Cloud Based Financial Platform Market Size, Share, Trends, Growth and Forecast 2032

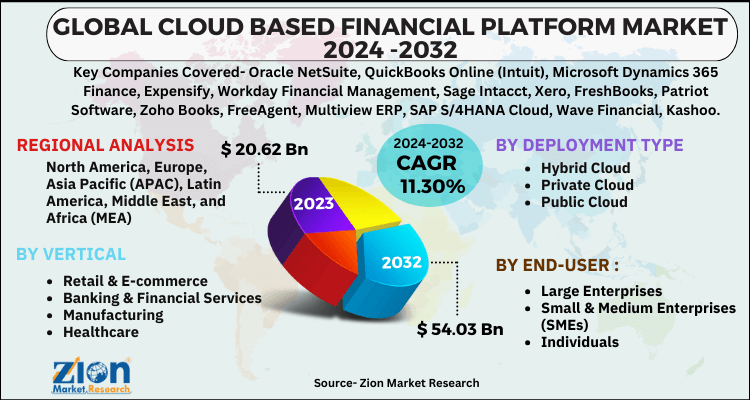

Cloud Based Financial Platform Market By Vertical (Retail & E-commerce, Banking & Financial Services, Manufacturing, Healthcare, and Others), By Deployment Type (Hybrid Cloud, Private Cloud, and Public Cloud), By End-User (Large Enterprises, Small & Medium Enterprises (SMEs), and Individuals), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

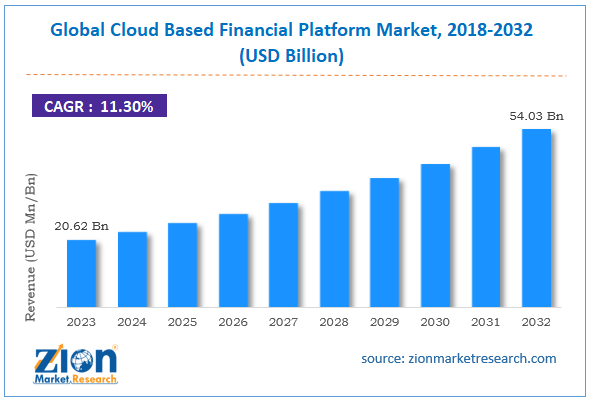

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 20.62 Billion | USD 54.03 Billion | 11.30% | 2023 |

Cloud Based Financial Platform Industry Prospective:

The global cloud based financial platform market size was worth around USD 20.62 billion in 2023 and is predicted to grow to around USD 54.03 billion by 2032 with a compound annual growth rate (CAGR) of roughly 11.30% between 2024 and 2032.

Cloud Based Financial Platform Market: Overview

Cloud-based financial platforms are digital applications or services designed to help companies and individuals manage financial transactions and tools over the Internet. These platforms operate on popular cloud platforms such as Amazon Web Server or Google Cloud. One of the key advantages of a cloud-based financial platform is the easy accessibility of the desired financial information.

For instance, businesses can obtain financial information about the company using a digital device such as a computer and the Internet. This allows companies to make informed decisions without delay. Cloud-based financial platforms are of various types.

For instance, some tools are designed to provide account-related financial information while some allow financial transactions to be carried out using the tool. In addition to this, the user interface and overall application of the tool are also influenced by the end-user.

Cloud-based financial platforms used by businesses typically offer comprehensive functionality while the ones by individuals for personal purposes may offer limited features. The demand for cloud-based financial platforms has been growing steadily due to increased end-user adoption and advancements in cloud technology. However, security concerns may impact the overall revenue in the industry.

Key Insights:

- As per the analysis shared by our research analyst, the global cloud based financial platform market is estimated to grow annually at a CAGR of around 11.30% over the forecast period (2024-2032)

- In terms of revenue, the global cloud based financial platform market size was valued at around USD 20.62 billion in 2023 and is projected to reach USD 54.03 billion by 2032.

- The market is projected to grow at a significant rate due to the increasing adoption by e-commerce companies.

- Based on the deployment type, the public cloud segment is anticipated to command the largest market share.

- Based on the end-user, the small & medium enterprises (SMEs) segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- Based on region, North America is projected to dominate the global market during the forecast period.

Cloud Based Financial Platform Market: Growth Drivers

Increasing adoption by e-commerce companies to drive market demand rate during the forecast period

The global cloud based financial platform market is projected to grow due to the increasing adoption of the solutions in the e-commerce industry. Online retailers of products are increasingly relying on cloud-based financial platforms to manage everyday financial transactions and streamline business operations. The global e-commerce industry has been one of the fastest-growing industries worldwide with billions of users accessing the different e-commerce portals every day.

In addition to this, e-commerce companies have been investing in solutions that help them improve business operations with the introduction of features such as mobile applications, same-day doorstep delivery, and product fragmentation. In the last few years, the e-commerce industry players have diversified product and service offerings.

For instance, the introduction of food and grocery delivery applications across major countries has witnessed increased adoption in urban cities. During the forecast period, the e-commerce industry is expected to witness higher returns on investment (ROI), especially with the introduction of AI-powered tools ensuring improved customer satisfaction.

Globalization and international partnerships across industries to promote market adoption rate

The growing rate of international partnerships and cross-border financial transactions across industries will act as a prominent driver for the adoption of cloud-based financial platforms. Companies worldwide are seeking international partnerships to enter new markets or in the form of technology collaborations. In such cases, the solutions available in the cloud-based financial platform can ease the process of cross-border partnerships.

In October 2024, one of India's largest steel companies, JSW Steel announced a new partnership with POSCO, a South Korean steel major to set up a new facility for integrated steel with 50% partnership of each firm.

Cloud Based Financial Platform Market: Restraints

Security concerns associated with cloud-based solutions to limit the industry’s expansion rate

The global industry for the cloud-based financial platform is projected to be restricted by the high-security concerns associated with the technology. Cloud-based solutions such as financial platforms are operated over the internet making the technology highly vulnerable to cybercrime and malware activities.

For instance, in December 2022, major financial transaction enabler PayPal announced a data breach that affected more than 35,000 customers of the company. Financial platforms hold highly confidential information making them highly attractive for cybercriminals.

Cloud Based Financial Platform Market: Opportunities

Ongoing advancements in cloud technology to generate market growth opportunities

The global cloud-based financial platform market is projected to generate growth opportunities due to ongoing investments in improving cloud technology. For instance, the introduction of hybrid cloud solutions has been pivotal in ensuring greater incorporation of cloud-based tools across industries. A hybrid cloud is a combination of private and public cloud. Additionally, other recent trends in cloud technology include serverless computing, sustainable cloud computing, and the introduction of artificial intelligence (AI) for improved performance.

In November 2023, Amazon Web Server (AWS), the technology-rich wing of Amazon, announced the commercial availability of a vector engine for Amazon OpenSearch Serverless with additional features. The tool allows the building of generative artificial intelligence and advanced machine learning (ML) augmented search experience applications.

In November 2024, Kyndryll, an IBM IT services spinoff, announced the launch of an AI private cloud in Japan. The tool is developed in partnership with Dell Technologies. It used Nvidia Chips and Dell AI Factory. The new solution is called the Kyndryl Vital AI Lab aiming to assist manufacturers, finance companies, academics, and insurance providers to deliver AI-powered solutions.

Cloud Based Financial Platform Market: Challenges

High cost and regulatory complexities impact overall growth trends in the industry

The global industry for cloud based financial platform is projected to be challenged by the high cost of developing and implementing the technology. In addition to this, financial platforms including the ones operating through cloud technology are widely regulated. The solution providers must ensure adherence to regional regulations for smooth business operations.

Cloud Based Financial Platform Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Cloud Based Financial Platform Market |

| Market Size in 2023 | USD 20.62 Billion |

| Market Forecast in 2032 | USD 54.03 Billion |

| Growth Rate | CAGR of 11.30% |

| Number of Pages | 219 |

| Key Companies Covered | Oracle NetSuite, QuickBooks Online (Intuit), Microsoft Dynamics 365 Finance, Expensify, Workday Financial Management, Sage Intacct, Xero, FreshBooks, Patriot Software, Zoho Books, FreeAgent, Multiview ERP, SAP S/4HANA Cloud, Wave Financial, Kashoo. |

| Segments Covered | By Vertical, By Deployment Type, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Cloud Based Financial Platform Market: Segmentation

The global cloud based financial platform market is segmented based on vertical, deployment type, end-user, and region.

Based on verticals, the global cloud based financial platform industry is divided into retail & e-commerce, banking & financial services, manufacturing, healthcare, and others.

Based on the deployment type, the global market segments are hybrid cloud, private cloud, and public cloud. In 2023, the highest demand was listed in the public cloud segment holding control over 53% of the total revenue. According to market analysis, public cloud systems offer greater cost-efficiency.

Moreover, they are highly scalable and hence can meet business requirements. Most public cloud service providers also comply with regional regulations thus earning customer trust and loyalty. AWS caters to the needs of more than 1.4 million active business-level users.

Based on the end-user, the global market segments are large enterprises, small & medium enterprises (SMEs), and individuals. In 2023, the highest growth was listed in the small & medium enterprises (SMEs) segment. It dominated more than 55% of the total market share. The growing incorporation of cloud technology across SMEs helping them streamline business operations is fueling the segmental growth rate. Large enterprises are significant market revenue generators driven by growing international collaborations,

Cloud Based Financial Platform Market: Regional Analysis

The US to lead the North American market during the forecast period

The global cloud based financial platform market will be led by North America during the forecast period. The US is expected to emerge as the leading revenue generator led by the presence of major technology giants providing cloud-based solutions to global and regional customers. Some of these names include Microsoft Azure, AWS, Dell Technologies, Oracle Cloud, and Cisco Systems.

Furthermore, the regional adoption of cloud-based financial platform is equally high. The US e-commerce industry is a growing market with heavy expenses in technological growth. Amazon, one of the world’s most valued e-commerce companies, is from the US. In addition to this, the existence of several strict policies governing financial institutions and their businesses has been crucial to the regional market growth rate in the past.

In October 2024, Santander, one of Spain’s largest banking companies, announced its entry into the US market. The company launched its digital banking subsidiary Openbank. The platform works as an integration of core banking systems along with customer-oriented applications. Moreover, the growing advancements in cloud technology driven by the escalating adoption of AI tools will be essential for the region in the long run.

Cloud Based Financial Platform Market: Competitive Analysis

The global cloud based financial platform market is led by players like:

- Oracle NetSuite

- QuickBooks Online (Intuit)

- Microsoft Dynamics 365 Finance

- Expensify

- Workday Financial Management

- Sage Intacct

- Xero

- FreshBooks

- Patriot Software

- Zoho Books

- FreeAgent

- Multiview ERP

- SAP S/4HANA Cloud

- Wave Financial

- Kashoo.

The global cloud based financial platform market is segmented as follows:

By Vertical

- Retail & E-commerce

- Banking & Financial Services

- Manufacturing

- Healthcare

- Others

By Deployment Type

- Hybrid Cloud

- Private Cloud

- Public Cloud

By End-User

- Large Enterprises

- Small & Medium Enterprises (SMEs)

- Individuals

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Cloud-based financial platforms are digital applications or services designed to help companies and individuals manage financial transactions and tools over the Internet.

The global cloud based financial platform market is projected to grow due to the increasing adoption of the solutions in the e-commerce industry.

According to study, the global cloud based financial platform market size was worth around USD 20.62 billion in 2023 and is predicted to grow to around USD 54.03 billion by 2032.

The CAGR value of the cloud based financial platform market is expected to be around 11.30% during 2024-2032.

The global cloud based financial platform market will be led by North America during the forecast period.

The global cloud based financial platform market is led by players like Oracle NetSuite, QuickBooks Online (Intuit), Microsoft Dynamics 365 Finance, Expensify, Workday Financial Management, Sage Intacct, Xero, FreshBooks, Patriot Software, Zoho Books, FreeAgent, Multiview ERP, SAP S/4HANA Cloud, Wave Financial and Kashoo.

The report explores crucial aspects of the cloud based financial platform market including detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed