Cosmetic Pigments Market Size, Share, Trends, Growth 2030

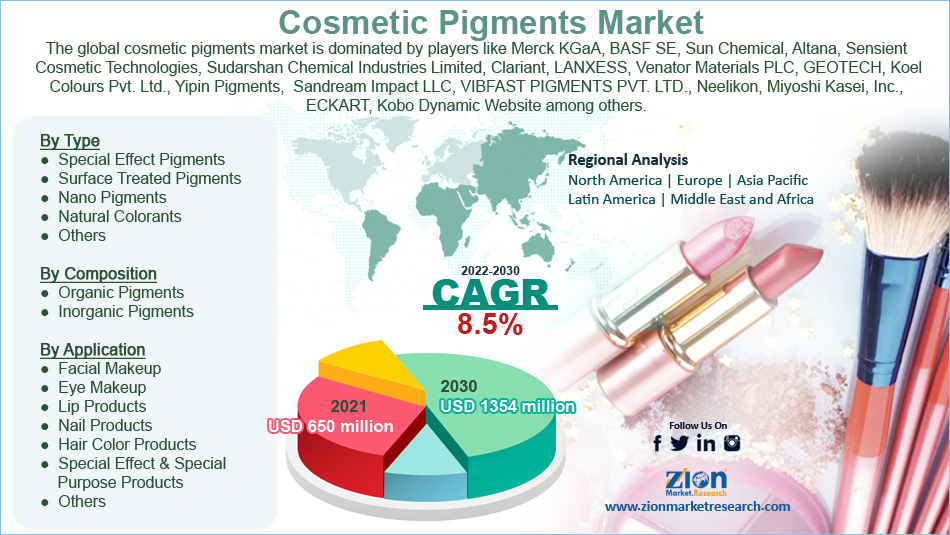

Cosmetic Pigments Market By Type (Special Effect Pigments, Surface Treated Pigments, Nano Pigments, Natural Colorants, and Others), By Composition (Organic Pigments and Inorganic Pigments), By Application (Facial Makeup, Eye Makeup, Lip Products, Nail Products, Hair Color Products, Special Effect & Special Purpose Products, and Others) and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2022 - 2030

| Market Size in 2021 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 650 Million | USD 1354 Million | 8.5% | 2021 |

Cosmetic Pigments Industry Prospective:

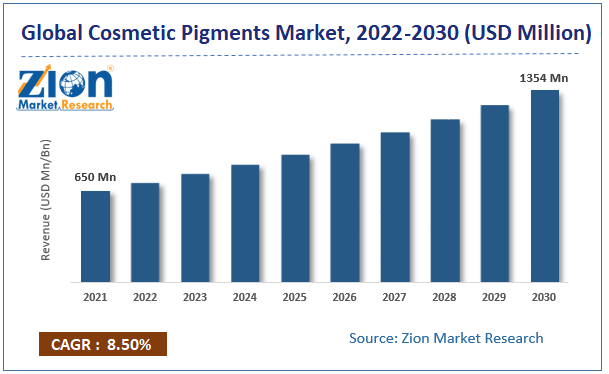

The global cosmetic pigments market size was worth around USD 650 million in 2021 and is predicted to grow to around USD 1354 million by 2030 with a compound annual growth rate (CAGR) of roughly 8.5% between 2022 and 2030.

The report analyzes the global cosmetic pigments market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the cosmetic pigment market.

Cosmetic Pigments Market: Overview

Cosmetic pigments are color additives used in the production of cosmetic goods like eye shadow, nail polish, lipstick, and nail enamel. Depending on the elemental makeup, they are primarily organic or inorganic in origin. This market has grown as a result of factors including an increase in the use of cosmetics for personal care, a rising awareness among consumers of the importance of looking attractive, and a desire for new, distinctive, and high-quality goods. Due to the growing consumer preference for environmentally friendly and sustainable products, the organic pigment market has been expanding quickly. As a result, manufacturers are now providing a wide range of colors, including neon shades, using chromium dioxides, ultramarines, and iron oxides, among other materials.

Key Insights

- As per the analysis shared by our research analyst, the global cosmetic pigments market is estimated to grow annually at a CAGR of around 8.5% over the forecast period (2022-2030).

- In terms of revenue, the global cosmetic pigments market size was valued at around USD 650 million in 2021 and is projected to reach USD 1354 million, by 2030.

- Constantly changing trends in cosmetics, and increased adaptation of global styles and trends are anticipated to augment the growth of the cosmetic pigments market.

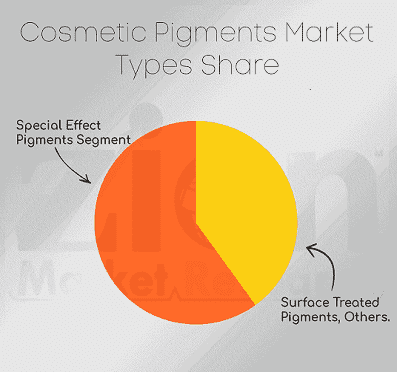

- Based on the type, the special effect pigments segment accounted for the largest market share in 2021.

- Based on the composition, the inorganic pigments segment held the largest market share in 2021.

- Based on region, Europe is expected to dominate the market during the forecast period.

To know more about this report, request a sample copy.

Cosmetic Pigments Market: Growth Drivers

Growing demand for cosmetic pigments in cosmetic and personal care products

Cosmetic pigments have qualities like a vivid and brilliantly luminous luster, shimmer, and shine. These particles are pigments and can be colorful, colorless, or luminous. Organic or inorganic finely powdered materials are also acceptable. They are typically chemically unaltered by the medium in which they are introduced and insoluble.

They are utilized in numerous cosmetic products, including those for the face, lips, eyes, and nails. Cosmetic pigments, particularly pearlescent pigments, are used in facial cosmetics to conceal imperfections and uneven skin tone. With more product variety available in the cosmetics and personal care market, there is an increased desire for cosmetics that complement the consumer's natural skin tone. Thus, cosmetic pigment use is being fueled by the quick rise in demand for cosmetic and beauty products.

Cosmetic Pigments Market: Restraints

Maintaining the standard of the cosmetic pigments used in the products sold on the mass market

The market for cosmetic pigments is expanding as a result of the rising demand for goods for color cosmetics. Maintaining the quality of cosmetic pigments for mass-market products like lip color, nail paints, and eye makeup products is a major difficulty that manufacturers of these pigments face. Although these products are produced in vast quantities, occasionally their quality falls short of what consumers would like. Thus, acting as a major restraining factor for the global cosmetic pigments market growth during the forecast period.

Cosmetic Pigments Market: Opportunities

Growing consumer interest towards environmentally friendly and sustainably produced ingredients in cosmetics and personal care products to provide lucrative opportunity

Many of the cosmetic pigments used in makeup products contain dangerous compounds that could be damaging to people's health. The development of more natural and cosmetic emulsifiers has been driven by a mix of rising consumer interest and government regulations. As a result, the market for organic pigments that are sustainable and good for the environment is expanding quickly. Companies that manufacture goods are making investments to enter the green market and are utilizing sustainable technologies. The growing market for cosmetic pigments made naturally is offering several opportunities for industry expansion.

Cosmetic Pigments Market: Challenges

Strict guidelines for the usage of certain pigments

Manufacturers of cosmetic pigments must adhere to strict laws governing cosmetics goods. Regarding the requirements for labeling, packaging, and the ingredients used in the production of the products, there are many restrictions. In Europe and North America, these laws are very strict. A similar practice is being adopted by other parts of the world as a result of rising environmental and health consciousness.

Color additives and pigments used in cosmetic applications are subject to regulations set forth by the US Food and Drug Administration (FDA). Regulations are put in place for health-hazardous pigments and dyes by the European Union (EU). Due to the risks to the environment posed by their use, the EU has limited the use of cadmium pigments and lead (Pb) and its derivatives. These regulations are limiting the manufacturing of cosmetic pigments, which has a substantial impact on their costs. Thus, acting as a major challenging factor for the global cosmetic pigment market growth over the forecast period.

Cosmetic Pigments Market: Segmentation

The global cosmetic pigments market is segmented based on the type, composition, application, and region

Based on the type, the global market is bifurcated into special effect pigments, surface-treated pigments, nano pigments, natural colorants, and others. The special effect pigments segment accounted for the largest market share in 2021 and is expected to dominate the market during the forecast period. The market for these pigments is anticipated to be driven during the projected period by the rising demand for special effect pigments in cosmetic products including lip products and eye shadows.

These pigments also contribute to improving skin tone. Special effect pigments give cosmetic goods a shimmer and improve their textures. When it comes to adding shine, glitter, color or color-travel effects, and coverage, pearlescent pigments are special effect pigments that are frequently utilized in the cosmetics industry. Powders and concentrates made of titanium dioxide and mica known as pearlescent pigments give the items effects ranging from a soft sheen to a glittering diamond.

Based on the composition, global cosmetic pigments are categorized into organic pigments and inorganic pigments. The inorganic pigments segment held the largest market share in 2021 and is expected to continue the same pattern during the forecast period. Zinc oxide, titanium dioxide, iron oxide, and chromium oxide are used in the production of inorganic cosmetic pigments. Lip balms and nail paints in white colors are made with the assistance of zinc dioxide. Formulations for sunscreen creams include titanium dioxide. Green cosmetics can be created using chromium dioxide.

To achieve the hues of red, yellow, and black, iron oxide is used. Dark blue eye shadows are created with ferric ferrocyanide. Hair care products often contain manganese violet. White opaque pigments, which are used to give opacity and lighten other hues, make up inorganic pigments. The color intensity of these pigments is lower than that of organic pigments. Thus, driving the segmental growth over the forecast period.

Recent Developments:

-

In July 2021, the global pigments division of BASF, known as BASF Colors & Effects, has been acquired by DIC Corp. through its subsidiary Sun Chemical (BCE). To better serve clients around the world, the acquisition combines the complementary portfolios of technologies, goods, manufacturing resources, supply chains, and customer service of the two businesses.

- In January 2019, an exclusive, long-term strategic partnership in the area of customized personal care products was announced by BASF and B2B Cosmetics. The personalization system, marketed by B2B Cosmetics under the name Emuage technology, will assist BASF in bringing distinctive expertise in personal care products. By simply selecting capsules, inserting them into the machine, and obtaining the finished product, users of the Emuage technology can make their personalized personal care products. The company was able to introduce this innovative technology to the market owing to this partnership.

Global Cosmetic Pigments Market Report Scope:

| Report Attributes | Report Details |

|---|---|

| Report Name | Cosmetic Pigments Market Research Report |

| Market Size in 2021 | USD 650 Million |

| Market Forecast in 2030 | USD 1354 Million |

| Compound Annual Growth Rate | CAGR of 8.5% |

| Number of Pages | 190 |

| Forecast Units | Value (USD Million), and Volume (Units) |

| Key Companies Covered | Merck KGaA, BASF SE, Sun Chemical, Altana, Sensient Cosmetic Technologies, Sudarshan Chemical Industries Limited, Clariant, LANXESS, Venator Materials PLC, GEOTECH, Koel Colours Pvt. Ltd., Yipin Pigments, NIHON KOKEN KOGYO CO.,LTD., Ferro Corporation, Dayglo Color Corp, Elemental SRL, Kolortek Co., Ltd, Sandream Impact LLC, VIBFAST PIGMENTS PVT. LTD., Neelikon, Miyoshi Kasei, Inc., ECKART, Kobo Dynamic Website among others. |

| Segments Covered | By Type, By Composition, By Application, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East and Africa (MEA) |

| Countries Covered | North America: U.S and Canada Europe: Germany, Italy, Russia, U.K, Spain, France, Rest of Europe APAC: China, Australia, Japan, India, South Korea, South East Asia, Rest of Asia Pacific Latin America: Brazil, Argentina, Chile The Middle East And Africa: South Africa, GCC, Rest of MEA |

| Base Year | 2021 |

| Historical Year | 2016 to 2020 |

| Forecast Year | 2022 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Cosmetic Pigments Market: Regional Analysis

Europe is expected to dominate the market during the forecast period

Europe is expected to dominate the global cosmetic pigments market during the forecast period. European manufacturers of cosmetics and personal care products use cutting-edge technology, including surface modification and pigment dispersion, to create high-quality goods. The market for cosmetic pigments in this region is being driven by the demand for high-quality cosmetic and personal care products. The market for cosmetic pigments in these areas is anticipated to grow as customers' disposable income rises.

Moreover, the biggest cosmetics market in Europe is Germany, followed by France and the UK. The majority of women and younger consumers eager to spend more money on such products drive the German cosmetics and toiletry industry. Products for caring for one's hair, skin, and face are the three categories with the biggest turnover. With a great interest in high-end cosmetics, Germany spends a relatively high USD 163 per person annually on cosmetics. Product releases and innovations are anticipated to drive sales in Germany despite the industry there becoming more mature and competitive. The development of the market in this nation has also been influenced by manufacturers' concentration on items for particular customer groups, such as anti-aging and men's grooming products.

Besides, the Asia Pacific is expected to grow at the highest CAGR during the forecast period. In the Asia Pacific, the nations like China and India are the leading consumers of cosmetic pigments. The need for cosmetic pigments in the region is anticipated to rise as a result of rising cosmetic manufacturing and consumption in nations like China, India, and the ASEAN nations. For instance, in China, face cosmetics are expected to bring in USD 2,842.4 million in 2020. In 2025, it is anticipated to reach USD 4,986.3 million.

Additionally, it is predicted that the country's lip product market will generate USD 5,011.4 million in revenue by 2025 from an estimated 2020 market of USD 3,121.5 million. Moreover, in India, the market for cosmetics is expected to generate revenues of USD 1,312.9 million in 2020 and USD 2,037.2 million in 2025. Additionally, it is predicted that the country's revenue from lip products will increase to USD 1,825.9 million in 2025 from a projected USD 1,282.3 million in 2020. Thus, this fact supports the market expansion in the region during the forecast period.

Cosmetic Pigments Market: Competitive Analysis

The global cosmetic pigments market is dominated by players like:

- Merck KGaA

- BASF SE

- Sun Chemical

- Altana

- Sensient Cosmetic Technologies

- Sudarshan Chemical Industries Limited

- Clariant

- LANXESS

- Venator Materials PLC

- GEOTECH

- Koel Colours Pvt. Ltd.

- Yipin Pigments

- NIHON KOKEN KOGYO CO.,LTD.

- Ferro Corporation

- Dayglo Color Corp

- Elemental SRL

- Kolortek Co. Ltd

- Sandream Impact LLC

- VIBFAST PIGMENTS PVT. LTD.

- Neelikon

- Miyoshi Kasei Inc.

- ECKART

- Kobo Dynamic Website

The global cosmetic pigments market is segmented as follows:

By Type

- Special Effect Pigments

- Surface Treated Pigments

- Nano Pigments

- Natural Colorants

- Others

By Composition

- Organic Pigments

- Inorganic Pigments

By Application

- Facial Makeup

- Eye Makeup

- Lip Products

- Nail Products

- Hair Color Products

- Special Effect & Special Purpose Products

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The expanding demand for color cosmetics and the increasing awareness of one's appearance is what is driving the global market for cosmetic pigments. Moreover, the rise in discretionary income in developed and developing nations especially in the female working force has also driven market growth.

According to the report, the global market size was worth around USD 650 million in 2021 and is predicted to grow to around USD 1354 million by 2030 with a compound annual growth rate (CAGR) of roughly 8.5% between 2022 and 2030.

The global cosmetic pigment market growth is expected to be driven by Europe. It is currently the world’s highest revenue-generating market due to the growing demand for cosmetics and personal care products in the region.

The global cosmetic pigments market is dominated by players like Merck KGaA, BASF SE, Sun Chemical, Altana, Sensient Cosmetic Technologies, Sudarshan Chemical Industries Limited, Clariant, LANXESS, Venator Materials PLC, GEOTECH, Koel Colours Pvt. Ltd., Yipin Pigments, NIHON KOKEN KOGYO CO., LTD., Ferro Corporation, Dayglo Color Corp, Elemental SRL, Kolortek Co., Ltd, Sandream Impact LLC, VIBFAST PIGMENTS PVT. LTD., Neelikon, Miyoshi Kasei, Inc., ECKART, Kobo Dynamic Website among others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed