Electronic Adhesives Market Size, Share, Trends, Growth 2030

Electronic Adhesives Market By Application (Consumer Electronics, Computers & Servers, Medical, Industrial, Communications, Commercial Aviation, Automotive, and Others), By Form (Solid, Paste, and Liquid), By Resin Type (PU, Acrylic, Silicone, and Epoxy), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2023 - 2030

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

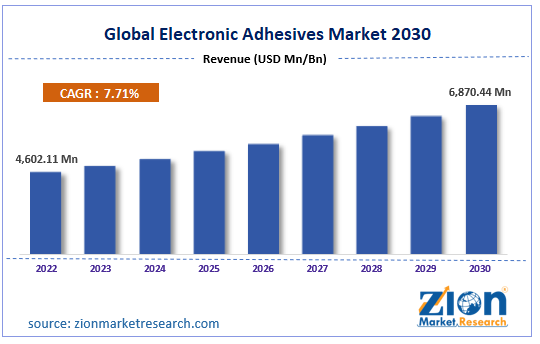

| USD 4602.11 Million | USD 6870.44 Billion | 7.71% | 2022 |

Electronic Adhesives Industry Prospective:

The global electronic adhesives market size was worth around USD 4,602.11 million in 2022 and is predicted to grow to around USD 6,870.44 million by 2030 with a compound annual growth rate (CAGR) of roughly 7.71% between 2023 and 2030.

Electronic Adhesives Market: Overview

Electronic adhesives are an integral part of the basic building blocks used in the electronic industry and are known as printed wiring boards (PCBs). These units use adhesive materials to create a strong bond between surface-mount components, conformal coatings, wire-tacking, and potting or encapsulating components. Modern adhesives play a dual function that includes creating a strong bond between components during electronic assembly and also creating a layer of protection to protect components from undergoing any potential damage. This includes protection from excessive heat, vibration, mechanical shock, corrosion, environmental conditions, and moisture. Some electronic adhesives also impart electrically and thermally conductive properties along with ultraviolet ray curing capabilities. These attributes have allowed electronic adhesives to replace some of the older methods of electronic assembly including the likes of soldering systems. The players operating in the electronic adhesives industry are expected to come across a steady growth rate during the forecast period.

Key Insights:

- As per the analysis shared by our research analyst, the global electronic adhesives market is estimated to grow annually at a CAGR of around 7.71% over the forecast period (2023-2030)

- In terms of revenue, the global electronic adhesives market size was valued at around USD 4,602.11 million in 2022 and is projected to reach USD 6,870.44 million, by 2030.

- The electronic adhesives market is projected to grow at a significant rate due to the increasing demand for high-performance flexible electronics

- Based on application segmentation, consumer electronics was predicted to show maximum market share in the year 2022

- Based on resin type segmentation, epoxy was the leading type in 2022

- On the basis of region, Asia-Pacific was the leading revenue generator in 2022

Request Free Sample

Request Free Sample

Electronic Adhesives Market: Growth Drivers

Increasing demand for high-performance flexible electronics to drive market growth

The global electronic adhesives market is projected to grow owing to the increasing demand for flexible electronics across end-user verticals. Flexible electronics refers to electronic circuit assembly technology that deals with mounting electronic devices on flexible plastic substrates and not on traditionally used stiff PCBs made of silicon wafers or other rigid material. Devices produced using this technology include smartphones, security tags, medical devices, health monitoring wearables, agricultural & environmental sensors, strain gauges in bridges and other equipment, and sensor units in airplanes or cars. The demand and consumption of electronic devices made with flexible electronic technology offer several advantages. They are highly durable, versatile, and energy efficient. In June 2022, Sony Electronics Inc. announced the launch of ILME-FR7, its most recent addition to the existing Cinema Line range. ILME-FR7 is the world’s first pan-tilt-zoom camera with a full-frame image sensor. It is also equipped with excellent cinematic features and a versatile remote.

In addition to this, the technology is expected to drastically change the digital healthcare sector. Research and studies predict that electronic skin patches made using flexible electronics can help meet the demands of the aging population. In August 2022, researchers at the Massachusetts Institute of Technology (MIT) developed a wireless and chip-free electronic skin using flexible electronic technology.

Such revolutionary development in the field of electronic adhesives is likely to push higher consumption.

Electronic Adhesives Market: Restraints

Constantly changing process of raw material to restrict market growth

The global electronic adhesives market growth may face restrictions owing to the fluctuating prices of raw materials used in the production of electronic adhesives. The materials used are resins, curing agents, fillers, solvents or carriers, catalysts, modifiers, and fluxes, to name a few. While some of the materials may be readily materials, crucial ingredients such as resins and solvents may be subject to changing prices as a result of disruption in the supply chain that can be caused by several external factors such as political relationships between trading nations, availability of initial goods, supply of manpower, and access to production facilities.

Electronic Adhesives Market: Opportunities

Rising investments in the telecommunication sector to create expansion possibilities

With the changing needs of consumers, the telecommunication industry is rapidly evolving resulting in higher investments in futuristic technology. Some examples include 5G-led telecom infrastructure, network slicing, open radio access networks, and telehealth. As of 2021, Australian Mobile Network Operators (MNOs) have rolled out over 4000 operation bases supporting 5G across the country. In addition to this, the European Commission (EU) has announced that it will provide funding of around €700 million to support the region’s 5G vision. Such developmental activities are an indication of the potential of 5G sectors in the telecom industry. In addition to this, the increasing number of space missions including the launch of several low orbits and the ones taking part in space probes has pushed innovation and development boundaries in the sector causing higher demand for efficient products supplied by the electronic adhesives industry players.

Electronic Adhesives Market: Challenges

Changing expectations from electronic adhesive suppliers in terms of product application could challenge the market growth trend

Since the electronics industry is changing at a faster pace, companies providing electronic adhesives have to continue re-establishing themselves as the requirement and expectations from end-consumers continue to revise. For instance, with growing production of miniaturized electronic components requires the use of electronic adhesives that are high in quality but can meet the demand for compact electronic products. In addition to this, these adhesives should be able to bond with varying substrates further adding to the diversity in the global electronic adhesives market. Some companies may fail to keep up with the evolving industry caused by intense challenging situations in the global market.

Electronic Adhesives Market: Segmentation

The global electronic adhesives market is segmented based on application, form, resin type, and region.

Based on application, the global market segments are consumer electronics, computers & servers, medical, industrial, communications, commercial aviation, automotive, and others. In 2022, the highest growth was registered in the consumer electronics sector driven by exponential expansion in the sector. The increase in end-buyers along with the existence of multiple manufacturers and sellers of consumer electronics has allowed the industry to set records in terms of revenue and consumption. In addition to this, the rising trend of online purchases has improved product awareness and accessibility. In 2022, Samsung, a leading producer of smart devices, shipped over 259 million units of smartphones. The same consumption pattern is prevalent in all segments of consumer electronics across price ranges.

Based on form, the electronic adhesives industry is divided into solid, paste, and liquid.

Based on resin type, the electronic adhesives industry is segmented into PU, acrylic, silicone, and epoxy. The demand for epoxy resins was higher as compared to other resin types mainly driven by the excellent functional attributes of the epoxy version. These variants are known to have superior mechanical properties. They also offer a significant level of chemical and thermal resistance specifically against alkalis. Unfilled epoxy systems have a thermal conductivity of 0.14 W/(m•K).

Electronic Adhesives Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Electronic Adhesives Market |

| Market Size in 2022 | USD 4,602.11 Million |

| Market Forecast in 2030 | USD 6,870.44 Million |

| Growth Rate | CAGR of 7.71% |

| Number of Pages | 227 |

| Key Companies Covered | Avery Dennison Corporation, Henkel AG & Co. KGaA, H.B. Fuller Company, 3M Company, Master Bond Inc., Dow Inc., Rogers Corporation, Panacol-Elosol GmbH, Momentive Performance Materials Inc., AI Technology Inc., Evonik Industries AG, Permabond Engineering Adhesives, Delo Industrial Adhesives, Loctite, Indium Corporation, and others. |

| Segments Covered | By Application, By Form, By Resin Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Electronic Adhesives Market: Regional Analysis

Asia-Pacific to witness the highest growth during the projected timeline

The global electronic adhesives market will be led by Asia-Pacific during the forecast period. The projection pattern is influenced by the presence of an extensive production line for electronic items in Asian countries especially China, South Korea, and Taiwan. These nations not only produce essential electronic components for international companies but also have a tremendous hold over the global electronic sector by producing some of the fastest-selling electronic products in the domestic and foreign markets. The prime example is Samsung which sold more units of smartphones than any other company in the world beating sales of iPhones as well.

In addition to this, the regional consumption of electronic adhesives is growing at a steady pace as countries such as India continue to invest in telecommunication infrastructure development projects. Moreover, in recent times, South Asian countries have increased their military budgets due to the changing socio-political environment in Asia. The countries are investing in highly advanced military-grade technology-driven ammunition and communication tools. The emerging segment of hybrid and electric vehicles could create higher growth possibilities.

Electronic Adhesives Market: Competitive Analysis

The global electronic adhesives market is led by players like:

- Avery Dennison Corporation

- Henkel AG & Co. KGaA

- H.B. Fuller Company

- 3M Company

- Master Bond Inc.

- Dow Inc.

- Rogers Corporation

- Panacol-Elosol GmbH

- Momentive Performance Materials Inc.

- AI Technology Inc.

- Evonik Industries AG

- Permabond Engineering Adhesives

- Delo Industrial Adhesives

- Loctite

- Indium Corporation

The global electronic adhesives market is segmented as follows:

By Application

- Consumer Electronics

- Computers & Servers

- Medical

- Industrial

- Communications

- Commercial Aviation

- Automotive

- Others

By Form

- Solid

- Paste

- Liquid

By Resin Type

- PU

- Acrylic

- Silicone

- Epoxy

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Electronic adhesives are an integral part of the basic building blocks used in the electronic industry and are known as printed wiring boards (PCBs).

The global electronic adhesives market is projected to grow owing to the increasing demand for flexible electronics across end-user verticals.

According to study, the global electronic adhesives market size was worth around USD 4,602.11 million in 2022 and is predicted to grow to around USD 6,870.44 million by 2030.

The CAGR value of the electronic adhesives market is expected to be around 7.71% during 2023-2030.

The global electronic adhesives market will be led by Asia-Pacific during the forecast period.

The global electronic adhesives market is led by players like Avery Dennison Corporation, Henkel AG & Co. KGaA, H.B. Fuller Company, 3M Company, Master Bond Inc., Dow Inc., Rogers Corporation, Panacol-Elosol GmbH, Momentive Performance Materials Inc., AI Technology, Inc., Evonik Industries AG, Permabond Engineering Adhesives, Delo Industrial Adhesives, Loctite, and Indium Corporation.

The global electronic adhesives market explores crucial aspects of the electronic adhesives market including detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the electronic adhesives market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed