Fertilizer Additives Market Size, Share, Trends, Growth 2030

Fertilizer Additives Market By Function (Corrosion Inhibitors, Hydrophobic Agents, Anti-dusting Agents, Anti-caking Agents, Slow Release Coatings, and Others), By End-product (Urea, Ammonium Nitrate, Ammonium Phosphate, Ammonium Sulphate, and Others) and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2023 - 2030

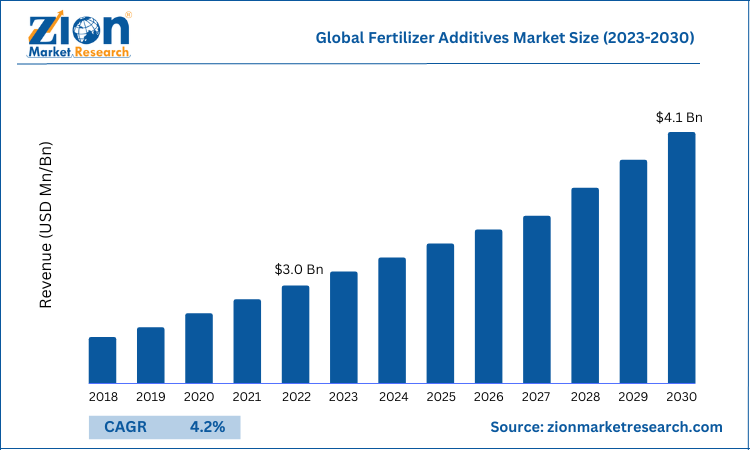

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 3.0 Billion | USD 4.1 Billion | 4.2% | 2022 |

Fertilizer Additives Industry Prospective:

The global fertilizer additives market size was worth around USD 3.0 Billion in 2022 and is predicted to grow to around USD 4.1 billion by 2030 with a compound annual growth rate (CAGR) of roughly 4.2% between 2023 and 2030.

The report analyzes the global fertilizer additives market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the fertilizer additives market.

Fertilizer Additives Market: Overview

To provide vital nutrients for plant growth, fertilizers are materials, either natural or synthetic, that are applied to the soil or plant tissues. To improve the quality of the soil and fertilizers and to ensure stability, fertilizer additives are employed in agricultural fields. They stop the corrosion of the shipping container and preserve soil nutrients including potassium, nitrogen, sulfur, and phosphorus.

They also give the fertilizer anti-caking and anti-foaming properties. Surface coatings may have major issues due to the foam. Fertilizers may contribute to the soil and plants' poor uptake of nutrients, which reduces soil fertility and slows plant development. There are a few chemical formulas that can stop the foam from forming. Few fertilizers are available in a powdered or granular form and the formation of the caking is higher in these materials, which results in product loss. To avoid such situations, anti-caking agents are used that facilitate easy consumption, packaging, and transport. These fertilizer additives are used in the production stage of the fertilizers or they have mixed while their application in the field.

Key Insights

- As per the analysis shared by our research analyst, the global fertilizer additives market is estimated to grow annually at a CAGR of around 4.2% over the forecast period (2023-2030).

- In terms of revenue, the global fertilizer additives market size was valued at around USD 3.0 billion in 2022 and is projected to reach USD 4.1 billion, by 2030.

- The global fertilizer additives industry is expanding and is anticipated to continue to grow over the next few years as a result of the expanding demand for fertilizer additives in the agriculture sector. It aids in preventing the loss of important chemicals throughout the production process, such as potassium, nitrogen, phosphorus, and sulfur.

- Based on function, the anti-caking agents segment held the largest revenue share in 2022.

- Based on the end product, the urea segment is expected to dominate the market over the forecast period.

- Based on region, the Asia Pacific is expected to dominate the market during the forecast period.

To know more about this report, Request a sample copy

Fertilizer Additives Market: Growth Drivers

Fertilizer additives used as corrosion inhibitor drives the market growth

The degradation of materials caused by chemical contact with their surroundings is known as corrosion. The effects of corrosion are numerous and diverse. They can have an impact on a person's digestive system, respiratory system, eyes, and skin, but they can also have a major negative impact on the safe, dependable, and efficient operation of equipment or buildings. Urea Ammonium Nitrate (UAN), for instance, is very corrosive to agricultural application equipment and, if not properly treated, can raise maintenance costs and result in unplanned equipment failures for product storage and transport. Corrosion inhibitors are specially formulated for the agricultural chemical industry and include corrosion inhibitors to address potential corrosion in the production, storage, and transportation processes. This results in high demand in the agricultural sector and has a significant positive impact on the industry for fertilizer additives.

Fertilizer Additives Market: Restraints

The nutrients in fertilizer may be deteriorated by additives limiting the market growth

To avoid lump formation, anti-caking chemicals are often employed in fertilizers. They are included to stop the decomposition of some nutrients, particularly vitamins. Anti-caking chemicals, however, have been proven to have a considerable negative impact on the chemical stability of vitamins and may even cause the nutrients in a powdered formulation to deteriorate. It could hasten the breakdown of advantageous chemicals rather than preserving certain nutrients, which would appear to be impeding the market expansion for fertilizer additives.

Fertilizer Additives Market: Opportunities

Increasing demand for food across the globe provides a lucrative opportunity

By 2050, the United Nations projects that there will be 9.2 billion people on the planet. According to this, the requirement for food would rise by 70% over the next 30 years as a result of the growing population. The need to increase food production is a result of this. Without the usage of fertilizers, the world will not be able to fulfill its expanding need for food production. Between 30 and 40 percent of the world's food is produced with commercial fertilizers. As a result, the need for fertilizer additives is increasing due to the growing need for food production, which is fueling the expansion of the fertilizer industry.

Fertilizer Additives Market: Challenges

The skin and respiratory system are damaged by fertilizers act as a major challenge to the industry expansion

If plant fertilizers are accidentally swallowed or breathed, they can be toxic to both humans and animals. The fertilizer may irritate the skin when handled, and it may be deadly if consumed. The poisoning-causing components are nitrates. A kind of nitrogen that plants may readily take is nitrates. Although necessary for plant development, large quantities of nitrogen in humans can be extremely hazardous. Nitrates reduce the capacity of red blood cells within our bodies to transport and distribute oxygen. The fertilizer additives industry is anticipated to suffer from these difficulties in fertilizer manufacturing.

Fertilizer Additives Market: Segmentation

The global fertilizer additives industry is segmented based on function, end-product, and region.

Based on function, the global market is bifurcated into corrosion inhibitors, hydrophobic agents, anti-dusting agents, anti-caking agents, slow-release coatings, and others. The anti-caking agents segment held the largest revenue share in 2022 and is expected to show its dominance over the forecast period. While stored, the majority of fertilizers tend to aggregate, and when applied in the field, fertilizer distribution will be erratic if it is not free-flowing. These circumstances can diminish the value of fertilizer and occasionally even cause harm to it.

In rare cases, they can even pose a hazard to the safety of industry personnel. Increasing anti-caking chemicals in fertilizer can increase product marketability, increase workplace safety, protect equipment, save transportation and handling costs, make it simpler to comply with regulations, and minimize airborne dust. Also, when a provider can launch a fertilizer product with the proper treatment, it will maximize market value while reducing the risk of quality disputes. Hence, the market for fertilizer additives is projected to benefit directly from the need for anti-caking agents.

Based on the end product, the global fertilizer additives industry is segmented into urea, ammonium nitrate, ammonium phosphate, ammonium sulfate, and others. The urea segment is expected to dominate the market over the forecast period. The most widely used nitrogenous fertilizer is urea, which is readily available and simple to produce.

Demand for urea is expected to increase in developing nations like India and Brazil. Because of its high nitrogen concentration, it is a preferred choice among farmers. Also, it is widely utilized by farmers and is freely accessible on the market, especially in the developing Asia-Pacific region. On the other hand, the ammonium nitrate segment is expected to grow at the highest CAGR over the forecast period. The nature that ammonium nitrate includes both nitrate and ammonia makes it one of the main sources of nitrogen.

It is more affordable than other nitrogenous products and has a higher nutritional value, which has enhanced its appeal among farmers. After urea, it is the nitrogenous product that is utilized the most frequently. In South America and Asia Pacific, growing economies that are thought to be price-sensitive, ammonium nitrate use has increased dramatically. The cheap cost and high nitrogen and ammonium content of ammonium nitrate can be ascribed to its rising demand.

Recent Developments:

- In April 2020, BASF introduced 'Limus Clear,' a novel urease inhibitor that may be used with liquid fertilizer (UAN) to reduce nitrogen losses and maintain optimal nitrogen availability for the crop.

- In January 2021, a company in Pennsylvania named Phospholutions secured USD 10.3 million in investment from VC investors for its Series A round. RhizoSorb, a product of Phospholutions, is a fertilizer addition that may be used in conjunction with phosphate fertilizers or added to them during production.

- In September 2022, Nouryon agreed to acquire ADOB Fertilizers, a prominent producer of chelated micronutrients, foliars, and other specialty fertilizers. The acquisition will allow Nouryon to extend its product line and enhance its offers to crop nutrition clients.

- In October 2022, OCP Group, a pioneer in phosphate-based plant and animal nutrition products, signed a legally binding agreement that provides for it to initially purchase 50% of Global Feed S.L. from Fertinagro Biotech S.L., a significant Spanish fertilizer manufacturer.

Fertilizer Additives Market Report Scope:

| Report Attributes | Report Details |

|---|---|

| Report Name | Fertilizer Additives Market Research Report |

| Market Size in 2022 | USD $3.0 Billion |

| Market Forecast in 2030 | USD $4.1 Bllion |

| Compound Annual Growth Rate | CAGR of 4.2% |

| Number of Pages | 201 |

| Forecast Units | Value (USD Billion), and Volume (Units) |

| Key Companies Covered | Clariant, Solvay, Calnetix Technologies, Filtra Catalysts & Chemicals Ltd, KAO Corporation, Tolsa Group, ChemSol LLC, Chemipol, Forbon Application, Calnetix Technologies LLC, Michelman, British Sulphur, Cameron Chemicals, Lignotechagro, Europiren B.V, Golden Grain Group Limited, Rock Chemie Co, Volant Chem, Saudi Specialty Ind. and Chemical Co. Ltd. among others. |

| Segments Covered | By Function, By End-product, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East and Africa (MEA) |

| Countries Covered | North America: U.S and Canada Europe: Germany, Italy, Russia, U.K, Spain, France, Rest of Europe APAC: China, Australia, Japan, India, South Korea, South East Asia, Rest of Asia Pacific Latin America: Brazil, Argentina, Chile The Middle East And Africa: South Africa, GCC, Rest of MEA |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Fertilizer Additives Market: Regional Analysis

The Asia Pacific is expected to dominate the market during the forecast period

The Asia Pacific is expected to dominate the fertilizer additives market during the forecast period. Throughout the projection period, it is anticipated that the expansion of the agricultural sector in developing nations like China and India would increase the demand for additives. A primary industry, agriculture has a significant role in determining the GDP of the countries in this region, including China and India. For instance, according to Inc42, the Indian agriculture sector would grow to US$ 24 billion by 2025.

The Indian food and grocery market is the sixth largest in the world, with retail accounting for 70% of total sales. Total foodgrain output in the nation is anticipated to be 149.92 million tonnes based on First Advance Estimates for FY 2022-23 (Kharif alone). Moreover, as a result of the shrinking agricultural land due to population growth, farmers are under more stress and have fewer options for the land. These elements have raised the demand for fertilizers, which has boosted the market for additives.

Throughout the past few years, China's agriculture industry has seen technological advancements and breakthroughs. The amount of arable land in China has drastically decreased over the previous two decades as a result of the population boom. Due to this cause, the market for additives has expanded as a result of increasing demand for fertilizers. In the Asia Pacific region, China accounted for more than one-fourth of the market for additives in 2019.

North America is expected to hold the largest market share over the forecast period. The United States dominates the market for fertilizer additives in North America. In this region, urea and ammonium nitrate were the most often used fertilizers last year. The region's governments now place a high priority on crop management planning, which will likely have a beneficial effect on the market for fertilizer additives in the years to come.

The United States is the world's largest producer and exporter of phosphorus, and it dominates the market for fertilizer additives in North America. The nation has seen a marked increase in the need for fertilizers and, consequently, fertilizer additives. Due to the wide range of storage temperatures, anti-caking compounds were the most often utilized fertilizer additions in the U.S. Thus, driving the market growth in the region during the forecast period.

Fertilizer Additives Market: Competitive Analysis

The global fertilizer additives market is dominated by players like:

- Clariant

- Solvay

- Calnetix Technologies

- Filtra Catalysts & Chemicals Ltd

- KAO Corporation

- Tolsa Group

- ChemSol LLC

- Chemipol

- Forbon Application

- Calnetix Technologies LLC

- Michelman

- British Sulphur

- Cameron Chemicals

- Lignotechagro

- Europiren B.V

- Golden Grain Group Limited

- Rock Chemie Co

- Volant Chem

- Saudi Specialty Ind.

- Chemical Co. Ltd.

The global fertilizer additives market is segmented as follows:

By Function

- Corrosion Inhibitors

- Hydrophobic Agents

- Anti-dusting Agents

- Anti-caking Agents

- Slow Release Coatings

- Others

By End-product

- Urea

- Ammonium Nitrate

- Ammonium Phosphate

- Ammonium Sulphate

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Fertilizers are natural or synthetic materials applied to the soil or plant tissues to supply essential nutrients for the growth of plants. Fertilizer additives are used in the crop field to enhance the quality of fertilizers and soil and provide stability.

The popularity of fertilizer additives is increasing among the farmers for prevention of essential nutrients, which may drive the global fertilizer additives market in future. They also perform several important functions such as anti-dusting agents, corrosion inhibitors, and hydrophobic agents during storage and transportation this is anticipated to boost the growth in the global market.

According to the report, the global market size was worth around USD 3.0 billion in 2022 and is predicted to grow to around USD 4.1 billion by 2030.

The global fertilizer additives market is expected to grow at a CAGR of 4.2% during the forecast period.

The global fertilizer additives market growth is expected to be driven by the Asia Pacific. It is currently the world’s highest revenue-generating market owing to the expansion of the agricultural sector in developing nations like China and India.

The global fertilizer additives market is dominated by players like Clariant, Solvay, Calnetix Technologies, Filtra Catalysts & Chemicals Ltd, KAO Corporation, Tolsa Group, ChemSol LLC, Chemipol, Forbon Application, Calnetix Technologies LLC, Michelman, British Sulphur, Cameron Chemicals, Lignotechagro, Europiren B.V, Golden Grain Group Limited, Rock Chemie Co, Volant Chem, Saudi Specialty Ind. and Chemical Co. Ltd. among others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed