Digital Payments Market Size, Share, Industry Analysis, Trends, Growth, 2030

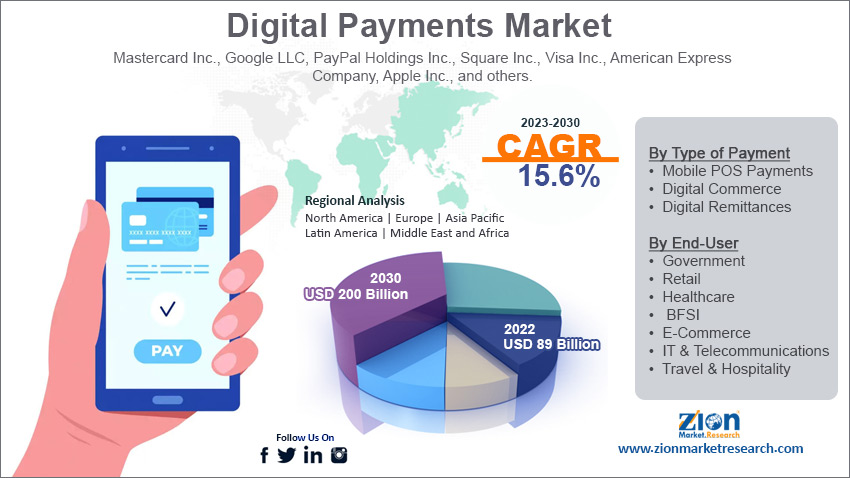

Digital Payments Market By Type of Payment (Mobile POS Payments, Digital Commerce, and Digital Remittances), By End-User (Government, Retail, Healthcare, BFSI, E-Commerce, IT & Telecommunications, and Travel & Hospitality), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2023 - 2030

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

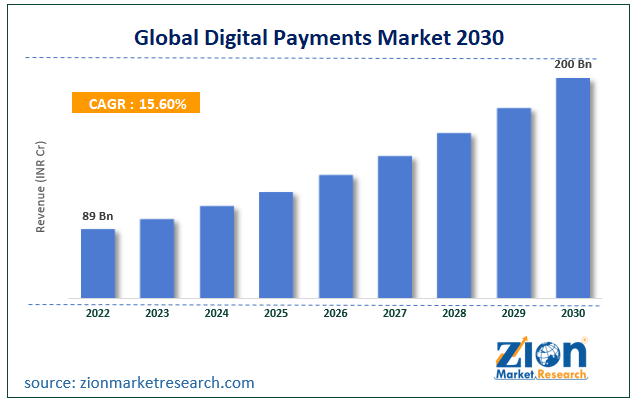

| USD 89 Billion | USD 200 Billion | 15.6% | 2022 |

Digital Payments Industry Prospective:

The global digital payments market size was evaluated at $89 billion in 2022 and is slated to hit $200 billion by the end of 2030 with a CAGR of nearly 15.6% between 2023 and 2030.

Digital Payments Market: Overview

Digital payment also referred to as electronic payment is the value transfer from one payment account to another by using a digital device. Moreover, digital payments can be primarily digital, partially digital, or completely digital. Reportedly, it includes payments made through smartphones, online banking transfers, QR codes, and payments made through prepaid cards, credit cards, and debit cards.

Key Insights

- As per the analysis shared by our research analyst, the global digital payments market is projected to expand annually at the annual growth rate of around 15.6% over the forecast timespan (2023-2030)

- In terms of revenue, the global digital payments market size was evaluated at nearly $89 billion in 2022 and is expected to reach $200 billion by 2030.

- The global digital payments market is anticipated to grow rapidly over the forecast timeline owing to the thriving e-commerce sector along with supportive government policies towards contactless payments.

- In terms of type of payment, the digital commerce segment is slated to register the highest CAGR over the forecast period.

- Based on the end-user, the retail segment is expected to dominate the segmental growth in the coming seven years.

- Region-wise, the North American digital payments industry is projected to register the fastest CAGR during the forecast timespan.

Request Free Sample

Request Free Sample

Digital Payments Market: Growth Factors

Flourishing e-commerce activities to spur the global market surge in the forecasting years

The thriving e-commerce sector along with supportive government policies towards contactless payments is predicted to steer the growth of the global digital payments industry. Moreover, an increase in the number of fintech firms along with breakthroughs in payment processing solutions is predicted to steer the growth of the global market. Furthermore, an outbreak of a pandemic such as COVID-19 has increased cashless transactions, thereby driving the growth of the global market. The onset of new contactless payment systems such as radio frequency identification, near-field communication, and host card emulation will steer the global market trends. Launching of new digital payments is likely to contribute humongous towards the size of the global market in the upcoming years.

In September 2023, HDFC Bank declared that it will launch three new digital payment products on the United Payments interface. Reportedly, the new solutions are predicted to redefine the way merchants and customers are involved in seamless financial transactions. In the third quarter of 2023, National Payments Corporation of India (NPCI), a UPI developer, revealed a slew of innovative products such as BillPay Connect, Credit Line on UPI, UPI LITE X, and Tap & Pay. Launching of these new products is aimed at creating sustainable, inclusive, and resilient digital payment systems.

Digital Payments Market: Restraints

A surge in cyber-terrorism can restrict the growth of the industry across the globe over the forecast period

A rise in the cases of online fraud and data violations can downsize the growth of the digital payments industry across the globe. A rise in cyber-attacks and an exponential increase in cyber crimes can adversely impact the expansion of the industry globally. Lack of uniformity & standardization in protocols witnessed in cross-border financial transactions can offset the growth of the industry.

Digital Payments Market: Opportunities

An increase in cross-border financial deals to open new avenues of growth for the global market

Surging globalization along with an increment in cross-border transactions will open new growth opportunities for the global digital payments market. An increase in wireless connectivity and swift expansion of online payment and e-banking systems along with flexibility, efficacy, and mobility provided by digital payments will open new growth avenues for the global market.

Digital Payments Market: Challenges

Stringent laws to curb identity thefts can prove to be a challenging task for the global industry expansion over 2023-2030

Strict legislation owing to identity fraud along with disruptions in the internet connectivity in remote regions can pose a huge challenge to the global digital payments industry expansion. Furthermore, the lack of availability of strong digital infrastructure in emerging economies and failure during the processing of online ATM transactions in these economies will pose a huge threat to the growth of the industry across the globe. Low awareness about the use of online systems can further challenge the global industry surge.

Digital Payments Market: Segmentation

The global digital payments market is sectored into the type of payment, end-user, and region.

In the type of payment terms, the digital payments market across the globe is divided into mobile POS payments, digital commerce, and digital remittances segments. Furthermore, the digital commerce segment, which amassed about 65% of the global market share in 2022, is expected to register the fastest annual rate of growth in the coming seven years. The expansion of the segment during 2023-2030 can be owing to a rise in online shopping activities from digital commerce tools. Apart from this, digital shopping offers a seamless shopping experience to the end users, thereby driving the segmental space.

Based on the end-user, the global digital payments industry is sectored into government, retail, healthcare, BFSI, e-commerce, IT & telecommunications, and travel & hospitality segments. Moreover, the retail sector, which led the global industry in 2022, is projected to dominate the segmental expansion even in the forecasting timespan. The segmental growth over the forecasting years can be due to the rise in online payments in the retail segment with the help of Internet banking apps, mobile banking apps, and digital wallets. The rise in the use of smartphones will further multiply the growth of the segment in the coming years.

Digital Payments Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Digital Payments Market |

| Market Size in 2022 | USD 89 Billion |

| Market Forecast in 2030 | USD 200 Billion |

| Growth Rate | CAGR of 15.6% |

| Number of Pages | 204 |

| Key Companies Covered | Mastercard Inc., Google LLC, PayPal Holdings Inc., Square Inc., Visa Inc., American Express Company, Apple Inc., and others. |

| Segments Covered | By Type of Payment, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Digital Payments Market: Regional Insights

Asia-Pacific is predicted to retain its global market domination over the forecast timeline

Asia-Pacific, which contributed about 47% of the global digital payments market earnings in 2022, is expected to be a dominating region in the next couple of years. Moreover, the regional market expansion over the period from 2023 to 2030 can be credited to a rise in smartphone usage and seamless internet connectivity in the region. Apart from this, the launching of 5G network connectivity in emerging economies such as India and China will further drive the regional market trends. Escalating preference for online payments owing to their seamlessness, user convenience, and accessibility is likely to spike the growth of the market in the region.

North American digital payments industry is predicted to record the fastest CAGR in the next seven years. The growth of the industry in the region over the forecast timeline can be attributed to an increase in online shopping activities and the thriving e-commerce sector in countries such as Canada and the U.S. In addition to this, thriving digital commerce activities leading to huge demand for secured digital payments are likely to translate into massive growth of the digital payments industry in North America.

Key Developments

- In the first half of 2023, PayPal Holdings, Inc., entered into a strategic partnership with KKR, a key investment firm, with a view of purchasing PayPal.

- In the first quarter of 2023, HDFC Bank, an Indian Private Bank, and Crunchfish, a tech firm developing online cash systems for banks, introduced the OfflinePay project aimed at exploring new avenues for online payments for traders as well as customers.

Digital Payments Market: Competitive Space

The global digital payments market profiles key players such as:

- Mastercard Inc.

- Google LLC

- PayPal Holdings Inc.

- Square Inc.

- Visa Inc.

- American Express Company

- Apple Inc.

The global digital payments market is segmented as follows:

By Type of Payment

- Mobile POS Payments

- Digital Commerce

- Digital Remittances

By End-User

- Government

- Retail

- Healthcare

- BFSI

- E-Commerce

- IT & Telecommunications

- Travel & Hospitality

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Digital payment also referred to as electronic payment is the value transfer from one payment account to another by using a digital device.

The global digital payments market growth over forecast period can be owing to an increase in the number of fintech firms along with breakthroughs in payment processing solutions.

According to a study, the global digital payments industry size was $89 billion in 2022 and is projected to reach $200 billion by the end of 2030.

The global digital payments market is anticipated to record a CAGR of nearly 15.6% from 2023 to 2030.

The North American digital payments industry is set to register the fastest CAGR over the forecasting timeline owing to an increase in online shopping activities and the thriving e-commerce sector in countries such as Canada and the U.S. In addition to this, thriving digital commerce activities leading to huge demand for secured digital payments are likely to translate into massive growth of the digital payments industry in North America.

The global digital payments market is led by players such as Mastercard Inc., Google LLC, PayPal Holdings, Inc., Square Inc., Visa Inc., American Express Company, and Apple Inc.

The global digital payments market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTEL analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five force analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed