Cooking Robot Market Size, Share, Trends, Growth and Forecast 2030

Cooking Robot Market By End-User (Commercial and Residential), By Robot Type (Cobots, SCARA, Delta Robots, and Others), By Application (Beverage Making, Meat Processing, Fast Food Preparation, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2023 - 2030

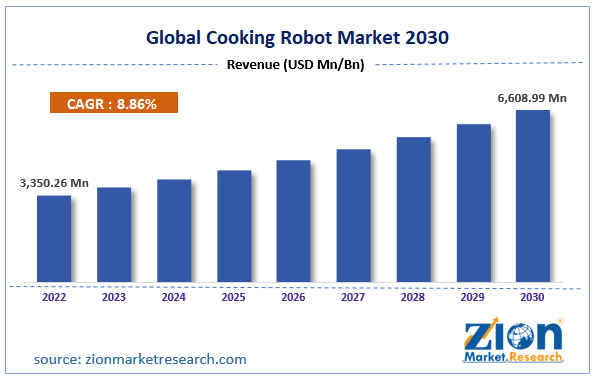

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 3,350.26 Million | USD 6,608.99 Million | 8.86% | 2022 |

Cooking Robot Industry Prospective:

The global cooking robot market size was worth around USD 3,350.26 million in 2022 and is predicted to grow to around USD 6,608.99 million by 2030 with a compound annual growth rate (CAGR) of roughly 8.86% between 2023 and 2030.

Cooking Robot Market: Overview

Cooking robots are advanced technology-powered cooking machines. They are enabled using Artificial Intelligence (AI) along with other breakthrough modern technologies and are developed to perform the role of a private chef either in a residential or commercial setting. These robots are specifically built and programmed to work in kitchen setups with minimal human assistance. Some of the roles performed by cooking robots are meal cooking, ingredient preparation, and cleaning to a certain extent. Currently, the industry for cooking robots is mainly dominated by the commercial segment since several restaurants across the globe have employed the help of programmed machine-based cooks.

Robots used for kitchen-based cooking are pre-programmed with several recipes. They also understand the several cooking types that may exist and have a considerable idea about cooking temperature and time thus delivering food products as close to food items prepared by a human. It is important to note that the cooking robot industry is an emerging market and is currently at its preliminary growth trajectory.

Key Insights:

- As per the analysis shared by our research analyst, the global cooking robot market is estimated to grow annually at a CAGR of around 8.86% over the forecast period (2023-2030).

- In terms of revenue, the global cooking robot market size was valued at around USD 3,350.26 million in 2022 and is projected to reach USD 6,608.99 million, by 2030.

- The cooking robot market is projected to grow at a significant rate due to the rising adoption in commercial food service centers.

- Based on end-user segmentation, the commercial was predicted to show maximum market share in the year 2022.

- Based on application segmentation, fast food preparation was the leading segment in 2022.

- On the basis of region, North America was the leading revenue generator in 2022.

Request Free Sample

Request Free Sample

Cooking Robot Market: Growth Drivers

Rising adoption in commercial food service centers to drive market demand

The global cooking robot market is expected to witness high growth driven by the increasing adoption of these AI-enabled machines in commercial food service units. Restaurants, fast food retailers, cafes, and other eateries across the globe are investing in cooking robots. The decision to deliver robot-cooked meals could be a result of several factors. For instance, cooking robots can help facilities improve delivery time and maintain food consistency. Since these robots are pre-fed with essential recipe-related information, the error margin in the food cooking process using robots is zero to negligible. Human chefs or cooks are more prone to falter in terms of consistency over time. However, this aspect can be completely avoided by using a robot. Additionally, they are known to be safe in terms of use. Manual cooking is typically associated with kitchen-related wounds such as cuts, burns, and other injuries. However, since cooking robots typically use an induction setup, the risk of injuries can be avoided.

For instance, several restaurants in Queens, New York have been using cooking robots for months and they have recorded positive responses from their regular customers. As per a recent research survey, people are willing to buy cooking robot-made food since they can offer premium quality food at a reasonable price, unlike expensive restaurants with gourmet chefs. In December 2023, the US witnessed the launch of the world’s first restaurant that is completely operated by Robots in terms of taking orders and food preparation. The fully automated restaurant is run under the brand name CaliExpress.

Cooking Robot Market: Restraints

High cost of robots and concerns over technical glitches may restrict market growth

The global cooking robot market will be impacted by the high cost of cooking robots. For instance, the starting cost of the Suvie Kitchen Robot 3.0 is around USD 399. Per-serving prices start at USD 9.99. Traditional and small-scale commercial centers may be unable to afford cooking robots leading to restricted growth. In addition to this, since these robots are powered by several technologies, there is always a risk of technical glitches.

Additionally, the machines have to be either plugged into a constant supply of power or the batteries have to be recharged regularly. In case of technical failure, the downtime may be high leading to loss of revenue. Furthermore, only a limited number of people and companies can resolve the technical issues which means that users may have to wait for many days until the device is ready for use again.

Cooking Robot Market: Opportunities

Increasing the number of product options globally to deliver higher-than-expected results

The global cooking robot industry will benefit from the rising number of new introductions in the commercial market thus allowing customers a better range in terms of options. Furthermore, it also drives market innovation and creates a pricing balance. In August 2023, Circus, a German food technology company announced that it had acquired Aitme, a Berlin-based startup focusing on culinary robotics. The move has allowed the former company to gain access to state-of-the-art technology related to robotics. Circus provides food using a chain of micro kitchens which can now be powered with advanced cooking robots.

In December 2023, Fresh2 Group Ltd launched Roxe Restaurant Robots. The company provides services to the food and restaurant supply industry. The launch is expected to help Fresh2 become a more dominant player in the coming years.

Rising demand for customized meal plans is an excellent possibility to explore

The rising consumer health awareness trend along with the growing demand for customized meals depending on the overall food needs of the people could act as potential growth drivers for the global cooking robot market. The advanced machines are highly specific in terms of food preparation. The urban population with limited free time could benefit from cooking robots since they can be programmed with recipes that meet the nutritional requirements of their users. As more people become health conscious and if the prices become affordable, the purchase rate for cooking robots is likely to grow to new heights.

Cooking Robot Market: Challenges

Apprehensions related to human resource replacement by robots could challenge market demand

One of the pressing concerns for global leaders is the growing apprehensions over AI replacing human resources which could have drastic consequences on the general population and the global economy. Cooking robots pose the threat of replacing human skills leading to a higher unemployment rate. Manufacturers must consciously make decisions that work toward comprehensive growth instead of being only profit-oriented as AI has the capability to completely disrupt the current economic systems.

Cooking Robot Market: Segmentation

The global cooking robot market is segmented based on end-user, robot type, application, and region.

By end-user, the global market is divided into commercial and residential. In 2022, the highest growth rate was registered in the commercial segment. Cooking robots have primarily witnessed higher adoption in commercial food establishments since these facilities can justify the investments made in buying and operating a cooking robot. Additionally, the need to maintain food consistency along with quick delivery time further encourages more food chain owners to invest in cooking robots. The residential segment is relatively new as the number of product offerings is also limited and the high cost may restrict the addition of new buyers. Wing Zone, a restaurant chain with 61 units, is reported to be the world’s leading robot-friendly restaurant as per official reports.

Based on robot, the global cooking robot industry divisions are cobots, SCARA, delta robots, and others.

Based on application, the global market is divided into beverage making, meat processing, fast food preparation, and others. In 2022, the highest demand was observed for the fast-food preparation segment. The majority of commercial users of cooking robots currently are fast food retail chains. These units have set and limited food items on the menu and hence robots can perform efficiently as they have to follow specific recipes. Gourmet restaurants tend to employ culinary maestro’s as they continue to experiment with their offerings. Presently, the US is home to more than 50,000 fast-foot facilities spread across the country.

Cooking Robot Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Cooking Robot Market |

| Market Size in 2022 | USD 3,350.26 Million |

| Market Forecast in 2030 | USD 6,608.99 Million |

| Growth Rate | CAGR of 8.86% |

| Number of Pages | 221 |

| Key Companies Covered | Moley Robotics, Seraphim Sense, Sony Corporation, Vesuvo V3, Samsung Electronics, Creator, Robolink, Zimplistic, FoldiMate, Tovala, Suvie, Picnic, PancakeBot, Anova Culinary, Markov Corporation, and others. |

| Segments Covered | By End-User, By Robot Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Cooking Robot Market: Regional Analysis

North America to dominate market scenario during the projection period

The global cooking robot market will be led by North America during the projection period. The high growth rate is the result of higher adoption of cooking robots in the US and Canada regions. The former has been a pioneer in terms of cooking robot technology development as well as adoption. In April 2023, US-based Aniai, a leading provider of kitchen solutions, announced the launch of Alpha Grill. It is an advanced cooking robot that works by combining technologies such as automation and AI. The main design of Alpha Grill allows it to prepare burger patties and can prepare 8 burgers in under a minute thus reducing cooking time by 50%. The presence of supporting infrastructure and government policies along with deeper penetration of the fast-food industry in the regional market aids higher growth in North America.

Europe is a highly influential market as it holds several cooking robot designers and suppliers. Eatch, a Dutch startup, has developed a cooking robot that can make up to 5000 meals per day. In 2023, UK-based robotics company, Moley launched cooking robots to be used in residential settings. The company modified its existing range of commercial robots to fit the food and budget requirements of domestic cooking robots.

Cooking Robot Market: Competitive Analysis

The global cooking robot market is led by players like:

- Moley Robotics

- Seraphim Sense

- Sony Corporation

- Vesuvo V3

- Samsung Electronics

- Creator

- Robolink

- Zimplistic

- FoldiMate

- Tovala

- Suvie

- Picnic

- PancakeBot

- Anova Culinary

- Markov Corporation

The global cooking robot market is segmented as follows:

By End-User

- Commercial

- Residential

By Robot Type

- Cobots

- SCARA

- Delta Robots

- Others

By Application

- Beverage Making

- Meat Processing

- Fast Food Preparation

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Cooking robots are advanced technology-powered cooking machines.

The global cooking robot market is expected to witness high growth driven by the increasing adoption of these AI-enabled machines in commercial food service units.

According to study, the global cooking robot market size was worth around USD 3,350.26 million in 2022 and is predicted to grow to around USD 6,608.99 million by 2030.

The CAGR value of cooking robot market is expected to be around 8.86% during 2023-2030.

The global cooking robot market will be led by North America during the projection period.

The global cooking robot market is led by players like Moley Robotics, Seraphim Sense, Sony Corporation, Vesuvo V3, Samsung Electronics, Creator, Robolink, Zimplistic, FoldiMate, Tovala, Suvie, Picnic, PancakeBot, Anova Culinary, and Markov Corporation, and others.

The report explores crucial aspects of the cooking robot market including detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed