Blue Hydrogen Market Size, Share, Growth, Trends, and Forecast, 2032

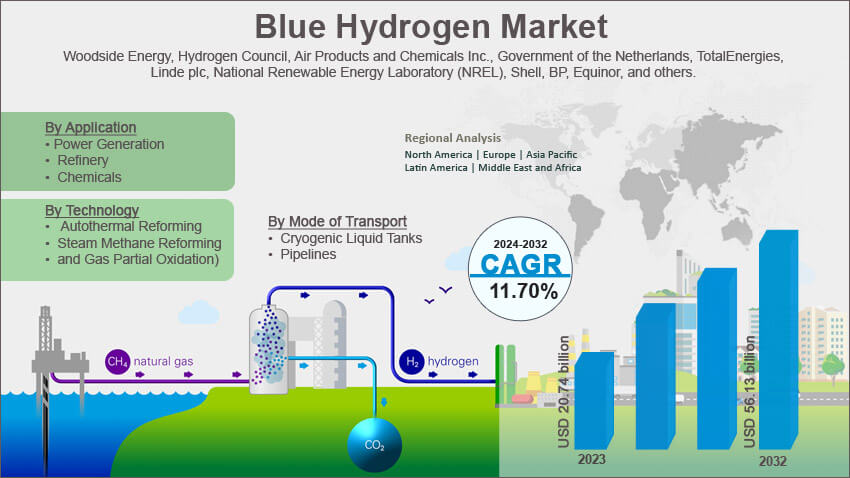

Blue Hydrogen Market By Application (Power Generation, Refinery, Chemicals, and Others), By Technology (Autothermal Reforming, Steam Methane Reforming, and Gas Partial Oxidation), By Mode of Transport (Cryogenic Liquid Tanks and Pipelines), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

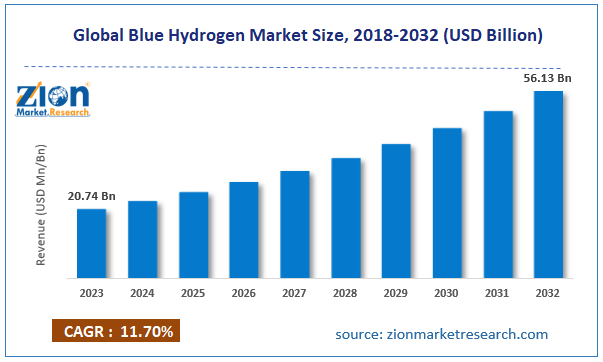

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 20.74 billion | USD 56.13 billion | 11.70% | 2023 |

Blue Hydrogen Industry Prospective:

The global blue hydrogen market size was worth around USD 20.74 billion in 2023 and is predicted to grow to around USD 56.13 billion by 2032 with a compound annual growth rate (CAGR) of roughly 11.70% between 2024 and 2032.

Blue Hydrogen Market: Overview

Blue hydrogen is also known as decarbonized hydrogen. It is produced from natural gas with the help of a process known as natural gas reforming in association with carbon capture and storage (CCS). Hydrogen is considered as an excellent source of clean energy. When hydrogen is burned, it produces energy. The only byproduct when hydrogen burns is water, unlike other sources of energy that result in the emission of harmful gasses such as carbon dioxide (CO2). Additionally, hydrogen is one of the most abundantly available elements in the universe. However, hydrogen cannot be found existing on its own. In almost all cases, it is often attached to other elements. On Earth, hydrogen is found mainly with oxygen in the form of water. Thus, there are several processes employed to obtain hydrogen as a standalone element. One such process refers to the use of natural gas.

The process used for obtaining blue hydrogen through natural gas is called steam methane reforming. In this process, a mixture is created using natural gas, a catalyst, and steam at an extremely high temperature. The reaction results in the formation of carbon monoxide and hydrogen. Water is later added to the mixture to produce carbon dioxide. This also results in the formation of more hydrogen. The CO2 gasses emitted during this process are captured and stored underground thus making the process entirely carbon-neutral. The hydrogen thus obtained in the end is called blue hydrogen.

Key Insights:

- As per the analysis shared by our research analyst, the global blue hydrogen market is estimated to grow annually at a CAGR of around 11.70% over the forecast period (2024-2032)

- In terms of revenue, the global blue hydrogen market size was valued at around USD 20.74 billion in 2023 and is projected to reach USD 56.13 billion by 2032.

- The market is projected to grow at a significant rate due to the growing effort toward reducing carbon emissions globally

- Based on application segmentation, the power generation segment is growing at a high rate and is projected to dominate the global market.

- Based on mode of transport segmentation, the pipelines segment is projected to swipe the largest market share.

- On the basis of region, North America is expected to dominate the global market during the forecast period.

Request Free Sample

Request Free Sample

Blue Hydrogen Market: Growth Drivers

Growing efforts toward reducing carbon emissions globally will impact the market demand rate

The global blue hydrogen market is expected to grow due to the growing efforts toward reducing carbon emissions. CO2 is considered as one of the leading environmental pollutants affecting the overall ecological quality of the world. Carbon dioxide is a greenhouse gas. It is crucial for trapping and radiating heat. However, excess CO2 leads to an increase in the global temperature since the addition of more carbon dioxide in the environment leads to the supercharging of natural greenhouse gasses. This in turn leads to the melting of ice caps and a rise in sea levels. As per official research, the current CO2 level in the atmosphere is around 0.04%. Industries and governments across the globe are under pressure to reduce carbon emissions.

One of the major key deliverables expected from industries is becoming carbon-neutral in the coming years. Several establishments have already begun initiatives to reduce carbon dioxide emissions. This is further promoted by regulations and implementation policies laid down by governments to hold companies responsible for carbon emissions. In November 2023, at the Conference of the Parties 28 (COP28), officials announced that dominant players in the oil & gas industry have pledged to become carbon-neutral by 2050. In September 2023, technology giant Apple announced the launch of its first range of carbon-neutral products. Hydrogen is considered a clean source of energy and thus more corporations and governments are interested in exploring the several aspects related to blue hydrogen production and consumption.

Rising demand for energy worldwide may lead to higher investments in the industry

The modern world is powered by energy. All industrial, commercial, and residential establishments run on power. The demand for energy is increasing at a rapid rate influenced by the growing rate of urbanization, rising population, and increasing infrastructure development.

However, renewable sources of energy are depleting quickly and there is an urgent need for developing novel solutions for energy generation. The global blue hydrogen market is expected to benefit from the increased need for energy in the coming years.

Blue Hydrogen Market: Restraints

Methane emissions during natural gas production will restrict the market expansion rate

The global industry for blue hydrogen is projected to be restricted due to several controversies surrounding the raw materials used in the production of blue hydrogen. The primary element during production is natural gas. Although blue hydrogen is termed as a clean source of energy, the production of natural gas leads to the harmful emission of methane caused due to fugitive leaks.

The transportation, extraction, and drilling of natural gas causes methane emissions which is considered a more potent greenhouse gas as compared to CO2. As per the International Energy Agency, when considered over 100 years, 1 ton of methane can be compared to 28 to 36 tons of carbon dioxide.

Blue Hydrogen Market: Opportunities

Rising investments toward building new production sites for blue hydrogen may generate high-growth opportunities

The global blue hydrogen market is projected to come across several growth opportunities due to the growing investment toward building new hydrogen harvesting plants across the globe. The rise in infrastructure development projects will allow a larger number of players to enter the industry and access the tools required for blue hydrogen production. In November 2023, Air Products, a global industrial gasses company, announced its plan to invest in constructing Europe’s largest blue hydrogen plant. The facility is expected to be equipped with novel carbon dioxide treatment and carbon capture technology. The unit is expected to become operational by 2026 and will allow leading customers of Air Products such as ExxonMobil to use the facility for blue hydrogen-related activities.

In January 2024, 8 Rivers, a US-based technology company, announced that it would invest USD 1.2 billion to construct a new blue ammonia complex in the country. The new complex will become the first commercial plant built using an advanced technology that produces low-cost hydrogen using fossil fuel. Almost 99% of the emissions will be captured during the process. In addition to this, more efforts are being made toward reducing methane emissions during the extraction and production of natural gas. If the methane levels can be controlled, the efficiency of blue hydrogen will automatically improve.

As world leaders and environmental agencies focus on developing new measures to reduce methane emissions, more players are expected to experiment with blue hydrogen. For instance, as per the International Energy Agency, the oil & gas sector can reduce methane emissions by 75% with the implementation of basic protocols such as constant upgrades to leaking equipment and early detection of leaks.

Blue Hydrogen Market: Challenges

Competition from higher demand for green hydrogen and high cost of infrastructure may challenge market expansion

The global blue hydrogen market is projected to be challenged by the higher demand for green hydrogen as well as the high cost of investment required to build an infrastructure that supports the production of blue hydrogen. Natural gas required for blue hydrogen production is facing several challenges due to disruptions in the supply chain. In addition to this, green hydrogen is considered cleaner since it does not emit any form of harmful gasses during the production process.

Blue Hydrogen Market: Segmentation

The global blue hydrogen market is segmented based on application, technology, mode of transport, and region.

Based on application, the global market segments are power generation, refinery, chemicals, and others. In 2023, the highest revenue-generating segment was power generation. It dominated nearly 37.01% of the total market share. The higher segmental growth rate was a result of an increase in the initiatives undertaken by power giants to reduce carbon emissions and attain carbon neutrality. Blue hydrogen has higher applications for converting renewable energy into stored fuel that can be used at a later time. The refinery segment is projected to grow at a CAGR of over 25% during the projection period.

Based on technology, the global blue hydrogen industry was divided into auto thermal reforming, steam methane reforming, and gas partial oxidation.

Based on the mode of transport, the global market segments are cryogenic liquid tanks and pipelines. In 2023, the highest return on investment was observed in the segment of the pipeline that held control over 71.01% of the total market share. Blue hydrogen is transported in gaseous form using a robust pipeline extending long distances. This mode of transportation is considered safe and efficient for transporting high volumes of blue hydrogen. The cryogenic liquid tanks segment is expected to grow at a CAGR of around 21%.

Blue Hydrogen Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Blue Hydrogen Market |

| Market Size in 2023 | USD 20.74 Billion |

| Market Forecast in 2032 | USD 56.13 Billion |

| Growth Rate | CAGR of 11.70% |

| Number of Pages | 210 |

| Key Companies Covered | Woodside Energy, Hydrogen Council, Air Products and Chemicals Inc., Government of the Netherlands, TotalEnergies, Linde plc, National Renewable Energy Laboratory (NREL), Shell, BP, Equinor, and others. |

| Segments Covered | By Application, By Technology, By Mode of Transport, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Blue Hydrogen Market: Regional Analysis

North America to deliver the highest revenue during the projection period

The global blue hydrogen market is expected to witness the highest growth in North America. The US and Canada will be at the forefront of regional growth during the projection period. The growing focus on deploying cleaner energy across industries including the power sector and refineries will promote higher adoption of blue hydrogen. Additionally, the presence of large-scale natural gas companies equipped to make large investments required for blue hydrogen production and transportation work in favor of North America’s dominance.

In February 2024, Exxon Mobil Corporation, a US-based natural gas company, signed a contract with Technip Energies. The latter will provide Exxon with critical engineering and design services to be used for the construction of a low-carbon hydrogen production plant and a CCS plan. These regions are actively working toward reducing carbon emissions which will open the door for higher growth in the region’s blue hydrogen sector.

The Middle East is expected to become the second-largest contributor to overall revenue. The rising investments in blue hydrogen plans across the Middle East will promote regional expansion rate in addition to the region’s pledge to become carbon neutral in the next 2 decades. Europe is anticipated to grow at a CAGR of around 26.01%. Europe has high expansion plans to reduce dependency on non-renewable fuel sources and move to clean alternatives.

Blue Hydrogen Market: Competitive Analysis

The global blue hydrogen market is led by players like:

- Woodside Energy

- Hydrogen Council

- Air Products and Chemicals Inc.

- Government of the Netherlands

- TotalEnergies

- Linde plc

- National Renewable Energy Laboratory (NREL)

- Shell

- BP

- Equinor

The global blue hydrogen market is segmented as follows:

By Application

- Power Generation

- Refinery

- Chemicals

By Technology

- Autothermal Reforming

- Steam Methane Reforming

- and Gas Partial Oxidation)

By Mode of Transport

- Cryogenic Liquid Tanks

- Pipelines

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Blue hydrogen is also known as decarbonized hydrogen. It is produced from natural gas with the help of a process known as natural gas reforming in association with carbon capture and storage (CCS).

The global blue hydrogen market is expected to grow due to the growing efforts toward reducing carbon emissions.

According to study, the global blue hydrogen market size was worth around USD 20.74 billion in 2023 and is predicted to grow to around USD 56.13 billion by 2032.

The CAGR value of blue hydrogen market is expected to be around 11.70% during 2024-2032.

The global blue hydrogen market is expected to witness the highest growth in North America.

The global blue hydrogen market is led by players like Woodside Energy, Hydrogen Council, Air Products and Chemicals, Inc., Government of the Netherlands, TotalEnergies, Linde plc, National Renewable Energy Laboratory (NREL), Shell, BP, and Equinor among others

The report explores crucial aspects of the blue hydrogen market including detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed