Corrosion Protection Coatings Market Size, Share, Industry Analysis, Trends, Growth, Forecasts 2030

Corrosion Protection Coatings Market By End-User Industry (Petrochemical, Oil & Gas, Marine, Infrastructure, Water Treatment, and Power Generation), By Resin Type (Zinc, Epoxy, Chlorinated Rubber, Polyurethane, Acrylic, and Others), By Technology (Powder, Water-Based, Solvent-Based, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2023 - 2030

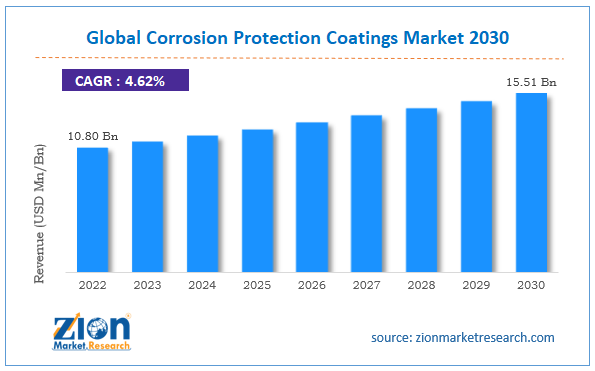

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 10.80 Billion | USD 15.51 Billion | 4.62% | 2022 |

Corrosion Protection Coatings Industry Prospective:

The global corrosion protection coatings market size was worth around USD 10.80 billion in 2022 and is predicted to grow to around USD 15.51 billion by 2030 with a compound annual growth rate (CAGR) of roughly 4.62% between 2023 and 2030.

Corrosion Protection Coatings Market: Overview

Corrosion protection coatings are materials that are applied to a surface for protection against corrosion and improve surface durability. The solid materials are applied as thin layers on the surface in industrial, residential, and commercial surfaces. Apart from the primary goal of protecting against corrosion, these coatings are also responsible for enhancing asset functionality along with improvements in the overall physical appearance. In most cases, corrosion protection coatings are available in a liquid state, and once applied, they automatically convert into a solid coating structure. They create a barrier between substrates and the external environment thus blocking any form of unnecessary elements from coming together and initiating the process of corrosion.

Furthermore, another important role of the coatings is to prevent electrochemical reactions or change the direction of the corrosion process so that the surface or the asset is not affected. For non-metallic coatings, polyurethanes, epoxies, and polymers are the most widely used materials. Whereas, for metallic coatings, the demand is higher for chromium, aluminum, and zinc materials. The demand in the corrosion protection coatings industry is expected to surge during the forecast period.

Key Insights:

- As per the analysis shared by our research analyst, the global corrosion protection coatings market is estimated to grow annually at a CAGR of around 4.62% over the forecast period (2023-2030)

- In terms of revenue, the global corrosion protection coatings market size was valued at around USD 10.80 billion in 2022 and is projected to reach USD 15.51 billion, by 2030.

- The corrosion protection coatings market is projected to grow at a significant rate due to the increasing applications in the oil & gas sector

- Based on end-user industry segmentation, infrastructure was predicted to show maximum market share in the year 2022

- Based on technology segmentation, solvent-based was the leading segment in 2022

- On the basis of region, Asia-Pacific was the leading revenue generator in 2022

Request Free Sample

Request Free Sample

Corrosion Protection Coatings Market: Growth Drivers

Increasing applications in the oil & gas sector to drive the market growth rate

The global corrosion protection coatings market is projected to grow owing to the increasing application of these materials in the oil & gas sector. The end-user application is one of the most significant contributors to the demand for coatings used for corrosion protection. The consumption rate of oil and gas has surged in the last century influenced by the rising industrialization rate. In modern times, the components belonging to the oil & gas industry are the driving forces for several economies. They are considered the most essential items to run a country and the industries flourishing in the regional market. With the rise in population rate along with higher consumption trends, oil exploration activities have surged to unprecedented levels.

Furthermore, the impact of the war between Russia and Ukraine has amplified the search for more reliable oil sources across the globe. Official reports published in 2023 reported that oil giants are redirecting profits earned during the year as a result of the price surge caused by the Russia and Ukraine conflict toward the exploration of new deposits. As per the International Energy Agency (IEA), oil-related investments reached a record high of USD 528 billion in 2023. This is the highest investment rate since 2015. The growing advancements in offshore oil exploration facilities hold tremendous growth potential in terms of demand for corrosion protection coatings. Since these facilities are built to withstand extreme environmental conditions, the assets used in offshore facilities are coated with a superior-grade corrosion protection layer.

Corrosion Protection Coatings Market: Restraints

Strict laws governing the components of coatings used for corrosion protection may restrict market growth

The global corrosion protection coatings market is likely to be restricted by the strict laws that surround the components used in the coating materials. Since these protective materials are supposed to be long-lasting and deliver exceptional performance, the components used in the coating materials sometimes include strong chemicals which leads to negative environmental impact.

Additionally, each region is governed by specific rules or mandates keeping in view the performance aspects of corrosion protection coatings. Managing the tedious and complex regulatory environment is not only time-consuming but also requires extensive investment.

Corrosion Protection Coatings Market: Opportunities

Increasing the launch of new solutions with improved performance may create growth opportunities

The global corrosion protection coatings market is expected to benefit from the increasing launch of new and improved solutions that deliver comprehensive protection. In April 2023, global giant PETRONAS announced that it had developed an innovative solution targeting the pressing concerns caused by perennial corrosion that is known to severely impact the overall integrity of the asset. The new material is called ProShield+ and is developed with the use of graphene material. It is extremely advanced and offers an exceedingly high barrier against unwanted environmental components. ProShield+ can be used on steel structures as a paint additive. As compared to typically used epoxy paint, ProShield+ has three times more water barrier characteristics thus enhancing surface protection.

In May 2023, Chemcoaters launched a new range of coating materials with dual applications. The leading maker of corrosion protection coatings launched FeGuard for hot-rolled and cold-rolled oiled and pickled steel structures. The company intends to reduce the gap that exists between galvanized and carbon product performance. Such trends are likely to help the market players generate higher revenue.

Rising infrastructure development projects to fuel market demand

The global corrosion protection coatings industry will register a high growth rate due to a substantial increase in infrastructure development projects globally. The regional governments are keen on attracting more foreign investments along with creating a supporting infrastructure for domestic companies and businesses. Alongside this, the rising demand for residential units and advanced commercial centers may aid the market growth trajectory.

Corrosion Protection Coatings Market: Challenges

Increasing the cost of the coating process may challenge market demand

The inflation rate across the globe is surging steadily. Additionally, the cost of raw materials used in the production of coatings for corrosion protection has increased in recent times. The international trading market is highly volatile and access to efficient teams for research and development is getting increasingly difficult. These factors have resulted in increased cost of the coating process which may impede the global corrosion protection coatings industry growth rate.

Corrosion Protection Coatings Market: Segmentation

The global corrosion protection coatings market is segmented based on end-user industry, resin type, technology, and others.

Based on end-user industry, the global market segments are petrochemical, oil & gas, marine, infrastructure, water treatment, and power generation. In 2022, the highest demand was witnessed in the infrastructure segment. The main reason for the higher segmental growth rate is the increased focus on functional and efficient infrastructure systems across countries to facilitate international trade. Moreover, the increasing investments in offshore infrastructure projects including port development and sites for power generation added to segmental dominance. In November 2023, the Bipartisan Infrastructure Law (BIL) in the USA directed an investment of USD 1.2 trillion toward infrastructure projects related to climate, energy, and transportation.

Based on resin type, the global corrosion protection coatings industry is divided into zinc, epoxy, chlorinated rubber, polyurethane, acrylic, and others.

Based on technology, the global market is divided into powder, water-based, solvent-based, and others. The highest growth rate was registered in the solvent-based segment. The segment growth rate is driven by the high-performance attributes offered by solvent-based corrosion protection coatings. They offer easy application and protection. Furthermore, during the curing procedure, factors such as humidity and temperature do not affect the overall process. High-quality corrosion protection coatings can last as long as 25 years in extreme weather conditions.

Corrosion Protection Coatings Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Corrosion Protection Coatings Market |

| Market Size in 2022 | USD 10.80 Billion |

| Market Forecast in 2030 | USD 15.51 Billion |

| Growth Rate | CAGR of 4.62% |

| Number of Pages | 219 |

| Key Companies Covered | Valspar Corporation, AkzoNobel N.V., The Sherwin-Williams Company, PPG Industries Inc., Nippon Paint Holdings Co. Ltd., Axalta Coating Systems, Tnemec Company Inc., Hempel A/S, 3M Company, Jotun A/S, Carboline Company, Kansai Paint Co. Ltd., Wacker Chemie AG, BASF SE, RPM International Inc., and others. |

| Segments Covered | By End-User Industry, By Resin Type, By Technology, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Corrosion Protection Coatings Market: Regional Analysis

Asia-Pacific to witness the highest growth rate during the forecast period

The global corrosion protection coatings market is expected to witness the highest growth in Asia-Pacific during the forecast period. The primary reason for the higher growth rate is the increased investments in infrastructure development projects. Countries such as China and India are emerging markets and are increasingly focused on several commercial, residential, and industrial infrastructure projects. In November 2023, it was reported that several local governments in China are seeking several infrastructure development projects after the region’s main legislative body announced sovereign debt issuance worth USD 137 billion. Furthermore, offshore-based projects have gained tremendous momentum in Asian countries.

In September 2023, Shanghai Electric launched two Ulstein-designed service operation vessels (SOVs) dedicated to regional wind farms. Asia-Pacific boasts of an extensive architecture that facilitates the manufacturing and supply of corrosion protection coatings. Europe is an important market with a high growth rate. The country is home to several producers of high-grade coatings for corrosion protection. In 2020, Atotech launched a new line of protective coating called DynaSmart. The technology has been patented and poses environmental benefits. The engineering process was managed in Germany while Asia hosts the production line.

Corrosion Protection Coatings Market: Competitive Analysis

The global corrosion protection coatings market is led by players like:

- Valspar Corporation

- AkzoNobel N.V.

- The Sherwin-Williams Company

- PPG Industries Inc.

- Nippon Paint Holdings Co. Ltd.

- Axalta Coating Systems

- Tnemec Company Inc.

- Hempel A/S

- 3M Company

- Jotun A/S

- Carboline Company

- Kansai Paint Co. Ltd.

- Wacker Chemie AG

- BASF SE

- RPM International Inc.

The global corrosion protection coatings market is segmented as follows:

By End-User Industry

- Petrochemical

- Oil & Gas

- Marine

- Infrastructure

- Water Treatment

- Power Generation

By Resin Type

- Zinc

- Epoxy

- Chlorinated Rubber

- Polyurethane

- Acrylic

- Others

By Technology

- Powder

- Water-Based

- Solvent-Based

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Corrosion protection coatings are materials that are applied to a surface for protection against corrosion and improve surface durability.

The global corrosion protection coatings market is projected to grow owing to the increasing application of these materials in the oil & gas sector.

According to study, the global corrosion protection coatings market size was worth around USD 10.80 billion in 2022 and is predicted to grow to around USD 15.51 billion by 2030.

The CAGR value of corrosion protection coatings market is expected to be around 4.62% during 2023-2030.

The global corrosion protection coatings market is expected to witness the highest growth in Asia-Pacific during the forecast period.

The global corrosion protection coatings market is led by players like Valspar Corporation, AkzoNobel N.V., The Sherwin-Williams Company, PPG Industries, Inc., Nippon Paint Holdings Co., Ltd., Axalta Coating Systems, Tnemec Company, Inc., Hempel A/S, 3M Company, Jotun A/S, Carboline Company, Kansai Paint Co., Ltd., Wacker Chemie AG, BASF SE, and RPM International Inc., and others.

The report explores crucial aspects of the corrosion protection coatings market including detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed