COVID-19 Diagnostics Market Size, Share, Trends, Growth and Forecast 2026

COVID-19 Diagnostics Market By Product (Instruments, Kits & Reagents, Diagnostic Services), By Technology (Molecular assay, Immunological assay, Digital PCR (dPCR), Clustered regularly interspaced short palindromic repeats (CRISPR), Microarray), By Test Type (Antigen-based Testing, Antibody (Serology) Testing, Molecular (PCR) Testing, Others) By Mode (Point-of-Care (PoC), Non-Point-of-Care (Non-PoC) By End-User (Hospitals, Diagnostic Labs & Clinics, Healthcare Labs & Clinics): Global Industry Perspective, Comprehensive Analysis and Forecast, 2020 - 2026

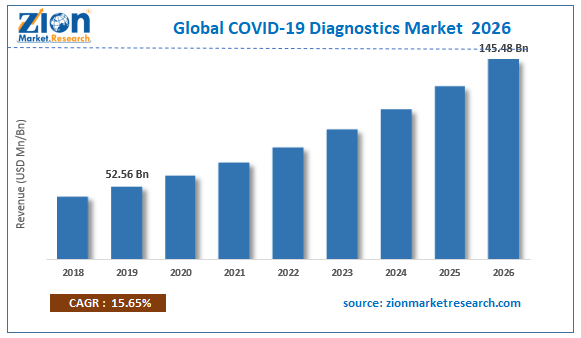

| Market Size in 2019 | Market Forecast in 2026 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 52.56 Billion | USD 145.48 Billion | 15.65% | 2019 |

The COVID-19 Diagnostics market is set for a rapid growth over the forecast period. In terms of revenue, the global COVID-19 Diagnostics market accounted for USD 52.56 Billion in 2019 and is expected to reach USD 145.48 Billion by 2026, growing at a CAGR of 15.65%.

Global COVID-19 Diagnostics Market: Overview

People across the globe continue to be affected by the outbreak of the latest coronavirus epidemic which was first identified in China in December 2019. In order to curb its spread and improve health outcomes, early and accurate diagnosis of COVID-19, the disease caused by an infection with the new coronavirus, is crucial. People with COVID-19 have reported the most common symptoms: fever, tiredness, shortness of breath and cough. Some people might also experience other signs such as: a sore throat, fever, runny or stuffy nose, muscle aches and pains, diarrhea, loss of smell or taste, and frequent trembling with chills. COVID-19 symptoms usually occur within 2 to 14 days of initial virus exposure. In the early stages of infection, some individuals show little or no symptoms of disease, but may still spread the virus to others. In mild cases, all that is needed to completely recover and prevent the virus from spreading to others may be home treatment and self-quarantine measures. Some situations, however, call for more complex medical procedures. Therefore, controlling the spread of SARS-CoV-2 is fundamentally dependent on identifying and isolating infected people, especially because COVID-19 can lead to little or no symptoms.

Global COVID-19 Diagnostics Market: Growth Factors

With the growing number of coronavirus-infected patients, the demand for COVID-19 diagnostic products is set to raise, particularly after the ease of lockdown across the globe. According to worldometer, as of January 06, 2021, the total number of coronavirus cases worldwide has risen to 86,999,323 with 1,879,435 death cases and 61,691,561 recoveries. Despite the gradual decrease anticipated in the number of positive patients in 2021, market growth is expected to be sustained by incorporating COVID-19 tests into routine diagnostic protocols.

Moreover, these testing projects are intended to pave the way for the travel industry to be prepared, providing a favorable climate for market operators. During this pandemic outbreak, the tourism and travel industries were most affected, leading to an upsurge in post-August 2020 COVID-19 testing initiatives, especially in tourism-based countries and regions. As these tests are able to transcend the limitations associated with conventional testing, this is also expected to propel market penetration of Point of Care Testing (PoC).

However, inorder to perform experiments in clinical laboratories, complex and pure reagents such as probes, primers and enzymes are crucial. A variety of factors have contributed to a shortage of these reagents, such as a sudden rise in demand, export bans, and stockpiling. In addition, limited companies produce these reagents, which leads to a shortage of supply due to inadequate production resources. Therefore, it is anticipated that the insufficient demand-to-supply ratio of reagents worldwide will adversely affect the overall diagnosis rate and impede market growth.

Global COVID-19 Diagnostics Market: Segmentation

The global COVID-19 diagnostics market can be segmented into Product, Technology, Test Type and region. The product segment is divided into Instruments, Kits & Reagents, and Diagnostic Services. The diagnostic services segment is estimated to dominate the market with a significant share in 2021. Diagnostic service providers are enhancing their testing capabilities by extending their technical footprints in existing diagnostic centers and laboratories, as well as introducing modern, high-capacity laboratories, which have contributed to the growth of the market. The expansion of diagnostic research capacities is further accelerated by partnerships between governments, public health organizations, test developers, and private labs.

The kits and reagents category is projected to record the highest rate of growth from 2021 to 2026. A major factor contributing to the rapid growth of this segment is the accelerated approval process. Companies are introducing numerous strategic initiatives, such as new product launch and partnerships, in response to the pandemic. Veredus Laboratories Pte Ltd., for example, introduced an extraction-free RT-PCR suite in September 2020 that includes a VereRT COVID-19 PCR kit for direct use either from a swab or from human saliva.

The technology segment is categorized into Molecular assay (Next-generation sequencing (NGS), RT-PCR, RT-LAMP); Immunological assay (ELISA, CLIA, LFIA); digital PCR (dPCR); Clustered regularly interspaced short palindromic repeats (CRISPR); and Microarray. The type of technology on which a test is based has a major impact on the diagnostic performance of the test, including specificity, sensitivity, dynamic range, consumption of reagents, reproducibility, equipment, throughput, expense, and ease-of-use.

In terms of technology, the molecular assay segment held the majority of its share in 2020 and, due to its increased demand for coronavirus diagnosis, is expected to show a substantial growth rate over the forecast period. In addition, PCR is known as a gold standard for detection of new virus infections. Whereas, NGS is a genomics technology that allows thousands to billions of DNA fragments to be sequenced simultaneously and can classify genetic material from completely different kingdoms of organisms. The applications of NGS technology covers the detection of infectious diseases, monitoring outbreaks, surveillance of infection control, and discovery of mutations and pathogens with various types of biological specimens (i.e., blood, cerebrospinal fluid, gastrointestinal fluid, respiratory samples, and ocular fluid)

The immunoassay segment is projected to rise during the forecast period at the fastest growth rate. This is due to the growing demand for rapid immunoassay testing for the diagnosis of diseases. For confirmation of SARS CoV-2 infections, many immunoassay test kits are being developed. The identification of SARS-CoV-2 antibodies is useful for detecting prior infection and immunity, which is critical for ongoing surveillance, epidemiological and vaccine studies, and for assessing the risk of health care staff. Notably, over time, COVID-19 antibody profiles and the role of immunological testing in immunity are still being determined.

In addition, three promising technologies for Covid-19 detection are digital PCR (dPCR), Clustered Frequently Interspaced Short Palindromic Repeats (CRISPR), and Microarray. COVID-19 is rarely screened for asymptomatic and slightly symptomatic individuals, which is partially because existing technologies have reduced throughput. Different technologies other than those mentioned above have either been developed or are in progress to detect high-sensitivity SARS-CoV-2 performance. In order to address this challenge, these three technologies are considered. Thus, they are also expected to hold a promising future with a significant market share in the coming years.

On the basis of test type, the market is segmented into Antigen-based Testing, Antibody (Serology) Testing, Molecular (PCR) Testing and Others. With a revenue share of almost 60 percent, molecular (PCR) research is expected to dominate the market in 2020. Currently, for the identification of COVID-19, the PCR technique is considered to be the most precise, leading to a significant increase in the adoption of PCR testing kits. Because of the detection benefits of the PCR technique, this approach is favoured over others by laboratories, diagnostic centers and clinics, hospitals and research institutes.

Antigen based testing is projected to grow from 2021 to 2026 at the highest CAGR. Antigen-based and antibody-based tests are found to be slightly more stable than RNA samples, making them less hazard-vulnerable during storage and transport, thus minimizing the risk of false-negative outcomes. Moreover, in sputum and blood samples, antigens and antibodies are more uniformly available, thus enhancing testing accuracy. Nevertheless, the most important benefit of immunoassays is their capacity to detect past infections.

In terms of mode, the segment covers Point-of-Care (PoC) and Non-Point-of-Care (Non-PoC). The non-PoC (centralized) research segment is projected to dominate the market in 2020. Most of the COVID-19 tests are currently performed in the laboratory environment, so laboratory testing is currently the market's main testing mode. The implementation of automated high-throughput systems enables the efficient processing at a given time of a high number of samples without compromising the consistency and integrity of the outcome. In a viable COVID-19-response strategy to bypass the spread, these factors make centralized testing a crucial aspect.

By end user, the diagnosis labs segment is expected to dominate the market in 2020, and continue to maintain its position throughout the forecast period. This is attributed to the fact that PCR testing procedures require the processing of a laboratory as it also involves the use of different types of reagents and other instruments. According to NHS England, nearly 20 percent of patients have a hospital-acquired COVID-19 infection. This allows more people to opt for diagnostic centers over COVID-19 testing hospitals, which is a major factor contributing to this segment's revenue generation. Therefore, the need to eliminate the risk of COVID-19 acquisition in hospitals is boosting the creation of diagnostic centers and clinics.

Global COVID-19 Diagnostics Market: Regional Analysis

Based on regions, the global COVID-19 Diagnostics market can be divided into five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. North America, with a majority of shares in 2020, dominated the market. This can be due to the rapid increase in cases of COVID-19 and the local involvement of key players involved in the development and production of diagnostic tests that combine different technologies. Due to the pandemic, regulatory bodies like the U.S. FDA and Health Canada are granting COVID-19 test kits with Emergency Use Authorizations (EUA) to improve testing. All these factors are expected to drive regional market growth.

The U.S. has emerged as a major contributor to regional growth, largely due to the efficient scaling-up of local companies' COVID-19 studies. The presence of key laboratories, such as the Laboratory Corporation of America (LabCorp) and Quest Diagnostics, has also strengthened the COVID-19 diagnostics market in the region. Quest Diagnostics conducted about 15.7 million COVID-19 molecular diagnostic tests and approximately 3.8 million COVID-19 antibody tests as of September 28, 2020. In order to allow large-scale testing in the country, such initiatives are planned.

Asia Pacific is expected to emerge as a lucrative regional market and is projected to grow from 2021 to 2026 at the fastest CAGR. China and India have made important contributions to this region's income. China is a major exporter of COVID-19 test kits, with these kits being exported by more than 100 Chinese companies.

Report Scope :

| Report Attributes | Report Details |

|---|---|

| Report Name | COVID-19 Diagnostics Market Size Report |

| Market Size in 2019 | USD 52.56 Billion |

| Market Forecast in 2026 | USD 145.48 Billion |

| Growth Rate | CAGR of 15.65% |

| Number of Pages | 188 |

| Forecast Units | Value (USD Billion), and Volume (Units) |

| Key Companies Covered | Hologic Inc., Perkin Elmer, Inc., Veredus Laboratories, Thermo Fisher Scientific, Inc., F. Hoffman-La Roche Ltd., 1drop Inc., Laboratory Corporation of America Holdings, ADT Biotech Sdn Bhd, bioMérieux SA, Neuberg Diagnostics, Luminex Corporation, Quidel Corporation, ALDATU BIOSCIENCES, Danaher, Mylab Discovery Solutions Pvt. Ltd., Quest Diagnostics, altona Diagnostics GmbH and Abbott among others. |

| Segments Covered | By Product, By Technology, By End Users and By Region. |

| Base Year | 2019 |

| Historical Year | 2015 to 2018 |

| Forecast Year | 2020 - 2026 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Global COVID-19 Diagnostics Market: Competitive Players

- Hologic Inc.

- Perkin Elmer

- Veredus Laboratories

- Thermo Fisher Scientific

- F. Hoffman-La Roche Ltd.

- 1drop Inc.

- Laboratory Corporation of America Holdings

- ADT Biotech Sdn Bhd

- bioMérieux SA

- Neuberg Diagnostics

- Luminex Corporation

- Quidel Corporation

- ALDATU BIOSCIENCES

- Danaher

- Mylab Discovery Solutions Pvt. Ltd.

- Quest Diagnostics

- Altona Diagnostics GmbH

Global COVID-19 Diagnostics Market: Regional Segment Analysis

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

With the growing number of coronavirus-infected patients, the demand for COVID-19 diagnostic products is set to raise, particularly after the ease of lockdown across the globe. According to worldometer, as of January 06, 2021, the total number of coronavirus cases worldwide has risen to 86,999,323 with 1,879,435 death cases and 61,691,561 recoveries. Despite the gradual decrease anticipated in the number of positive patients in 2021, market growth is expected to be sustained by incorporating COVID-19 tests into routine diagnostic protocols.

According to Zion Market Research, the COVID-19 Diagnostics market is expected to generate revenue of around USD 12.56 Billion in 2019 and is expected to reach USD 145.48 Billion by 2026, growing at a CAGR of 15.65%.

North America, with a majority of shares in 2020, dominated the market. This can be due to the rapid increase in cases of COVID-19 and the local involvement of key players involved in the development and production of diagnostic tests that combine different technologies. Due to the pandemic, regulatory bodies like the U.S. FDA and Health Canada are granting COVID-19 test kits with Emergency Use Authorizations (EUA) to improve testing. All these factors are expected to drive regional market growth. Asia Pacific is expected to emerge as a lucrative regional market and is projected to grow from 2021 to 2026 at the fastest CAGR. China and India have made important contributions to this region's income. China is a major exporter of COVID-19 test kits, with these kits being exported by more than 100 Chinese companies.

Some of the key players in COVID-19 Diagnostics market are Hologic Inc., Perkin Elmer, Inc., Veredus Laboratories, Thermo Fisher Scientific, Inc., F. Hoffman-La Roche Ltd., 1drop Inc., Laboratory Corporation of America Holdings, ADT Biotech Sdn Bhd, bioMérieux SA, Neuberg Diagnostics, Luminex Corporation, Quidel Corporation, ALDATU BIOSCIENCES, Danaher, Mylab Discovery Solutions Pvt. Ltd., Quest Diagnostics, altona Diagnostics GmbH and Abbott among others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed