Enterprise Imaging Solutions Market Size, Share, Forecast 2030

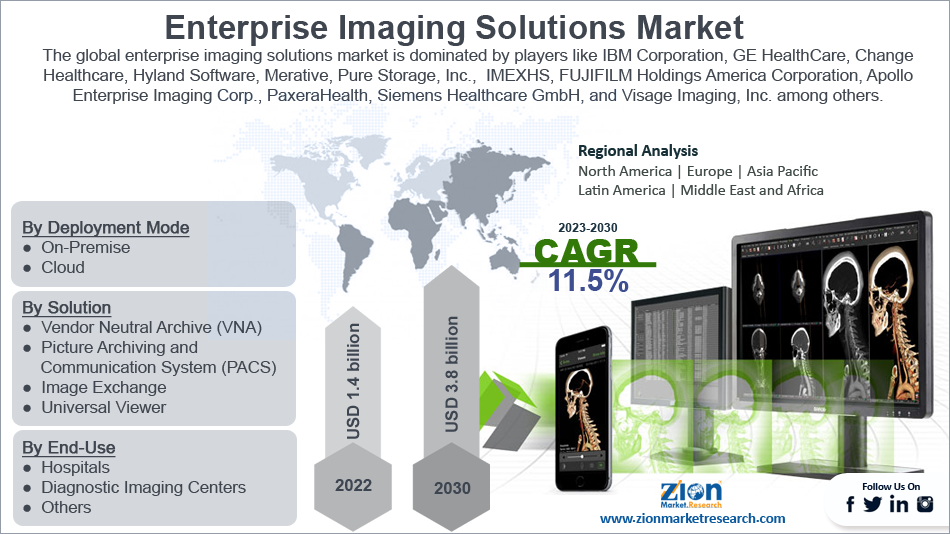

Enterprise Imaging Solutions Market By Deployment Mode (On-Premise and Cloud), By Solution (Vendor Neutral Archive (VNA), Picture Archiving and Communication System (PACS), Image Exchange and Universal Viewer), By End-Use (Hospitals, Diagnostic Imaging Centers, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2023 - 2030

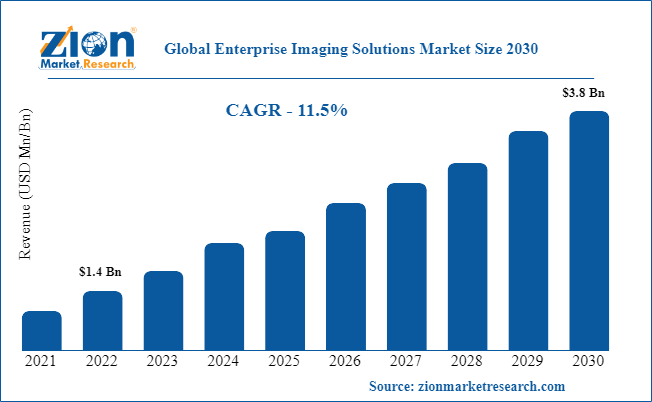

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1.4 Billion | USD 3.8 Billion | 11.5% | 2022 |

Enterprise Imaging Solutions Industry Prospective:

The global enterprise imaging solutions market size was worth around USD 1.4 Billion in 2022 and is predicted to grow to around USD 3.8 Billion by 2030 with a compound annual growth rate (CAGR) of roughly 11.5% between 2023 and 2030.

The report analyzes the global enterprise imaging solutions market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the enterprise imaging solutions industry.

Enterprise Imaging Solutions Market: Overview

A set of strategies, initiatives, and workflows implemented across a healthcare enterprise to consistently and optimally capture, index, manage, store, distribute, view, exchange, and analyze all clinical imaging and multimedia content to enhance the electronic health record" is the most widely used definition of enterprise imaging.

In its broadest sense, enterprise imaging is usually accomplished using a single archive. Typical DICOM images from conventional imaging modalities, like CT or MRI, as well as visible light images, like photographs, images from arthroscopes and endoscopes, fundal examinations, and any examination in which the data are displayed as an image and not as text, a graph, or a diagram, are all considered medical images. Every one of these pictures is a component of the thorough longitudinal medical record. The idea that the EMR serves as a singular source of truth for information about the patient's medical care is supported by the inclusion of images in the EMR/EHR.

Key Insights

- As per the analysis shared by our research analyst, the global enterprise imaging solutions market is estimated to grow annually at a CAGR of around 11.5% over the forecast period (2023-2030).

- In terms of revenue, the global enterprise imaging solutions market size was valued at around USD 1.4 billion in 2022 and is projected to reach USD 3.8 billion, by 2030.

- The growing usage of radiology imaging in the field of oncology, orthopedics, cardiology, women’s health, and many more is also one of the factors that are contributing to the growth of the market.

- Based on the deployment mode, the cloud segment is expected to grow at the highest CAGR over the forecast period.

- Based on the solution, the Picture Archiving and Communication System (PACS) segment is expected to account for the largest market share during the forecast period.

- Based on the end-use, the diagnostic imaging centers are expected to capture the largest revenue share over the forecast period.

- Based on region, North America is expected to dominate the market during the forecast period.

Enterprise Imaging Solutions Market: Growth Drivers

The growing prevalence of chronic disease and the rising geriatric population drive the market growth

Government initiatives to speed up the longevity revolution have resulted in a fast aging of the global population. The majority of developed nations are witnessing a rise in the population of seniors. In 2019, there were 703 million individuals aged 65 or older, and the UN predicts that number will increase to 1.5 billion by the year 2050. Around the world, the prevalence of chronic diseases is increasing, especially in the areas of hypertension, diabetes, and respiratory issues. Over the forecast period, the market for enterprise imaging solutions will expand as a result of an aging population and an increase in chronic diseases.

Enterprise Imaging Solutions Market: Restraints

Security threats impede the market growth

Patient data safety and protecting patient information are two of the most urgent health IT issues in the sector. For cyber attackers, healthcare workers are important targets. Threats to digital security are continuously emerging from unanticipated sources. A centralized network, while providing significant efficiency gains and cost savings on storage solutions, is more susceptible to cybersecurity threats than networks working independently. This is one potential drawback of an enterprise imaging solution. Thus, the security issue is expected to hinder the enterprise imaging solutions industry's growth.

Enterprise Imaging Solutions Market: Opportunities

The number of hospitals and diagnostic facilities is growing

The demand for better healthcare facilities is rising in tandem with the threat of disease and infection to humanity, and to meet this demand, major market players in the healthcare sector are expanding their networks across numerous nations worldwide. Diagnostic centers are expanding quickly in high-income countries like the U.S. Diagnostic facilities offer services like radiography, computed tomography, echocardiogram, photoacoustic imaging, and others. With the aid of this technology, early detection of chronic diseases like cancer, cardiovascular disease, and others is possible. According to the American Cancer Society, 80% of people diagnosed with cancer in the US are 55 years of age or older, and 57% are 65 years of age or older. Thus, this is expected to drive the enterprise imaging solutions market growth over the forecast period.

Enterprise Imaging Solutions Market: Challenges

The high cost of installation

A hospital-wide PACS implementation is expensive. Even though the cost of computer hardware and software has dropped significantly in recent years, installing a complete PACS in a 500-bed hospital would still cost between USD 1.5 million and USD 2.5 million, plus an additional 6% in yearly maintenance. Thus, the high cost of installation is expected to pose a major challenge for the enterprise imaging solutions market expansion.

Enterprise Imaging Solutions Market: Segmentation

The global enterprise imaging solutions industry is segmented based on the deployment mode, solution, end-use, and region.

Based on the deployment mode, the global market is bifurcated into on-premise and cloud. The cloud segment is expected to grow at the highest CAGR over the forecast period. In comparison to traditional IT solutions, a cloud-native solution generally makes extensive use of automation features in its application to run, support, and upgrade numerous customer accounts from a single instance. According to the Forbes article, cloud-native solutions aid in enabling flexibility, interoperability, efficiency, and resiliency. Thus, this is expected to drive market growth over the forecast period. Besides, the on-premise segment is expected to dominate the market over the forecast period. The growth in this segment is owing to the increased level of data security. Some healthcare organizations favor on-site solutions because they don't want to chance to transfer their sensitive patient data to a cloud platform. Moreover, they can add customization as per their need, in turn, driving the segment growth over the forecast period.

Based on the solution, the market is segmented into Vendor Neutral Archive (VNA), Picture Archiving and Communication System (PACS), Image Exchange, and Universal Viewer. The Picture Archiving and Communication System (PACS) segment is expected to account for the largest market share during the forecast period. The many advantages offered by PACS, include a substantial reduction in the time and physical obstacles associated with conventional film-based image retrieval, distribution, and display. PACS are extensively used by healthcare professionals because they store images digitally, negating the need to retain hard copies of the images. Thus, this advantage is expected to drive segmental growth over the forecast period.

Based on the end-use, the global enterprise imaging solutions industry is divided into hospitals, diagnostic imaging centers, and others. The diagnostic imaging centers are expected to capture the largest revenue share over the forecast period. The increasing use of diagnostic imaging, the rise in patient imaging volumes, and the accessibility of cutting-edge technology in diagnostic facilities are all contributing to the segment's development.

Recent Developments:

- In March 2022, at the HIMSS22 Global Health Conference & Exhibition, Royal Philips—a pioneer in health technology—announced its most recent developments in analytics and interoperability solutions. A fully integrated cloud-enabled health IT platform for meeting various workflow requirements across the imaging business is Philips HealthSuite Interoperability. To increase productivity and support greater efficacy at the point of care, Philips Enterprise Performance Analytics - Performance Bridge now offers operational insights and in-depth analytics to the cardiology department outside of radiology. Both developments are a part of Philips' portfolio of Data Management and Interoperability Solutions, a cohesive, scalable set of cutting-edge technology, analytics, and professional services intended to help healthcare providers constantly enhance performance.

- In March 2022, at booth 3947 of the Healthcare Information and Management Systems Society (HIMSS) 2022 Global Health Conference & Exhibition, which runs from March 15–March 18 at the Orange County Convention Center in Orlando, FL, FUJIFILM Healthcare Americas Corporation, a leading provider of enterprise imaging and informatics solutions, will highlight its award-winning Synapse Enterprise Imaging portfolio. Synapse Radiology PACS, Cardiology PACS, and Vendor Neutral Archive (VNA) are three cutting-edge solutions that Fujifilm showcased at HIMSS booth #3947. They were honored at the 2022 Best In KLAS® Show, which was hosted on March 14 and served as the official opening of HIMSS 2022.

- In September 2022, one of the biggest image exchange networks of curated clinical and imaging data, Life Image, has been acquired by Intelerad Medical Systems, a supplier of enterprise imaging solutions. By combining two of the top image exchange providers in the market, Intelerad is demonstrating its dedication to assisting clinicians and patients in driving the imaging transformation away from siloed PACS towards interoperable image exchange.

- In January 2023, Bayer acquired Blackford Analysis, a provider of artificial intelligence-based healthcare technology. By enabling the adoption and advantages of medical imaging AI, the company aims to "improve the lives of patients and populations." The acquisition will support this goal.

Enterprise Imaging Solutions Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Enterprise Imaging Solutions Market Research Report |

| Market Size in 2022 | USD 1.4 Billion |

| Market Forecast in 2030 | USD 3.8 Billion |

| Growth Rate | CAGR of 11.5% |

| Number of Pages | 199 |

| Key Companies Covered | IBM Corporation, GE HealthCare, Change Healthcare, Hyland Software, Inc., Merative, Pure Storage, Inc., Agfa-Gevaert Group, Dicom Systems, Inc., Canon Medical Informatics, Inc, IMEXHS, FUJIFILM Holdings America Corporation, Apollo Enterprise Imaging Corp., Koninklijke Philips N.V., PaxeraHealth, Siemens Healthcare GmbH, and Visage Imaging, Inc. among others. |

| Segments Covered | By Deployment Mode, By Solution, By End-Use, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Enterprise Imaging Solutions Market: Regional Analysis

North America is expected to dominate the market during the forecast period

North America is expected to dominate the global enterprise imaging solutions market during the forecast period. As a consequence of improved healthcare infrastructure and high healthcare spending in the region, research and development have increased. Additionally, the enterprise imaging solution market share in this region is growing as a result of quick advances in research and development, increased investment by major market participants, and supportive governmental regulations.

For instance, according to the American Medical Association, in 2021, the United States spent 2.7% more on health care, amounting to $4.3 trillion or $12,914 per person. Moreover, the growing number of imaging volumes along with the growing geriatric population in the region is expected to drive market growth. As per Administration on Aging (AoA), in the United States, there were 54.1 million people 65 and elderly as of 2019. More than one in seven Americans made up 16% of the population, represented. Since 2009, there have been 14.4 million more older Americans than there were in 2009 (a 36 percent rise), versus a 3% increase in the population under 65.

The number of Americans aged 45 to 64 (who will turn 65 over the next 20 years) rose by 4% from 80.3 million to 83.3 million between 2009 and 2019. Americans aged 60 and older grew from 55.7 million to 74.6 million, a 34% increase. These facts support the market expansion during the forecast period because the older population is vulnerable to different types of diseases which demand imaging solutions for the diagnosis of the disease.

The Asia Pacific is expected to grow at the highest CAGR over the forecast period. The growth in the region is attributed to the prevalence of chronic diseases such as cancer, cardiovascular and others. The American College of Cardiology reports a sharp rise in the number of cardiovascular disease (CVD) deaths in Asia. The Asia-Pacific region is responsible for half of all cardiovascular fatalities worldwide. The demand for medical imaging solutions is fueled by the region's rising prevalence of chronic diseases, which also contributes to the expansion of the enterprise imaging solution market.

Enterprise Imaging Solutions Market: Competitive Analysis

The global enterprise imaging solutions market is dominated by players like:

- IBM Corporation

- GE HealthCare

- Change Healthcare

- Hyland Software Inc.

- Merative

- Pure Storage Inc.

- Agfa-Gevaert Group

- Dicom Systems Inc.

- Canon Medical Informatics Inc

- IMEXHS

- FUJIFILM Holdings America Corporation

- Apollo Enterprise Imaging Corp.

- Koninklijke Philips N.V.

- PaxeraHealth

- Siemens Healthcare GmbH

- Visage Imaging Inc.

The global enterprise imaging solutions market is segmented as follows:

By Deployment Mode

- On-Premise

- Cloud

By Solution

- Vendor Neutral Archive (VNA)

- Picture Archiving and Communication System (PACS)

- Image Exchange

- Universal Viewer

By End-Use

- Hospitals

- Diagnostic Imaging Centers

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Enterprise imaging is a set of workflows, strategies, and initiatives that are been implemented in the healthcare enterprise to optimally and consistently store, manage, index, capture, analyze, exchange, view, and distribute all multimedia content and clinical imaging to improve the electronic health record. Enterprise imaging solutions offer healthcare systems meaningful data aiding to share, analyze, and unlock the information finally leading to better patient care.

The rise in penetration of cloud-based solutions in the healthcare sector, the rise in integration with enhanced electronic health records, and the growing necessity of better patient care services are some of the crucial factors that are boosting the growth of the global enterprise imaging solutions market.

According to the report, the global market size was worth around USD 1.4 billion in 2022 and is predicted to grow to around USD 3.8 billion by 2030.

The global enterprise imaging solutions market is expected to grow at a CAGR of 11.5% during the forecast period.

The global enterprise imaging solutions market growth is expected to be driven by North America. It is currently the world’s highest revenue-generating market owing to the growing medical imaging volumes along with the increasing geriatric population.

The global enterprise imaging solutions market is dominated by players like IBM Corporation, GE HealthCare, Change Healthcare, Hyland Software, Inc., Merative, Pure Storage, Inc., Agfa-Gevaert Group, Dicom Systems, Inc., Canon Medical Informatics, Inc, IMEXHS, FUJIFILM Holdings America Corporation, Apollo Enterprise Imaging Corp., Koninklijke Philips N.V., PaxeraHealth, Siemens Healthcare GmbH, and Visage Imaging, Inc. among others.

Choose License Type

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed