Automated Investment Platforms Market Size, Share, Analysis, Trends, Growth, 2032

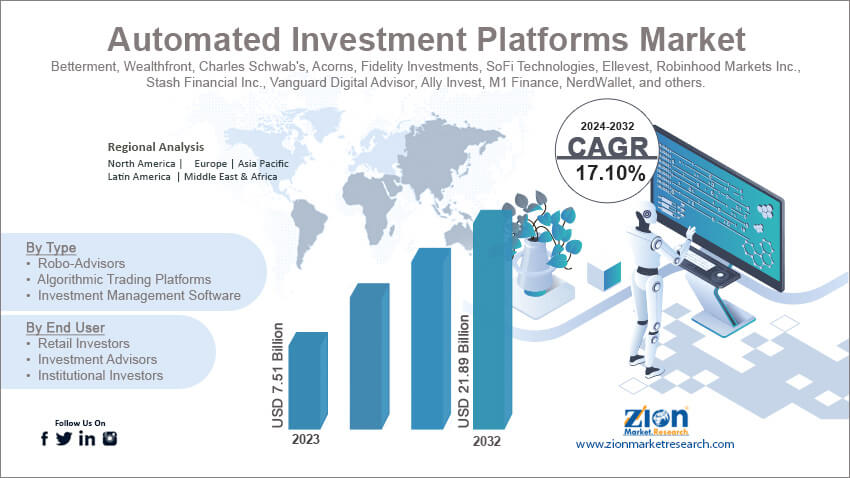

Automated Investment Platforms Market By Type (Robo-Advisors, Algorithmic Trading Platforms, and Investment Management Software), By End-User (Retail Investors, Investment Advisors, and Institutional Investors), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032-

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

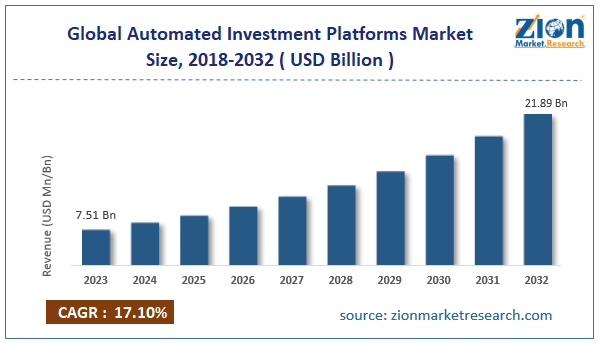

| USD 7.51 Billion | USD 21.89 Billion | 17.10% | 2023 |

Automated Investment Platforms Industry Prospective:

The global automated investment platforms market size was worth around USD 7.51 billion in 2023 and is predicted to grow to around USD 21.89 billion by 2032 with a compound annual growth rate (CAGR) of roughly 17.10% between 2024 and 2032.

Automated Investment Platforms Market: Overview

An algorithmic platform that manages users' personal money automatically is called a robo-advisor. They respond to online questions about risk tolerance and personal financial goals rather than seeking advice from a licensed counselor. Using this data, the robo-advisor creates a customized investment portfolio and automatically allocates the client's cash among a range of assets; inexpensive exchange-traded funds (ETFs) are frequently used.

First-time investors or those with a long-term buy-and-hold strategy will find robo-advisors perfect due to their laissez-faire approach. They also usually offer reduced costs as compared to traditional consultants. Though they usually don't provide the same level of individualized counsel as a human advisor, robo-advisors might not be appropriate for more complicated financial situations.

Key Insights

- As per the analysis shared by our research analyst, the global automated investment platforms market is estimated to grow annually at a CAGR of around 17.10% over the forecast period (2024-2032).

- In terms of revenue, the global automated investment platforms market size was valued at around USD 7.51 billion in 2023 and is projected to reach USD 21.89 billion by 2032.

- The increasing product launch is expected to drive the Automated Investment Platforms industry over the forecast period.

- Based on the type, the robo-advisors segment is expected to hold the largest market share over the forecast period.

- Based on the end user, the institutional investor segment is expected to capture the largest market share over the projected period.

- Based on region, North America is expected to dominate the market during the forecast period.

Request Free Sample

Request Free Sample

Automated Investment Platforms Market: Growth Drivers

Emergence of robo-advisory services care drives market growth

The increasing use of smartphones and the growing number of internet users worldwide have led to a notable uptake of robo-advising services in recent times. Additionally, because they give consumers fast, affordable options for investing in funds, robo-advising services are handy and frequently used by investors. This factor significantly helps the expansion of the robo-advisory market.

Furthermore, robo-advisors use cutting-edge technology like data analytics, machine learning, and artificial intelligence (AI) to provide automated investment recommendations. These technological advancements allow robo-advisors to analyze large volumes of data, evaluate market patterns, and deliver customers customized investment advice.

As these technologies become more advanced, robo-advising platforms become more accurate and efficient, drawing in more investors. Thus, the benefits of robo-advisory drive the growth of the automated investment platforms market.

Automated Investment Platforms Market: Restraints

Cybersecurity threats hinder market growth

Trading platforms with AI capabilities manage vast amounts of confidential financial data, which makes them appealing targets for data breaches and cyberattacks. Strong cybersecurity measures, like encryption, intrusion detection systems, and access controls, are essential to guard against data theft, illegal access, and trading algorithm manipulation.

Additionally, data handling procedures inside AI-powered trading platforms have become more sophisticated to comply with data protection standards like the CCPA and GDPR. Thus, this is expected to hamper the automated investment platforms industry.

Automated Investment Platforms Market: Opportunities

Growing product launches offer a lucrative opportunity for market growth

The growing product launch is expected to offer a lucrative opportunity for the growth of the automated investment platforms market during the forecast period. In October 2024, Earnix Lending Plus is an end-to-end AI-driven software platform that combines automated credit risk decisions with sophisticated pricing analytics, price optimization, and simulation capabilities in a single solution. Earnix is the leading global provider of intelligent decision-making SaaS solutions for financial services.

Without relying on IT, the platform enables lenders to automate loan pricing and approvals through machine learning-based credit scorecards, update rates, and apply credit policy enhancements as needed. Lenders can also simulate the effects and interactions of pricing and credit strategies by utilizing Earnix's advanced analytical framework.

Automated Investment Platforms Market: Challenges

Market volatility risk poses a major challenge to market expansion

Particularly when using algorithmic trading strategies or high-frequency trading, AI-powered trading algorithms have the potential to increase systemic risks and amplify market volatility. Market participants and regulators face difficulties in managing systemic risks due to the possibility of cascading effects and instability resulting from the interconnectedness of trading algorithms and the rapid changes in market dynamics. Therefore, the market volatility risk poses a major challenge for the automated investment platforms market.

Automated Investment Platforms Market: Segmentation

The global automated investment platform industry is segmented based on type, end-user, and region.

Based on the type, the global automated investment platform market is segmented into robo-advisors, algorithmic trading platforms, and investment management software. The robo-advisors segment is expected to hold the largest market share over the forecast period.

The need for automated investment platforms primarily comes from younger generations, particularly millennials, who are more accustomed to digital financial services. Because these tech-savvy consumers find robo-advisors affordable, user-friendly, and convenient, their user base and revenue stream are expanding.

Furthermore, the increasing acceptance of passive investment approaches, like index fund investing, is consistent with the services that robo-advisors typically provide. By providing automated, algorithm-driven portfolio management, these platforms take advantage of the trend and appeal to investors looking for long-term, low-maintenance investment options.

Based on the end user, the global automated investment platforms industry is bifurcated into retail investors, investment advisors, and institutional investors. The institutional investors segment is expected to capture the largest market share over the projected period. The capacity to base investment choices on vast databases of financial information is highly valued by institutional investors.

AI and big data analytics-driven automated platforms enable organizations to use enormous volumes of data to spot patterns, improve portfolio performance, and strengthen risk management. The demands of institutional investors for accuracy and effectiveness in their investing strategies are well met by this data-driven approach.

Moreover, institutional investors handling sizable portfolios find automated platforms appealing due to their great scalability. By effectively managing a broad range of assets across many markets through the use of algorithms, these platforms enable institutions to grow their investment operations without having to correspondingly raise infrastructure or human expenditures. Thereby driving the segment growth.

Automated Investment Platforms Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Automated Investment Platforms Market |

| Market Size in 2023 | USD 7.51 Billion |

| Market Forecast in 2032 | USD 21.89 Billion |

| Growth Rate | CAGR of 17.10% |

| Number of Pages | 219 |

| Key Companies Covered | Betterment, Wealthfront, Charles Schwab's, Acorns, Fidelity Investments, SoFi Technologies, Ellevest, Robinhood Markets Inc., Stash Financial Inc., Vanguard Digital Advisor, Ally Invest, M1 Finance, NerdWallet, and others. |

| Segments Covered | By Type, By End User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Automated Investment Platforms Market: Regional Analysis

North America dominates the market over the projected period

North America is expected to lead the global Automated Investment Platforms market growth during the forecast period. Large tech companies, academic institutions, and tech startups all call it home, and these entities are at the forefront of advances in data analytics, AI, and machine learning. Investment from both domestic and foreign markets is drawn to this innovation ecosystem, which also promotes the creation of cutting-edge trading systems driven by AI.

Moreover, venture capital firms, extensive capital markets, institutional investors, and willing funding sources for cutting-edge businesses and technological projects are all part of North America's highly developed financial ecosystem. Because funding is readily available, producers of AI-powered trading platforms may fund R&D, infrastructure, and hiring new employees, which spurs innovation in products and growth in markets.

Operators of AI-powered trading platforms and investors can also benefit from the clarity and stability that North America's well-established regulatory frameworks for financial markets offer. Therefore driving the regional expansion of the market.

Automated Investment Platforms Market: Competitive Analysis

The global automated investment platforms market is dominated by players like:

- Betterment

- Wealthfront

- Charles Schwab's

- Acorns

- Fidelity Investments

- SoFi Technologies

- Ellevest

- Robinhood Markets Inc.

- Stash Financial Inc.

- Vanguard Digital Advisor

- Ally Invest

- M1 Finance

- NerdWallet

The global automated investment platforms market is segmented as follows:

By Type

- Robo-Advisors

- Algorithmic Trading Platforms

- Investment Management Software

By End User

- Retail Investors

- Investment Advisors

- Institutional Investors

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

An algorithmic platform that manages users' personal money automatically is called a robo-advisor. They respond to online questions about risk tolerance and personal financial goals rather than seeking advice from a licensed counselor. Using this data, the robo-advisor creates a customized investment portfolio and automatically allocates the client's cash among a range of assets; inexpensive exchange-traded funds (ETFs) are frequently used. First-time investors or those with a long-term buy-and-hold strategy will find robo-advisors perfect due to their laissez-faire approach. They also usually offer reduced costs as compared to traditional consultants. Though they usually don't provide the same level of individualized counsel as a human advisor, robo-advisors might not be appropriate for more complicated financial situations.

The global automated investment platforms market is being driven by several factors including rising technological advancements, increasing product launches, rising integration with advanced technology, popularity in the millennial population, and others.

According to the report, the global automated investment platforms market size was worth around USD 7.51 billion in 2023 and is predicted to grow to around USD 21.89 billion by 2032.

The global automated investment platforms market is expected to grow at a CAGR of 17.10% during the forecast period.

The global automated investment platforms market growth is expected to be driven by North America. It is currently the world’s highest revenue-generating market due to the presence of the major players.

The global automated investment platforms market is dominated by players like Betterment, Wealthfront, Charles Schwab's, Acorns, Fidelity Investments, SoFi Technologies, Ellevest, Robinhood Markets, Inc., Stash Financial, Inc., Vanguard Digital Advisor, Ally Invest, M1 Finance and NerdWallet among others.

The automated investment platforms market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed