Diaper Market Size Report, Industry Share, Analysis, Growth, 2030

Diaper Market By End-User (Babies and Adults), By Sales Channel (E-Commerce Stores, Pharmacies, and Supermarkets/Hypermarkets), By Type (Disposable Diaper and Cloth Diaper), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2023 - 2030

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 74.59 Billion | USD 124.58 Billion | 6.71% | 2022 |

Diaper Industry Prospective:

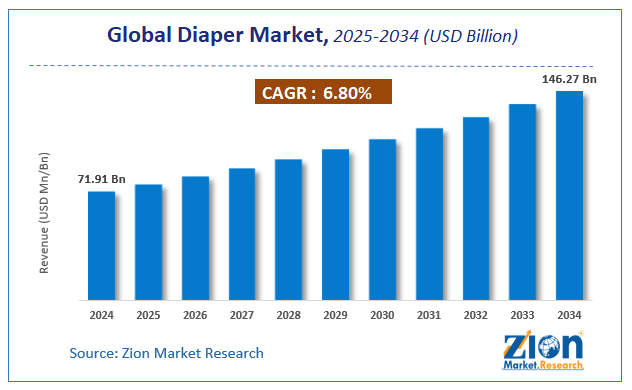

The global diaper market size was worth around USD 74.59 billion in 2022 and is predicted to grow to around USD 124.58 billion by 2030 with a compound annual growth rate (CAGR) of roughly 6.71% between 2023 and 2030.

Diaper Market: Overview

A diaper is an underwear worn by babies or adults to defecate or urinate without using a toilet. It is also known as a nappy and upon wearing, it absorbs or contains human waste without soiling the outer clothing material or the surrounding. Once the diapers are used for the toilet they should be changed to avoid discomfort or bacteria growth that can lead to infection. Nappies are generally made of synthetic disposable materials or cloth such as hemp, cotton, bamboo, microfiber, and others. Certain diapers can be washed and reused; however, disposable diapers should be thrown after they are soiled the first time. These hygiene products are generally worn by toddlers or children who have not yet been trained to use the toilet or who are known to suffer from bedwetting. There is a section of diapers available for adults as well that are worn by elderly citizens or people suffering from involuntary or uncontrolled urine leakage. The demand for diapers is growing at a rapid rate and during the forecast period, revenue in the diaper industry is likely to reach greater heights.

Key Insights:

- As per the analysis shared by our research analyst, the global diaper market is estimated to grow annually at a CAGR of around 6.71% over the forecast period (2023-2030)

- In terms of revenue, the global diaper market size was valued at around USD 74.59 billion in 2022 and is projected to reach USD 124.58 billion, by 2030.

- The diaper market is projected to grow at a significant rate due to the increasing childbirth rate

- Based on type segmentation, the disposable diaper was predicted to show maximum market share in the year 2022

- Based on end-user segmentation, babies was the leading segment in 2022

- On the basis of region, North America was the leading revenue generator in 2022

Diaper Market: Growth Drivers

Increasing childbirth rate to drive market growth

The global diaper market is projected to grow owing to the increasing rate of childbirth across the globe. According to the data published by the United Nations (UN), around 385,000 babies are born every day which amounts to 140 million babies per year. As predicted, the world population is likely to reach 10 billion by 2056. As the number of children continues to grow, the demand for child essentials such as diapers will rise as nappies are an essential part of children’s hygiene.

Rising new product launches to create higher revenue

The number of diaper providers including big brands and domestic sellers has increased over the years. Every year, more products are added to the commercial market and it helps to increase the consumer base as product awareness grows simultaneously. This trend also includes the aggressive expansion strategies adopted by international players to target new consumer sets, especially in emerging nations that are witnessing a rise in consumer disposable income.

In March 2023, Kimberly-Clark, a US-based multinational personal care provider, relaunched Huggies Complete Comfort baby diapers. The company has invested heavily in consumer research to understand the changing consumer needs and expectations. For instance, the product provides 5 in 1 comfort value. On the other hand, Kimberly-Clark launched a new range for its Huggies brand in Europe in a bid to attract a new set of customers. The company is providing diapers based on age fragments that are 0-3 months, 4+ months, and 12+ months, with the corresponding names Beginning, Freedom, and Adventure. The creative marketing and advertising tactics help to create more conversations among consumers which eventually translates to higher sales.

Diaper Market: Restraints

Improper waste disposal system for used diapers to restrict market growth

The excessive use of nappies generally tends to leave a long-lasting impact on the environment. Disposable nappies, in addition to containing plastics, are generally thrown by the babies’ or adults’ waste. This makes it difficult to recycle diapers as currently there are no effective and large-scale means of cleaning diapers before being put to recycle. This is a major growth restraint limiting the global diaper market expansion since the entire lifecycle of a diaper starting from manufacturing to distribution can lead to environmental impact at least to a certain extent. A recent report concluded that India alone generates around 2 lakh tonnes of diaper waste per year.

Diaper Market: Opportunities

Increasing demand for non-synthetic diapers made from organic material to create new growth possibilities

The diaper industry growth trend may be further pushed by the increasing demand for organic diapers for babies and adults. These variants do not contain any synthetic material and are typically made from plant-based raw materials. The ingredients for organic diapers are renewable and environmentally friendly. Since they do not contain added fragrance or chlorine, they are exceptionally safe for application and do not harm the skin of the wearer in any way.

Diaper manufacturers are actively trying to tap into the growing consumer group that is actively seeking organic diapers due to several associated advantages for babies and the environment. In June 2023, Dyper announced the launch of a new range of diapers with fully recyclable kraft paper packaging and innovative design. The new segment of diapers aligns with the company’s goal to reduce plastic consumption and wastage. During the same time, SuperBottoms India, a leading Indian cloth diaper brand, launched Special Needs Diaper for people for protection against involuntary bowel movements and urine in children between the ages of 5 to 14 years.

Diaper Market: Challenges

High price of diapers and lack of access to create challenges against growth

The global diaper market growth trend may be challenged due to the high price of diapers used for babies. For instance, the average cost of a single disposable diaper may range between USD 0.2 to USD 0.3. Since a child may need more than a few diapers per day, the number of diapers used over time reaches higher values, translating to higher costs. The average total expense per year for diapers may reach as close to USD 870. For people with limited budgets or more than one child, the number may be too high and thus remain unaffordable. Moreover, consumers from low-income groups or parents in economies grappling with social-political tension may not have access to diapers. These factors can greatly impact sales in the diaper industry.

Diaper Market: Segmentation

The global diaper market is segmented based on end-user, sales channel, type, and region.

Based on end-user, the global market segments are babies and adults. In 2022, the highest growth was observed in the babies segment since the largest consumers of diapers are either babies or infants. The former refers to children in age 0 to 1 year and the latter refers to the needs of children aged 1 to 3 years. These are age groups that are the most significant users of diapers since babies are unable to control their bowel movement and they do not undertake toilet training unless they reach a certain age. The higher number of babies born in the last 2 years was the major reason for exceptional revenue in the segment. As per the United Nations Children's Fund, more than 116 million babies were born during the pandemic.

Based on sales channel, the diaper industry is fragmented into e-commerce stores, pharmacies, and supermarkets/hypermarkets.

Based on type, the global market divisions are disposable diaper and cloth diaper. The highest growth was observed in the disposable diaper group since they offer higher convenience and are known to perform better in terms of absorption and protection as compared to cloth diapers. In recent times, the technology used for the production of disposable items has improved making the products safer for application. This includes the use of superabsorbent polymers which allow retaining urine for more times as per their weight. On average, a baby may need 10 to 12 diaper changes a day.

Diaper Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Diaper Market |

| Market Size in 2022 | USD 74.59 Billion |

| Market Forecast in 2030 | USD 124.58 Billion |

| Growth Rate | CAGR of 6.71% |

| Number of Pages | 229 |

| Key Companies Covered | Hello Bello, Pampers, Babyganics, Huggies, Member's Mark, Luvs, Up & Up, Seventh Generation, GoodNites, Earth's Best, Cuties, CVS Health, Parent’s Choice, Rascal + Friends, Walgreens Well Beginnings, Mama Bear, Diaper Genie, Dyper, Bambo Nature, the Honest Company, and others. |

| Segments Covered | By End-User, By Sales Channel, By Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Diaper Market: Regional Analysis

North America to register the highest growth rate during the coming period

The global diaper market is expected to witness the highest growth in North America with the US and Canada regions acting as largest revenue generators. Growth in the region is driven by higher access to diapers as the per capita income in these economies is higher. In addition to this, North American regions have strict regulations related to child healthcare with strict actions taken against negligent parents. Since diapers are considered basic childcare products, there are several brands available in the market catering to the needs of babies and infants.

The US is home to some of the largest personal care brands that provide products across continents leading to higher sales of goods in the regional market as well. These companies are working on innovative products and technologies to improve overall product performance while being less harsh on the environment. In August 2023, Dyper announced the launch of the world’s first charcoal-enhanced disposable baby diaper. The high-performance product is environmentally friendly and is meant for a larger group of consumers. Similarly, Healthbaby launched a new range of eco-friendly diapers at the popular retail chain Target.

Diaper Market: Competitive Analysis

The global diaper market is led by players like:

- Hello Bello

- Pampers

- Babyganics

- Huggies

- Member's Mark

- Luvs

- Up & Up

- Seventh Generation

- GoodNites

- Earth's Best

- Cuties

- CVS Health

- Parent’s Choice

- Rascal + Friends

- Walgreens Well Beginnings

- Mama Bear

- Diaper Genie

- Dyper

- Bambo Nature

- the Honest Company

The global diaper market is segmented as follows:

By End-User

- Babies

- Adults

By Sales Channel

- E-Commerce Stores

- Pharmacies

- Supermarkets/Hypermarkets

By Type

- Disposable Diaper

- Cloth Diaper

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

A diaper is underwear worn by babies or adults to defecate or urinate without using a toilet.

The global diaper market is projected to grow owing to the increasing rate of childbirth across the globe.

According to study, the global diaper market size was worth around USD 74.59 billion in 2022 and is predicted to grow to around USD 124.58 billion by 2030.

The CAGR value of the diaper market is expected to be around 6.71% during 2023-2030.

The global diaper market is expected to witness the highest growth in North America with the US and Canada regions acting as largest revenue generators.

The global diaper market is led by players like Hello Bello, Pampers, Babyganics, Huggies, Member's Mark, Luvs, Up & Up, Seventh Generation, GoodNites, Earth's Best, Cuties, CVS Health, Parent’s Choice, Rascal + Friends, Walgreens Well Beginnings, Mama Bear, Diaper Genie, Dyper, Bambo Nature, and the Honest Company among several others.

The report explores crucial aspects of the diaper market including a detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed