Debt Collection Software Market Size & Share Report, Growth, Trends, 2032

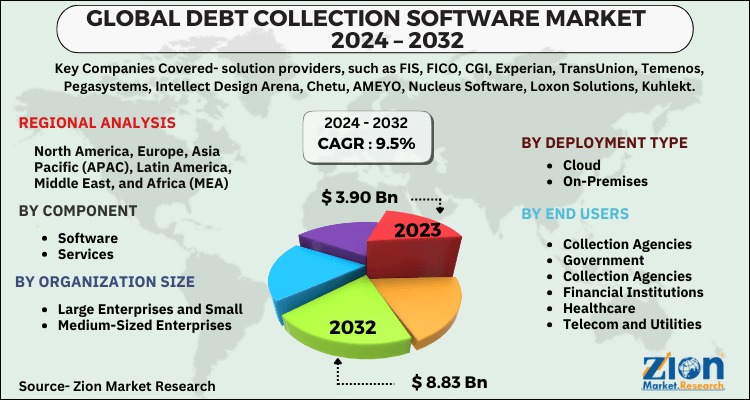

Debt Collection Software Market: By Component (Software and Services) By Organization Size (Large Enterprises and Small and Medium-Sized Enterprises) By Deployment Type (Cloud and On-Premises) By End Users (Collection Agencies, Government, Collection Agencies, Financial Institutions, Healthcare, Telecom and Utilities and Others) By Region: Global Industry Perspective, Comprehensive Analysis And Forecast, 2024 - 2032.

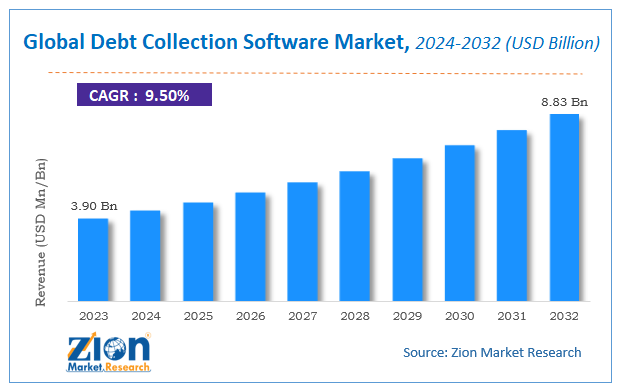

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 3.90 Billion | USD 8.83 Billion | 9.5% | 2023 |

Debt Collection Software Market Insights

According to a report from Zion Market Research, the global Debt Collection Software Market was valued at USD 3.90 Billion in 2023 and is projected to hit USD 8.83 Billion by 2032, with a compound annual growth rate (CAGR) of 9.5% during the forecast period 2024-2032. This report explores market strengths, weakness, opportunities, and threats. It also provides valuable insights into the market's growth drivers, challenges, and the future prospects that may emerge in the Debt Collection Software Market industry over the next decade.

The debt collection software market shows a significant demand owing to rising automation in the process of depth collection. Outsourcing debt recovery to expertized debt collection agencies is another factor boosting the market growth. Moreover, increasing need for self-service payment models inorder to speed up the collection can also influence the market growth over the forecast period. Additionally, acceleration of digital strategies to expand collection services at a faster pace is expected to contribute to the market’s growth opportunity. However, enforcement of debt collection regulations worldwide may pose a challenge to the market.

Debt Collection Software Market: Segmentation

The study provides a decisive view of the global debt collection software market by segmenting the market based on by component, by organization size, deployment type, end users segment and by Region. All the segments have been analyzed based on present and future trends and the market is estimated from 2024 to 2032.

By component segment analysis includes software and services.

By organization size segment analysis includes large enterprises and small and medium-sized enterprises.

By deployment type segment analysis includes cloud and on-premises.

By end users segment analysis includes collection agencies, government, collection agencie, financial institutions, healthcare, telecom and utilities and others.

The Regional segment includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

On the basis of component, debt collection software market is fragmented into software and services. Debt collection software helps lenders and third-party collection agencies to control credit risk and recover unpaid debt from debtors. The technology allows financial institutions, collection agencies, and lending companies to redefine their collection strategies and improve customer satisfaction by delivering different payment options for debts owed to them.

The organization size segment is divided into large enterprises and small and medium-sized enterprises. The SME segment will increase at a higher rate than the large company segment during the forecast period. Small and medium-sized businesses can make most use of mobility-based low-cost debt collection software solutions inorder to remain competitive in the market. In addition, small and medium-sized businesses with less financial strength compared to large enterprises would require additional support from debt collection software solutions providers to optimize the use of their resources.

Debt Collection Software Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Debt Collection Software Market |

| Market Size in 2023 | USD 3.90 Billion |

| Market Forecast in 2032 | USD 8.83 Billion |

| Growth Rate | CAGR of 9.5% |

| Number of Pages | 172 |

| Key Companies Covered | solution providers, such as FIS, FICO, CGI, Experian, TransUnion, Temenos, Pegasystems, Intellect Design Arena, Chetu, AMEYO, Nucleus Software, Loxon Solutions, Kuhlekt, EXUS and Katabat among others. |

| Segments Covered | By Component, By Organization Size, By Deployment Type, By End Users and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

The global debt collection software market covers five major geographic regions, namely, Asia Pacific, North America, Middle East & Africa, Europe, and Latin America. North America is expected to have the largest market size during the forecast period due to the availability of advanced technologies and developing debt collection software. Growth in the presence of debt collection software vendors and government support are also two factors influencing market growth in the region.

The debt collection software market in Asia Pacific is anticipated to grow faster in the coming years, due to the rising demand for advanced debt collection software and services. The debt collection software enables numerous firms to fine-tune the collection process, improve debt recovery rate and manage credit risk. New Zealand & Australia, Japan, India, China are leading in the debt collection software market.

The debt collection software market comprises key solution providers, such as:

- FIS

- FICO

- CGI

- Experian

- TransUnion

- Temenos

- Pegasystems

- Intellect Design Arena

- Chetu

- AMEYO

- Nucleus Software

- Loxon Solutions

- Kuhlekt

- EXUS

- Katabat

The report segments the debt collection software market as follows:

Global Debt Collection Software Market: Component Segment Analysis

- Software

- Services

Global Debt Collection Software Market: Organization Size Segment Analysis

- Large Enterprises and Small

- Medium-Sized Enterprises

Global Debt Collection Software Market: Deployment Type Segment Analysis

- Cloud

- On-Premises

Global Debt Collection Software Market: End Users Segment Analysis

- Collection Agencies

- Government

- Collection Agencies

- Financial Institutions

- Healthcare

- Telecom and Utilities

- Others

Global Debt Collection Software Market: Regional Segment Analysis

- North America

- U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The Debt Collection Software Market was valued at USD 3.90 Billion in 2023.

The Debt Collection Software Market is expected to reach USD 8.83 Billion by 2032, growing at a CAGR of 9.5% between 2024 to 2032.

Global Debt Collection Software Market players such as solution providers, FIS, FICO, CGI, Experian, TransUnion, Temenos, Pegasystems, Intellect Design Arena, Chetu, AMEYO, Nucleus Software, Loxon Solutions, Kuhlekt, EXUS and Katabat among others.

The debt collection software market shows a significant demand owing to rising automation in the process of depth collection. Outsourcing debt recovery to expertized debt collection agencies is another factor boosting the market growth. Moreover, increasing need for self-service payment models inorder to speed up the collection can also influence the market growth over the forecast period. Additionally, acceleration of digital strategies to expand collection services at a faster pace is expected to contribute to the market’s growth opportunity. However, enforcement of debt collection regulations worldwide may pose a challenge to the market.

The Regional segment includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

Choose License Type

List of Contents

Debt Collection Software Market InsightsDebt Collection Software Market:SegmentationDebt Collection Software Report ScopeThe report segments the debt collection software market as follows:Global Debt Collection Software Component Segment AnalysisGlobal Debt Collection Software Organization Size Segment AnalysisGlobal Debt Collection Software Deployment Type Segment AnalysisGlobal Debt Collection Software End Users Segment AnalysisGlobal Debt Collection Software Regional Segment AnalysisHappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed