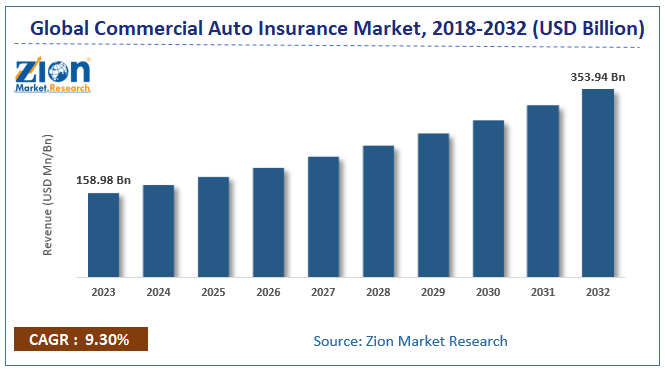

Commercial Auto Insurance Market Growth, Size, Share, Trends, and Forecast 2032

Commercial Auto Insurance Market By Type (physical damage insurance, liability insurance, and rental insurance), By Application (commercial vehicle and passenger car) And By Region: - Global And Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts, 2024-2032

| Market Size in 2023 | Market Forecast in 2032 | Growth Rate (in %) | Base Year |

|---|---|---|---|

| USD 158.98 Billion | USD 353.94 Billion | CAGR at 9.30% | 2023 |

Description

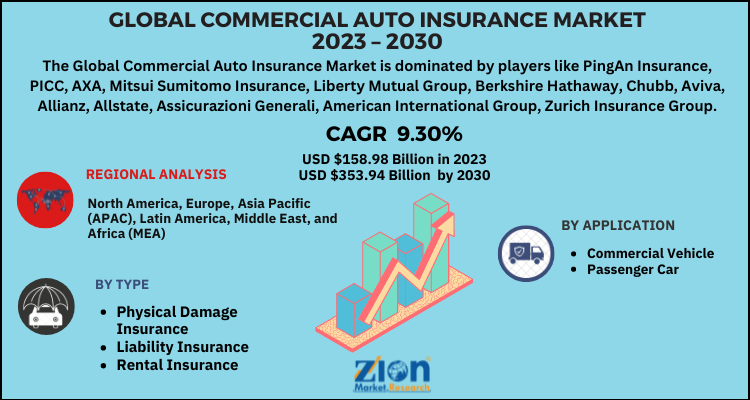

According to the report published by Zion Market Research, the global Commercial Auto Insurance Market size was valued at USD 158.98 Billion in 2023 and is predicted to reach USD 353.94 Billion by the end of 2032. The market is expected to grow with a CAGR of 9.30% during the forecast period. The report analyzes the global Commercial Auto Insurance Market’s growth drivers, restraints, and impact on demand during the forecast period. It will also help navigate and explore the arising opportunities in the Commercial Auto Insurance Market industry.

Global Commercial Auto Insurance Market: Overview

Commercial auto insurances are auto insurance policies that cover any damages, along with injuries that are caused to the employees, during the scope of the business. Commercial auto insurance policies are an excellent way to insure all the on-field employees in an organization. With the growing number of car accidents, companies want to cover their employees and decrease any form of risk in the near future. In light of this, auto insurance service providers are actively employed in this market to raise awareness and aid in the market growth during the forecast period.

For instance, in 2018, an approximate of 2,841 people died in the US owing to distracted driving methods. Moreover, out of the nearly 40,000 fatal accidents per year in the US, 25% of such accidents are a result of distracted driving. In light of this, many key commercial auto insurance providers have started to create awareness about the coverage of damages under several auto insurance policies. Thus, such strategies are set to boost the commercial auto insurance market growth in the near future.

Global Commercial Auto Insurance Market: Growth Factors

The global commercial auto insurance market growth is rising at a tremendous pace owing to the factors such as the rising demand for automobiles, rapid urbanization in most developing as well as underdeveloped regions, and the inclination of key players towards creating awareness on the essentiality of auto insurance policies. Moreover, the changing regulations in the automobile industry push the demand for commercial auto insurance policies. For instance, most automobile authorities have made it mandatory to buy auto insurance during the purchase of the vehicle.

Also, the United Nations General Assembly has set a striving target of halving the comprehensive number of injuries and deaths happen during traffic crashes by 2030. Such strategies will help in boosting the share of commercial auto insurance in the forecast period. Furthermore, the rise in road accidents and the severity of claims is another prominent factor pushing the market growth. For instance, according to the data published in June 2021 by World Health Organization (WHO), an approximate of 1.3 million people die each year as a result of road traffic crashes.

Road accidents cost most countries nearly 3% of their overall domestic product. Also the same source stated 93% of the world's fatalities on the roads befall in the low- and middle-income countries, even though such countries have about 60% of the world's vehicles. Also, in 2020, State Farm, a prominent auto insurance player paid approximate of USD 12.1 million in claims for catalytic converter theft. However, in the initial 6 months of 2021, that number grew to more than USD 21 million in paid claims. Such high statistics give rise to the adoption of commercial auto insurance policies across the world.

The COVID-19 outbreak has forced the auto insurance players to re-examine its role and eliminate the black swan events in the industry. The outbreak accelerated the digitization process. The insurance providers struggled to gain familiarity with virtual communication modes. However, with the adoption of alternative approaches and risk modeling techniques, the market is set to grow amid the pandemic.

Global Commercial Auto Insurance Market: Segmentation

The global commercial auto insurance market is classified based on type, application, and region.

Based on the type, the global commercial auto insurance market is segmented into physical damage insurance, liability insurance, and rental insurance.

On the basis of application, the global commercial auto insurance market is bifurcated into commercial vehicle and passenger car.

Commercial Auto Insurance Market : Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Commercial Auto Insurance Market Research Report |

| Market Size in 2023 | USD 158.98 Billion |

| Market Forecast in 2032 | USD 353.94 Billion |

| Growth Rate | CAGR of 9.30% |

| Number of Pages | 196 |

| Key Companies Covered | PingAn Insurance, PICC, AXA, Mitsui Sumitomo Insurance, Liberty Mutual Group, Berkshire Hathaway, Chubb, Aviva, Allianz, Allstate, Assicurazioni Generali, American International Group, Zurich Insurance Group, Prudential, China Life Insurance Group, Travelers Insurance, GEICO, State Farm, Erie Insurance, MAPFRE, and Generali Group, among others. |

| Segments Covered | By Type, By Application and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Global Commercial Auto Insurance Market: Regional Analysis

The European region is estimated to hold the largest share in the global commercial auto insurance market over the forecast period. The rise in government initiatives, growing concerns regarding car accidents & injuries, and the increase in the number of prominent insurance providers are the chief elements driving the growth of the market in this region. For instance, in 2019, nearly 22,800 people were killed in road accidents in the European Union. In the same year, Romania had 96 people killed per million inhabitants in road accidents, which was the highest among all the European Union countries.

Thus, such high statistics indirectly point towards the significant share of this region in the global commercial auto insurance market. Moreover, North America is projected to witness considerable growth in the market due to the growing competition among the manufacturers to launch new policies to lure customers. The rising medical costs in relation to accidents as well as the booming cost of vehicle physical damage repairs will push the growth of the North American commercial auto insurance market in the anticipated period.

Global Commercial Auto Insurance Market: Competitive Players

Some of the key players in the global commercial auto insurance market are:

- PingAn Insurance

- PICC

- AXA

- Mitsui Sumitomo Insurance

- Liberty Mutual Group

- Berkshire Hathaway

- Chubb

- Aviva

- Allianz

- Allstate

- Assicurazioni Generali

- American International Group

- Zurich Insurance Group

- Prudential

- China Life Insurance Group

- Travelers Insurance

- GEICO

- State Farm

- Erie Insurance

- MAPFRE

- Generali Group

- among others.

The Global Commercial Auto Insurance Market is segmented as follows:

By Type

- physical damage insurance

- liability insurance

- rental insurance

By Application

- commercial vehicle

- passenger car

Global Commercial Auto Insurance Market: Regional Segment Analysis

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

What Reports Provides

- Full in-depth analysis of the parent market

- Important changes in market dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional markets

- Testimonials to companies in order to fortify their foothold in the market.

Table Of Content

Choose License Type

FrequentlyAsked Questions

Factors such as increasing road accidents, the launch of top-notch coverage policies, as well as the presence of established players are the key factors that are driving the growth of the market. Furthermore, an increasing inclination towards the usage of auto insurance policies will offer lucrative opportunities for the growth of the global commercial auto insurance market during the forecast period.

Some of the key players in the global commercial auto insurance market are MAPFRE, PingAn Insurance, PICC, AXA, Mitsui Sumitomo Insurance, Liberty Mutual Group, Berkshire Hathaway, Chubb, Aviva, and Generali Group.

Europe is estimated to hold the largest share in the global commercial auto insurance market over the forecast period. The rise in government initiatives and increase in road accident cases are the major factors that are boosting the growth of the market in this region.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed