Commercial Lighting Market Size, Share, Industry Analysis, Trends, Growth 2030

Commercial Lighting Market By Installation Type (Retrofit Installations and New Installations), By Offering (Hardware, Software, and Services), By Communication Technology (Wireless and Wired), By Application (Outdoor and Indoor), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2023 - 2030

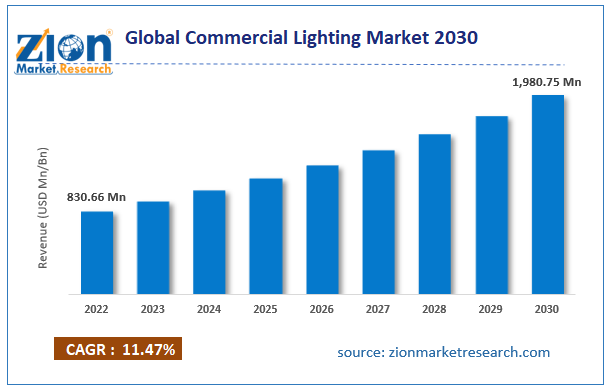

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 830.66 Million | USD 1,980.75 Million | 11.47% | 2022 |

Commercial Lighting Industry Prospective:

The global commercial lighting market size was worth around USD 830.66 million in 2022 and is predicted to grow to around USD 1,980.75 million by 2030 with a compound annual growth rate (CAGR) of roughly 11.47% between 2023 and 2030.

Commercial Lighting Market: Overview

Commercial lighting is the use of illumination tools and lights meant only for commercial spaces. Commercial lightings are designed keeping in view the illumination needs of commercial spaces such as corporate offices, government buildings, recreational centers, hotels, stores, and other public-access facilities. They are considerably different from lighting systems designed for industrial or residential settings. In most cases, a commercial establishment developer is likely to consult an experienced professional with expertise in understanding and delivering light requirements as per the needs of the unit. Some factors that separate commercial lighting and residential lighting are the higher cost of installation of the former type along with higher maintenance charges.

However, they also tend to have superior options for energy saving. Lighting consultants play a crucial role in developing a lighting plan for commercial units since they are aware of the right tools that will deliver optimum results based on the area that has to be covered as well as the end application of the commercial facility. During the forecast period, the demand for commercial lighting is expected to continue growing since investments in commercial centers have surged in recent times.

Key Insights:

- As per the analysis shared by our research analyst, the global commercial lighting market is estimated to grow annually at a CAGR of around 11.47% over the forecast period (2023-2030)

- In terms of revenue, the global commercial lighting market size was valued at around USD 830.66 million in 2022 and is projected to reach USD 1,980.75 million, by 2030.

- The commercial lighting market is projected to grow at a significant rate due to the rising innovation in the field of commercial lighting

- Based on installation type segmentation, new installations were predicted to show maximum market share in the year 2022

- Based on communication technology segmentation, wired was the leading segment in 2022

- On the basis of region, North America was the leading revenue generator in 2022

Request Free Sample

Request Free Sample

Commercial Lighting Market: Growth Drivers

Rising innovation in the field of commercial lighting to drive market growth

The global commercial lighting market is expected to benefit from the increasing rate of innovation and development in terms of lighting solutions with improved performance and better energy-saving options. Commercial centers typically have advanced requirements in terms of lighting as compared to residential units. They tend to cover broader areas and must be carefully designed to not interfere with the overall ambiance or work of employees working at the units. They must be designed in a way that contributes to overall ambiance upliftment. The change in consumer demands and expectations driven by several external and internal factors has led to a growing need for constant innovation in the field of commercial lighting solutions.

In November 2023, Halonix Technologies announced the launch of Wall De-light. The new range offers not only aesthetically pleasing lighting solutions but also encourages an innovation-led era in the industry. The prices are highly competitive but do not compromise on the overall product performance. In October 2023, Lumenpulse, an industry leader with a core focus on providing lighting solutions for urban environments, commercial centers, and institutions, launched Lumenfacade Max. The product has exterior applications and it is an architectural linear fixture. It works as an amalgamation of technology, performance, and design.

Rising investments in the construction of new and improved commercial centers may propel market growth

The demand for the global commercial lighting market is expected to increase due to the growing construction of new commercial centers and administrative buildings. Several countries across the globe are investing in grand commercial centers as a means to showcase economic growth or gain international recognition. Additionally, older buildings are unable to meet the modern requirements of commercial units leading to demolitions and the development of new centers.

For instance, India is witnessing the construction of a new international airport in Mumbai city. As of December 2023, almost 60% of the work is completed and the unit is set to be inaugurated in December 2024.

Commercial Lighting Market: Restraints

High cost of initial investment to restrict market growth

The global industry for commercial lighting is projected to witness certain growth restrictions due to the high initial cost of investment required to establish a plan for efficient commercial lighting. Since most centers are spread across a large area, lighting solutions are more expensive owing to the area that needs to be covered.

Additionally, the entire space doesn't need to have the same type of lighting since the final application of the space plays a crucial role in determining the type of lighting that must be used. Other factors such as access to natural light and illumination intensity depending on the commercial unit must be paid attention to when drafting the lighting plan.

Commercial Lighting Market: Opportunities

Rising applications of smart commercial lighting may fuel market demand

The global commercial lighting market is projected to gain momentum due to the increase in demand for smart lighting solutions. Companies and institutions are increasingly seeking innovative measures through which they can reduce costs and save more energy. Smart commercial lighting is an excellent way of controlling energy use remotely. Smart systems consist of working with digital technology and software connected to a common platform that can be operated over a smart system such as a computer, laptop, tablet, or smartphone. Furthermore, some smart solutions are also equipped with sensors thus passing relevant information to the concerned authority who in turn can make necessary adjustments to save more energy and eventually bring down the application cost.

In June 2023, URC, a leading solutions provider in terms of commercial and residential automation, launched URC Lighting LT-3300. It is a novel lighting solution with an all-in-one approach. In October 2023, GVS, a China-based building intelligence provider, announced the completion of the Xi'an Nanfeihong Plaza Smart Lighting Project in which the company used logic control modules and motion sensors in restrooms, public corridors, and other spaces in the commercial center. GVS K-BUS smart lighting control system (KNX) is expected to help the facility save up to 30% of energy.

Commercial Lighting Market: Challenges

High replacement costs and establishing connections with legacy systems may challenge market demand

The global commercial lighting market will be impacted by the challenges faced in terms of the high cost of replacement. Since commercial lighting solutions are specially designed as per the requirement of the facility, replacement costs are generally higher due to the uniqueness of the products used in creating a lighting system. Additionally, lighting consultants face difficulty in establishing a seamless connection between new solutions and legacy systems especially contemporary lighting solutions.

Commercial Lighting Market: Segmentation

The global commercial lighting market is segmented based on installation type, offering, communication technology, application, and region.

Based on installation type, the global market segments are retrofit installations and new installations. In 2022, the highest growth was observed in the new installations segment driven by the rising construction of new commercial units across the globe. Commercial space has always been an important part of the real estate sector and in the last decade, this segment has witnessed rapid growth. Economies across the globe are investing in developing modern and technology-rich commercial centers to attract domestic and international investors. For instance, the US commercial real estate market is over USD 30 trillion.

Based on offering, the global commercial lighting industry is segmented into hardware, software, and services.

Based on communication technology, the global market segments are wireless and wired. In 2022, the highest growth was mainly observed in the wired segment however, the wireless segment is currently growing at the fastest rate. The wired segment is considered more affordable and hence is accepted by a large part of commercial center owners. The wireless segment is similar to smart technologies. It requires modern tools including software, hardware, and a service provider thus the cost of investment is higher. In 2015, the monthly utility bill of the Pentagon, the Department of Defense headquarters, was around USD 1.5 million, as per official sources.

Based on application, the global market segments are outdoor and indoor.

Commercial Lighting Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Commercial Lighting Market |

| Market Size in 2022 | USD 830.66 Million |

| Market Forecast in 2030 | USD 1,980.75 Million |

| Growth Rate | CAGR of 11.47% |

| Number of Pages | 218 |

| Key Companies Covered | General Electric (GE), Signify (formerly Philips Lighting), Cree Inc., Osram Licht AG, Zumtobel Group, Acuity Brands, Lutron Electronics, Hubbell Lighting, Havells Sylvania, Eaton Corporation, NVC Lighting, Legrand, Samsung Electronics, Panasonic Lighting, Thorn Lighting., and others. |

| Segments Covered | By Installation Type, By Offering, By Communication Technology, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Commercial Lighting Market: Regional Analysis

North America to lead the way during the projection period

The global commercial lighting market will be led by North America during the forecast period. The reason for the higher growth rate is the presence of a well-established commercial real estate market in the leading nations of Canada and the US. The latter is the world’s most dominating country in terms of global power across industries. These countries are home to several commercial centers including headquarters of global giants from all sectors as well as other commercial units such as sports and recreational facilities. Furthermore, New York City in the US is the hub for the financial market for the country and other nations. As of May 2023, more than 400 skyscrapers were listed in New York City alone out of which most of them are commercial spaces.

Asia-Pacific is a fast-growing region primarily driven by countries such as China, Singapore, India, Japan, and South Korea. China is a leading nation in terms of commercial lighting solutions provider to consumers within the country as well as across international borders. The growing demand for smart commercial lighting as well as the existence of modern yet affordable solutions providers may drive regional growth.

Commercial Lighting Market: Competitive Analysis

The global commercial lighting market is led by players like:

- General Electric (GE)

- Signify (formerly Philips Lighting)

- Cree Inc.

- Osram Licht AG

- Zumtobel Group

- Acuity Brands

- Lutron Electronics

- Hubbell Lighting

- Havells Sylvania

- Eaton Corporation

- NVC Lighting

- Legrand

- Samsung Electronics

- Panasonic Lighting

- Thorn Lighting.

The global commercial lighting market is segmented as follows:

By Installation Type

- Retrofit Installations

- New Installations

By Offering

- Hardware

- Software

- Services

By Communication Technology

- Wireless

- Wired

By Application

- Outdoor

- Indoor

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Commercial lighting is the use of illumination tools and lights meant only for commercial spaces.

The global commercial lighting market is expected to benefit from the increasing rate of innovation and development in terms of lighting solutions with improved performance and better energy-saving options.

According to study, the global commercial lighting market size was worth around USD 830.66 million in 2022 and is predicted to grow to around USD 1,980.75 million by 2030.

The CAGR value of commercial lighting market is expected to be around 11.47% during 2023-2030.

The global commercial lighting market will be led by North America during the forecast period.

The global commercial lighting market is led by players like General Electric (GE), Signify (formerly Philips Lighting), Cree, Inc., Osram Licht AG, Zumtobel Group, Acuity Brands, Lutron Electronics, Hubbell Lighting, Havells Sylvania, Eaton Corporation, NVC Lighting, Legrand, Samsung Electronics, Panasonic Lighting, and Thorn Lighting.

The report explores crucial aspects of the commercial lighting market including detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed