Digitization in Lending Market Size, Share, Trends, Growth and Forecast 2032

Digitization in Lending Market by Loan Type (Personal Loans, Auto Loans, and Business Loans); by Deployment (On Computer and On Smart Phone): Global Industry Analysis, Size, Share, Growth, Trends, and Forecast 2024- 2032

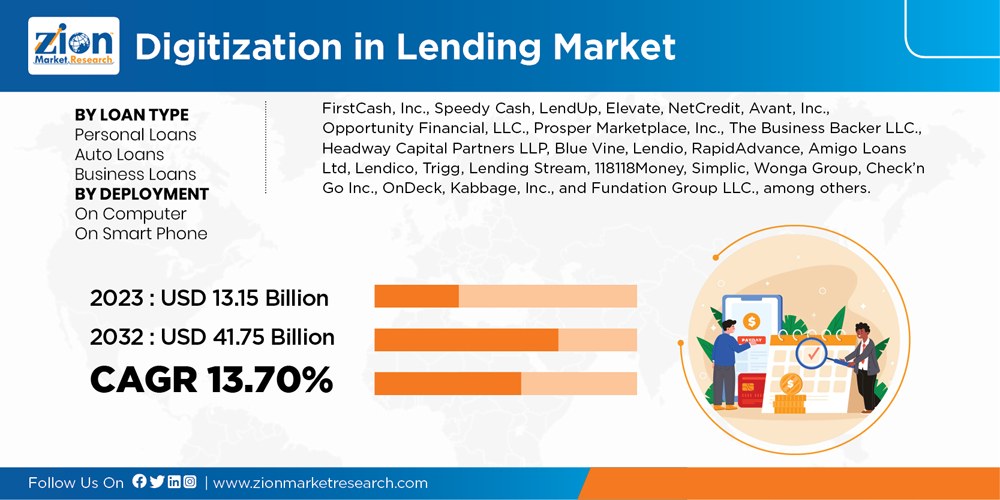

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 13.15 Billion | USD 41.75 Billion | 13.70% | 2023 |

Digitization in Lending Market?: Industry Perspective

The global Digitization in Lending Market size was worth around USD 13.15 Billion in 2023 and is predicted to grow to around USD 41.75 Billion by 2032 with a compound annual growth rate (CAGR) of roughly 13.70% between 2024 and 2032.

Report Brief

- The report covers the forecast and analysis for the digitization in lending market on a global and regional level.

- The report includes the positive and the negative factors that are influencing the growth of the market.

- Market opportunities are discussed in detail.

- The key target audience for the market has been determined in the report.

- The revenue generated by the prominent industry players has been analyzed in the report.

- The market numbers have been calculated using top-down and the bottom-up approaches.

- The digitization in lending market has been analyzed using Porter’s Five Forces Analysis.

- The market is segmented on the basis of loan type and deployment which in turn is bifurcated on regional and country level.

- All the segments have been evaluated based on the present and the future trends.

- The report deals with the in-depth quantitative and qualitative analyses of the digitization in lending market.

- The report includes the detailed company profiles of the prominent market players.

Market Summary

Digital lending is an advancement in the lending and borrowing process which is carried out on the online or digital platform without making use of paperwork.

The digital loan origination platforms make use of automated processes such as document and electronic data capture, e-signatures, and automated underwriting. Advanced analytical models help in automation of credit decisions at a rapid pace.

Drivers and Restraints

The digitalization in banking industry is the key factor driving the growth of digitization in lending market. Across the various aspects of business, digitalization is the reason for sweeping and large-scale transformations. The digitalization in banking industry also provides unparalleled opportunities for value capture and creation. Business leaders across all the sectors are adopting with the strategic implications of these transformations for their organizations and industry ecosystems.

Digitization allows lenders to more effectively target their customers with appropriately timed offers. Digital lending automates complex processes and reduces manual interferences owing to which its demand is increasing. In the coming years, there will be an increasing adoption of digital lending.

The lack of interoperability and standards may negatively affect the growth of digitization in lending market

Segmentation

The business loan segment accounted for a major market share of around USD 980 million in the digitization in lending market in 2017. The growing number of small- and mid-sized business globally and the ease in the process of lending are factors driving the business loan segment in the global digitization in lending market.

The personal loans segment is expected to grow at CAGR of 53.3% during the forecast period. The flexible process for personal loans through digitalized lending is expected to propel the growth of segment in the digitization in lending market over the forecast period.

On computer and on smartphone are the two types of deployment in digitization in lending market. “On smartphone” deployment segment is expected to register rapid CAGR growth of 53.8% from 2017 to 2025. Ease of accessibility and support for several advanced applications are factors that are driving the on-smartphone segment. Whereas, on computer deployment segment accounted for the highest share in the global digitization in lending market in the year 2016. The large use of computers in various industries for digital lending is the key factor contributing towards the growth of the segment.

Europe accounted for the largest share of around 39% in the digitization in lending market in 2017. In Europe, the U.K. and France contributed the largest share in the digitization in lending market in the region. Presence of major banking sectors in countries such as the U.K. and France have positively contributed to the growth of the market. In Europe, HSBC bank is one of the leading banks with total assets summing to under USD 2.5 trillion. Continuous growth in finance sector of the region is expected to open up immense growth opportunities for the market during the forecast period.

China is expected to register the highest CAGR growth of 54.2% between 2017 and 2025. The rising adoption of online methods for banking in China and a strong base of the banking industry in the country is expected to propel the growth of the market over the forecast period. Moreover, increasing number of small- and mid-sized business in the country is expected to significantly contribute to the growth of the market in the country.

In North America, the U.S. accounted for the largest share in the digitization in lending market. The presence of large banking lenders in the U.S. and the increasing adoption of the online platforms in the banking processes are expected to influence the growth of the market in the coming years.

Digitization in Lending Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Digitization in Lending Market Size Report |

| Market Size in 2023 | USD 13.15 Billion |

| Market Forecast in 2032 | USD 41.75 Billion |

| Growth Rate | CAGR of 13.70% |

| Number of Pages | 188 |

| Forecast Units | Value (USD Billion), and Volume (Units) |

| Key Companies Covered | FirstCash, Inc., Speedy Cash, LendUp, Elevate, NetCredit, Avant, Inc., Opportunity Financial, LLC., Prosper Marketplace, Inc., The Business Backer LLC., Headway Capital Partners LLP, Blue Vine, Lendio, RapidAdvance, Amigo Loans Ltd, Lendico, Trigg, Lending Stream, 118118Money, Simplic, Wonga Group, Check'n Go Inc., OnDeck, Kabbage, Inc., and Fundation Group LLC., among others. |

| Segments Covered | By Loan Type, By Deployment and By region |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Industry Players

The report includes detailed profiles of the prominent market players that are trending in the market. Key companies profiled in the report are FirstCash, Inc., Speedy Cash, LendUp, Elevate, NetCredit, Avant, Inc., Opportunity Financial, LLC., Prosper Marketplace, Inc., The Business Backer LLC., Headway Capital Partners LLP, Blue Vine, Lendio, RapidAdvance, Amigo Loans Ltd, Lendico, Trigg, Lending Stream, 118118Money, Simplic, Wonga Group, Check'n Go Inc., OnDeck, Kabbage, Inc., and Fundation Group LLC., among others.

The new product launch, technological advancement in digital lending, and increase in spending on research and development for better customer experience are the some of the major factors contributing towards the growth of market globally. Speedy Cash is an application that provides a loan to the customer. Speedy Cash is a payday lender that provides several ways for a payday loan with multiple choices of payment.

Moreover, the increasing mergers, acquisitions, and partnerships among the various market players of the lending industry are expected to propel the growth of the market over the forecast period. For instance, in September 2016, the FirstCash, Inc. had signed the strategic merger agreement with Cash America International, Inc.

Thriving Banking Sector To Support Europe’s Regional Dominance

Regionally, Europe has been leading the worldwide digitization in lending market and is anticipated to continue on the dominant position in the years to come, states the digitization in lending market study. Rise in the banking business across the countries such as France and UK is the main factor behind the dominance of the European digitization in lending market. In addition to this, seamless expansion witnessed across the finance sector in Europe is another significant factor that is supporting this regional digitization in lending market.

The global digitization in lending market is segmented as follows:

By Loan Type

- Personal Loans

- Auto Loans

- Business Loans

By Deployment

- On Computer

- On Smart Phone

By Region

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- The Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The global Digitization in Lending Market size was worth around USD 13.15 Billion in 2023 and is predicted to grow to around USD 41.75 Billion by 2032

compound annual growth rate (CAGR) of roughly 13.70% between 2024 and 2032.

The largest share of the Digitization in Lending Market is held by Asia Pacific. Developing countries of Asia Pacific such as China, Japan, and India will be dominating the market scenario mainly due to the rising constructional activities. The growth of Asia-Pacific region is expected to be followed by the Middle East and North America. Also, significant growth is expected from Western Europe owing to the developments taking place in this region especially in countries such as Italy, Germany, the U.K, France, and Spain. However, growth in Africa, Latin America, and Eastern Europe is anticipated to be moderate over the forecast period.

Key companies profiled in the report are FirstCash, Inc., Speedy Cash, LendUp, Elevate, NetCredit, Avant, Inc., Opportunity Financial, LLC., Prosper Marketplace, Inc., The Business Backer LLC., Headway Capital Partners LLP, Blue Vine, Lendio, RapidAdvance, Amigo Loans Ltd, Lendico, Trigg, Lending Stream, 118118Money, Simplic, Wonga Group, Check'n Go Inc., OnDeck, Kabbage, Inc., and Fundation Group LLC., among others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed