Electric Bus Charging Station Market Size, Share, Trends, Growth and Forecast 2030

Electric Bus Charging Station Market By Charging (Off-Board and On-Board), By Platform (On-the-Go and Depot), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2023 - 2030

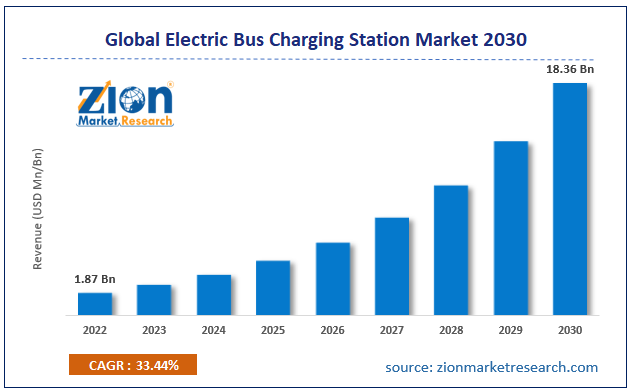

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1.87 Billion | USD 18.36 Billion | 33.44% | 2022 |

Electric Bus Charging Station Industry Prospective:

The global electric bus charging station market size was worth around USD 1.87 billion in 2022 and is predicted to grow to around USD 18.36 billion by 2030 with a compound annual growth rate (CAGR) of roughly 33.44% between 2023 and 2030.

Electric Bus Charging Station Market: Overview

An electric bus charging station is a charging point for buses powered by electricity. Traditionally, private or public transport buses run on fuel, especially diesel. However, in recent times, more companies have been working on manufacturing electric buses that are a part of the larger electric vehicle segment. These buses are propelled using electric motors, unlike conventional buses that work with internal combustion engines. The electric versions can either be continuously fed electricity or power from an external source or they may store required electricity onboard whenever needed.

At present time, most electric buses run on batteries as in this variant energy is obtained using an onboard battery pack. An electric bus charging station, on the other hand, is a spot where battery packs for buses can be recharged for further application. These stations generally consist of a metal box with one or more charging chords or guns attached to it. Charging stations for electric buses are different from charging stations for cars and smaller vehicles since the former requires higher load capacity and faster charging. The electric bus charging station industry is expected to grow rapidly during the forecast period.

Key Insights:

- As per the analysis shared by our research analyst, the global electric bus charging station market is estimated to grow annually at a CAGR of around 33.44% over the forecast period (2023-2030)

- In terms of revenue, the global electric bus charging station market size was valued at around USD 1.87 billion in 2022 and is projected to reach USD 18.36 billion, by 2030.

- The electric bus charging station market is projected to grow at a significant rate due to the growing focus on sustainable growth

- Based on platform segmentation, on-the-go was predicted to show maximum market share in the year 2022

- Based on charging segmentation, on-board was the leading segment in 2022

- On the basis of region, Asia-Pacific was the leading revenue generator in 2022

Electric Bus Charging Station Market: Growth Drivers

Growing focus on sustainable growth to drive market revenue

The global electric bus charging station market is projected to grow owing to the increasing focus on sustainable growth and reducing environmental pollution caused by excessive consumption of non-renewable sources of energy such as oil, gas, petrol, and diesel. As per official data, around 11.65% of the deaths worldwide are caused by air pollution. Earth’s temperature is rising at a worrying rate and the impact can be seen in dramatic climate changes with excessive rainfall, famine, drought, and flood. The automotive industry is one of the leading environmental polluters leading to an increased need and demand for environmentally friendly solutions. Electric vehicles (EVs) have tremendous potential to help in reducing the pressure on non-renewable energy sources. Several countries across the globe are promoting the manufacturing and use of electric buses in private and public sectors. A report published by Sustainable Bus claimed that Europe witnessed the registration of nearly 1767 electric buses in the first half of 2022.

Growing focus on enhancing public transport systems to promote higher adoption

With an increase in traffic congestion that ultimately leads to concerns over the safety of people and the environment alike, regional governments are working toward enhancing public transport infrastructure with an aim to encourage more people to opt for public transport including buses. Apart from being less harsh to the environment, electric buses are superior in performance since they provide a smooth riding experience and are faster than conventional buses. In August 2023, the Indian government announced its approval for a USD 7 billion project through which the country will introduce around 50,000 electric buses across 170 cities. With this move, India aims to reduce air pollution in the country while also creating jobs for its citizens. However, these buses cannot function efficiently without a functional charging station infrastructure. As the manufacturing of electric buses for public transport continues to grow, investments in the electric bus charging station industry are also expected to rise.

Electric Bus Charging Station Market: Restraints

High cost of initial investment to restrict market growth

Charging stations for buses are high-investment projects. The associated expense is multifaceted since it includes several layers. For instance, setting up an electric bus charging station would require extensive land away from residential areas to maintain safety. Additionally, the cost of a typical high-power Lever 2 charger is around USD 2000 to USD 5000. Installation costs can go as high as USD 1,000 to USD 10,000 depending on installation difficulty. Furthermore, since the electricity consumed by buses is higher than by smaller passenger vehicles, the operational cost of an electric bus charging station will always remain high and may be further pushed to higher limits in case of changes in the electricity supply. The current volatility observed in the global economy with rising inflation rates could limit global electric bus charging station market growth.

Electric Bus Charging Station Market: Opportunities

Launch of fast charging ports and continuous innovation to create growth opportunities

Since the investments in the electric bus sector are growing rapidly, manufacturers of charging ports used for powering electric buses have been adapting to the new demand and expectations from the end-consumers. In July 2023, ABC Companies in association with PG&E and Proterra announced the launch of North America’s largest bus or coach charging facility located in California. The charging unit can support around 1.4 megawatts of EV charging power and is equipped with 20 dual-cable EV charging dispensers with space for charging around 40 electric buses. In addition to this, several countries have evolved further and developed innovative charging solutions. In 2021, Volvo Buses launched an alternate method to charge electric buses with the introduction of a roof-mounted pantograph also known as panto up. This move will also allow Volvo buses to reduce on-board weight and will be currently available in Volvo 7900 Electric Articulated and Volvo 7900 Electric in Europe.

In 2015, ABB, a global leader in power and automation technology, introduced a fast charging system that allows buses to run for 24 hours and 7 days. Such technologies help in reaching zero emissions which is better for the environment and the companies operating electric buses. The charging port has a charge time of 46 minutes.

Electric Bus Charging Station Market: Challenges

Lack of supporting infrastructure to create challenges during the forecast period

The electric bus charging station industry players may face challenges owing to the lack of supporting infrastructure. For instance, countries with limited electricity generation capabilities or unfavorable government policies may refrain from investing in resource-intensive projects such as electric bus charging stations. In addition to this, in the case of 100% electric buses, there is an associated risk of buses running out of power before reaching the destination. Other issues such as the charging speed of power stations and lack of standardization are additional constraints faced by electric bus charging station service providers.

Electric Bus Charging Station Market: Segmentation

The global electric bus charging station market is segmented based on charging, platform, and region.

Based on charging, the global market segments are off-board and on-board. In 2022, the highest growth was observed in the on-board charging segment. In this type, electric buses are charged using an on-board charger and there is limited or no reliance on external sources for energy. These buses are less expensive to manufacture and limit range anxiety in bus drivers. However, the market of off-board charging is also significantly high since the charging speed in this variant is higher but requires extensive infrastructure development costs. Buses manufactured by Olectra-BYD for the Indian market have two on-board chargers and each charger has a capacity of 40kW.

Based on the platform, the electric bus charging station industry divisions are on-the-go and depot. The most revenue-generating segment in 2022 was on-the-go. These variants allow buses to travel longer distances in a limited time. The primary concern with on-the-go platforms is the requirement of an extensive infrastructure that can support on-the-charging since it typically requires high power rates going as far as up to 500kW. Revenue from the depot segment plays a crucial role in overall market revenue and is expected to grow at a steady pace during the forecast period.

Electric Bus Charging Station Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Electric Bus Charging Station Market |

| Market Size in 2022 | USD 1.87 Billion |

| Market Forecast in 2030 | USD 18.36 Billion |

| Growth Rate | CAGR of 33.44% |

| Number of Pages | 229 |

| Key Companies Covered | Proterra, ABB. Alstom, Siemens, Volvo Group, Heliox, Eaton, BYD, New Flyer Industries, ChargePoint, Keolis, Schneider Electric, Opbrid, Toshiba, EvoBus, IPT Technology, Yunex Traffic, Nuvve, Heliox, ABB TOSA., and others. |

| Segments Covered | By Charging, By Platform, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Electric Bus Charging Station Market: Regional Analysis

Asia-Pacific to dominate the market growth during the forecast period

The global electric bus charging station market is expected to witness the highest growth in Asia-Pacific with China, Japan, South Korea, and India leading the regional revenue. As of 2023, China has an extensive line of electric bus charging stations. The overall infrastructure is highly developed. On the other hand, Japan is known for its futuristic approach toward sustainable growth. As per official reports, in 2022, China invested in over 86000 new charging stations and it currently has 1.42 million electric charging units. In February 2023, it was reported that more than 1,38,000 units of electric buses were sold in China in 2022. On the other hand, Japan is aiming to achieve carbon neutrality by 2050. To achieve this goal, the Japanese government extended a subsidy of USD 911 million to build and construct EV charging stations.

Europe is projected to grow at a rapid rate driven by the increasing investments toward the construction of advanced and highly efficient electric bus charging stations. The European Commission has laid out several initiatives to reduce carbon emissions and dependence on fossil fuels, especially in the automotive industry. Europe’s market may benefit from an already well-established public transport system.

Electric Bus Charging Station Market: Competitive Analysis

The global electric bus charging station market is led by players like:

- Proterra

- ABB. Alstom

- Siemens

- Volvo Group

- Heliox

- Eaton

- BYD

- New Flyer Industries

- ChargePoint

- Keolis

- Schneider Electric

- Opbrid

- Toshiba

- EvoBus

- IPT Technology

- Yunex Traffic

- Nuvve

- Heliox

- ABB TOSA.

The global electric bus charging station market is segmented as follows:

By Charging

- Off-Board

- On-Board

By Platform

- On-the-Go

- Depot

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

An electric bus charging station is a charging point for buses powered by electricity. Traditionally, private or public transport buses run on fuel, especially diesel.

The global electric bus charging station market is projected to grow owing to the increasing focus on sustainable growth and reducing environmental pollution caused by excessive consumption of non-renewable sources of energy such as oil, gas, petrol, and diesel.

According to study, the global electric bus charging station market size was worth around USD 1.87 billion in 2022 and is predicted to grow to around USD 18.36 billion by 2030.

The CAGR value of the electric bus charging station market is expected to be around 33.44% during 2023-2030.

The global electric bus charging station market is expected to witness the highest growth in Asia-Pacific with China, Japan, South Korea, and India leading the regional revenue.

The global electric bus charging station market is led by players like Proterra, ABB. Alstom, Siemens, Volvo Group, Heliox, Eaton, BYD, New Flyer Industries, ChargePoint, Keolis, Schneider Electric, Opbrid, Toshiba, EvoBus, IPT Technology, Yunex Traffic, Nuvve, Heliox, and ABB TOSA.

The report explores crucial aspects of the electric bus charging station market including a detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed