Data Center Market Size, Share, Trends, Growth 2032

Data Center Market By Component (Solution and Services), By Type (Colocation, Hyperscale, Edge, and Others), By Enterprise Size (Large Enterprises and Small & Medium Enterprises), By End-User (BFSI, IT and Telecom, Government, Energy and Utilities, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

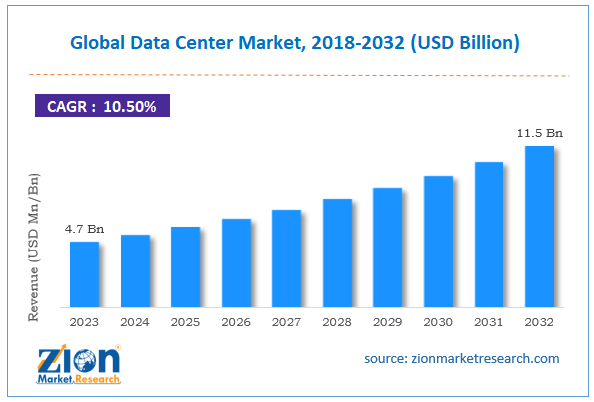

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 4.7 Billion | USD 11.5 Billion | 10.5% | 2023 |

Data Center Industry Prospective:

The global data center market size was around USD 4.7 billion in 2023 and is predicted to grow to around USD 11.5 billion by 2032, with a compound annual growth rate (CAGR) of roughly 10.5% between 2024 and 2032.

Data Center Market: Overview

A data center is a physical room, building, or facility with IT infrastructure for developing, operating, and providing applications and services. It also stores and maintains data for those applications and services. Data centers began as privately owned, tightly controlled, on-premises facilities hosting traditional IT technology for the sole use of a single firm. They have recently evolved into remote or networked facilities owned by cloud service providers (CSPs). These CSP data centers house virtualized IT infrastructure that can be shared by various organizations and customers.

Key Insights

- As per the analysis shared by our research analyst, the global data center market is estimated to grow annually at a CAGR of around 10.5% over the forecast period (2024-2032).

- In terms of revenue, the global data center market size was valued at around USD 4.7 billion in 2023 and is projected to reach USD 11.5 billion by 2032.

- The increasing number of end-use industries is expected to drive the data center market over the forecast period.

- Based on the component, the solution segment is expected to hold the largest market share over the forecast period.

- Based on the type, the hyperscale segment is expected to dominate the market expansion over the projected period.

- Based on the enterprise size, the large enterprises segment is expected to capture the largest market share over the projected period.

- Based on the end user, the BFSI sector holds a prominent revenue share of the market.

- Based on region, North America is expected to dominate the market during the forecast period.

Data Center Market: Growth Drivers

Growing demand for data storage drives market growth

An important factor significantly influencing the landscape of the data center market is the spike in demand for digitized archival and born-digital storage. Significant demand for storage solutions that are safe, scalable, and readily available is being fueled by the enormous development in digital content, things that were born digital, and digitized archives.

The adoption of remote work and the transition to digital operations by many industries is another factor driving the demand for data centers. The management of vast amounts of digital content can be accomplished using these cloud-based systems, which offer both lower costs and greater flexibility. In the public sector of the United Kingdom, for instance, there has been a tremendous increase in the usage of cloud computing over the past decade.

As stated by the Cloud Industry Forum, the percentage of businesses that have used cloud services has skyrocketed from 38 percent in the year 2010 to an astounding 78 percent in the year 2023. This rise in adoption reveals an overall rate of 84%, demonstrating that a significant section of the population uses several cloud services for their computing needs.

A major shift toward cloud-based solutions has been noted in the public sector as well as in a variety of commercial enterprises, and this transition represents such a trend. This parallels the growing reliance on cloud storage for managing digitized archives and archives that were born digitally around the world.

Data Center Market: Restraints

High initial investment and operational costs hinder market growth

One of the most important issues in the data center sector is the high initial investment and running expenses connected to the building and maintenance of these facilities. Particularly for small and medium-sized businesses (SMEs) or organizations looking to grow their information technology infrastructure, these costs can be a major barrier.

Components, including servers, storage devices, networking equipment, power distribution units (PDUs), and cooling systems, call for a large sum of money. Building hyperscale and corporate data centers can run anywhere from millions to billions of dollars.

Furthermore, data centers running servers demand enormous volumes of electricity for cooling and running operations. Operating expenses heavily include cooling-related expenses, including air conditioning, liquid cooling, and other like techniques.

Data Center Market: Opportunities

The rising introduction of innovative solutions offers a lucrative opportunity for market growth

The growing introduction of innovative solutions offers a lucrative opportunity for the data center market over the analysis period. For instance, in March 2024, Eaton, an expert in intelligent power management, released a new modular data center solution for North America. This solution is meant for companies trying to quickly meet growing needs for artificial intelligence, machine learning, and edge computing.

Among other kinds of installations, Eaton's SmartRack® modular data centers can be placed in a matter of days in a range of sites, including manufacturing facilities, warehouses, and enterprise or colocation data centers.

Eaton's SmartRack modular data centers are designed for significant information technology equipment with up to 150 kW of equipment load, therefore optimizing a performance-oriented data center solution. These data centers house cooling, information technology, and service enclosures along with racks.

Fast sizing, configuring, commissioning, and deployment of the Eaton SmartRack modular data centers enable them to meet a range of needs. The modular enclosures of these data centers are sturdy and somewhat lightweight.

Data Center Market: Challenges

Lack of skilled workforce poses a major challenge to market expansion

Due to a shortage of qualified professionals who are capable of constructing, managing, and maintaining modern data centers, the data center industry is up against a significant challenge. The demand for highly trained information technology professionals is growing as cloud computing, artificial intelligence, the Internet of Things, and edge computing continue to improve. This has led to a skills gap in the field. Having specialized knowledge is required due to the growing utilization of hyperscale, cloud, and edge computing.

Highly specialized skills are required to successfully manage AI-driven automation, cybersecurity, and high-performance computing (HPC). Quantum computing, software-defined networking (SDN), and artificial intelligence-powered cooling are examples of forthcoming technologies that require new skill sets. Professionals in the information technology field are required to continually refresh their skills and earn certifications to maintain their relevance. Thus, the shortage of skilled workforce poses a major challenge for the data center industry expansion.

Data Center Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Data Center Market |

| Market Size in 2023 | USD 4.7 Billion |

| Market Forecast in 2032 | USD 11.5 Billion |

| Growth Rate | CAGR of 10.5% |

| Number of Pages | 223 |

| Key Companies Covered | Cisco Systems Inc., 365 Data Centers, Apple Inc., China Telecom Corp. Ltd., Cyxtera Technologies Inc., CyrusOne LLC, Google LLC, Digital Realty Trust Inc., Equinix Inc., Hewlett Packard Enterprise Co., Intel Corp., International Business Machines Corp., KDDI Corp., Microsoft Corp., Nippon Telegraph and Telephone Corp., Oracle Corp., Salesforce Inc., Verizon Communications Inc., SAP SE, and others. |

| Segments Covered | By Component, By Type, By Enterprise Size, By End User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Data Center Market: Segmentation

The global data center industry is segmented based on component, type, enterprise size, end user, and region.

Based on the component, the global data center market is bifurcated into solutions and services. The solution segment is expected to hold the largest market share over the forecast period. The segment expansion is attributed to the growing demand from various industries.

Based on the type, the global data center industry is bifurcated into colocation, hyperscale, edge, and others. The hyperscale segment is expected to dominate the market expansion over the projected period. Large buildings known as hyperscale data centers are made to accommodate cloud services, high-performance computing, and vast data storage.

Tech behemoths, including Amazon Web Services (AWS), Microsoft Azure, Google Cloud, Meta, and Alibaba Cloud, have constructed these data centers to manage massive amounts of data and computational tasks. Growing collaboration among the key market players is expected to flourish the industry expansion.

For instance, in December 2024, Energy Vault Holdings Inc. and RackScale Data Centers ("RSDC"), a new data center developer, formed a strategic alliance.

Through the implementation of Energy Vault's exclusive B-NestTM hyperscale battery energy storage system, this collaboration seeks to expedite the delivery of 2GW of firm, primary power to data center locations established by RSDC. In 2026, the parties hope to start building data center locations.

Based on the enterprise size, the global data center market is bifurcated into large enterprises and small and medium enterprises. The large enterprises segment will capture the largest market share over the projected period. The growing need to manage massive amounts of data drives the segment expansion.

Based on the end user, the global data center industry is bifurcated into BFSI, IT and telecom, government, energy and utilities, and others. The BFSI sector holds a prominent revenue share of the market. The rise of online banking, mobile payments, and digital wallets requires high-performance computing, which drives market expansion.

Data Center Market: Regional Analysis

North America dominates the market over the projected period

North America is expected to dominate the global data center market. The region is a center for digital change and technical innovation. Data centers are required to support cloud computing, e-commerce, online services, and other digital projects due to the region's growing digital economy. North America uses cloud services extensively because of their affordability, scalability, and flexibility.

To increase the infrastructure of cloud providers, more data centers are required. Large amounts of data are produced and needed by the financial, medical, entertainment, and e-commerce industries. This data must be processed, stored, and analyzed in data centers.

Data Center Market: Competitive Analysis

The global data center market is dominated by players like:

- Cisco Systems Inc.

- 365 Data Centers

- Apple Inc.

- China Telecom Corp. Ltd.

- Cyxtera Technologies Inc.

- CyrusOne LLC

- Google LLC

- Digital Realty Trust Inc.

- Equinix Inc.

- Hewlett Packard Enterprise Co.

- Intel Corp.

- International Business Machines Corp.

- KDDI Corp.

- Microsoft Corp.

- Nippon Telegraph and Telephone Corp.

- Oracle Corp.

- Salesforce Inc.

- Verizon Communications Inc.

- SAP SE

The global data center market is segmented as follows:

By Component

- Solution

- Services

By Type

- Colocation

- Hyperscale

- Edge

- Others

By Enterprise Size

- Large Enterprises

- Small and Medium Enterprises

By End User

- BFSI

- IT and Telecom

- Government

- Energy and Utilities

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

A data center is a physical room, building, or facility with IT infrastructure for developing, operating, and providing applications and services. It also stores and maintains data for those applications and services.

The data center market is expanding due to several factors, such as growing demand for cloud services, the surge in data generation, rising investment in hyperscale data centers, and the growing end-use industry.

According to the report, the global data center market size was worth around USD 4.7 billion in 2023 and is predicted to grow to around USD 11.5 billion by 2032.

The global data center market is expected to grow at a CAGR of 10.5% during the forecast period.

The global data center market growth is expected to be driven by North America. It is currently the world’s highest revenue-generating market due to the presence of major players and technological innovation.

The global data center market is dominated by players like Cisco Systems Inc., 365 Data Centers, Apple Inc., China Telecom Corp. Ltd., Cyxtera Technologies Inc., CyrusOne LLC, Google LLC, Digital Realty Trust Inc., Equinix Inc., Hewlett Packard Enterprise Co., Intel Corp., International Business Machines Corp., KDDI Corp., Microsoft Corp., Nippon Telegraph and Telephone Corp., Oracle Corp., Salesforce Inc., Verizon Communications Inc. and SAP SE among others.

The data center market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed