Automated Dispensing Machines Market Growth, Size, Share, Trends, and Forecast 2032

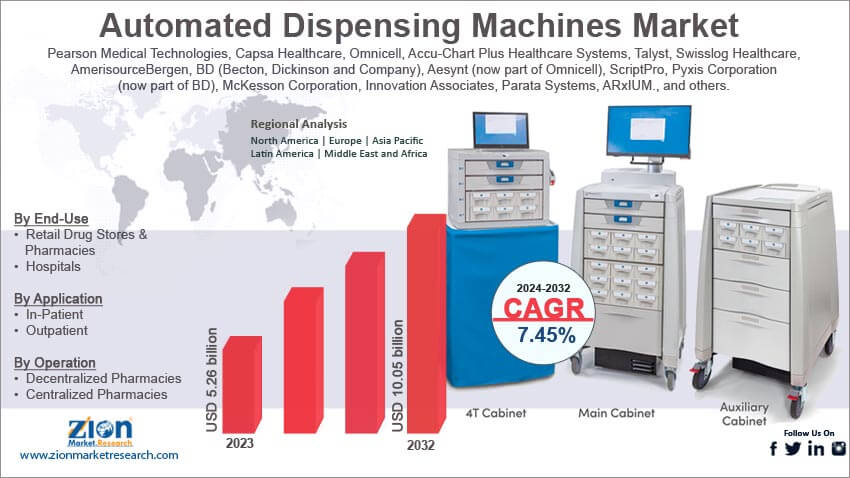

Automated Dispensing Machines Market By End-Use (Retail Drug Stores & Pharmacies, Hospitals, and Others), By Application (In-Patient and Outpatient), By Operation (Decentralized Pharmacies and Centralized Pharmacies), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

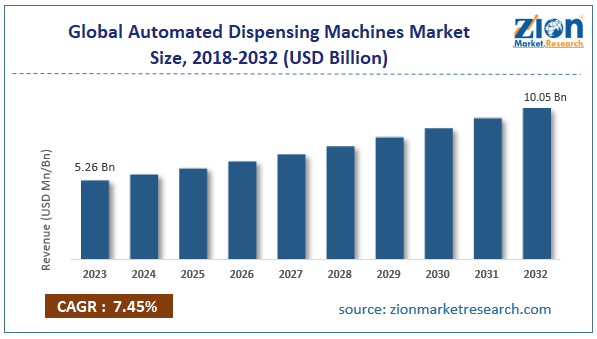

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 5.26 billion | USD 10.05 billion | 7.45% | 2023 |

Automated Dispensing Machines Industry Prospective:

The global automated dispensing machines market size was worth around USD 5.26 billion in 2023 and is predicted to grow to around USD 10.05 billion by 2032 with a compound annual growth rate (CAGR) of roughly 7.45% between 2024 and 2032.

Automated Dispensing Machines Market: Overview

Automated dispensing machines (ADMs) are computerized automatic medicine cabinets placed in healthcare settings such as hospitals and clinics. They are also known as automated dispensing devices (ADD), unit-based cabinets (UBC), or automated dispensing cabinets (ADC). ADMs are used for storing and dispensing information near the point of care. They are useful in tracking and controlling drug distribution thus in a way, contributing to enhancing patient care and reducing the risk of inaccurate drug distribution. Medical inventory can be effectively controlled using ADMs since automated dispensing cabinets can only be accessed by authenticated users. Moreover, these machines keep a record of dispensed medicine. The extended application of ADMs is registered in the reduced paperwork associated with billing. Nurses, on the other hand, can directly feed information into the systems cabinets in case of returned medicines. The information is used for crediting patients' accounts automatically. Unit-based cabinets are considered highly effective when dealing with drugs that are slightly different such as hydromorphone and morphine. Such medicines are frequently confused leading to medicinal errors and impacting the overall health of the patient. The growing digitization in the healthcare sector is expected to drive the market demand during the forecast period

Key Insights:

- As per the analysis shared by our research analyst, the global automated dispensing machines market is estimated to grow annually at a CAGR of around 7.45% over the forecast period (2024-2032)

- In terms of revenue, the global automated dispensing machines market size was valued at around USD 5.26 billion in 2023 and is projected to reach USD 10.05 billion, by 2032.

- The market is projected to grow at a significant rate due to the rising investments in healthcare-related technological improvements

- Based on the end-user, the hospital segment is growing at a high rate and will continue to dominate the global market as per industry projection

- Based on the operation, the centralized pharmacies segment is anticipated to command the largest market share

- Based on region, North America is projected to dominate the global market during the forecast period

Request Free Sample

Request Free Sample

Automated Dispensing Machines Market: Growth Drivers

Rising investments in healthcare-related technological improvements will drive the market growth rate

The global automated dispensing machines market is expected to grow due to the increasing investments in healthcare-related technological advancements. The mounting pressure on the global healthcare infrastructure as a result of the increased need for quality medical care has encouraged healthcare players to experiment and invest in technologies that can help improve patient care. Additionally, COVID-19 played a major role in highlighting the drawbacks of the current healthcare systems across the globe. It also resulted in a high emphasis on ensuring that the healthcare sector continues to invest in new technologies that can assist in carrying out mundane activities such as medicine dispensing while allowing human resources to concentrate on more quality work. For instance, India’s leading hospital brand Fortis Healthcare announced in 2023, its intention to invest around INR 400 in the coming years to be used for infrastructure and capacity development in the country. In 2021, the US recorded an investment of USD 1 trillion as per the American Rescue Plan Act which aims to construct, modernize, and renovate healthcare facilities equipping them with state-of-the-art technologies and necessary patient-care tools. Additionally, patients are demanding improved solutions. Unlike a few years ago, the current patient group has higher awareness about medical solutions and they are demanding enhanced care from hospital facilities.

Rising number of patients globally fuels the market expansion rate

The number of patients across the globe is rising rapidly. Additionally, more people now have access to healthcare since job opportunities and earning capacity have increased. The availability of medical insurance along with higher investments by governments to make healthcare more affordable has resulted in increasing patient footfall in hospitals and clinics thus promoting the demand in the global automated dispensing machines market. In May 2021, the Irish government abolished its two-tier healthcare system and created a universally accessible healthcare system in the form of Sláintecare.

Automated Dispensing Machines Market: Restraints

Lack of pre-administration screening when using ADMs could limit the market expansion rate

The global industry for automated dispensing machines is expected to be restricted due to the lack of screening conducted by pharmacists before the medicines are placed in ADMs. As per research conducted by the Patient Safety Authority (PSA), several reports have emerged suggesting that automated dispensing machines have resulted in errors related to accurate medicine dispersal. Such inaccuracies are a result of proper scanning protocols before placing the medicines in automated dispensing machines from the end of concerned medical professionals. It puts patient safety at risk.

Automated Dispensing Machines Market: Opportunities

Rising launch of new solutions with improved features will create more growth opportunities

The global automated dispensing machines market is expected to witness high growth opportunities due to the increasing launch of new solutions with improved features. The growing research on integrating Artificial Intelligence (AI) features and ADMs will help the market flourish at an unprecedented rate. In October 2023, an affiliate arm of Hanmi Science, JVM, launched a modernized automated dispensing machine equipped with a robotic arm. The ADM was launched in Europe thus allowing the company to expand its global footprint. The new launch by JVM is called MENITH and is one of the next-generation products developed by the firm. Manufacturers are working on improving product accuracy, efficiency, and safety. For instance, in May 2021, Northern Lights Regional Health Centre (NLRHC) launched a novel automated dispensing machine with real-time medication tracking and higher security features.

Expansion into new territories and international collaborations hold high-growth avenues

The global automated dispensing machines industry players can expect high growth avenues by expanding into new territories, especially across international borders. The growing collaboration between healthcare companies and information technology system developers is likely to hold exceptional growth potential during the forecast period.

Automated Dispensing Machines Market: Challenges

High cost of investments will challenge the market expansion rate

The global market for automated dispensing machines is expected to be challenged by the high cost of developing ADMs. Automated dispensing tools are designed using sophisticated technology and do not have any room for error. Additionally, a major concern for the industry players is to avoid excessive overriding in terms of profiling of the patient since it can lead to severe allergic reactions.

Automated Dispensing Machines Market: Segmentation

The global automated dispensing machines market is segmented based on end-use, application, operation, and region.

Based on end-use, the global market segments are retail drug stores & pharmacies, hospitals, and others. In 2023, the highest growth was registered in the hospitals segment. The growing cases of medication errors in hospitals due to the lack of automated solutions are resulting in a higher emphasis on the adoption of ADMs globally. Moreover, the rising shortage of skilled medical professionals and the need to develop patient-friendly solutions will drive the segmental demand in the coming years. As per market projections, the total number of healthcare professionals globally is expected to drop by 10 million by the end of 2030.

Based on application, the global automated dispensing machines industry is segmented into in-patient and outpatient.

Based on operation, the global industry segments are decentralized pharmacies and centralized pharmacies. In 2023, the highest demand was registered in the centralized pharmacies sector. Factors such as the need for streamlining and accurate resource allocation, ensuring that the medicines are available on time, and the demand for solutions to reduce overall costs will drive the segmental growth rate in the projection period. The US Food and Drug Administration typically receives around 100,000 incidents of medication errors.

Automated Dispensing Machines Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Automated Dispensing Machines Market |

| Market Size in 2023 | USD 5.26 Billion |

| Market Forecast in 2032 | USD 10.05 Billion |

| Growth Rate | CAGR of 7.45% |

| Number of Pages | 223 |

| Key Companies Covered | Pearson Medical Technologies, Capsa Healthcare, Omnicell, Accu-Chart Plus Healthcare Systems, Talyst, Swisslog Healthcare, AmerisourceBergen, BD (Becton, Dickinson and Company), Aesynt (now part of Omnicell), ScriptPro, Pyxis Corporation (now part of BD), McKesson Corporation, Innovation Associates, Parata Systems, ARxIUM., and others. |

| Segments Covered | By End-Use, By Application, By Operation, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Automated Dispensing Machines Market: Regional Analysis

North America to register the highest growth rate during the forecast period

The global automated dispensing machines market will be led by North America during the forecast period. The US and Canada regions will dominate the regional market growth rate. The US has a robust healthcare infrastructure and witnesses continuous investments, research, and development in technological innovation. The US Federal government ensures that more funds are allotted for improving patient care. Additionally, the growing rate of healthcare technological transformation helps in promoting the adoption of automated dispensing machines. The rising number of medical patients, higher access to primary medical care, and the growing need to reduce medication errors will be essential in driving the regional growth rate. Europe is an important market for ADMs. The region has registered a surge in the number of new ADM launches in the last few years. The growing pressure on the regional healthcare industry as well as the rising discontent among medical professionals in several European countries about the excess work with less pay will open more avenues for adoption of ADMs in these countries. London-based Synergy Medical announced the launch of SynMed Ultra, its latest offering in automated pharmacy systems. The new solution is highly effective in dispensing solid oral medications.

Automated Dispensing Machines Market: Competitive Analysis

The global automated dispensing machines market is led by players like :

- Pearson Medical Technologies

- Capsa Healthcare

- Omnicell

- Accu-Chart Plus Healthcare Systems

- Talyst

- Swisslog Healthcare

- AmerisourceBergen

- BD (Becton

- Dickinson and Company)

- Aesynt (now part of Omnicell)

- ScriptPro

- Pyxis Corporation (now part of BD)

- McKesson Corporation

- Innovation Associates

- Parata Systems

- ARxIUM.

The global automated dispensing machines market is segmented as follows:

By End-Use

- Retail Drug Stores & Pharmacies

- Hospitals

By Application

- In-Patient

- Outpatient

By Operation

- Decentralized Pharmacies

- Centralized Pharmacies

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Automated dispensing machines (ADMs) are computerized automatic medicine cabinets placed in healthcare settings such as hospitals and clinics.

The global automated dispensing machines market is expected to grow due to the increasing investments in healthcare-related technological advancements.

According to study, the global automated dispensing machines market size was worth around USD 5.26 billion in 2023 and is predicted to grow to around USD 10.05 billion by 2032.

The CAGR value of automated dispensing machines market is expected to be around 7.45% during 2024-2032.

The global automated dispensing machines market will be led by North America during the forecast period.

The global automated dispensing machines market is led by players like Pearson Medical Technologies, Capsa Healthcare, Omnicell, Accu-Chart Plus Healthcare Systems, Talyst, Swisslog Healthcare, AmerisourceBergen, BD (Becton, Dickinson and Company), Aesynt (now part of Omnicell), ScriptPro,Pyxis Corporation (now part of BD), McKesson Corporation, Innovation Associates, Parata Systems and ARxIUM.

The report explores crucial aspects of the automated dispensing machines market including detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed