Calcium Aluminate Market Size, Share, Trends, Growth and Forecast 2028

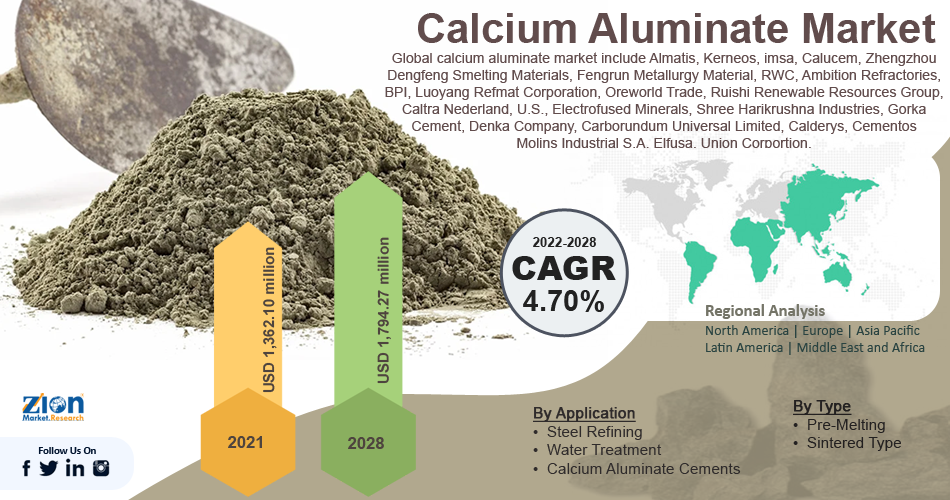

Calcium Aluminate Market by Type (Pre-melting and Sintered Type), By Application (Steel Refining, Water Treatment, and Calcium Aluminate Cements) and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data and Forecasts 2022 - 2028

| Market Size in 2021 | Market Forecast in 2028 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1,362.10 Million | USD 1,794.27 Million | 4.70% | 2021 |

Industry Prospective:

The global calcium aluminate market size was worth around USD 1,362.10 million in 2021 and is estimated to grow to about USD 1,794.27 million by 2028, with a compound annual growth rate (CAGR) of approximately 4.70% over the forecast period. The report analyzes the calcium aluminate market drivers, restraints/challenges, and their effect on the demands during the projection period. In addition, the report explores emerging opportunities in the calcium aluminate market.

Calcium Aluminate Market: Overview

Aluminum and calcium oxide are heated at high temperatures to create a group of minerals known as calcium aluminates. Depending on the purity level needed, lime and alumina or limestone and bauxite are combined to create calcium aluminates, which, when cooled, leave behind hard calcium aluminate clinkers. It can be utilized as an aggregate when crushed or screened, with the composition and color depending on the amount and purity of each source ingredient. The clinker can harden very quickly yet in a controlled fashion in formulations when ground into a fine powder and used as a binder, which creates a paste when combined with water. Additionally, it contains trace levels of phosphorus, magnesium, iron, silicon, and manganese. Calcium aluminate is added to the mix to provide concrete products with additional high-strength durability.

It is often used as mineral reagents or high-performance specialty binders across various sectors. Because of their resilience to abrasion, heat, and corrosion, rapid hardening, and ease of grading variation control, calcium aluminates serve as specialized binders in concrete and mortars for specialized applications. By mixing them with additional high-quality components, unique hydraulic binders can be created. They can also be found in non-hydraulic systems because they are used as mineral reagents. Because of their low-temperature melting properties and capacity to absorb impurities in molten metal, some grades of calcium aluminate, for instance, are utilized in metallurgical treatments (foundry, iron and steel industries).

COVID-19 Impact:

The rapid COVID-19 pandemic outbreak has caused further disruptions in the import and export of calcium aluminate, leading to the implementation of rigorous lockdown procedures worldwide. Lockdowns were imposed by the authorities in many places. Numerous manufacturing industries, notably the chemical industry and overall economic activity, have been severely impacted by COVID-19. Lockdowns implemented in many countries and supply shortages affect the chemical industry. The industry's growth and development have been hampered by the downturn in economic activity, which has a domino effect on the demand for calcium aluminate from the building industry in particular.

Key Insights

- As per the analysis shared by our research analyst, the global calcium aluminate market value to grow at a CAGR of 4.70% over the forecast period.

- In terms of revenue, the global calcium aluminate market size was valued at around USD 1,362.10 million in 2021 and is projected to reach USD 1,794.27 million by 2028.

- Increasing demand for calcium aluminate in water treatment applications and the growing need for steel refining across the globe are the major factors driving the market's growth.

- Asia Pacific dominated the global calcium aluminate market in 2021.

Calcium Aluminate Market: Growth Drivers

The market growth is expected to boost with increased usage from the construction sector

The use of products will undoubtedly be influenced positively by the rise in global building industry. It is mostly employed in building chemistry in several applications, including sealers, self-leveling toppings, repair mortars, non-shrink grouts, and bedding mortars. During the projected period, encouraging government regulations, urbanization, public & private funding, and a growing population will increase building attraction usage. These factors are major drivers of the global calcium aluminate market growth.

Calcium Aluminate Market: Restraints

High cost to impede market progress to a certain extent

Calcium aluminate is used in the mining and construction industries. Still, several things can function as market restrictions, like high prices that can make people reluctant to buy such equipment. Contractors are discouraged from purchasing the equipment due to high purchasing cost, installation expenses, and maintenance prices. Such reasons may influence people to decide against purchasing, which is anticipated to result in a drop in market demand.

Calcium Aluminate Market: Opportunities

Substitute for fluorspar to present growth prospects for the market in coming period

In refining steel, calcium aluminates are employed to reduce ladle slag. Due to the need for fluorspar-free ladle slag fluxing and using calcium aluminates is a cost-effective method, their use has expanded. Fluorspar is only used in steel workshops that use aluminum-killed steel. Because of this, the use of calcium aluminate as a fluorspar alternative has expanded, allowing for the effective and quick fluidization of calcium oxide (CaO). Calcium aluminate provides fluidity and basicity necessary for effective steel refining in the ladle, as well as the dilution of manganese oxide (MnO) and iron oxide (FeO) levels in the carryover slag.

Calcium Aluminate Market: Challenges

The active presence of substitutes in the market to pose challenge for market growth

The presence of substitutes for calcium aluminate, such as aluminum slag, is expected to restrict the growth of this global calcium aluminate market.

Calcium Aluminate Market: Segmentation

The global calcium aluminate market is classified based on type, application, and region.

The market is divided into pre-melting and sintered types according to type. In an electric arc furnace, the pre-melting process uses raw materials. It is required to reduce the viscosity of the molten metal and clean it of impurities to manufacture high-quality steel. Depending on the mixing pattern utilized throughout these procedures, pre-melting can be classified as either static or dynamic. While dynamic melting creates convection currents that uniformly mix across vessel walls, static pre-melting uses direct electric current flow into the refractory material to produce stationary melt. At the same time, the sintered kind is one of the product types in calcium aluminate. Sintering turns some materials from powder or granules into solid forms by heating and cooling them.

The application separates the global market into calcium aluminate cement, water treatment, and steel refining. A white-colored hydrated metal oxide with good chemical stability, calcium aluminate reacts with metal oxides and alkalis. It can be utilized as a foundation material for aluminum products in industries including smelting, non-ferrous metallurgy, the production of refractories, cement, etc. Calcium aluminate is used in the water treatment due to its unique properties. To make calcium aluminate cement, calcium aluminate clinker is also crushed with a minor amount of gypsum and other additives.

Recent Developments

- After receiving the necessary regulatory clearances, Cementos Molins will merge with calcium aluminate cement producer Calucem in November 2021. Calucem is the owner of a bauxite mine in Turkey and the Pula grinding plant in Istria, Croatia. Cementos Molins is now the world's second-largest calcium aluminate producer due to the recent acquisition. According to the company, it expands and improves its selection of innovative and eco-friendly items in line with its manageable growth plan.

Calcium Aluminate Market: Regional Landscape

The Asia Pacific dominated the calcium aluminate market in 2021

Demand for calcium aluminate is highest in the Asia Pacific, followed by Europe and North America, in that order. It is projected that countries like China, India, South Korea, Japan, Indonesia, and Vietnam will significantly impact the calcium aluminate market in the Asia Pacific region soon. The Asia Pacific is anticipated to dominate the global calcium aluminate market throughout the forecast period. China is expected to soon dominate the area's calcium aluminate market.

In terms of demand, the United States controls the calcium aluminate market in North America, making it one of the areas with the greatest potential globally. The calcium aluminate market is anticipated to grow quickly in Latin America during the forecast period. The need for calcium aluminate in water treatment applications is one of the factors driving this market's expansion. It is anticipated that Western Europe will have a greater need for calcium aluminate than the rest of Europe in the future years.

Report Scope:

| Report Attributes | Report Details |

|---|---|

| Report Name | Calcium Aluminate Market Size Report |

| Market Size in 2021 | USD 1,362.10 Million |

| Market Forecast in 2028 | USD 1,794.27 Million |

| Growth Rate | CAGR of 4.70% |

| Number of Pages | 188 |

| Forecast Units | Value (USD Billion), and Volume (Units) |

| Key Companies Covered | Almatis, Kerneos, imsa, Calucem, Zhengzhou Dengfeng Smelting Materials, Fengrun Metallurgy Material, RWC, Ambition Refractories, BPI, Luoyang Refmat Corporation, Oreworld Trade, Ruishi Renewable Resources Group, Caltra Nederland, U.S., Electrofused Minerals, Shree Harikrushna Industries, Gorka Cement, Denka Company, Carborundum Universal Limited, Calderys, Cementos Molins Industrial S.A, Elfusa, Union Corportion. |

| Segments Covered | By Type, By Application, By End-User, and By Region |

| Base Year | 2021 |

| Historical Year | 2015 to 2020 |

| Forecast Year | 2021 - 2028 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Calcium Aluminate Market: Competitive Landscape

- Almatis

- Kerneos

- imsa

- Calucem

- Zhengzhou Dengfeng Smelting Materials

- Fengrun Metallurgy Material

- RWC

- Ambition Refractories

- BPI

- Luoyang Refmat Corporation

- Oreworld Trade

- Ruishi Renewable Resources Group

- Caltra Nederland

- U.S.

- Electrofused Minerals

- Shree Harikrushna Industries

- Gorka Cement

- Denka Company

- Carborundum Universal Limited

- Calderys

- Cementos Molins Industrial S.A

- Elfusa

- Union Corportion.

The global Calcium Aluminate Market is segmented as follows:

By Type

- Pre-Melting

- Sintered Type

By Application

- Steel Refining

- Water Treatment

- Calcium Aluminate Cements

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The increasing demand for calcium aluminate in water treatment applications and the growing need for steel refining influence the calcium aluminate market.

The calcium aluminate market was worth around USD 1,362.10 million in 2021 and is estimated to grow to about USD 1,794.27 million by 2028, with a compound annual growth rate (CAGR) of approximately 4.70% over the forecast period.

Asia Pacific leads the global calcium aluminate market in terms of demand. It is projected that countries like China, India, South Korea, Japan, Indonesia, and Vietnam will significantly impact the calcium aluminate market in the Asia Pacific region soon. The Asia Pacific is anticipated to dominate the global calcium aluminate market throughout the forecast period. China is expected to soon dominate the area's calcium aluminate market soon.

Key players functioning in the global calcium aluminate market include Almatis, Kerneos, imsa, Calucem, Zhengzhou Dengfeng Smelting Materials, Fengrun Metallurgy Material, RWC, Ambition Refractories, BPI, Luoyang Refmat Corporation, Oreworld Trade, Ruishi Renewable Resources Group, Caltra Nederland, U.S., Electrofused Minerals, Shree Harikrushna Industries, Gorka Cement, Denka Company, Carborundum Universal Limited, Calderys, Cementos Molins Industrial S.A, Elfusa, Union Corportion.

Choose License Type

List of Contents

Industry Prospective:OverviewCOVID-19 Impact:Key InsightsGrowth DriversThe market growth is expected to boost with increased usage from the construction sectorRestraintsHigh cost to impede market progress to a certain extent OpportunitiesSubstitute for fluorspar to present growth prospects for the market in coming periodChallengesThe active presence of substitutes in the market to pose challenge for market growthSegmentationThe global calcium aluminate market is classified based on type, application, and region.Recent DevelopmentsRegional LandscapeThe Asia Pacific dominated the calcium aluminate market in 2021Competitive LandscapeThe global Market is segmented as follows:RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed