Battery Metals Market Growth, Size, Share, Trends, and Forecast 2032

Battery Metals Market By Product (cobalt, lithium, nickel, and others), By Application (electronic devices, starter, lighting, and ignition (SLI), stationary battery energy storage, electric vehicles (EVs), and others) And By Region: - Global And Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts, 2024-2032

| Market Size in 2023 | Market Forecast in 2032 | Growth Rate (in %) | Base Year |

|---|---|---|---|

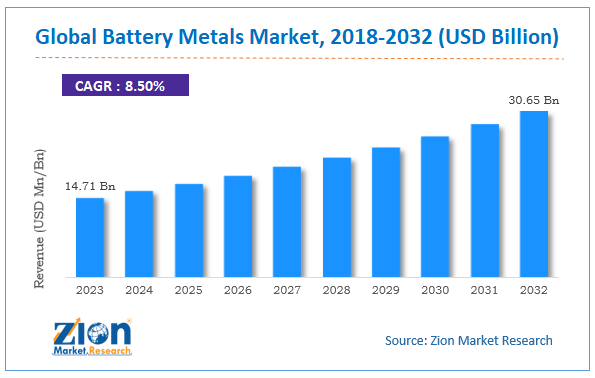

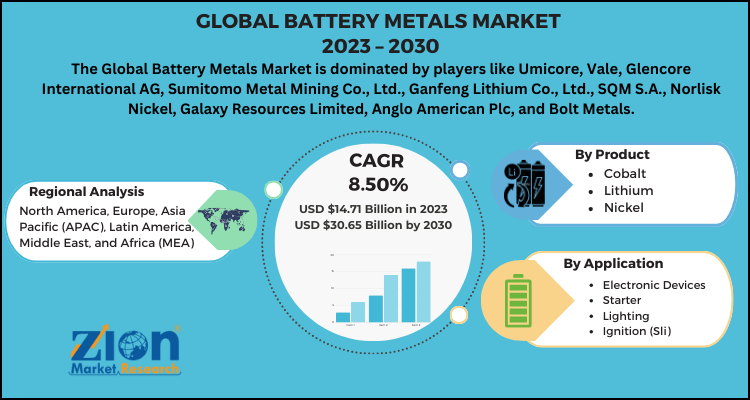

| USD 14.71 Billion | USD 30.65 Billion | CAGR at 8.50% | 2023 |

Description

According to the report published by Zion Market Research, the global Battery Metals Market size was valued at USD 14.71 Billion in 2023 and is predicted to reach USD 30.65 Billion by the end of 2032. The market is expected to grow with a CAGR of 8.50% during the forecast period. The report analyzes the global Battery Metals Market’s growth drivers, restraints, and impact on demand during the forecast period. It will also help navigate and explore the arising opportunities in the Battery Metals Market industry.

Global Battery Metals Market: Overview

Battery metals are raw materials that are utilized in the manufacturing of batteries that include nickel, lithium, cobalt, graphite, and manganese batteries. These battery metals are utilized in batteries made for electric automobiles, electronics, and other such applications. Cobalt is majorly utilized as cathode substance in lithium-ion batteries. Because of its storage capacity and high energy density, nickel is applied in battery-operated applications.

Global Battery Metals Market: Growth Factors

Emergence of newer and more advanced portable devices such as smartphones, tablets, laptops, and other gadgets is a growth factor responsible for the remarkable expansion of the global battery metals market. Additionally, the increasing requirement for electric automobiles and hybrid electric automobiles in the developed and developing nations globally is expected to stimulate the development of the battery metals market over the forecast timeframe.

Also, the rapid expansion of the renewable energy resources industry is due to various factors including favorable government policies towards the use of sustainable energy sources, growing expenditures towards solar, wind, & hydro power plants, rising awareness about the many benefits of renewable energy sources, and rising popularity of electric vehicles are some factors that will indirectly contribute to the expansion of the global battery metals market.

Nonetheless, surging battery wastes and the many risks associated with the supply and security because of the trade relations between the countries are the factors predicted to impact the development of the global battery metals negatively by hampering its growth. On the other hand, the surging investments and expenses for the electrification of villages and rural regions is anticipated to make available many potential opportunities for market expansion for the major companies working in this market.

The COVID-19 induced lockdown restrictions have caused temporary bans on exports and imports, therefore disturbing the supply chain, curbing the market development in the last three quarters of 2020. Nonetheless, the market is projected to recover in the last months of 2020 or by the first quarter of the year 2021 when the manufacturing of electronic automobiles and other batteries resumes.

Global Battery Metals Market: Segmentation

The global battery metals market is segregated by product, application, and region.

Based on product, the market is categorized into cobalt, lithium, nickel, and others.

By application, the global battery metals market has been bifurcated into electronic devices, starter, lighting, and ignition (SLI), stationary battery energy storage, electric vehicles (EVs), and others.

Battery Metals Market : Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Battery Metals Market Research Report |

| Market Size in 2023 | USD 14.71 Billion |

| Market Forecast in 2032 | USD 30.65 Billion |

| Growth Rate | CAGR of 8.50% |

| Number of Pages | 196 |

| Key Companies Covered | Umicore, Vale, Glencore International AG, Sumitomo Metal Mining Co., Ltd., Ganfeng Lithium Co., Ltd., SQM S.A., Norlisk Nickel, Galaxy Resources Limited, Anglo American Plc, and Bolt Metals |

| Segments Covered | By Product, By Application and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Global Battery Metals Market: Regional Analysis

Asia Pacific leads the global battery metals market and is predicted to exhibit this trend over the forthcoming years. This can be attributed to China as it is a leading producer of batteries in the world. This producing competency is due to its large supply chain. Considering this, China is expected to continue this trend even after the COVID-19 pandemic is over and be the main contributor in the Asia Pacific battery metals market.

North America ranks second in terms of market share of the global battery metals market. The United States is a major manufacturer in this region and also a key market for metals in North America. Rising requirements for electronic vehicles due to various government initiatives and the changing preferences of people due to awareness regarding the benefits of using electric cars, electric motorcycles, and electric bikes are the factors steering the market expansion in this region.

On the other hand, Europe battery metals market has great potential for development and already holds a large chunk of the global market. Many companies are investing in this regional market for setting up factories due to the growing requirements for electric automobiles. Additionally, some Asian organizations are investing in the European market for establishing new plants in the region, aiding the global battery metals industry growth.

Global Battery Metals Market: Competitive Players

The global battery metals market is highly competitive because of the existence of numerous major companies in this industry. Targeting to expand their market share, organizations are implementing key strategies such as acquisitions, mergers, and expansions, which will assist in reinforcing their presence in this market. The rapid growth in this market is attracting investors for investing in this market.

Some of the major companies competing in the global battery metals market are:

- Umicore

- Vale

- Glencore International AG

- Sumitomo Metal Mining Co., Ltd.

- Ganfeng Lithium Co., Ltd.

- SQM S.A.

- Norlisk Nickel

- Galaxy Resources Limited

- Anglo American Plc

- Bolt Metals.

The Global Battery Metals Market is segmented as follows:

By Product

- cobalt

- lithium

- nickel

- and others

By Application

- electronic devices

- starter

- lighting

- ignition (SLI)

- stationary battery energy storage

- electric vehicles (EVs)

- and others

Global Battery Metals Market: Regional Segment Analysis

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

What Reports Provides

- Full in-depth analysis of the parent market

- Important changes in market dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional markets

- Testimonials to companies in order to fortify their foothold in the market.

Table Of Content

FrequentlyAsked Questions

Emergence of newer and more advanced portable devices such as smartphones, tablets, laptops, and other gadgets is a growth factor responsible for the remarkable expansion of the global battery metals market. Additionally, the increasing requirement for electric automobiles and hybrid electric automobiles in the developed and developing nations globally is expected to stimulate the development of the battery metals market over the forecast timeframe.

Asia Pacific leads the global battery metals market and is predicted to exhibit this trend over the forthcoming years. This can be attributed to China as it is a leading producer of batteries in the world. This producing competency is due to its large supply chain. Considering this, China is expected to continue this trend even after the COVID-19 pandemic is over and be the main contributor in the Asia Pacific battery metals market.

Some of the major companies competing in the global battery metals industry are Umicore, Vale, Glencore International AG, Sumitomo Metal Mining Co., Ltd., Ganfeng Lithium Co., Ltd., SQM S.A., Norlisk Nickel, Galaxy Resources Limited, Anglo American Plc, and Bolt Metals.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed