Contactless Payment Terminals Market Size, Share, Analysis, Trends, Growth, 2032

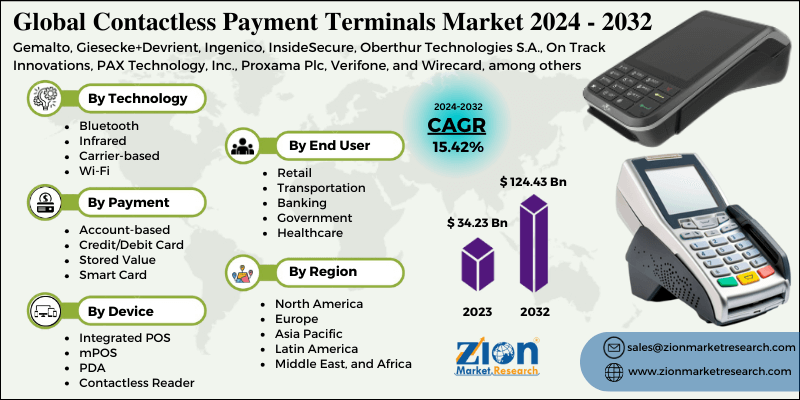

Contactless Payment Terminals Market: By Technology (Bluetooth, Infrared, Carrier-based and Wi-Fi), By Payment Method (Account-based, Credit/Debit Card, Stored Value, and Smart Card), By Device (Integrated POS, mPOS, PDA, Unattended Terminal and Contactless Reader), By End-user Industry (Retail, Transportation, Banking, Government and Healthcare), And By Region: Global Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032

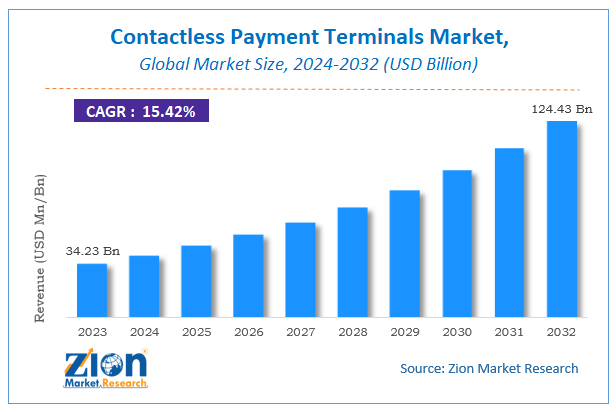

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 34.23 Billion | USD 124.43 Billion | 15.42% | 2023 |

Contactless Payment Terminals Market Insights

Zion Market Research has published a report on the global Contactless Payment Terminals Market, estimating its value at USD 34.23 Billion in 2023, with projections indicating that it will reach USD 124.43 Billion by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 15.42% over the forecast period 2024-2032. The report explores the factors fueling market growth, the hitches that could hamper this expansion, and the opportunities that may arise in the Contactless Payment Terminals Market industry. Additionally, it offers a detailed analysis of how these elements will affect market demand dynamics and market performance throughout the forecast period.

Contactless Payment Terminals Market: Overview

Consumers can use smart cards, wearables, key fobs, smartphones, and other devices to make contactless payments, which are a safe way to pay for goods and services. In order to facilitate contactless transactions in the contactless payment industry, radio-frequency identification (RFID) and near field communication (NFC) technologies are primarily used. Furthermore, transaction devices with an embedded chip and antenna allow customers to wave or tap their smart cards, key fobs, or handheld devices over a reader at a point of sale (POS) terminal. Customers can complete transactions instantly with the tap of a card, which is the main benefit of contactless payment. This improves transaction speed and makes contactless payment even more efficient. The demand for contactless payment solutions has risen dramatically across all countries as contactless payment technologies become more integrated into mobile handsets and smart phones.

Contactless Payment Terminals Market: COVID-19 Impact Analysis

COVID-19's outbreak is expected to have a positive effect on the market. Because of the rise in adoption and use of digitalized and online payment methods around the world, the COVID-19 pandemic has had a significant impact on the market. Furthermore, in order to stop the virus from spreading, many governments have imposed a lockdown, which has resulted in a decrease in cash usage. The rise of cyber-attacks and a lack of infrastructure in developing economies, on the other hand, are expected to stifle market growth.

Contactless Payment Terminals Market: Growth Factors

The market's growth is being bolstered by continuous product and service innovation, as well as advancements in payment security technologies. Furthermore, contactless payments allow for money transfers between a point-of-sale terminal and a customer's payment device. Over the forecast period, the market is expected to grow due to a paradigm shift in customer payment awareness and preferences. Furthermore, the increasing use of contactless technologies in a variety of applications, such as ticketing, toll booths, gas stations, and vending machines, is expected to drive market growth.

The market will grow due to rising demand from merchants and consumers to reduce billing and transaction times. Merchants and consumers are both concerned about the safety and security of money transactions. The market is expected to grow due to a number of factors, including rising government initiatives and ongoing advancements in networking infrastructure for the development of smart solutions. Several government administrations around the world are encouraging merchants to use advanced payment systems.

Technology Segment Analysis Preview

Wi-fi segment held a share of over 60% in 2020. Increasing use of hardware devices such as mobile phones, speakers, semiconductors, sensors, displays, and many more are boosting the numbers. The increased advantages of the contactless payment terminals through these technologies have compelled the business organizations to adopt contactless payment terminal. Bluetooth, Infrared and Carrier-based are other types of technology segment.

Payment Method Segment Analysis Preview

Over the forecast period, the smart cards segment is expected to grow at the fastest rate. The segment is expected to grow due to rising demand for smart cards across a variety of industries, as well as increasing adoption of blockchain technology by several smartcard providers to improve card security. Smart cards are becoming more widely accepted around the world. Merchants are focusing on reducing customer wait times by allowing them to use smart cards for faster transactions.

Device Segment Analysis Preview

In 2023, the smartphone and wearables segment dominated the market, accounting for more than 59.0 percent of global revenue. An increase in the adoption of smartphones and wearable devices among young people in various countries is expected to boost the segment's growth prospects. In everyday activities, the use of smartphones and wearables has skyrocketed. In addition, wearable innovations such as payment rings and bands are expected to drive segment growth over the forecast period.

Contactless Payment Terminals Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Contactless Payment Terminals Market |

| Market Size in 2023 | USD 34.23 Billion |

| Market Forecast in 2032 | USD 124.43 Billion |

| Growth Rate | CAGR of 15.42% |

| Number of Pages | 180 |

| Key Companies Covered | Gemalto, Giesecke+Devrient, Ingenico, InsideSecure, Oberthur Technologies S.A., On Track Innovations, PAX Technology, Inc., Proxama Plc, Verifone, and Wirecard, among others |

| Segments Covered | By Technology, By Payment Method, By Device, By End-user Industry and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

End-User Industry Segment Analysis Preview

In 2020, the retail segment dominated the market, accounting for more than 61.0 percent of global revenue. To increase their presence and visibility in the market, retailers are implementing innovative technologies such as big data analytics, cloud computing, social networks, and digital stores. Furthermore, retailers are beginning to recognize the advantages of contactless payments, which include increased revenue, shorter transaction times, lower operating costs, and improved operational efficiency. Furthermore, mobile payments have aided retailers in reducing line lengths at checkout and speeding up the transaction process.

Over the forecast period, the hospitality segment is expected to grow at the fastest rate. In the hospitality industry, contactless payment is becoming increasingly popular. Hospitality companies have begun to adopt some of the most cutting-edge technology in order to provide a more user-friendly experience for their customers. Because of the numerous benefits it provides, such as fast and secure transactions and a high level of customer satisfaction, these businesses are increasingly adopting contactless payment solutions.

Regional Analysis Preview

In 2020, Europe dominated the contactless payment market, accounting for over 33% of global revenue. The growth of the regional market can be attributed to the region's consistently increasing electronic money transactions. The demand for contactless payment in the region is expected to be driven by payment solutions enabled by real-time and biometric data, as well as the secure performance of smart card transactions. Additionally, favorable government regulations, such as open banking and the second Payment Services Directive, are aiding regional market expansion.

Over the forecast period, North America is expected to be the fastest-growing regional market. North America's well-established IT industry encourages technological advancement. In addition, regional IT companies are leveraging their efforts to promote the adoption of a contactless payment platform. In addition, in response to the growing threat of cyber-crime, the companies are collaborating with a number of financial institutions to develop secure, transparent, decentralized, and robust platforms.

Contactless Payment Terminals Market: Competitive Landscape

Some of key players in contactless payment terminals market are

- Gemalto

- Giesecke+Devrient

- Ingenico

- InsideSecure

- Oberthur Technologies S.A.

- On Track Innovations

- PAX Technology Inc.

- Proxama Plc

- Verifone

- Wirecard

- among others.

To expand their customer base and strengthen their product portfolio, market players are focusing on business strategies such as new product launches. For example, Mastercard certified Thales Group's first-ever contactless fingerprint payment card in January 2020. Furthermore, in technologically advanced countries, this new certification is expected to drive product adoption. In addition, the project is currently implementing a number of pilot projects. Several players are focusing on implementing various types of technology in order to improve the performance of their payment platforms. Vendors are incorporating blockchain technology into retail payment applications to improve security and speed. Business strategies, such as partnerships, are also on the minds of vendors. Visa Inc., for example, partnered with Samsung in January 2020 to develop a tap-to-phone program. This program allows micro-sellers to accept payments using Android smartphones without the need for any additional hardware.

The global contactless payment terminals market is segmented as follows:

By Technology

- Bluetooth

- Infrared

- Carrier-based

- Wi-Fi

By Payment Method

- Account-based

- Credit/Debit Card

- Stored Value

- Smart Card

By Device

- Integrated POS

- mPOS

- PDA

- Unattended Terminal

- Contactless Reader

End-user Industry

- Retail

- Transportation

- Banking

- Government

- Healthcare

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The global contactless payment terminals market accounted for USD 34.23 Billion in 2023.

The global contactless payment terminals market is expected to reach USD 124.43 Billion by 2032, growing at a CAGR of 15.42% from 2024 to 2032.

The market's growth is being bolstered by continuous product and service innovation, as well as advancements in payment security technologies. Furthermore, contactless payments allow for money transfers between a point-of-sale terminal and a customer's payment device.

In 2020, Europe dominated the contactless payment market, accounting for over 33% of global revenue. The growth of the regional market can be attributed to the region's consistently increasing electronic money transactions.

Some of key players in contactless payment terminals market are Gemalto, Giesecke+Devrient, Ingenico, InsideSecure, Oberthur Technologies S.A., On Track Innovations, PAX Technology, Inc., Proxama Plc, Verifone, and Wirecard, among others.

Choose License Type

List of Contents

Contactless Payment Terminals Market InsightsContactless Payment Terminals Overview Contactless Payment Terminals COVID-19 Impact Analysis Contactless Payment Terminals Growth FactorsTechnology Segment Analysis PreviewPayment Method Segment Analysis PreviewDevice Segment Analysis PreviewContactless Payment Terminals Report ScopeEnd-User Industry Segment Analysis PreviewRegional Analysis Preview Contactless Payment Terminals Competitive LandscapeThe global contactless payment terminals market is segmented as follows:By TechnologyBy Payment MethodBy DeviceEnd-user IndustryBy RegionRelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed