Crop Protection Chemicals Market Size, Share, Analysis, Trends, Growth, 2032

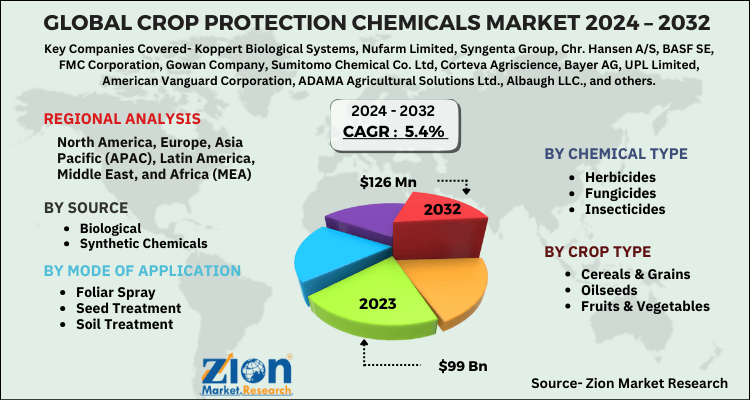

Crop Protection Chemicals Market By Chemical Type (Herbicides, Fungicides, and Insecticides), By Source (Biological and Synthetic Chemicals), By Mode of Application (Foliar Spray, Seed Treatment, and Soil Treatment), By Crop Type (Cereals & Grains, Oilseeds, and Fruits & Vegetables), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 99 Billion | USD 126 Billion | 5.4% | 2023 |

Crop Protection Chemicals Industry Prospective:

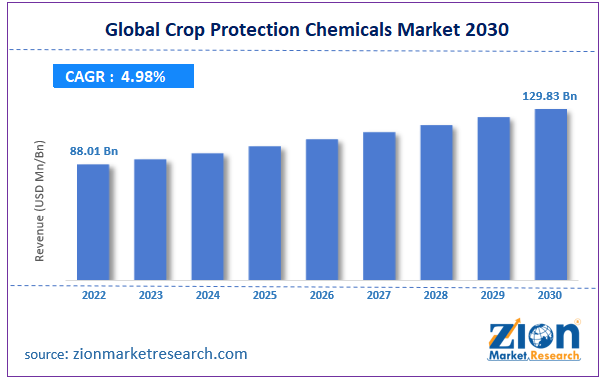

The global crop protection chemicals market size was evaluated at $99 billion in 2023 and is slated to hit $126 billion by the end of 2032 with a CAGR of nearly 5.4% between 2024 and 2032.

Crop Protection Chemicals Market: Overview

Crop protection chemicals, also known as pesticides, are products used to control pests, weeds, and diseases that can spoil the harvest of crops.

Reportedly, they play a key part in precision farming and assist in improving crop yield & food quality. Moreover, the product types include fungicides, herbicides, and insecticides.

Key Insights

- As per the analysis shared by our research analyst, the global crop protection chemicals market is projected to expand annually at the annual growth rate of around 5.4% over the forecast timespan (2024-2032)

- In terms of revenue, the global crop protection chemicals market size was evaluated at nearly $99 billion in 2023 and is expected to reach $126 billion by 2032.

- The global crop protection chemicals market is anticipated to grow rapidly over the forecast timeline owing to escalating demand for food, surging population, and increasing urbanization.

- In terms of chemical type, the herbicides segment is slated to register the highest CAGR over the forecast period.

- Based on source, the synthetic chemicals segment is predicted to contribute majorly towards segmental space in the upcoming years.

- On the basis of mode of application, the foliar spray segment is predicted to dominate the segmental surge over 2024-2032

- Based on crop type, the cereals & grains segment is predicted to contribute majorly towards industry expansion over the analysis timespan.

- Region-wise, the North American crop protection chemicals industry is projected to register the fastest CAGR during the assessment timespan.

Crop Protection Chemicals Market: Growth Factors

Huge food intake with a rapidly increasing populace globally to drive global market trends

Escalating demand for food with a surging population and increasing urbanization will contribute remarkably towards the growth of the global crop protection chemicals market.

Furthermore, large-scale production of bio-pesticides and precision farming are some of the key factors driving the market space across various regions. Growing awareness of sustainable farming activities, along with consumer preference for food safety, is projected to spearhead the expansion of the global market.

In addition, an increment in the allocation of capital to farming activities and the coining of new crop protection measures can further accentuate the global market surge.

The large-scale use of digital systems, including AI and IoT, for protecting crops and the use of drone technologies for increasing crop yield with appropriate spraying of chemicals & water will drive the market surge in the ensuing years.

An increase in the upstream and downstream activities in the chemical sector will expedite the market surge in the upcoming years.

Crop Protection Chemicals Market: Restraints

Oscillations in raw material prices can prove to be a detrimental factor in the industry growth

An increase in product costs and surging prices of research & development activities are likely to obstruct the global crop protection chemicals industry.

Fluctuations in raw commodity costs and consumer preference for organic food products can inhibit the global industry demand.

Crop Protection Chemicals Market: Opportunities

Focus on developing new formulations of product can create a slew of growth avenues for the global market

Breakthroughs in product formulations, such as the development of control-release crop protection chemicals and microencapsulation, will expand the scope of the global crop protection chemicals market in the years ahead.

Integration of data analytics and connected things offers real-time insights into the chemical sector with a view to improving the use of chemicals along with increasing product effectiveness in pest control activities. This, in turn, will embellish the expansion of the market across the globe.

Surging highlight on integrated pest management helps farmers in using a combination of various chemical & biological tools for protecting crops, and this has paved the way for launching eco-friendly crop protection chemicals, thereby spurring the market landscape.

Crop Protection Chemicals Market: Challenges

Surging issues of contamination of food items can challenge the global industry growth over forecast period

Growing concerns over pesticide residue contaminating food products and its hazardous effect on human health and developing of product resistance can hinder the growth of the global crop protection chemicals industry.

Furthermore, surging environmental pollution caused by the excessive use of chemicals in farming activities and demand for sustainable farming activities will obstruct the global industry expansion.

Crop Protection Chemicals Market: Segmentation

The global crop protection chemicals market is divided into chemical type, source, mode of application, crop type, and region.

In terms of chemical type, the crop protection chemicals market across the globe is segmented into herbicides, fungicides, and insecticides segments.

Apparently, the herbicides segment, which gathered nearly two-thirds of the global market revenue in 2023, is expected to record the fastest CAGR in the coming eight years due to the need for weed control, labor scarcity for removing weeds manually, and surging growth of herbicide-resistant weeds in farmlands.

Based on source, the global crop protection chemicals industry is divided into biological and synthetic chemicals segments. Apparently, the synthetic chemicals segment, which dominated the global industry share in 2023, is projected to contribute majorly towards the segmental surge in the analysis timeframe. This can be a result of the need for quick outcomes and a huge crop yield to fulfill the food demand of the rising global population.

On the basis of mode of application, the global crop protection chemicals market is sectored into foliar spray, seed treatment, and soil treatment segments.

Furthermore, the foliar spray segment, which accounted majorly towards the segmental surge in 2023, is likely to foster the segmental expansion in the forecast timeline.

The growth of the segment in the ensuing years can be due to the beneficial effect of direct spraying of chemicals on plant leaves, thereby providing immediate control of crop pests & crop plant diseases.

Based on the crop type, the crop protection chemicals industry can be bifurcated into cereals & grains, oilseeds, and fruits & vegetables segments.

Moreover, the cereals & grains segment, which leads the global industry revenue in 2023, is projected to account lucratively towards the global industry growth in the years ahead.

Moreover, the growth of the segment can be credited to a rise in the demand for cereals & grains owing to their cost-effectiveness. Moreover, the susceptibility of the cereals & grains crops to pests can prop up the segmental surge.

Crop Protection Chemicals Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Crop Protection Chemicals Market |

| Market Size in 2023 | USD 99 Billion |

| Market Forecast in 2032 | USD 126 Billion |

| Growth Rate | CAGR of 5.4% |

| Number of Pages | 227 |

| Key Companies Covered | Koppert Biological Systems, Nufarm Limited, Syngenta Group, Chr. Hansen A/S, BASF SE, FMC Corporation, Gowan Company, Sumitomo Chemical Co. Ltd, Corteva Agriscience, Bayer AG, UPL Limited, American Vanguard Corporation, ADAMA Agricultural Solutions Ltd., Albaugh LLC., and others. |

| Segments Covered | By Chemical Type, By Source, By Mode of Application, By Crop Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Crop Protection Chemicals Market: Regional Insights

Asia-Pacific is likely to maintain leading status in the global market over the assessment period

Asia-Pacific, which contributed for about three-fourths of the global crop protection chemicals market size in 2023, is slated to establish a leading position in the global market in the analysis timeframe.

Furthermore, the regional market expansion in the coming decade can be due to the swiftly exploding population in countries such as China and India.

Moreover, the flourishing farming sector in the region, along with the diverse climatic conditions witnessed in the region, will drive the regional market expansion.

Presence of key manufacturers in the countries such as India, Indonesia, Thailand, and Malaysia will embellish the market progress in APC in the foreseeable future.

The North American crop protection chemicals industry is expected to register the highest CAGR in the prognosis timespan. The elevation of the industry in the region can be subject to the execution of strict legislation, the launch of new farming techniques, and a focus on precision agriculture practices in countries such as Canada and the U.S.

Crop Protection Chemicals Market: Competitive Space

The global crop protection chemicals market profiles key players such as:

- Koppert Biological Systems

- Nufarm Limited

- Syngenta Group

- Chr. Hansen A/S

- BASF SE

- FMC Corporation

- Gowan Company

- Sumitomo Chemical Co. Ltd

- Corteva Agriscience

- Bayer AG

- UPL Limited

- American Vanguard Corporation

- ADAMA Agricultural Solutions Ltd.

- Albaugh LLC.

The global crop protection chemicals market is segmented as follows:

By Chemical Type

- Herbicides

- Fungicides

- Insecticides

By Source

- Biological

- Synthetic Chemicals

By Mode of Application

- Foliar Spray

- Seed Treatment

- Soil Treatment

By Crop Type

- Cereals & Grains

- Oilseeds

- Fruits & Vegetables

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Crop protection chemicals, which are referred to as pesticides, are products that are utilized for controlling pests, weeds, and diseases that can spoil the harvest of crops.

The global crop protection chemicals market will grow over the forecast period due to growing awareness of sustainable farming activities and consumer preference for food safety.

According to a study, the global crop protection chemicals industry size was $99 billion in 2023 and is projected to reach $126 billion by the end of 2032.

The global crop protection chemicals market is anticipated to record a CAGR of nearly 5.4% from 2024 to 2032.

The North American crop protection chemicals industry is set to register the fastest CAGR over the forecasting timeframe owing to the execution of strict legislation, the launch of new farming techniques, and the focus on precision agriculture practices in countries such as Canada and the U.S.

The global crop protection chemicals market is led by players such as Koppert Biological Systems, Nufarm Limited, Syngenta Group, Chr. Hansen A/S, BASF SE, FMC Corporation, Gowan Company, Sumitomo Chemical Co., Ltd, Corteva Agriscience, Bayer AG, UPL Limited, American Vanguard Corporation, ADAMA Agricultural Solutions Ltd., and Albaugh LLC.

The global crop protection chemicals market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, cash-benefit analysis, market attractiveness analysis, sentiment analysis, PESTEL analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five force analysis, factor analysis, and value chain analysis. It provides an apt scenario about demand and factor conditions in the country impacting the profitability of the firms in the domestic and international markets.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed