Digital Remittance Market Size, Share, Growth, Trends, and Forecast 2032

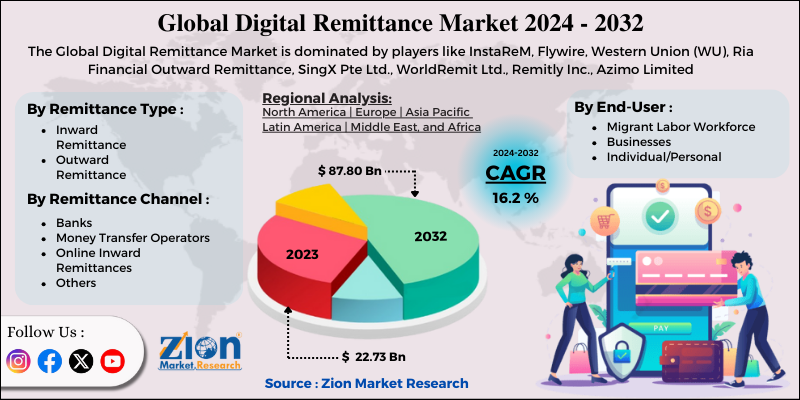

Digital Remittance Market by Remittance Type (Inward and Outward), by Remittance Channel (Banks, Money Transfer Operators, Online Platforms, and Others), and by End-User (Migrant Labor Workforce, Businesses, and Individual/Personal): Global Industry Perspective, Comprehensive Analysis, and Forecast, 2024-2032.

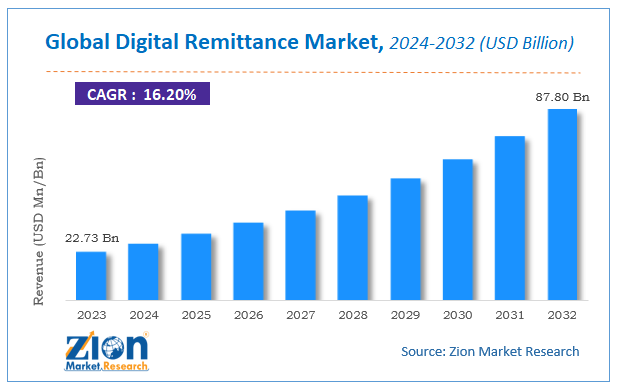

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 22.73 Billion | USD 87.80 Billion | 16.2% | 2023 |

Digital Remittance Market: Size

The global Digital Remittance market size was worth around USD 22.73 billion in 2023 and is predicted to grow to around USD 87.80 billion by 2032 with a compound annual growth rate (CAGR) of roughly 16.2% between 2024 and 2032.

The study provides historical data from 2018 to 2022 along with a forecast from 2024 to 2032 based on revenue (USD billion). The report covers a forecast and an analysis of the Digital Remittance market on a global and regional level.

Digital Remittance Market: Overview

A remittance is a process of fund transfer by a distant worker to another person in his/her home country. The money transferred by the immigrants enters into competition with international aid as a major financial inflow to developing economies. As per the World Bank, the global remittance increased by 10%, i.e., to USD 689 billion in 2018, which included USD 528 billion to developing countries.

Increasing immigration rate from developing to developed nations in search of education and jobs is the major factor driving the global digital remittance market growth. In addition, the rising use of mobile devices that facilitates convenient, 24/7 trouble-free, and cost-effective money transfer are also expected to contribute notably toward the global digital remittance market growth. On the contrary, the security concerns and lack of awareness among the users may hamper the market growth. Nonetheless, the increasing mobile penetration and internet usage are estimated to open new growth opportunities for the global digital remittance market.

Digital Remittance Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Digital Remittance Market |

| Market Size in 2023 | USD 22.73 Billion |

| Market Forecast in 2032 | USD 87.80 Billion |

| Growth Rate | CAGR of 16.2% |

| Number of Pages | 145 |

| Key Companies Covered | InstaReM, Flywire, Western Union (WU), Ria Financial Outward Remittance, SingX Pte Ltd., WorldRemit Ltd., Remitly Inc., Azimo Limited |

| Segments Covered | By Remittance Type, By Remittance Channel, By End-User and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Digital Remittance Market: Segmentation

The global digital remittance market is segmented on the basis of remittance type, remittance channel, end-user, and region. All the segments have been analyzed based on present and future trends and the market is estimated from 2024 to 2032.

Based on remittance type, the market is categorized into inward and outward. The inward remittance segment is expected to register a high CAGR in the future, owing to the increasing adoption of mobiles payment apps in developed nations.

By remittance channel, the market includes banks, money transfer operators, online platforms, and others.

By end-user, the market includes migrant labor workforce, businesses, and individual/personal.

Digital Remittance Market: Regional Analysis

The regional segmentation includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. Each region has been further segmented into major countries, such as the U.S., Canada, Mexico, UK, France, Germany, China, India, Japan, and Brazil.

By region, North America held the largest share of global digital remittance market in 2023, owing to the presence of major financial and communication service companies, such as Western Union (WU), MoneyGram, and Ria Financial Services. These companies have adopted the latest technologies to develop mobile apps that directly connect the customers across the globe with 24/7 activation. Europe is expected to witness constant growth in the global digital remittance market, as the region is a major automobile hub along with the increasing number of cross border business transactions resulting in high demand for digital remittance between the automobile players across the region. The Asia Pacific digital remittance market is slated to be the fastest growing over the forecast time period, owing to the rising mobile-based payment methods and high adoption of advanced technology, such as blockchain in banking and financial services.

Digital Remittance Market: Competitive Players

Some key participants of the global digital remittance market include

- InstaReM

- Flywire

- Western Union (WU)

- Ria Financial Outward Remittance

- SingX Pte Ltd.

- WorldRemit Ltd.

- Remitly Inc.

- Azimo Limited

- TransferWise Ltd.

- Ripple

- MoneyGram

- TNG Wallet.

The Global Digital Remittance Market is segmented as follows:

Digital Remittance Market: Remittance Type Analysis

- Inward Remittance

- Outward Remittance

Digital Remittance Market: Remittance Channel Analysis

- Banks

- Money Transfer Operators

- Online Inward Remittances

- Others

Digital Remittance Market: End-User Analysis

- Migrant Labor Workforce

- Businesses

- Individual/Personal

Digital Remittance Market: Regional Analysis

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

A remittance is a process of fund transfer by a distant worker to another person in his/her home country. The money transferred by the immigrants enters into competition with international aid as a major financial inflow to developing economies.

According to study, the Digital Remittance Market size was worth around USD 22.73 billion in 2023 and is predicted to grow to around USD 87.80 billion by 2032.

The CAGR value of Digital Remittance Market is expected to be around 16.2% during 2024-2032.

North America has been leading the Digital Remittance Market and is anticipated to continue on the dominant position in the years to come.

The Digital Remittance Market is led by players like InstaReM, Flywire, Western Union (WU), Ria Financial Outward Remittance, SingX Pte Ltd., WorldRemit Ltd., Remitly Inc., Azimo Limited, TransferWise Ltd., Ripple, MoneyGram, and TNG Wallet.

Choose License Type

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed