Chargeback Management Software Market Size, Share, Trends, Growth 2032

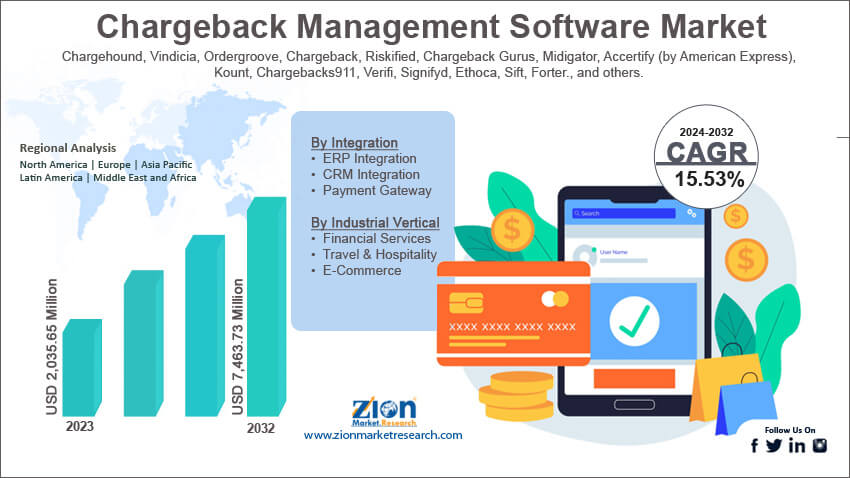

Chargeback Management Software Market By Integration (ERP Integration, CRM Integration, Payment Gateway, and Others), By Industrial Vertical (Financial Services, Travel & Hospitality, and E-Commerce), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

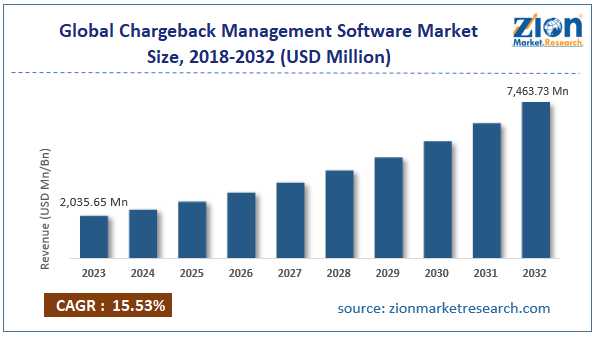

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 2,035.65 Million | USD 7,463.73 Million | 15.53% | 2023 |

Chargeback Management Software Industry Perspective:

The global chargeback management software market size was worth around USD 2,035.65 million in 2023 and is predicted to grow to around USD 7,463.73 million by 2032 with a compound annual growth rate (CAGR) of roughly 15.53% between 2024 and 2032.

Chargeback Management Software Market: Overview

Chargeback management software is an application or a program used by a credit card merchant to minimize the impact of chargeback on business operations. When a credit card issuing bank reverses a payment due to faulty charges or customer dispute is known as a chargeback. The management of such issues deals with recovering lost revenue caused by chargebacks while also analyzing and mitigating any future chargebacks. Research indicates that companies managing chargeback issues efficiently have higher customer satisfaction. They also conduct more secure transactions with minimal error. Chargeback management applications are used for managing internal information, integrating other chargeback systems such as chargeback alerts, and analyzing data related to chargeback.

They also offer reporting and tracking features with more actionable data on how to win or handle chargeback-related issues. The rising adoption of automated solutions across the globe is expected to drive the chargeback management software market demand during the projection period. However, the technical challenges associated with information technology (IT) systems may inhibit the market growth rate.

Key Insights:

- As per the analysis shared by our research analyst, the global chargeback management software market is estimated to grow annually at a CAGR of around 15.53% over the forecast period (2024-2032)

- In terms of revenue, the global chargeback management software market size was valued at around USD 2,035.65 million in 2023 and is projected to reach USD 7,463.73 million by 2032.

- The chargeback management software market is projected to grow at a significant rate due to the rising number of credit card holders across the globe

- Based on the integration, the payment gateway segment is growing at a high rate and will continue to dominate the global market as per industry projection

- Based on the industrial vertical, the financial services segment is anticipated to command the largest market share

- Based on region, North America is projected to dominate the global market during the forecast period

Request Free Sample

Request Free Sample

Chargeback Management Software Market: Growth Drivers

Rising number of credit card holders across the globe will drive the market demand rate

The global chargeback management software market is expected to grow due to the rising number of credit card holders across the globe. It is a payment card issued by a bank that allows buyers to purchase a product without cash using credit. The buyer has the option to make the payment later within a time frame issued by the bank. Credit cards allow greater purchase power and are a form of ‘buy now pay later’ concept. If credit card payments are handled responsibly, it is an excellent form of managing saved income. Additionally, it also offers several other benefits. For instance, goods and service sellers have increasingly started offering several lucrative incentives and discounts when making payments through credit cards.

Additionally, most credit cards offer access to avail equated monthly installment (EMI) facility. Certain cards also provide purchase protection through insurance. The rise in consumer awareness about the benefits of credit cards has caused an increase in demand for credit cards across most banks. In addition to this, credit cards are the primary form of payment in several economies such as the US and European territories. According to the Federal Reserve, more than 82% of American adults had access to a credit card in 2022. Similarly, developing nations are observing a change in consumer lifestyle and greater acceptance of credit forms of payment. For instance, as per the Reserve Bank of India, around 99.5 million credit cards were in circulation in the Indian economy in 2023.

Rising cases of payment fraud globally will encourage more companies to adopt chargeback management software

The global economy is currently witnessing a surge in payments across business-to-customer (B2C) and business-to-business (B2B) transactions along with other forms of businesses. However, the massive rise in the number of transactions has opened doors for a high rate of payment fraud and crimes. Identity theft is a major concern in the global economy concerning transactions related to credit cards. In 2023, the Federal Trade Commission (FTC) recorded more than 420,000 cases of identity theft due to credit card fraud. Such incidents put customers and merchants at high risk of losing personal monetary funds, thus creating growth scope for the global chargeback management software industry.

Chargeback Management Software Market: Restraints

Limited awareness about the tool may restrict the market growth rate

The global industry for chargeback management software is expected to be restricted due to limited product awareness. Chargeback management software offers niche solutions and hence does not enjoy the perks of a widely used product or service. In addition to this, like other IT systems, chargeback management software is also vulnerable to cyber security threats as the number of incidents related to the loss of customer data has increased in the last few years.

Chargeback Management Software Market: Opportunities

Growing development of comprehensive chargeback management systems may generate growth opportunities

The global chargeback management software market is expected to generate growth opportunities for the growing launch of new solutions with improved features. In April 2024, Salesforce, a leading software company, announced the launch of new additional features in the Einstein Copilot Banking Actions and Transaction Dispute Management platforms. The former is an Artificial Intelligence (AI) powered chatbot for bank service agents while the latter is used for dispute management. The company announced the launch of the Einstein 1 platform in 2023 to provide customers access to infuse automation, AI, and analytics for higher customer experience. In January 2024, Riskified, a leading provider of intelligence for managing e-commerce fraud and risks, announced the expansion of the company-owned platform Dispute Resolve. The solution is built using AI integrations and an expanded gateway for auto-compiling and formatting strong evidence for every incident related to chargebacks.

Surging online transactions, especially through e-commerce channels may fuel the adoption of chargeback management solutions

Customer dispute trends have been on the rise as the e-commerce segment continues to experience a high influx of frequent buyers. The e-commerce industry is one of the world’s fastest-growing sectors and billions of people shop online for all types of products including essentials to unique items. The constant launch of new e-commerce websites with improved customer service is further promoting growth in the e-commerce sector. As the number of online buying and selling of goods or services rises, merchants are at a higher risk of encountering regular chargebacks. Such incidents are directly expected to impact the global chargeback management software industry.

Chargeback Management Software Market: Challenges

High costs associated with the systems may challenge the market expansion trajectory

The global market for chargeback management software is projected to be challenged by the high expenses associated with the purchase and implementation of the tool. Companies must have supporting infrastructure to deploy and efficiently use advanced IT programs. Additionally, they also have to spend on training the employees for optimal program utilization resulting in extra costs.

Chargeback Management Software Market: Segmentation

The global chargeback management software market is segmented based on integration, industrial vertical, and region.

Based on the integration, the global market segments are ERP integration, CRM integration, payment gateway, and others. In 2023, the highest growth was observed in the payment gateway segment since it is the point of origin necessitating the use of chargeback management software. These devices can be integrated to work in tandem with fraud detection tools that are a default part of payment gateway solutions thus improving chances of effectively managing customer dissatisfaction and dispute. PayPal, with operations in more than 200 countries, is the most common payment gateway globally.

Based on the industrial vertical, the global market segments are financial services, travel & hospitality, and e-commerce. In 2023, the financial services segment was the leading revenue generator. Chargeback management solutions have found extensive customers in financial service-providing institutions, especially banks. The growing transaction fraud encountered by banks across the globe is a leading reason for higher segmental demand. The US has more than 4500 registered banks operating in the country.

Chargeback Management Software Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Chargeback Management Software Market |

| Market Size in 2023 | USD 2,035.65 Million |

| Market Forecast in 2032 | USD 7,463.73 Million |

| Growth Rate | CAGR of 15.53% |

| Number of Pages | 223 |

| Key Companies Covered | Chargehound, Vindicia, Ordergroove, Chargeback, Riskified, Chargeback Gurus, Midigator, Accertify (by American Express), Kount, Chargebacks911, Verifi, Signifyd, Ethoca, Sift, Forter., and others. |

| Segments Covered | By Integration, By Industrial Vertical, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Chargeback Management Software Market: Regional Analysis

North America will deliver the most lucrative growth opportunities during the forecast period

The global chargeback management software market will be dominated by North America over the forecast period. The US and Canada are likely to contribute significantly to the regional market growth rate driven by the availability of highly renowned chargeback management solutions providers in the region. Some of the most popular brands operating in North America that also have a presence in the international market include companies such as Sift, Global eCommerce, Chargeback Gurus, Ethoca, and Verifi. In a recent event, the ‘Best Chargeback Management Program’ was awarded to US-based Verifi. In March 2024, a credit card giant based out of US Mastercard announced a partnership with Worldpay to prevent merchant chargebacks. The companies are collaborating to develop solutions that will help customers settle disputes at a faster rate while also reducing the number of chargeback incidents. Another US-based player Pegasystems Inc. announced the launch of new additions in the Pega Smart Dispute™ system especially targeting to help the retail banks streamline chargeback processes.

Asia-Pacific is expected to generate significant revenue driven by the growing number of buyers and sellers operating in the regional e-commerce market. Additionally, the surging number of credit card holds in Asia-Pacific may contribute to a higher need for regional financial companies to invest in chargeback management systems.

Chargeback Management Software Market: Competitive Analysis

The global chargeback management software market is led by players like

- Chargehound

- Vindicia

- Ordergroove

- Chargeback

- Riskified

- Chargeback Gurus

- Midigator

- Accertify (by American Express)

- Kount

- Chargebacks911

- Verifi

- Signifyd

- Ethoca

- Sift and Forter.

- And Others

The global chargeback management software market is segmented as follows:

By Integration

- ERP Integration

- CRM Integration

- Payment Gateway

By Industrial Vertical

- Financial Services

- Travel & Hospitality

- E-Commerce

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Chargeback management software is an application or a program used by a credit card merchant to minimize the impact of chargeback on business operations.

The global chargeback management software market is expected to grow due to the rising number of credit card holders across the globe.

According to study, the global chargeback management software market size was worth around USD 2,035.65 million in 2023 and is predicted to grow to around USD 7,463.73 million by 2032.

The CAGR value of the chargeback management software market is expected to be around 15.53% during 2024-2032.

The global chargeback management software market will be dominated by North America over the forecast period.

The global chargeback management software market is led by players like Chargehound, Vindicia, Ordergroove, Chargeback, Riskified, Chargeback Gurus, Midigator, Accertify (by American Express), Kount, Chargebacks911, Verifi, Signifyd, Ethoca, Sift and Forter.

The report explores crucial aspects of the chargeback management software market including a detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed