Color-Coated Steel Market Size, Share, Price, Trends, and Forecast to 2028

Color-Coated Steel Market By Type (Metallic Coated Steel, Organic Coated Steel, and Tinplate), By Application (Building & Construction, Appliances, Automotive, and Others), And By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2022 - 2028

| Market Size in 2021 | Market Forecast in 2028 | CAGR (in %) | Base Year |

|---|---|---|---|

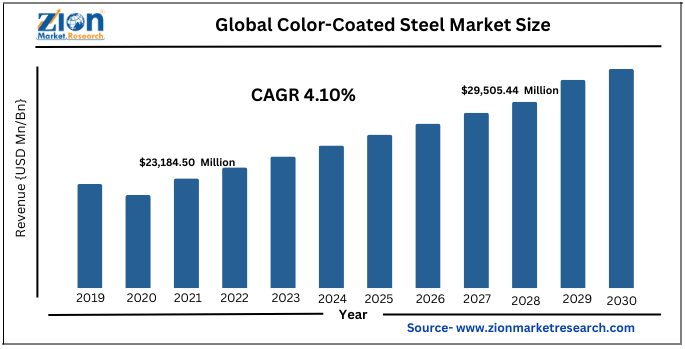

| USD 23,184.50 Million | USD 29,505.44 Million | 4.10% | 2021 |

Global Color-Coated Steel Industry Prospective:

The global color-coated steel market size was worth around USD 23,184.50 Million in 2021 and is estimated to grow to about USD 29,505.44 Million by 2028, with a compound annual growth rate (CAGR) of approximately 4.10% over the forecast period. The report analyzes the color-coated steel market drivers, restraints/challenges, and their effect on the demands during the projection period. In addition, the report explores emerging opportunities in the color-coated steel market.

Color-Coated Steel Market: Overview

Coated steel is steel with a layer of organic or metallic chemicals put on it to stop rusting. The three primary varieties of coated steel are tinplate, organic (non-metallic), and metallic coated steel. Applications requiring corrosion protection, a beautiful aesthetic, or food safety can benefit from coated steel. Customers who want to protect steel from corrosive environments at a reasonable cost may want to consider coated steel. The zinc coating will sacrifice itself to protect the underlying steel by serving as a barrier between it and the elements. Items with metal coatings are made to withstand harsh environments, extending the useful life of the finished product by protecting the steel from corrosion.

Coated steel is the best material for many building uses, especially walls and roofs because it also offers good corrosion resistance. Coated steel can be roll-formed, pressed, punched, and connected to many structural and adorning components for various purposes. Food packaging applications, such as food cans and beverages, have seen tremendous growth in recent years, particularly in the Asia Pacific, due to shifting regional demographics, such as houses that are getting smaller in conjunction with the young generation's adoption of a fast-paced lifestyle.

Key Insights

- As per the analysis shared by our research analyst, the global color-coated steel market value will grow at a CAGR of 4.10% over the forecast period.

- In terms of revenue, the global color-coated steel market size was valued at around USD 23,184.50 million in 2021 and is projected to reach USD 29,505.4 million by 2028.

- The automotive sector is increasingly using color-coated steel because of its low manufacturing costs, and several global advantages are the major factors driving the market's growth.

- By type, the metallic coated steel dominated the market in 2021.

- By application, the building & construction category dominated the market in 2021.

- Asia Pacific dominated the color-coated steel market in 2021.

Color-Coated Steel Market: Growth Drivers

A rise in electric vehicle sales is driving the demand for color-coated steel.

One of the key factors propelling the growth of the global color-coated steel market is the rising demand for electric vehicles around the globe. The exteriors of electric cars frequently feature pre-painted galvanized steel. Additionally, the IEA (International Energy Association) reports that the global market for electric vehicles will reach 2.94 million units in 2020, up 40% from the previous year. The body of electric vehicles forms the entire vehicle construction and is coated steel. On the body of the electric automobile, ready-made coated steel is a cost-effective material. The market for color-coated steel is now experiencing significant demand from the electric vehicle sector.

Color-Coated Steel Market: Restraints

Stringent regulatory framework imposed by the government to restrict market growth

The market is being hampered by the tariffs that the U.S. government has imposed on most nations, including Canada, the European Union, India, and Mexico, for the trade of steel and aluminum. In addition, the U.S. government has imposed tariffs on imported goods from China, including steel, which is hurting the steel industry. Transporting color-coated steel from one location to another necessitates vertical packaging and uploading & unloading. To prevent relative product movement or rolling during transportation and damage to the color-coated steel, the product must be fastened firmly in the truck or other vehicle. Additionally, the market is being constrained by high transportation costs to the manufacturers brought on by ongoing fuel price hikes.

Color-Coated Steel Market: Opportunities

Growing adoption of environment-friendly products to create growth prospects for market

Environmentally friendly items are becoming more widely used, and steel production produces less CO2 than previous generations. Because non-ferrous metals like zinc and copper can contaminate soil and are quickly absorbed into the ground by rain, various governments around the world forbid their use. Steel sheets with colored coatings are recycled, melted, or processed to create different roofing materials. Because of this, the steel sheet or coil is completely eco-friendly. Steel is generally preferred in construction because it can be efficiently utilized again. Additionally, the global color-coated steel market is being opened up by investments in eco-friendly, efficient engineering projects, and increased funding for sustainable living.

Color-Coated Steel Market: Challenges

The availability of inexpensive substitutes is impeding the expansion of market.

The affordability of low-cost alternatives like aluminum and galvanized aluminum is a significant obstacle to expanding the global color-coated steel market. Galvanized aluminum products provide many benefits over coated steel items, including being lighter, more accessible, and more inexpensive. The U.S. Geological Survey estimates that compared to November 2020, aluminum output grew by 16 percent to 77,000 metric tonnes in December 2020.

Color-Coated Steel Market: Segmentation

The type, application, and region categories are used to segment the global color-coated steel market.

based on type, Tinplate, organically coated steel, and metallically coated steel make up the three varieties of the market based on type. In 2021, the metallic coated sector had the biggest market share in the coated steel industry. The metals are coated through various procedures, including hot-dip galvanization and the annealing of steel sheets. Metallic steel coat offers great defense for metal surfaces against oxidation, corrosion, and other forms of obsolesce. One of the main reasons metallic coating is chosen over other types of coating, such as organic coating and tin coating, is that it also offers the benefit of quick assembly and disassembly. The demand for metallic coated steel in the color-coated steel industry is primarily driven by it.

based on application, Automotive, appliances, building & construction, and other industries are included in the application-based area. The building & construction industry held the largest share in the color-coated steel market. The demand for coated steel goods like pipe and tubular is primarily driven by the rise in construction activity worldwide. The World Bank projects that the cost of spending in the construction industry will reach US$11.9 trillion by 2023, an increase of 4.2 percent over the previous year's cost. This major factor driving the building and construction industry's need for coated steel.

Global Color-Coated Steel Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Color-Coated Steel Market |

| Market Size in 2021 | USD 23,184.50 Million |

| Market Forecast in 2025 | USD 29,505.44 Million |

| Compound Annual Growth Rate | CAGR of 4.10% |

| Number of Pages | 166 |

| Forecast Units | Value (USD Million), and Volume (Units) |

| Key Companies Covered | ArcelorMittal, Essar Steel, POSCO, Voestalpine AG, JFE Steel Corporation, Nippon Steel Corporation, OJSC Novolipetsk Steel, Baosteel Group, SSAB AB, Severstal, JSW, ChinaSteel, Kobe Steel Ltd., Nucor, and Tata Steel. |

| Segments Covered | By Product, By Application, By End-User And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latian America, Middle East and Africa (MEA) |

| Countries Covered | North America: U.S and Canada Europe: Germany, Italy, Russia, U.K, Spain, France, Rest of Europe APAC: China, Australia, Japan, India, South Korea, South East Asia, Rest of Asia Pacific Latin America: Brazil, Argentina, Chile The Middle East And Africa: South Africa, GCC, Rest of MEA |

| Base Year | 2020 |

| Historical Year | 2016 to 2020 |

| Forecast Year | 2021 - 2028 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Recent Developments

- To introduce their new premium color coated steel product lines, "KALASH" and "KALASH GOLD," ArcelorMittal and Nippon Steel Corporation formed a joint venture in March 2021.

- Tata Steel launched two new coated product names in June 2020 in partnership with ECAs: GalvaRoS and Colornova (Emerging Corporate Accounts). These products were released to satisfy the ECAs' expanding needs (Emerging Corporate Accounts).

Color-Coated Steel Market: Regional Landscape

Asia Pacific dominated the color-coated steel market in 2021

Due to the growing population and rising demand for infrastructure in nations like China, India, Japan, and South Korea, Asia Pacific is predicted to have a substantial CAGR in the global color-coated steel market during the forecast period. Due to the significant presence of manufacturers in the area and the quick expansion of numerous end-use industries, the region is experiencing tremendous growth in office space, retail establishments, and public safety construction activities, which fuels the Asia Pacific market.

Europe has a sizeable portion of the market due to the region's increased emphasis on infrastructure development and construction activities in Germany, the United Kingdom, and Russia during the forecast period. Pre-painted metal is created by continuously applying a paint coating to strip metals, such as steel and aluminum, and was initially utilized in Europe, where it is anticipated that demand for color-coated steel will increase. Further, in the markets like Latin America and the Middle East & Africa witnessed consistent growth. The market is anticipated to be stimulated by the increasing use of color-coated steel in various regional industries.

Color-Coated Steel Market: Competitive Landscape

Key players functioning in the global color-coated steel market include

- ArcelorMittal

- Essar Steel

- POSCO

- Voestalpine AG

- JFE Steel Corporation

- Nippon Steel Corporation

- and OJSC Novolipetsk Steel

- Baosteel Group

- SSAB AB

- Severstal

- JSW

- ChinaSteel

- Kobe Steel Ltd.

- Nucor

- Tata Steel.

Color coated steel market is segmented as follows:

By Type

- Metallic Coated Steel

- Organic Coated Steel

- Tinplate

By Application

- Building & Construction

- Appliances

- Automotive

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The automotive sector is increasingly using color coated steel because of its low manufacturing costs and several advantages, which are the main drivers of market expansion throughout the forecast period.

The global color-coated steel market was worth around USD 23,184.50 million in 2021 and is estimated to grow to about USD 29,505.44 million by 2028, with a compound annual growth rate (CAGR) of approximately 4.10% over the forecast period.

Asia Pacific is expected to witness a significant CAGR in global color-coated steel market during the forecast period, due to the rising population along with the increasing demand for infrastructure in countries such as China, India, Japan, and South Korea.

Key players functioning in the global color-coated steel market include ArcelorMittal, Essar Steel, POSCO, Voestalpine AG, JFE Steel Corporation, Nippon Steel Corporation, OJSC Novolipetsk Steel, Baosteel Group, SSAB AB, Severstal, JSW, ChinaSteel, Kobe Steel Ltd., Nucor, and Tata Steel.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed