Driver Safety Systems Market Size, Share, Trends, Growth 2030

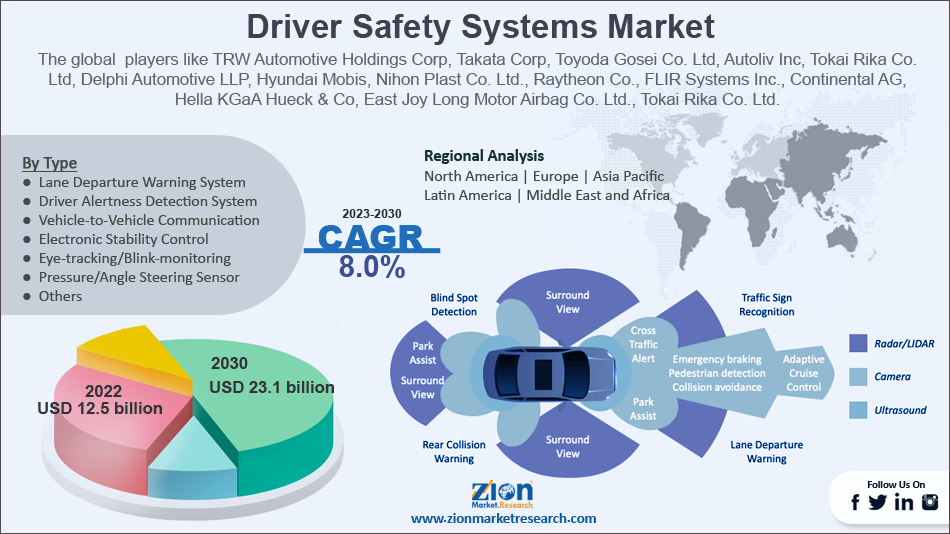

Driver Safety Systems Market By Type (Lane Departure Warning System, Driver Alertness Detection System, Vehicle-to-Vehicle Communication, Electronic Stability Control, Eye-tracking/Blink-monitoring, Pressure/Angle Steering Sensor, and Others), By Vehicle Type (Passenger and Commercial), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2023 - 2030

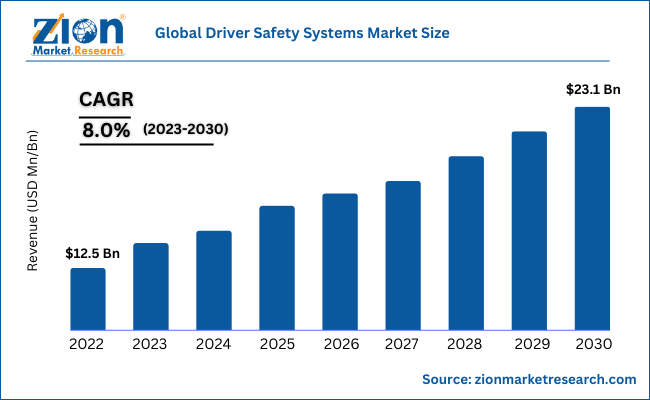

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 12.5 Billion | USD 23.1 Billion | 8.0% | 2022 |

Driver Safety Systems Industry Prospective:

The global driver safety systems market size was worth around USD 12.5 Billion in 2022 and is predicted to grow to around USD 23.1 Billion by 2030 with a compound annual growth rate (CAGR) of roughly 8.0% between 2023 and 2030.

The report analyzes the global driver safety systems market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the driver safety systems industry.

Driver Safety Systems Market: Overview

Safety is a keyword based on which every worldwide standard is defined. No matter it is a product or a service, the whole calculation of the mechanism is derived from the perspective of safety. And in terms of human safety, while driving, it is a stringent parameter considered before designing the process, product, or any mechanism. The government introducing regulations related to passenger safety and forcing the automobile manufacturer to assemble required safety features has motivated the demand for driver safety systems market. However, driver safety has multiple faces in terms of automotive applications. Every single assembly that is intended to protect the driver and passengers riding the vehicle is considered the safety system.

Key Insights

- As per the analysis shared by our research analyst, the global driver safety systems market is estimated to grow annually at a CAGR of around 8.0% over the forecast period (2023-2030).

- In terms of revenue, the global driver safety systems market size was valued at around USD 12.5 billion in 2022 and is projected to reach USD 23.1 billion, by 2030.

- The growing number of fatalities across the globe in road accidents is expected to propel the market growth over the forecast period.

- Based on the type, the eye-tracking/blink-monitoring segment is expected to capture the largest revenue share over the forecast period.

- Based on the vehicle type, the passenger vehicles segment is expected to dominate the market during the forecast period.

- Based on region, the Asia Pacific region is expected to capture the largest market share over the forecast period.

Driver Safety Systems Market: Growth Drivers

Advancements in the sensor drive the market growth

The majority of the sensors used in ADAS systems, including radar, image, ultrasonic, and LiDAR, carry out multiple tasks and use a lot of energy. To get around these restrictions, researchers are integrating various types of sensors to provide output that is dependable and effective. However, each sensor has its limitations. These many sensor systems improve system dependability without sacrificing security. Additionally, extensive research and development are being done in the field of sensing technology to improve its ability to survive harsh environmental conditions, consume less energy, and leave a smaller carbon imprint. A linear LIDAR with horizontal beam scanning capabilities was launched by DENSO. Additionally, the business unveiled a low-cost, small-scale linear LIDAR that was commercialized in the automobile sector. This system was incorporated into DAIHATSU’s collision avoidance assistance system to improve pedestrian and driver safety. All these factors are projected to boost the expansion of the global driver safety systems market during the forecast period.

Driver Safety Systems Market: Restraints

High development cost impedes the market growth

The need for data transport is expanding as there are more electronic systems in modern vehicles. As a result, automakers are putting a lot of effort into creating new technology systems. Systems like adaptive cruise control, lane-keeping assistance, parking aid, and accident prevention rely on a range of various sensors throughout the car. The cost of the ADAS system is rising due to the development of improved sensors, which is limiting the driver safety systems market's expansion.

Driver Safety Systems Market: Opportunities

New technology and infrastructure provide a lucrative opportunity

The market expansion for the driver safety systems market may be aided by new technology and vehicular infrastructure created by various companies for use in their automobiles. Technology such as automatic emergency braking, road signs, lane departure warning, lane assist, pedestrian detection, self-driving cars, adaptive cruise control, adaptive light control, automatic parking, autonomous valet parking, navigation systems, crosswind stabilization, driver monitoring systems, emergency driver assistant could help more drivers drive more efficiently while allowing manufacturers to keep up with growing consumer demand. Due to their excellent efficiency, these devices aid in lowering the number of traffic incidents. For instance, blind-spot monitoring lowers lane-changing incidents by 14%, according to the IIHS (Insurance Institute for Highway Safety). The system reportedly reduced lane-change crash-related injuries by 23%.

Driver Safety Systems Market: Challenges

Malfunctioning of the system poses a major challenge

Electronic parts of the system could malfunction and provide inaccurate information. Additionally, both the cars and the passengers may be in danger because of the challenging system handling and high risk of cyber security threats. The safety and life of users may be in danger due to system flaws or deliberate or unintentional errors. Therefore, this is anticipated to present a significant hurdle for driver safety systems market expansion.

Driver Safety Systems Market: Segmentation

The global driver safety systems industry is segmented based on type, vehicle type, and region.

Based on the type, the global market is bifurcated into lane departure warning systems, driver alertness detection systems, vehicle-to-vehicle communication, electronic stability control, eye-tracking/blink-monitoring, pressure/angle steering sensor, and others. The eye-tracking/blink-monitoring segment is expected to capture the largest revenue share over the forecast period. The automotive industry is heavily reliant on eye tracking for safety. The use of technology to identify sleepy or distracted drivers can help avoid car accidents. As the number of accidents across the globe rises dramatically. For instance, according to the World Health Organization, an estimated 1.3 million individuals each year pass away in automobile accidents. Thus, the growing number of accidents across the globe is expected to rise with the adoption of this technology, which in turn, drives segmental growth over the forecast period.

Based on the vehicle type, the global driver safety systems industry is bifurcated into commercial and passenger vehicles. The passenger vehicles segment is expected to dominate the market during the forecast period. The segment's expansion can be ascribed to the rising consumer awareness of safety systems, supportive legislation, and raising standards for road safety in developing economies. Several nations in Asia Pacific, North America, and Europe have passed laws requiring the integration of various ADAS in the passenger car market. Vision Zero is a program established by the European Union to eradicate all traffic fatalities by the year 2050. By the end of 2030, the regulating body aims to cut injuries and fatalities by 50%. By 2022, new passenger vehicles must have important safety features such as autonomous emergency braking, lane departure warning, and attention and tiredness monitoring.

Recent Developments:

- In January 2023, with the launch of the Snapdragon RideTM Flex SoC, Qualcomm Technologies, Inc. announced the newest addition to the company's expanding Snapdragon® Digital ChassisTM product lineup. The digital cockpit, ADAS, and AD functions may coexist on a single SoC due to the Flex SoC's engineering, which supports mixed-criticality workloads across heterogeneous computational resources. The Flex SoC is equipped with an Automotive Safety Integrity Level D (ASIL-D) safety island and is designed to meet the highest level of automotive safety. It enables a hardware architecture to support isolation, freedom from interference, and quality-of-service (QoS) for specific ADAS functions. To meet the mixed-criticality workload requirements for driver assistance safety systems, digital reconfigurable clusters, infotainment systems, driver monitoring systems (DMS), and park-assist systems, the Flex SoC pre-integrates a software platform that supports multiple operating systems operating concurrently, hypervisor enablement with isolated virtual machines, and real-time operating system (OS) with an Automotive Open System Architecture (AUTOSAR).

- In December 2022, The next-generation innovations for the Honda SENSING 360 omnidirectional safety and driver-assistive system and Honda SENSING Elite, a premium version of Honda SENSING, were unveiled by Honda Motor Co., Ltd. Honda is pursuing the research and development of safety technologies from the perspectives of both hardware and software to create a collision-free society for everyone sharing the road, based on the worldwide safety slogan "Safety for Everyone." 99% of Honda's new automotive models sold in Japan and the U.S. as well as 86% globally have the Honda SENSING safety and driver-assistive system already installed. Honda SENSING-equipped vehicles have now sold over 14 million units in total*1.

- In January 2022, Leading mobility provider DENSO recently revealed that it has created the Global Safety Package 3*1, an active safety system intended to increase vehicle safety by enhancing their environment-sensing abilities. The Toyota Noah and Voxy, Lexus NX, Hino Ranger, and Lexus ES all make use of this product.

Driver Safety Systems Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Driver Safety Systems Market Research Report |

| Market Size in 2022 | USD 12.5 Billion |

| Market Forecast in 2030 | USD 23.1 Billion |

| Growth Rate | CAGR of 8.0% |

| Number of Pages | 220 |

| Key Companies Covered | TRW Automotive Holdings Corp, Takata Corp, Toyoda Gosei Co. Ltd, Autoliv Inc, Tokai Rika Co. Ltd, Delphi Automotive LLP, Hyundai Mobis, Nihon Plast Co. Ltd., Raytheon Co., FLIR Systems Inc., Continental AG, Hella KGaA Hueck & Co, East Joy Long Motor Airbag Co. Ltd., Tokai Rika Co. Ltd, and Infineon Technologies AG among others. |

| Segments Covered | By Type, By Vehicle Type, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Driver Safety Systems Market: Regional Analysis

The Asia Pacific is expected to capture the largest market share during the forecast period

The Asia Pacific is expected to capture the largest global driver safety systems market share during the forecast period. The growth in the region is attributed to the increasing automotive industry, especially in India and China. One of the biggest auto markets in the world is China, where more than 20.17 million passenger cars were sold in 2020, a 5.89% annual reduction from the previous year. Despite the pandemic, China remains one of the world's top vehicle exporters, which presents an incredible opportunity for predictive technology to establish itself in the Chinese auto industry.

The Chinese government is putting a lot of emphasis on electric mobility as well as ADAS components of advanced vehicle technology. With the addition of the new level 2 and level 3 ADAS technologies, major automakers in the region are modernizing their product lineup. For instance, the new Chitu compact SUV was introduced by the HAVAL brand of Great Wall Motor Co. Ltd in May 2021. It is powered by a 1.5L turbocharged engine with a 7-speed wet dual-clutch transmission and has a maximum power output of 135kW and a peak torque of 275Nm. The car also has a Level 2 ADAS system, which, depending on the version, has different features.

Europe is expected to grow at the fastest rate over the forecast period owing to the increasing number of accidents. In industrialized nations, traffic accidents are a leading source of fatalities. A potential approach may involve a variety of intelligent transportation systems. These include cutting-edge driver-aid technologies within the automobile or truck. In an increasingly complicated driving environment, they assist drivers in maintaining a safe speed and distance, staying in their lane, avoiding overtaking in dangerous circumstances, and safely passing through intersections.

According to eImpact's high-scenario forecast for 2020, Electronic Stability Control (ESC) is predicted to avoid the vast majority of fatalities and injuries—roughly 3,000 (-14%) and 50,000 (-6%) annually. Significant reductions in fatalities are also seen with Speed Alert (with active gas pedal) (-5%), eCall (-4%), and Lane Keeping Support (-3%). These applications also have the potential to reduce traffic congestion, as accidents account for 15% of all traffic in Europe, in turn, driving the market expansion in the region.

Driver Safety Systems Market: Competitive Analysis

The global driver safety systems market is dominated by players like:

- TRW Automotive Holdings Corp

- Takata Corp

- Toyoda Gosei Co. Ltd

- Autoliv Inc

- Tokai Rika Co. Ltd

- Delphi Automotive LLP

- Hyundai Mobis

- Nihon Plast Co. Ltd.

- Raytheon Co.

- FLIR Systems Inc.

- Continental AG

- Hella KGaA Hueck & Co

- East Joy Long Motor Airbag Co. Ltd.

- Tokai Rika Co. Ltd

- Infineon Technologies AG

- Among Others.

The global driver safety systems market is segmented as follows:

By Type

- Lane Departure Warning System

- Driver Alertness Detection System

- Vehicle-to-Vehicle Communication

- Electronic Stability Control

- Eye-tracking/Blink-monitoring

- Pressure/Angle Steering Sensor

- Others

By Vehicle Type

- Passenger

- Commercial

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Safety is a keyword based on which every worldwide standard is defined. No matter it is a product or a service, the whole calculation of the mechanism is derived from the perspective of safety. And in terms of human safety, while driving, it is a stringent parameter considered before designing the process, product, or any mechanism. The government introducing regulations related to passenger safety and forcing the automobile manufacturer to assemble required safety features has motivated the demand for driver safety systems market.

Vehicle owners by self-modifying the safety of their vehicles’ gradation has significantly increased the demand for the safety systems market in the aftermarket, this also drives the growth of the global driver safety systems market. Technology and engineering companies coming up with various new developments that support the safety of drivers and passengers have created some impressive impact on the global market.

According to the report, the global market size was worth around USD 12.5 billion in 2022 and is predicted to grow to around USD 23.1 billion by 2030.

The global driver safety systems market is expected to grow at a CAGR of 8.0% during the forecast period.

The global driver safety systems market growth is expected to be driven by the Asia Pacific. It is currently the world’s highest revenue-generating market owing to the large production base of automobiles and the increasing emphasis of the government on safety.

The global driver safety systems market is dominated by players like TRW Automotive Holdings Corp, Takata Corp, Toyoda Gosei Co. Ltd, Autoliv Inc, Tokai Rika Co. Ltd, Delphi Automotive LLP, Hyundai Mobis, Nihon Plast Co. Ltd., Raytheon Co., FLIR Systems Inc., Continental AG, Hella KGaA Hueck & Co, East Joy Long Motor Airbag Co. Ltd., Tokai Rika Co. Ltd and Infineon Technologies AG among others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed