Automotive Telematics Market Size, Share, Trends, Growth 2034

Automotive Telematics Market By Type (Embedded, Tethered, and Integrated), By Service (Safety and Security, Information and Navigation, Diagnostics and Tracking, and Entertainment), By Vehicle Type (Passenger Cars and Commercial Vehicles), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

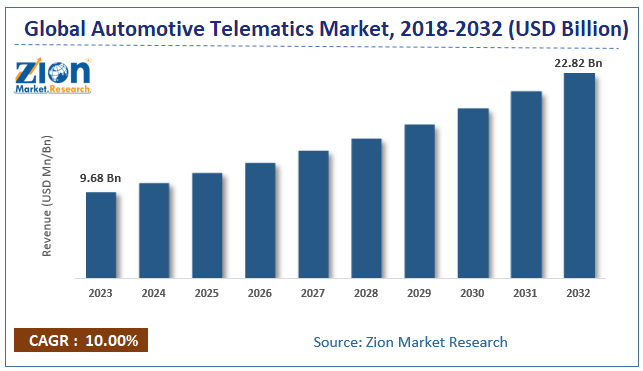

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 9.05 Billion | USD 23.69 Billion | 10.10% | 2024 |

Automotive Telematics Industry Prospective:

The global automotive telematics market was valued at approximately USD 9.05 billion in 2024 and is expected to reach around USD 23.69 billion by 2034, growing at a compound annual growth rate (CAGR) of roughly 10.10% between 2025 and 2034.

Automotive Telematics Market: Overview

Automotive telematics is the integrated application of telecommunications, information processing, and vehicular technologies to enable the transmission of data to and from vehicles. This technology combines GPS systems, cellular connectivity, sensors, and software to gather, process, and send information about your vehicle.

Modern telematics systems provide various functionalities, including real-time vehicle tracking, remote diagnostics, predictive maintenance alerts, driver behavior monitoring, emergency assistance, navigation services, and entertainment options.

Telematics revolutionized fleet management, usage-based insurance, and vehicle maintenance. It created a data-rich environment where car manufacturers, service providers, and other stakeholders can develop more sophisticated services and business models around vehicle connectivity.

The rapid expansion of connected vehicle technologies, increasing regulatory mandates for vehicle safety features, and growing demand for advanced driver assistance systems are expected to drive substantial growth in the automotive telematics industry over the forecast period.

Key Insights:

- As per the analysis shared by our research analyst, the global automotive telematics market is estimated to grow annually at a CAGR of around 10.10% over the forecast period (2025-2034)

- In terms of revenue, the global automotive telematics market size was valued at around USD 9.05 billion in 2024 and is projected to reach USD 23.69 billion by 2034.

- The automotive telematics market is projected to grow significantly due to the rising demand for connected vehicles, increasing adoption of IoT in the automotive sector, and continuous technological advancements in telematics solutions.

- Based on type, embedded telematics lead the segment and will continue to dominate the global market.

- Based on service, safety, and security services are anticipated to command the largest market share.

- Based on vehicle type, passenger cars are expected to lead the market during the forecast period.

- Based on region, North America is projected to dominate the global market during the forecast period.

Automotive Telematics Market: Growth Drivers

Increasing regulatory mandates for vehicle safety and connectivity

The global automotive telematics market is experiencing robust growth driven by expanding regulatory requirements for vehicle safety features and connectivity across major automotive markets. The European Union's eCall regulation, which requires all new vehicles to be equipped with automatic emergency calling systems, has accelerated telematics adoption across European markets.

Similar laws are emerging in other regions, such as Russia's ERA-GLONASS system, Brazil's CONTRAN 245 vehicle tracking requirement, and China's initiatives for connected vehicle standards. Statistical data from regulatory impact assessments shows that telematics-enabled emergency notification systems reduce emergency response time by 40-50% on average and can save thousands of lives annually.

As governments worldwide prioritize road safety through technology mandates, regulatory-driven demand for automotive telematics will continue to grow beyond consumer preference.

Rising demand for connected vehicle services and features

Consumer expectations for seamless connectivity and digital experiences have become significant drivers in the automotive telematics market. According to automotive consumer preference studies and analyses from organizations like J.D. Power, new vehicle buyers now consider connectivity features important in their purchase decisions, which is higher among younger demographics. Vehicle manufacturers report that connected features increase customer satisfaction scores by 15-20% and improve brand loyalty metrics.

The expansion of smartphone integration, voice control systems, and cloud-based services has created consumer expectations that vehicles will be an extension of their digital lives. Premium telematics provides features with consumers demonstrating willingness to pay subscription fees for advanced services, including real-time traffic information, remote vehicle control, over-the-air updates, and personalized in-vehicle experiences.

As digital natives become the dominant car-buying demographic, consumer demand for connected experiences continues accelerating telematics adoption across all vehicle segments, from economy to luxury.

Automotive Telematics Market: Restraints

Data privacy and cybersecurity concerns

Despite the growth of the automotive telematics industry, there are significant challenges around data privacy and cybersecurity in connected vehicles. According to cybersecurity research and industry reports, connected vehicles can generate up to 25GB of data an hour, raising questions about data ownership, usage rights, and privacy. Consumer surveys show vehicle owners worry about how manufacturers, insurance companies, and third parties use their driving data.

The increasing connectivity of vehicles has expanded the attack surface for cyber threats. Research has shown vulnerabilities in telematics control units, communication protocols, and backend systems. High-profile remote vehicle hacking demos have brought consumer and regulatory attention to automotive cybersecurity.

The combination of evolving privacy regulations like GDPR in Europe and CCPA in California and growing awareness of cybersecurity risks means manufacturers and service providers must navigate a complex risk landscape to develop next-generation telematics solutions.

Automotive Telematics Market: Opportunities

Integration with advanced driver assistance systems and autonomous vehicles

The automotive telematics market opens significant opportunities with ADAS and emerging autonomous vehicle technologies. Cloud-connected telematics enables functions like high-definition map updates, swarm intelligence from vehicle fleets, remote monitoring, and over-the-air software updates.

Studies show that telematics data sharing between vehicles can improve collision avoidance system effectiveness by knowing what is happening beyond the sensor's immediate range. Major automotive manufacturers and technology companies are investing heavily in telematics-ADAS platforms as the foundation of their autonomous vehicle roadmaps.

As vehicles move up the automation levels, telematics becomes a must-have rather than a nice-to-have, so there are big opportunities in premium telematics solutions with advanced data processing and high bandwidth connectivity to support autonomous functions.

Automotive Telematics Market: Challenges

Technology fragmentation and standardization issues

The automotive telematics industry faces ongoing challenges related to technological fragmentation across vehicle platforms, connectivity standards, and service ecosystems.

The lack of universal telematics standards creates huge integration challenges for service providers. Vehicle manufacturers implement proprietary telematics platforms with unique protocols, data formats, and service architectures, creating barriers to compatibility between different vehicle brands and models. This fragmentation makes it hard for third-party applications and services to work across multiple vehicle platforms. Industry surveys show that telematics service providers cite interoperability as a major barrier to market growth.

The resulting technology fragmentation increases development costs, complicates service delivery, and confuses consumers in navigating different connectivity approaches across vehicle brands.

Automotive Telematics Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Automotive Telematics Market |

| Market Size in 2024 | USD 9.05 Billion |

| Market Forecast in 2034 | USD 23.69 Billion |

| Growth Rate | CAGR of 10.10% |

| Number of Pages | 211 |

| Key Companies Covered | Robert Bosch GmbH, Continental AG, Verizon Connect, AT&T Inc., Geotab Inc., TomTom International BV, Trimble Inc., Visteon Corporation, LG Electronics, MiX Telematics, Harman International (Samsung), Octo Telematics, Airbiquity Inc., Teletrac Navman, DENSO Corporation, ConnectedDrive Technologies, AutoConnect Solutions, VehicleSense Systems, CalAmp, Omnitracs LLC., and others. |

| Segments Covered | By Type, By Service, By Vehicle Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Automotive Telematics Market: Segmentation

The global automotive telematics market is segmented into type, service, vehicle type, and region.

Based on type, the market is segregated into embedded, tethered, and integrated systems. Embedded telematics lead the market with the largest share due to their reliability, seamless functionality, and ability to operate independently from other devices.

Based on service, the market is divided into safety and security, information and navigation, diagnostics and tracking, and entertainment. Safety and security services are expected to lead the market during the forecast period due to regulatory requirements and high consumer valuation of these capabilities.

Based on vehicle type, the automotive telematics industry is categorized into passenger cars and commercial vehicles. Passenger cars are expected to lead the market due to higher production volumes and stronger consumer demand for connectivity features in personal vehicles.

Automotive Telematics Market: Regional Analysis

Asia Pacific to lead the market

Asia-Pacific is leading the global automotive telematics market due to fast technology adoption, expanding telecommunication infrastructure, and aggressive connected vehicle services implementation. China accounts for about 35% of the global market share, driven by strong consumer demand, a mature telematics ecosystem, and big investments from prominent automotive and technology companies.

According to automotive industry reports and market research from the China Association of Automobile Manufacturers, Asia-Pacific consumers are the fastest to pay a premium for connected vehicle features, with new vehicle buyers asking for telematics.

The region's dynamic innovation environment, expanding 5G network coverage, and multiple telematics service providers create perfect conditions for advanced services development. Major regional automakers are offering more advanced telematics packages as standard features. Even in entry-level vehicles, telematics is going mainstream.

Europe is set to grow significantly.

Europe represents a robust and growing automotive telematics market driven by stringent regulatory requirements, strong technology infrastructure, and high consumer awareness of connected vehicle benefits.

The region's focus on environmental sustainability creates demand for telematics that optimize routing, reduce emissions, and support electric vehicle infrastructure. Strong consumer privacy protections under GDPR have driven the development of privacy by design in telematics implementations.

The extensive cross-border travel within the European Union has accelerated demand for seamless telematics services that function across national boundaries without interruption.

European automotive manufacturers have pioneered advanced driver assistance systems that integrate with telematics platforms, creating comprehensive safety ecosystems that attract safety-conscious consumers.

Recent Market Developments:

- In March 2025, the European Commission is set to propose draft legislation aimed at granting fair access to vehicle data for insurers, leasing companies, and repair shops.

- In April 2025, in response to concerns from Germany's antitrust authority, Google agreed to unbundle its Automotive Services, including Google Maps, Google Play, and Google Assistant, allowing carmakers to choose individual features and integrate rival services into in-vehicle infotainment platforms.

Automotive Telematics Market: Competitive Analysis

The global automotive telematics market is led by players like:

- Robert Bosch GmbH

- Continental AG

- Verizon Connect

- AT&T Inc.

- Geotab Inc.

- TomTom International BV

- Trimble Inc.

- Visteon Corporation

- LG Electronics

- MiX Telematics

- Harman International (Samsung)

- Octo Telematics

- Airbiquity Inc.

- Teletrac Navman

- DENSO Corporation

- ConnectedDrive Technologies

- AutoConnect Solutions

- VehicleSense Systems

- CalAmp

- Omnitracs LLC.

The global automotive telematics market is segmented as follows:

By Type

- Embedded

- Tethered

- Integrated

By Service

- Safety and Security

- Information and Navigation

- Diagnostics and Tracking

- Entertainment

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Automotive telematics is the integrated application of telecommunications, information processing, and vehicular technologies to enable the transmission of data to and from vehicles.

The automotive telematics market is expected to be driven by increasing regulatory mandates for vehicle safety features, rising consumer demand for connected services, integration with advanced driver assistance systems, developments in autonomous vehicle technology, and the growing adoption of usage-based insurance and fleet management solutions.

According to our study, the global automotive telematics market was worth around USD 9.05 billion in 2024 and is predicted to grow to around USD 23.69 billion by 2034.

The CAGR value of the automotive telematics market is expected to be around 10.10% during 2025-2034.

The global automotive telematics market will register the highest growth in Asia Pacific during the forecast period.

Key players in the automotive telematics market include Robert Bosch GmbH, Continental AG, Verizon Connect, AT&T Inc., Geotab Inc., TomTom International BV, Trimble Inc., Visteon Corporation, LG Electronics, MiX Telematics, Harman International (Samsung), Octo Telematics, Airbiquity Inc., Teletrac Navman, DENSO Corporation, ConnectedDrive Technologies, AutoConnect Solutions, VehicleSense Systems, CalAmp, and Omnitracs LLC.

The report comprehensively analyzes the automotive telematics market, including an in-depth discussion of market drivers, restraints, emerging trends, regional dynamics, and future growth opportunities. It also examines competitive dynamics, technological innovations, service offerings, and the evolving connected vehicle ecosystem shaping the telematics landscape.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed