Business Travel Accident Insurance Market Size, Share, And Growth Report 2032

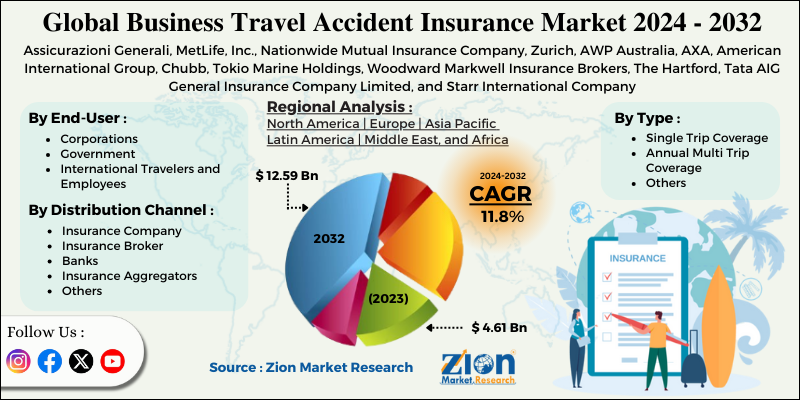

Business Travel Accident Insurance Market by Type (Single Trip Coverage, Annual Multi Trip Coverage, and Others), by Distribution Channel (Insurance Company, Insurance Broker, Banks, Insurance Aggregators, and Others), and by End-User (Corporations, Government, and International Travelers and Employees (Expats)): Global Industry Perspective, Comprehensive Analysis, and Forecast, 2024-2032

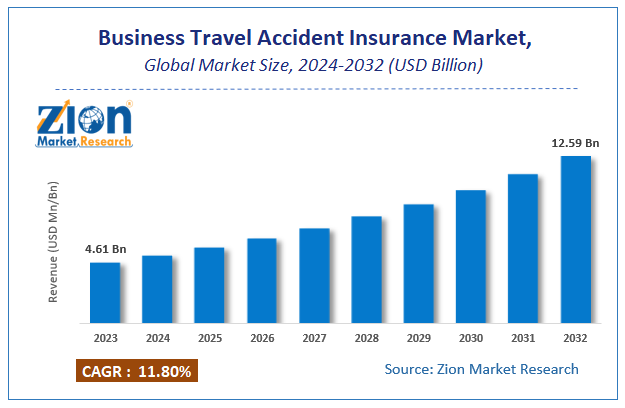

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 4.61 Billion | USD 12.59 Billion | 11.8% | 2023 |

Business Travel Accident Insurance Market: Size

The global Business Travel Accident Insurance market size was worth around USD 4.61 billion in 2023 and is predicted to grow to around USD 12.59 billion by 2032 with a compound annual growth rate (CAGR) of roughly 11.8% between 2024 and 2032.

The study provides historical data from 2018 to 2022 along with a forecast from 2024 to 2032 based on revenue (USD billion). The report covers a forecast and an analysis of the Business Travel Accident Insurance market on a global and regional level.

Business Travel Accident Insurance Market: Overview

Business travel accident insurance provides accidental insurance cover for business trips of a customer or an organization. Moreover, it provides dismemberment benefits and accidental death coverage for employees who are traveling for their company’s business. The travel accident insurance coverage includes assistance for disability, accident medical expenditures, paralysis, coma, etc. Over the ages, travel insurance has grown significantly. Terrorism and acts of war were once customary exclusions on travel insurance, but are now protected by many insurance companies. The expenditures of flight cancellation, baggage loss, and other unanticipated proceedings are also protected under most business travel insurance plans.

Rapidly flourishing international trade, constantly transforming trade practices, improving global economic situation, growing need to sustain client relations worldwide, rising occurrences of terrorist attacks and natural disasters, increasing popularity of price comparison applications and websites, growing trend of multi-trip policies, rising business travel, and various benefits offered by business travel accident insurance will act as major driving factors for the growth of the global business travel accident insurance market in the years ahead. The constantly altering trade practices and economic order has made it easy for companies to expand their businesses across multiple countries. Growing awareness among small organizations to protect their employees will create new opportunities for the players operating in the global business travel accident insurance market. Nonetheless, the lack of guidance and high premium may restrict the global business travel accident insurance market in the future.

The report provides company market share analysis to give a broader overview of the key players in the business travel accident insurance market. In addition, the report also covers key strategic developments of the market including acquisitions & mergers, new product launch, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the business travel accident insurance market on a global and regional basis.

Business Travel Accident Insurance Market: Segmentation

The study provides a decisive view of the business travel accident insurance market based on type, distribution channel, end-user, and region.

By type, the business travel accident insurance market includes single trip coverage, annual multi-trip coverage, and others.

The distribution channel segment includes insurance company, insurance broker, banks, insurance aggregators, and others.

The end-user segment includes corporations, government, and international travelers and employees (expats).

Business Travel Accident Insurance Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Business Travel Accident Insurance Market |

| Market Size in 2023 | USD 4.61 Billion |

| Market Forecast in 2032 | USD 12.59 Billion |

| Growth Rate | CAGR of 11.8% |

| Number of Pages | 110 |

| Key Companies Covered | Assicurazioni Generali, MetLife, Inc., Nationwide Mutual Insurance Company, Zurich, AWP Australia, AXA, American International Group, Chubb, Tokio Marine Holdings, Woodward Markwell Insurance Brokers, The Hartford, Tata AIG General Insurance Company Limited, and Starr International Company |

| Segments Covered | By type, By distribution channel, By end-user and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Business Travel Accident Insurance Market: Regional Analysis

The regional segment includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa with its further classification into major countries including the U.S., France, UK, Spain, Germany, Italy, China, Japan, India, and South Africa.

Europe represents an established region for business travel accident insurance market and will show the fastest growth in the future. UK and Germany are the leading countries for business travel accident insurance market in Europe. The North American market will display substantial growth in the future. The U.S. is the leading country market in North America. The Asia Pacific region is anticipated to advance at the most dominant rate over the estimated time period. India, China, and Japan are expected to majorly contribute to this regional market.

Business Travel Accident Insurance Market: Competitive Players

Some key players of the global business travel accident insurance market include:

- Assicurazioni Generali

- MetLife Inc.

- Nationwide Mutual Insurance Company

- Zurich

- AWP Australia

- AXA

- American International Group

- Chubb

- Tokio Marine Holdings

- Woodward Markwell Insurance Brokers

- The Hartford

- Tata AIG General Insurance Company Limited

- Starr International Company

The Global Business Travel Accident Insurance Market is segmented as follows:

Global Business Travel Accident Insurance Market: By Type

- Single Trip Coverage

- Annual Multi Trip Coverage

- Others

Global Business Travel Accident Insurance Market: By Distribution Channel

- Insurance Company

- Insurance Broker

- Banks

- Insurance Aggregators

- Others

Global Business Travel Accident Insurance Market: By End-User

- Corporations

- Government

- International Travelers and Employees (Expats)

Global Business Travel Accident Insurance Market: By Region

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Business travel accident insurance provides accidental insurance cover for business trips of a customer or an organization. Moreover, it provides dismemberment benefits and accidental death coverage for employees who are traveling for their company’s business.

According to study, the Business Travel Accident Insurance Market size was worth around USD 4.61 billion in 2023 and is predicted to grow to around USD 12.59 billion by 2032.

The CAGR value of Business Travel Accident Insurance Market is expected to be around 11.8% during 2024-2032.

Europe has been leading the Business Travel Accident Insurance Market and is anticipated to continue on the dominant position in the years to come.

The Business Travel Accident Insurance Market is led by players like Assicurazioni Generali, MetLife, Inc., Nationwide Mutual Insurance Company, Zurich, AWP Australia, AXA, American International Group, Chubb, Tokio Marine Holdings, Woodward Markwell Insurance Brokers, The Hartford, Tata AIG General Insurance Company Limited, and Starr International Company.

Choose License Type

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed