail

- Offline Retail

- Specialty Sports Stores

- Departmental Stores

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Athletic clothing has progressed beyond its utilitarian beginnings to become a major style phenomenon and cultural fashion. Nike, Adidas, and Lululemon have all played significant roles in transforming sportswear into a lifestyle statement. Athletic clothing has successfully spanned the gap between sportswear and regular fashion, with a focus on performance, innovation, and style.

The global athletic apparel market cap may grow owing to the due to combination of shifting consumer lifestyles and a growing emphasis on health and wellness.

According to study, the global athletic apparel market size was worth around USD 15.23 billion in 2023 and is predicted to grow to around USD 21.22 billion by 2032.

The CAGR value of the athletic apparel market is expected to be around 3.1% during 2024-2032.

The global athletic apparel market growth is expected to be driven by Asia Pacific. It is world's most profitable market pushed by a rising emphasis on health and fitness consciousness, a rising middle-class population, and a surge in demand for athleisure wear.

The global athletic apparel market is led by players like Nike, Inc., Adidas AG, Under Armour, Inc., Puma SE, Lululemon Athletica Inc., ASICS Corporation, Columbia Sportswear Company, VF Corporation (owns brands like The North Face, Vans, and Timberland), New Balance Athletics, Inc., and Skechers USA, Inc.

The report analyzes the global athletic apparel market drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the athletic apparel industry.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed