Consumer Healthcare Market Size, Share, Trends, Growth and Forecast 2034

Consumer Healthcare Market By Product Type (OTC pharmaceuticals, Personal Care Products, Vitamins And Dietary Supplements, and Fitness Equipment), By Distribution Channel (Retail Pharmacies, Online Retailers, Supermarkets/Hypermarkets, and Specialty Stores), By Consumer Demographics (Pediatric, Adult, and Geriatric), By Application (Pain Management, Weight Management, Digestive Health, Oral Care, and Skin Care), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

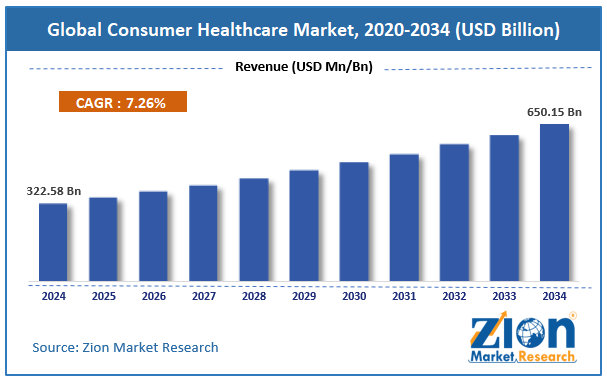

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 322.58 Billion | USD 650.15 Billion | 7.26% | 2024 |

Consumer Healthcare Industry Prospective:

The global consumer healthcare market size was valued at approximately USD 322.58 billion in 2024 and is expected to reach around USD 650.15 billion by 2034, growing at a compound annual growth rate (CAGR) of roughly 7.26% between 2025 and 2034.

Consumer Healthcare Market: Overview

Consumer healthcare products encompass over-the-counter medications, personal care items, vitamins, supplements, and wellness devices that consumers purchase directly without prescription requirements. This market enables self-care and preventative health management so people can manage their health outside traditional healthcare settings. The consumer healthcare market has changed health maintenance, personal care, and wellness across many demographics.

Consumer healthcare products are the bedrock of modern preventative health, providing access to medications, hygiene solutions, nutritional support, and monitoring capability so people can manage minor ailments in day-to-day health and prevent more significant conditions. Aging populations, digital health integration, and growing health consciousness drive the consumer healthcare industry.

Over the forecast period, the expansion of preventative health approaches, digital health, clean-label product innovation, and self-care adoption across many geographies will drive the market.

Key Insights:

- As per the analysis shared by our research analyst, the global consumer healthcare market is estimated to grow annually at a CAGR of around 7.26% over the forecast period (2025-2034)

- In terms of revenue, the global consumer healthcare market size was valued at around USD 322.58 billion in 2024 and is projected to reach USD 650.15 billion by 2034.

- The consumer healthcare market is projected to grow significantly due to increasing health awareness post-pandemic, rising preferences for self-medication, growth in aging populations requiring regular health management products, and expanding e-commerce platforms enhancing product accessibility.

- Based on product type, vitamins and dietary supplements lead the segment and will continue to dominate the global market.

- Based on distribution channels, online retailers are anticipated to command the largest market share by the end of the forecast period.

- Based on consumer demographics, adult consumers are expected to lead the market during the forecast period.

- Based on application, skin care will remain dominant during the forecast period.

- Based on region, North America is projected to dominate the global market during the forecast period.

Consumer Healthcare Market: Growth Drivers

Rising consumer empowerment and health consciousness

In the consumer healthcare market, with preventative health on the rise, there's more focus on products that deliver everyday wellness. Consumers seek healthcare products offering transparency, natural ingredients, and scientifically backed benefits to enhance their self-care routines.

According to recent industry surveys, 47% of consumers have increased their interest in preventative health in the last 5 years, and investment in personal wellness products has risen proportionally. Growing consumer preference for personalized health solutions and digital health integrations further shapes market trends.

Digital health integration and personalized solutions

Technology drives the consumer healthcare industry, with manufacturers adding features like mobile health apps, wearables, and AI-powered diagnostic tools. Modern consumer healthcare products now offer personalization, tracking, and better effectiveness. 68% of new consumer healthcare purchases are influenced by digital, and mobile health app connectivity is one of the top three features requested.

Manufacturers are allocating more of their R&D budget to connected health solutions with a 22% increase in digital health investments. Integration of real-time data analytics and remote monitoring capabilities further enhances user engagement and treatment outcomes.

Consumer Healthcare Market: Restraints

Regulatory complexities and product safety concerns

Regulatory compliance, safety standards, and marketing claim restrictions are considerable barriers to the consumer healthcare market. Manufacturers must adapt to changing regulations as product effectiveness and ingredient safety concerns grow.

Industry reports show that 71% of manufacturers say regulatory compliance is the number one barrier to market growth, especially for products that make health claims across multiple geographies. Companies increasingly invest in regulatory expertise and certification processes to navigate complex global compliance requirements.

Consumer Healthcare Market: Opportunities

Integration of sustainable practices and natural formulations

Eco-friendly packaging and natural ingredient formulations transform the consumer healthcare market by providing improved sustainability, reduced environmental impact, and alignment with consumer values.

Natural and organic consumer health products can now deliver similar effectiveness to traditional formulations but with ecological benefits and fewer synthetic ingredients. Companies using sustainable consumer health approaches report 35% higher consumer loyalty and 28% stronger brand perception than those using traditional models.

Consumer Healthcare Market: Challenges

Information overload and consumer skepticism

The consumer healthcare market is bustling, but information overload and growing consumer skepticism are massive barriers to entry. 63% of potential buyers cite mixed health information as the only reason for hesitation. 51% of retailers say testimonial marketing is ineffective as consumers demand more scientific proof. Supply chain transparency and ingredient sourcing verification make it challenging for manufacturers to build consumer trust.

Many regions have different self-care approaches that impact marketing and product development. As consumers prioritize evidence-based benefits, the demand for clinically validated, transparent health products that balance efficacy and natural formulation will grow.

Request Free Sample

Request Free Sample

Consumer Healthcare Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Consumer Healthcare Market |

| Market Size in 2024 | USD 322.58 Billion |

| Market Forecast in 2034 | USD 650.15 Billion |

| Growth Rate | CAGR of 7.26% |

| Number of Pages | 213 |

| Key Companies Covered | Johnson and Johnson, Procter and Gamble, Pfizer Inc., GlaxoSmithKline plc, Sanofi S.A., Bayer AG, Abbott Laboratories, Reckitt Benckiser Group plc, Nestlé S.A., Colgate-Palmolive Company, Unilever, Kimberly-Clark Corporation, Church and Dwight Co. Inc., The Himalaya Drug Company, Cipla Inc., Sun Pharmaceutical Industries Ltd., Perrigo Company plc, Prestige Consumer Healthcare Inc., Nature's Bounty Co., Herbalife Nutrition Ltd., and others. |

| Segments Covered | By Product Type, By Distribution Channel, By Consumer Demographics, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Consumer Healthcare Market: Segmentation

The global consumer healthcare market is segmented into product type, distribution channel, consumer demographics, application, and region.

Based on product type, the industry is segregated into OTC pharmaceuticals, personal care products, vitamins and dietary supplements, and fitness equipment. Vitamins and dietary supplements lead the market by offering enhanced nutritional support, preventative health benefits, and wellness optimization. Dietary supplements account for approximately 38% of total consumer healthcare sales.

Based on distribution channels, the consumer healthcare industry is divided into retail pharmacies, online retailers, supermarkets/hypermarkets, and specialty stores. Online retailers are expected to lead the market by the end of the forecast period, as e-commerce platforms provide superior accessibility, comparison capabilities, and home delivery convenience.

Based on consumer demographics, the consumer healthcare industry is categorized into pediatric, adult, and geriatric. Adult consumers are expected to lead the market since they represent the most extensive buyer base seeking daily wellness and preventative health products, accounting for approximately 58% of consumer healthcare product usage.

Based on application, the industry is segregated into pain management, weight management, digestive health, oral care, and skin care. Skin care applications dominate the market due to the widespread adoption of dermatological products for appearance enhancement and skin health maintenance.

Consumer Healthcare Market: Regional Analysis

North America to lead the market

North America leads the consumer healthcare industry due to its self-care culture, high healthcare costs driving prevention, and robust retail infrastructure in the U.S. and Canada. The U.S. accounts for 38% of global consumer healthcare sales, as preventative health is deeply ingrained in the consumer psyche. The region has an extensive retail and e-commerce infrastructure with brand awareness and consumer education in healthcare products.

Big manufacturers like Johnson and Johnson, Procter and Gamble, and GSK have significant regional presence and marketing to ensure product innovation and consumer engagement. North American consumers spend more on preventative healthcare products than global consumers, so the wellness industry is thriving.

North America also has a favorable regulatory environment for OTC medicines and supplements, driving the market. Strong digital and personalized health options drive consumer healthcare adoption across all demographics.

The rise of telehealth and digital pharmacies has expanded consumer access to healthcare products, enhancing convenience and affordability. Additionally, increasing investment in functional foods and nutraceuticals is shaping market growth.

Asia Pacific to grow significantly.

Asia Pacific is growing rapidly in the consumer healthcare market, driven by the growing middle class, post-pandemic health awareness, and digitalization of healthcare resources. India's consumer healthcare has seen 26% growth in the last 3 years, mainly in nutritional supplements and immunity-boosting products.

Countries like China, Japan, and South Korea are developing e-commerce and direct-to-consumer models for healthcare products and expanding the market for digitally savvy consumers. Southeast Asian countries have seen 23% annual growth in natural and traditional medicine being integrated into modern consumer formats.

The region's emphasis on preventative health and traditional wellness drives the development of hybrid products combining modern science with conventional ingredients, especially in countries with established herbal medicine traditions.

Recent Market Developments:

- In January 2025, Johnson and Johnson Consumer Health introduced new specialty skin care lines, including the Neutrogena Hydro Boost Biome Series and Aveeno Microbiome Collection, targeting the skin-gut connection with advanced formulations.

- In February 2025, Bayer Consumer Health launched the all-new Berocca Mind, a cognitive performance supplement with clinically proven ingredients, setting new benchmarks for brain health support.

Consumer Healthcare Market: Competitive Analysis

The global consumer healthcare market is led by players like:

- Johnson and Johnson

- Procter and Gamble

- Pfizer Inc.

- GlaxoSmithKline plc

- Sanofi S.A.

- Bayer AG

- Abbott Laboratories

- Reckitt Benckiser Group plc

- Nestlé S.A.

- Colgate-Palmolive Company

- Unilever

- Kimberly-Clark Corporation

- Church and Dwight Co. Inc.

- The Himalaya Drug Company

- Cipla Inc.

- Sun Pharmaceutical Industries Ltd.

- Perrigo Company plc

- Prestige Consumer Healthcare Inc.

- Nature's Bounty Co.

- Herbalife Nutrition Ltd.

The global consumer healthcare market is segmented as follows:

By Product Type

- OTC pharmaceuticals

- Personal care products

- Vitamins and dietary supplements

- Fitness equipment

By Distribution Channel

- Retail pharmacies

- Online retailers

- Supermarkets/Hypermarkets

- Specialty stores

By Consumer Demographics

- Pediatric

- Adult

- Geriatric

By Application

- Pain management

- Weight management

- Digestive Health

- Oral care

- Skincare

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Consumer healthcare products encompass over-the-counter medications, personal care items, vitamins, supplements, and wellness devices that consumers purchase directly without prescription requirements.

The consumer healthcare market is expected to be driven by increasing health consciousness post-pandemic, rising preferences for natural and clean-label products, technological integration enabling personalized health solutions, expansion of e-commerce platforms, and growing aging populations seeking preventative health products.

According to our study, the global consumer healthcare market was worth around USD 322.58 billion in 2024 and is predicted to grow to around USD 650.15 billion by 2034.

The CAGR value of the consumer healthcare market is expected to be around 7.26% during 2025-2034.

The global consumer healthcare market will register the highest growth in North America during the forecast period.

Key players in the consumer healthcare market include Johnson and Johnson, Procter and Gamble, Pfizer Inc., GlaxoSmithKline plc, Sanofi S.A., Bayer AG, Abbott Laboratories, Reckitt Benckiser Group plc, Nestlé S.A., Colgate-Palmolive Company, Unilever, Kimberly-Clark Corporation, Church and Dwight Co., Inc., The Himalaya Drug Company, Cipla Inc., Sun Pharmaceutical Industries Ltd., Perrigo Company plc, Prestige Consumer Healthcare Inc., Nature's Bounty Co., and Herbalife Nutrition Ltd.

The report comprehensively analyses the consumer healthcare market, including an in-depth discussion of market drivers, restraints, emerging trends, regional dynamics, and future growth opportunities. It also examines competitive dynamics, technological innovations, the evolving landscape of product formulations, consumer preferences, and regulatory requirements shaping the consumer healthcare ecosystem.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed