Electric Bus Market Size, Share, Growth, Forecast 2030

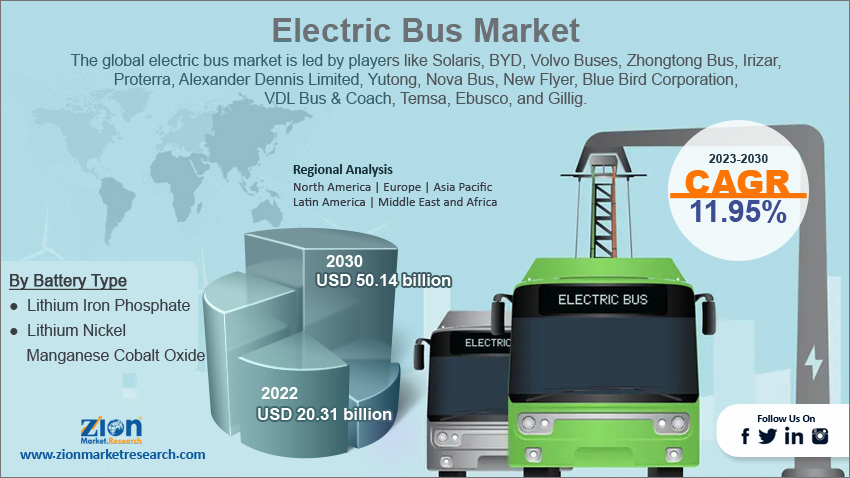

Electric Bus Market By End-User (Private and Public), By Battery Type (Lithium Iron Phosphate and Lithium Nickel Manganese Cobalt Oxide), By Application (Intracity and Intercity), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2023 - 2030

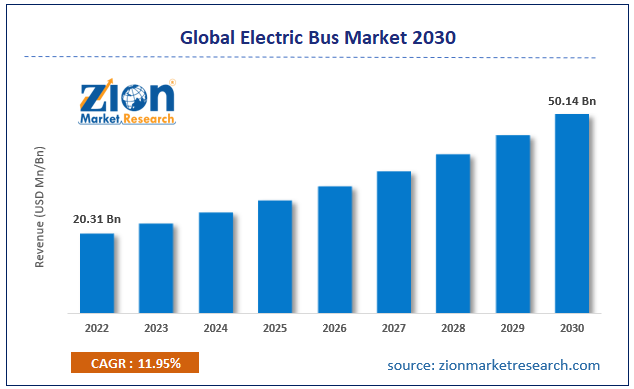

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 20.31 Billion | USD 50.14 Billion | 11.95% | 2022 |

Electric Bus Industry Prospective:

The global electric bus market size was worth around USD 20.31 billion in 2022 and is predicted to grow to around USD 50.14 billion by 2030 with a compound annual growth rate (CAGR) of roughly 11.95% between 2023 and 2030.

Electric Bus Market: Overview

An electric bus is a movable vehicle, with higher seating capacity as compared to cars, in which the propulsion system and other accessory settings are powered using a zero-emission electricity source. The main difference between an electric bus and a traditional bus is that the latter is powered by an internal propulsion system that runs on fuel. On the other hand, an electric bus is charged at a power station by plugging it into an electric grid. The buses’ battery system stores the electricity for application by powering up the electric engine. These transportation tools require less maintenance in comparison to fuel-run buses since the engines have fewer parts than internal combustion engines.

Electric buses are regarded as sustainable solutions to the growing pollution rate as not only are the buses environmentally friendly but have been proven as more economical, especially in the current unprecedented times with disruptions in the fuel supply chain. However, the industry for electric buses grapples with certain restrictions and limitations that require more attention for the industry players to deliver better results during the forecast period.

Key Insights:

- As per the analysis shared by our research analyst, the global electric bus market is estimated to grow annually at a CAGR of around 11.95% over the forecast period (2023-2030)

- In terms of revenue, the global electric bus market size was valued at around USD 20.31 billion in 2022 and is projected to reach USD 50.14 billion, by 2030.

- The electric bus market is projected to grow at a significant rate due to the growing number of countries envisioning carbon neutrality

- Based on end-user segmentation, the public was predicted to show maximum market share in the year 2022

- Based on application segmentation, intercity was the leading segment in 2022

- On the basis of region, Asia-Pacific was the leading revenue generator in 2022

Request Free Sample

Request Free Sample

Electric Bus Market: Growth Drivers

Growing number of countries envisioning carbon neutrality to create higher demand

The global electric bus market is projected to grow owing to the increasing number of countries and world leaders laying out visions that relate to achieving carbon neutrality. The concept refers to carbon emissions that are balanced out or neutralized by eliminating or absorbing equal amounts of carbon dioxide from the environment using several measures including shifting toward sustainable transportation solutions such as electric buses. For instance, the European Union aims to become carbon neutral by 2050 for which it has already laid out the European Green Deal, a €1.8 trillion investment plan. Similarly, Australia is working with the Long-Term Emissions Reduction Plan through which the country will neutralize carbon emissions by 2050. A large number of nations across the globe have pledged similar commitments and this is expected to push more investments toward electric buses.

Worsening traffic rate to encourage more people toward public transport creating a window for electric buses

Traffic jam rates have soared to new heights in recent times. The increasing number of people choosing cars for transportation as opposed to public transport systems such as buses has resulted in growing traffic across the globe. Citizens of Mumbai, India lost 121 hours annually in traffic jams in 2021 and had a congestion rate of 53%. These statistics hold true for all major urban cities worldwide. Electric buses are projected to prove an ideal solution since the buses are better in performance and comfort as compared to internal combustion engine-powered buses and can prove beneficial in improving the public transport ecosystem.

Electric Bus Market: Restraints

Questionable bus performance in severe weather conditions could restrict market conditions

A 2020 report published by the Center for Transportation and the Environment (CTE), a non-profit organization working for sustainable transportation technologies, claimed that electric buses tend to lose range during colder weather conditions as compared to hydrogen fuel cell buses. The study concluded that electric buses witnessed a 37.8% decrease in range. Similar concerns have been frequently raised especially in colder countries where temperatures can fall to extremely low temperatures thus impacting the global electric bus market growth.

Lack of charging infrastructure could limit market expansion

Electric buses can run only in the presence of an efficient charging infrastructure. However, there is a large gap between the availability scale and requirement scale of electric bus charging stations. Additionally, several emerging nations do not have access to uninterrupted electricity supply. For instance, China was reported to be facing power shortages caused by constant draughts or heat waves.

Electric Bus Market: Opportunities

Investments in renewable electricity for electric buses to create future growth possibilities

The electric bus industry players are expected to have access to tremendous growth opportunities due to the growing investments in renewable energy for charging electric buses. In December 2020, the Bergen region in Norway saw that in the city’s fleet of 138 buses, around 102 electric runs were running completely on renewable energy. In July 2022, India witnessed the deployment of the first 200 KW solar rooftop for electric buses owned by the Ashok Leyland brand. The unit is currently sourcing almost 20% of its energy requirements using green energy.

Rising cross-border partnerships to open new avenues for growth

Several key players are transcending regional boundary limitations and collaborating with partners across the globe to create a global supply chain for electric buses and associated accessories. For instance, in September 2023, the US and India announced a strategic partnership through which the countries will work to launch 10,000 electric buses in India. In June 2021, Convergence Energy Services Ltd (CESL) and JBM Renewables announced a partnership for setting up electric vehicle charging stations in an integrated ecosystem.

Electric Bus Market: Challenges

High cost of initial investment and other technical issues to create barriers against growth

The global electric bus market revenue size is expected to come across certain growth barriers caused by the high cost of initial investment required to build an electric bus and the supporting charging infrastructure. Since buses run on longer routes, they must have access to multiple charging stations at several points leading to an expensive initial investment. Additionally, businesses must also invest in training bus drivers and other technicians since electric buses run on different technology as compared to fuel-powered buses.

Electric Bus Market: Segmentation

The global electric bus market is segmented based on end-user, battery type, application, and region.

Based on end-user, the global market segments are private and public. In 2022, the public segment was the leading revenue generator as it controlled more than 85.1% of the total share. Increasing government initiatives to build cleaner, efficient, and comfortable public transport systems and rising collaboration with other countries for the supply of electric buses or the development of charging infrastructure were the main growth propellers. During the forecast period, the private sector may grow at a CAGR of around 20.45%.

Based on battery type, the electric bus industry segments are lithium iron phosphate and lithium nickel manganese cobalt oxide.

Based on application, the electric bus industry divisions are intracity and intercity. The highest revenue-generation segment in 2022 was intercity which held dominance over 90.02% of the final revenue. Intercity electric bus infrastructure is relatively easier to build since it requires limited investment. Moreover, a large percentage of the currently available electric buses are ideal for limited range. The intracity segment may grow at a CAGR of 26.56% by 2030.

Electric Bus Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Electric Bus Market |

| Market Size in 2022 | USD 20.31 Billion |

| Market Forecast in 2030 | USD 50.14 Billion |

| Growth Rate | CAGR of 11.95% |

| Number of Pages | 233 |

| Key Companies Covered | Solaris, BYD, Volvo Buses, Zhongtong Bus, Irizar, Proterra, Alexander Dennis Limited, Yutong, Nova Bus, New Flyer, Blue Bird Corporation, VDL Bus & Coach, Temsa, Ebusco, Gillig., and others. |

| Segments Covered | By End-User, By Battery Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Electric Bus Market: Regional Analysis

Asia-Pacific to deliver the best results during the upcoming period

The global electric bus market will be led by Asia-Pacific during the forecast period. In 2022, it generated around 80.2% of the global revenue. China, Japan, South Korea, and India are the leading nations in the regional economy. China is one of the world’s largest consumers and manufacturers of electric buses. As of current times, the country has around 600,000 electric buses on the road since China has drastically scaled up its investments in the electric vehicle sector. India, on the other hand, has signed multiple deals with domestic automobile manufacturers as well as international players to create an efficient and greener public transport ecosystem. In August 2023, the Indian government announced that it had allotted USD 7 billion to deploy electric buses in 170 cities. Increasing traffic congestion, rising pollution rate, and aging public transport systems are the most crucial factors for India’s growth. Europe is projected to grow at a steady CAGR. Increased efforts to reach carbon neutrality and the presence of key manufacturers of electric buses may drive regional revenue.

Electric Bus Market: Competitive Analysis

The global electric bus market is led by players like:

- Solaris

- BYD

- Volvo Buses

- Zhongtong Bus

- Irizar

- Proterra

- Alexander Dennis Limited

- Yutong

- Nova Bus

- New Flyer

- Blue Bird Corporation

- VDL Bus & Coach

- Temsa

- Ebusco

- Gillig.

The global electric bus market is segmented as follows:

By End-User

- Private

- Public

By Battery Type

- Lithium Iron Phosphate

- Lithium Nickel Manganese Cobalt Oxide

By Application

- Intracity

- Intercity

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

An electric bus is a movable vehicle, with higher seating capacity as compared to cars, in which the propulsion system and other accessory settings are powered using a zero-emission electricity source.

The global electric bus market is projected to grow owing to the increasing number of countries and world leaders laying out visions that relate to achieving carbon neutrality.

According to study, the global electric bus market size was worth around USD 20.31 billion in 2022 and is predicted to grow to around USD 50.14 billion by 2030.

The CAGR value of the electric bus market is expected to be around 11.95% during 2023-2030.

The global electric bus market will be led by Asia-Pacific during the forecast period. In 2022, it generated around 80.2% of the global revenue.

The global electric bus market is led by players like Solaris, BYD, Volvo Buses, Zhongtong Bus, Irizar, Proterra, Alexander Dennis Limited, Yutong, Nova Bus, New Flyer, Blue Bird Corporation, VDL Bus & Coach, Temsa, Ebusco, and Gillig.

The report explores crucial aspects of the electric bus market including a detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed