Bathroom Partitions Market Size, Share, Growth, Trends, and Forecast 2030

Bathroom Partitions Market By Product Type (Floor-Mounted Overhead-Braced, Ceiling-Hung, Floor-to-Ceiling, and Restroom Cubicles), By Application (Commercial Buildings, Educational Institutions, Healthcare Facilities, Industrial Facilities, and Hospitality), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts 2023 - 2030

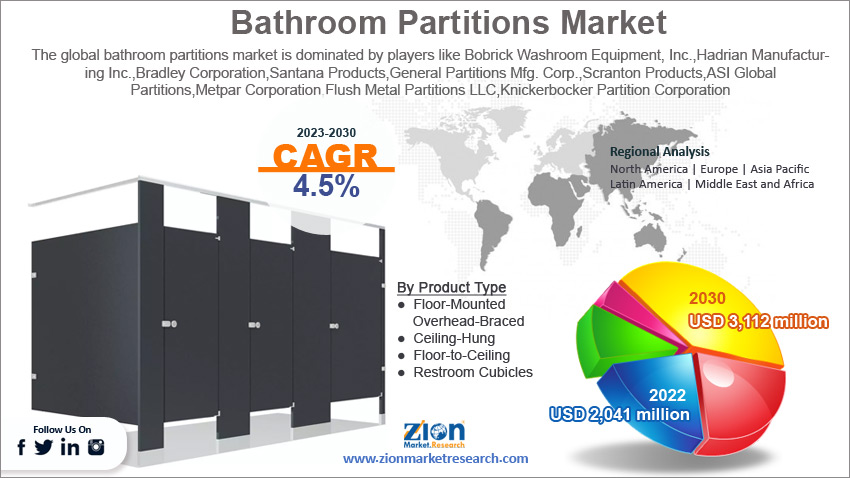

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 2,041 million | USD 3,112 million | 4.5% | 2022 |

Bathroom partitions Industry Prospective:

The global bathroom partitions market size was worth around USD 2,041 million in 2022 and is predicted to grow to around USD 3,112 million by 2030 with a compound annual growth rate (CAGR) of roughly 4.5% between 2023 and 2030.

Bathroom partitions Market: Overview

Bathroom partitions, an integral component of commercial restroom design, serve as dividers that offer privacy and functionality within shared bathroom spaces. These partitions are essential for maintaining a hygienic and comfortable environment, providing users with the necessary privacy while using restroom facilities in public places such as offices, schools, restaurants, and other commercial establishments. Bathroom partitions come in various styles and configurations to meet diverse design and functional needs. Common styles include floor-mounted overhead-braced, ceiling-hung, and floor-to-ceiling configurations. Each style offers different levels of sturdiness and aesthetics, allowing architects and designer’s flexibility in creating restroom layouts that align with the overall design of the space.

Moreover, bathroom partitions contribute to accessibility and compliance with building codes by providing options that cater to users with different mobility needs. This includes creating accessible stalls that comply with the guidelines of the Americans with Disabilities Act (ADA), ensuring that restroom facilities are inclusive and usable by all individuals. Additionally, advancements in design have led to innovations such as anti-bacterial coatings, easy-to-clean surfaces, and eco-friendly materials, addressing not only functional needs but also sustainability and hygiene concerns.

Key Insights

- As per the analysis shared by our research analyst, the global bathroom partitions industry is estimated to grow annually at a CAGR of around 4.5% over the forecast period (2023-2030).

- In terms of revenue, the global bathroom partitions market size was valued at around USD 2,041 million in 2022 and is projected to reach USD 3,112 million, by 2030.

- The global bathroom partitions market is projected to grow at a significant rate due to in the continuous growth in commercial construction and infrastructure projects.

- Based on product type segmentation, floor-mounted overhead-braced was predicted to hold maximum market share in the year 2022.

- Based on application segmentation, commercial buildings were the leading revenue generator in 2022.

- On the basis of region, Asia Pacific was the leading revenue generator in 2022.

Request Free Sample

Request Free Sample

Bathroom Partitions Market: Growth Drivers

Continuous growth in commercial construction and infrastructure projects to drive the market growth.

The bathroom partitions market is driven by several key factors, with one of the primary drivers being the continuous growth in commercial construction and infrastructure projects. As urbanization and population density increase, there is a rising demand for public facilities, including restrooms in commercial spaces such as offices, malls, airports, and educational institutions. This surge in construction activities, both new builds and renovations, fuels the demand for durable, aesthetically pleasing, and functional bathroom partitions. Additionally, a growing emphasis on hygiene and sanitation standards in public spaces contributes significantly to the market's expansion. With an increased awareness of health and well-being, there is a rising demand for restroom solutions that are easy to clean, resistant to moisture and bacteria, and comply with hygiene regulations. Manufacturers are responding to this trend by developing innovative materials and technologies, such as anti-bacterial coatings and easy-to-clean surfaces, driving the adoption of modern bathroom partition solutions. As businesses and institutions prioritize the well-being of occupants, the demand for advanced and hygienic restroom facilities, including partitions, acts as a key driver propelling the growth of the bathroom partitions market.

Major real estate developers and construction companies are investing heavily in commercial construction projects. These investments are being driven by the strong demand for new office space, retail space, and hospitality facilities.

Hines, a global real estate investment firm, has invested over USD 100 billion in new commercial construction projects in the past five years.

Similarly, Brookfield Property Partners, another global real estate investment firm, has invested over USD 50 billion in new commercial construction projects in the past five years.

Bathroom Partitions Market: Restraints

Economic downturns on construction activities may restrain market growth.

One significant restraint in the bathroom partitions market is the impact of economic downturns on construction activities. The market is closely tied to the overall health of the construction industry, and during economic recessions or downturns, there tends to be a slowdown in construction projects. Reduced investments in new commercial buildings or renovations can lead to a decline in the demand for bathroom partitions. Additionally, budget constraints during economic challenges may prompt builders and facility managers to prioritize cost-cutting measures, potentially affecting the adoption of higher-end or specialized partition materials and features.

Another restraint is the increasing competition among manufacturers, leading to price wars and margin pressure. As the market becomes more saturated with various suppliers offering similar products, there is a tendency for intense competition based on pricing rather than product differentiation. This can pose challenges for manufacturers and may impact their ability to invest in research and development for innovative features or materials. As a result, the commoditization of certain types of bathroom partitions could hinder the overall market growth and innovation within the industry.

Bathroom Partitions Market: Opportunities

Potential to cater to the growing trend of digital and mobile-first lifestyles to provide growth opportunities

One notable opportunity in the bathroom partitions market lies in the growing trend toward sustainable and eco-friendly construction practices. As environmental awareness and sustainability become integral considerations in modern building designs, there is an increasing demand for bathroom partitions made from recycled or environmentally friendly materials. Manufacturers can capitalize on this opportunity by developing and promoting partitions that meet eco-friendly standards, providing a competitive edge in a market where sustainability is gaining prominence. Additionally, the incorporation of energy-efficient manufacturing processes and the use of materials with low environmental impact can align with the broader movement toward green building practices.

Furthermore, the ongoing advancements in materials and technology present an opportunity for innovation within the bathroom partitions market. Manufacturers can explore novel materials that offer enhanced durability, aesthetics, and functionality. For instance, the integration of smart technologies, such as sensors for occupancy monitoring or touchless features, can contribute to improved hygiene and user experience. Innovations in antimicrobial surfaces and coatings can address health concerns, further expanding the market's potential. By staying at the forefront of technological developments, companies can position themselves as leaders in providing cutting-edge and high-performance bathroom partition solutions.

Moreover, the global focus on health and wellness in commercial spaces provides an opportunity for bathroom partition manufacturers to create designs that contribute to a positive and comfortable restroom experience. Incorporating ergonomic and user-friendly features, along with aesthetically pleasing designs, can enhance the overall restroom environment. As businesses recognize the importance of creating welcoming and hygienic spaces for employees and customers, there is a growing market for bathroom partitions that prioritize both functionality and user satisfaction. Manufacturers can leverage this opportunity by aligning their product offerings with the evolving preferences of end-users in the commercial space.

Bathroom Partitions Market: Challenges

Volatility in raw material prices to challenge market growth

One significant challenge facing the bathroom partitions market is the volatility in raw material prices. The production of bathroom partitions relies on materials such as steel, high-density polyethylene (HDPE), phenolic, and other specialized components. Fluctuations in the prices of these raw materials can pose challenges for manufacturers, impacting production costs and potentially affecting profit margins. Economic uncertainties, geopolitical factors, and disruptions in the supply chain can contribute to unpredictable material costs, making it challenging for companies in the bathroom partitions market to maintain stable pricing and financial planning.

Moreover, regulatory compliance and evolving industry standards present a challenge for bathroom partition manufacturers. As building codes and standards related to safety, accessibility, and environmental considerations evolve, manufacturers must stay abreast of these changes to ensure their products meet the latest requirements. Adapting to new regulations may necessitate adjustments to designs, materials, or manufacturing processes, adding complexity to production and potentially requiring additional investments in research and development. Meeting diverse and sometimes conflicting regulatory standards across different regions can be a logistical and operational challenge, requiring a proactive approach to stay competitive in the evolving landscape of the bathroom partitions market.

Bathroom Partitions Market: Segmentation

The global bathroom partitions market is segmented based on product type, application, and region.

Based on product type, the global market segments are floor-mounted overhead-braced, ceiling-hung, floor-to-ceiling, and restroom cubicles. At present, the global market is dominated by the floor-mounted overhead-braced segment. This product type offers a robust and stable construction that appeals to a broad range of commercial and public restroom settings. The floor-mounted overhead-braced partitions are known for their ease of installation, durability, and cost-effectiveness, making them a preferred choice for various applications. Additionally, their design allows for flexibility in accommodating diverse architectural layouts, contributing to their popularity and current dominance in the global market.

Based on application the global bathroom partitions industry categorized as commercial buildings, educational institutions, healthcare facilities, industrial facilities, and hospitality. In 2022, commercial buildings was the largest shareholding segment in the global industry. This is primarily due to the extensive demand for modern and aesthetically pleasing restroom solutions in commercial spaces. As the global economy grows, there is a concurrent increase in the construction of office complexes, shopping malls, and other commercial establishments, driving the need for high-quality bathroom partitions. Additionally, businesses increasingly recognize the importance of providing a positive restroom experience for employees and customers, emphasizing both functionality and design. This heightened focus on enhancing commercial spaces, coupled with the growing trend of sustainable and hygienic restroom solutions, contributes to the dominance of the commercial buildings segment in the global bathroom partitions market.

Bathroom Partitions Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Bathroom Partitions Market |

| Market Size in 2022 | USD 2,041 Million |

| Market Forecast in 2030 | USD 3,112 Million |

| Growth Rate | CAGR of 4.5% |

| Number of Pages | 216 |

| Key Companies Covered | Bobrick Washroom Equipment, Hadrian Manufacturing, Bradley Corporation, Santana Products, General Partitions Mfg., Scranton Products, ASI Global Partitions, Metpar Corporation, Flush Metal Partitions, Knickerbocker Partition., and others. |

| Segments Covered | By Product Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Bathroom Partitions Market: Regional Analysis

Asia Pacific to lead the market during the forecast period

Asia Pacific is anticipated to emerge as the leading force in the bathroom partitions market during the forecast period. The region's dominance is underpinned by a confluence of factors driving the demand for modern and efficient restroom solutions. The rapid pace of urbanization and industrialization, particularly in countries like China and India, is generating substantial demand for commercial spaces and infrastructure projects. This surge in construction activities corresponds with a heightened need for contemporary bathroom partitions in newly developed or renovated buildings.

Moreover, the Asia Pacific region is witnessing a cultural shift towards increased awareness of hygiene standards and an emphasis on creating aesthetically pleasing restroom environments. This shift is propelling the demand for advanced bathroom partitions that not only offer functional privacy but also contribute to the overall ambiance of public and commercial spaces.

The Chinese government has introduced mandatory hygiene standards for public restrooms, while the Indian government has launched a program to upgrade public restrooms in major cities.

Manufacturers catering to these evolving preferences stand to benefit from the region's growing demand for high-quality restroom solutions.

Government initiatives promoting infrastructure development and the rise in tourism-related projects further fuel the growth of the commercial construction sector in Asia Pacific.

The Asian Development Bank (ADB) estimates that Asia Pacific will need to invest USD 26.2 trillion in infrastructure by 2030 also The World Tourism Organization (UNWTO) forecasts that international tourist arrivals in Asia Pacific will reach 801 million by 2030. As a result, there is a parallel increase in the requirement for durable, stylish, and hygienic bathroom partitions. With these factors at play, Asia Pacific is positioned to lead the bathroom partitions market, reflecting the region's dynamic economic growth, urbanization trends, and the evolving expectations for modern restroom facilities.

Key Developments:

2023: ASI Group partners with Formica Corporation, a leading manufacturer of surfacing materials, to develop new bathroom partitions made with Formica's durable and stylish laminates. This partnership will provide architects and designers with more options for creating unique and functional bathroom spaces.

2023: ASI Group launches the ASI Infinity line of bathroom partitions, which are designed to be modular and flexible to meet the needs of a wide range of commercial spaces.

2022: Bradley Corporation partners with Sloan Valve Company, a leading manufacturer of plumbing fixtures, to develop integrated restroom solutions that combine Bradley's partitions with Sloan's fixtures. This partnership will provide customers with a more seamless and coordinated approach to restroom design.

2022: Global toilet partitions manufacturer ASI Group acquires the commercial bathroom partitions business of R.L. Wilson, a leading provider of metal toilet partitions. This acquisition expands ASI Group's product portfolio and strengthens its position as a leading global supplier of bathroom partitions.

2022: Bradley Corporation launches the Bradley Guardian line of bathroom partitions, which are designed to be vandal-resistant and durable for high-traffic restrooms.

2021: Bradley Corporation, a leading manufacturer of commercial restroom products, acquires H&E Products, a provider of toilet partitions, lockers, and other restroom accessories. This acquisition adds H&E Products' expertise in manufacturing high-density polyethylene (HDPE) partitions to Bradley's portfolio.

2021: Scranton Products launches the Scranton Eco line of bathroom partitions, which are made from recycled materials and are designed to be environmentally friendly.

Bathroom partitions Market: Competitive Analysis

The global bathroom partitions market is dominated by players like:

- Bobrick Washroom Equipment, Inc.

- Hadrian Manufacturing Inc.

- Bradley Corporation

- Santana Products

- General Partitions Mfg. Corp.

- Scranton Products

- ASI Global Partitions

- Metpar Corporation

- Flush Metal Partitions LLC

- Knickerbocker Partition Corporation

The global bathroom partitions market is segmented as follows:

By Product Type

- Floor-Mounted Overhead-Braced

- Ceiling-Hung

- Floor-to-Ceiling

- Restroom Cubicles

By Application

- Commercial Buildings

- Educational Institutions

- Healthcare Facilities

- Industrial Facilities

- Hospitality

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Bathroom partitions, an integral component of commercial restroom design, serve as dividers that offer privacy and functionality within shared bathroom spaces. These partitions are essential for maintaining a hygienic and comfortable environment, providing users with the necessary privacy while using restroom facilities in public places such as offices, schools, restaurants, and other commercial establishments.

The global bathroom partitions market cap may grow owing to the due to the continuous growth in commercial construction and infrastructure projects.

According to study, the global bathroom partitions market size was worth around USD 2,041 million in 2022 and is predicted to grow to around USD 3,112 million by 2030.

The CAGR value of the bathroom partitions market is expected to be around 4.5% during 2023-2030.

The global bathroom partitions market growth is expected to be driven by Asia Pacific. It is currently the world’s highest revenue-generating market owing to rapid pace of urbanization and industrialization, particularly in countries like China and India.

The global Bathroom partitions market is led by players like Bobrick Washroom Equipment, Hadrian Manufacturing, Bradley Corporation, Santana Products, General Partitions Mfg., Scranton Products, ASI Global Partitions, Metpar Corporation, Flush Metal Partitions, and Knickerbocker Partition.

The report analyzes the global bathroom partitions market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the bathroom partitions industry.

Choose License Type

List of Contents

Bathroom partitionsIndustry Prospective:Bathroom partitions OverviewKey InsightsGrowth DriversRestraintsOpportunitiesChallengesSegmentationReport ScopeRegional AnalysisKey Developments:Bathroom partitions Competitive AnalysisThe global bathroom partitions market is segmented as follows:By RegionHappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed