ATM Outsourcing Services Market Size, Share, Growth, Forecast 2030

ATM Outsourcing Services Market By Type [End-to-End Outsourced ATM Services and Individual Services], By Deployment [Mobile ATMs, On-Site ATMs, and Off-Site ATMs], By And By Region - Global And Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts 2023 - 2030-

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 21.35 Billion | USD 27.47 Billion | 3.10% | 2022 |

Description

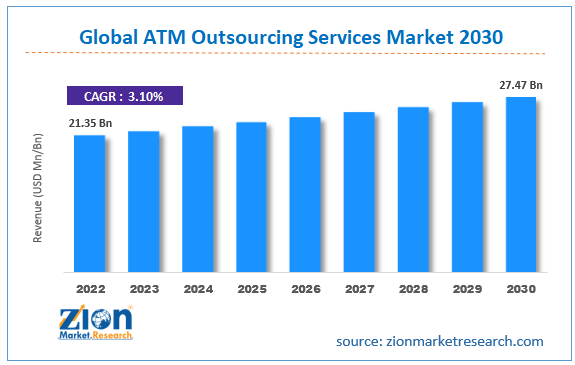

The global ATM outsourcing services market size was worth around USD 21.35 billion in 2022 and is predicted to grow to around USD 27.47 billion by 2030 with a compound annual growth rate (CAGR) of roughly 3.10% between 2023 and 2030.

The report analyzes the global ATM outsourcing services market drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the ATM outsourcing services industry.

Global ATM Outsourcing Services Market: Overview

The banking sector is one of the rapidly growing sectors all over the world. The rising number of customers has significantly increased the burden of money transactions, additional costs on banks, and related queries. This is primarily instigating the attention toward ATM outsourcing from the last few years all over the world. ATM outsourcing services provide timely system updates, cash management, compliance issues, and equipment maintenance. Along with this, other services offered by ATM outsourcing include infrastructure required for ATM, ATM installation, site identification, connectivity support, and also some market players offer FLM & SLM services. ATM outsourcing helps lower capital costs, manage operating expenses, and lower the burden of regulatory compliance.

Global ATM Outsourcing Services Market: Growth Factors

The global ATM outsourcing services market is growing at a significant rate. The factors fueling the growth of the market include the increasing burden of operational costs, server issues, and expansion of ATM services. Banks are facing tremendous burdens of clients, due to the unavailability of ATM services in undeveloped regions number of people visiting banks for money transactions is still increasing. With some operational restrictions, banks are still not able to reach all end-users.

This is one of the major factors propelling the growth of ATM outsourcing in developing regions. Furthermore, maintenance of ATM to assure hassle-free services to customers is also an important part and at the same time hectic for banks, hence banks now prefer to adopt outsourcing options to provide better ATM services. On the other hand, some banks still prefer to maintain their ATM by their professional teams, to ensure security as well as convenience for the customers. Such factors may hinder the growth of the ATM outsourcing services market in the forecast period. However, better service assurance and cost benefits associated with outsourcing the ATM services are expected to provide better growth opportunities to the ATM outsourcing services market.

ATM Outsourcing Services Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | ATM Outsourcing Services Market Research Report |

| Market Size in 2022 | USD 21.35 Billion |

| Market Forecast in 2030 | USD 27.47 Billion |

| Growth Rate | CAGR of 3.10% |

| Number of Pages | 210 |

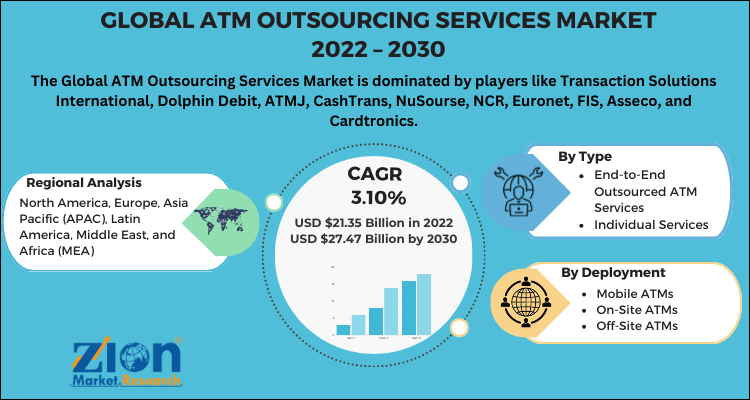

| Key Companies Covered | Transaction Solutions International, Dolphin Debit, ATMJ, CashTrans, NuSourse, NCR, Euronet, FIS, Asseco, and Cardtronics |

| Segments Covered | By Type, By Deployment, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

COVID-19 pandemic situations have severely affected most of the sectors and banking sectors are not an exemption. In the current pandemic situation, the percentage of online money transactions has increased at a significant rate; this has already negatively impacted the use of ATMs. Furthermore, due to the lockdown period, there has been a significant loss in customer gain which has already pulled down revenue in the banking sector, hence new projects or expansion of services has paused by most of the banks all around the world. These factors shortened the demand for ATM outsourcing services. However, several governments around the world have taken effective steps to get back the economy on track which may fuel the growth global ATM outsourcing services market over the forecast period.

Global ATM Outsourcing Services Market: Segmentation

The global ATM outsourcing services market is bifurcated based on type, deployment, and region.

Based on the type, the global ATM outsourcing services market is divided into end-to-end outsourced ATM services and individual services. Individual services are further bifurcated into ATM site maintenance & repair services, ATM cash management services, ATM security services, ATM site outsourcing services, and others.

Based on the deployment, the global ATM outsourcing services market is split into mobile ATMs, on-site ATMs, and off-site ATMs. Among these, the off-site ATMs segment is expected to register rapid growth over the forecast period.

Global ATM Outsourcing Services Market: Competitive Players

Key players operating in the global ATM outsourcing services market are Transaction Solutions International, Dolphin Debit, ATMJ, CashTrans, NuSourse, NCR, Euronet, FIS, Asseco, and Cardtronics among others.

Global ATM Outsourcing Services Market: Regional Analysis

Asia Pacific is expected to set a dominant position in the global ATM outsourcing services market. The major revenue is anticipated to generate from the Southeast Asia Pacific region. Countries such as India and China are expected to be the most lucrative market in the Asia Pacific region. North America and Europe are the major developed market.

The ATM outsourcing services market in North America is anticipated to grow at a healthy rate over the forecast period, while Europe is estimated to generate significant revenue in the global ATM outsourcing services market over the forecast period.

ATM Outsourcing Services Market: Competitive Analysis

The global ATM outsourcing services market is dominated by players like:

- Transaction Solutions International

- Dolphin Debit

- ATMJ

- CashTrans

- NuSourse

- NCR

- Euronet

- FIS

- Asseco

- Cardtronics

The Global ATM Outsourcing Services market is segmented as follows:

By Type

- End-to-End Outsourced ATM Services

- Individual Services

By Deployment

- Mobile ATMs

- On-Site ATMs

- Off-Site ATMs

Global ATM Outsourcing Services Market: Regional Segment Analysis

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

What Reports Provides

- Full in-depth analysis of the parent market

- Important changes in market dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional markets

- Testimonials to companies in order to fortify their foothold in the market.

Table Of Content

FrequentlyAsked Questions

The banking sector is one of the rapidly growing sectors all over the world. The rising number of customers has significantly increased the burden of money transactions, additional costs on banks, and related queries. This is primarily instigating the attention toward ATM outsourcing from the last few years all over the world. ATM outsourcing services provide timely system updates, cash management, compliance issues, and equipment maintenance.

The global ATM outsourcing services market is growing at a significant rate. The factors fueling the growth of the market include the increasing burden of operational costs, server issues, and expansion of ATM services. Banks are facing tremendous burdens of clients, due to the unavailability of ATM services in undeveloped regions number of people visiting banks for money transactions is still increasing.

The global ATM outsourcing services market size was worth around USD 21.35 billion in 2022 and is predicted to grow to around USD 27.47 billion by 2030.

The global ATM outsourcing services market is anticipated to record a CAGR of nearly 3.10% from 2023 to 2030.

Asia Pacific is expected to set a dominant position in the global ATM outsourcing services market. The major revenue is anticipated to generate from the Southeast Asia Pacific region. Countries such as India and China are expected to be the most lucrative market in the Asia Pacific region. North America and Europe are the major developed market.

Key players operating in the global ATM outsourcing services market are Transaction Solutions International, Dolphin Debit, ATMJ, CashTrans, NuSourse, NCR, Euronet, FIS, Asseco, and Cardtronics among others.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed