Fishing Vessel Market Size, Share, Industry Analysis, Trends, Growth, 2032

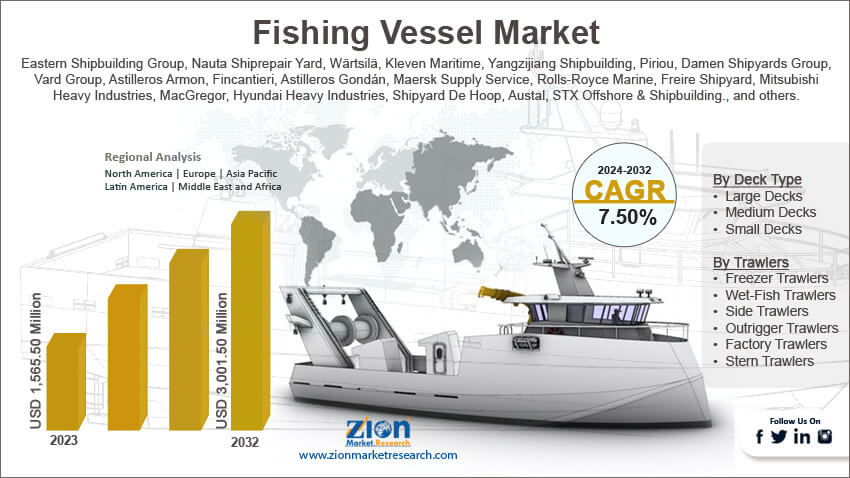

Fishing Vessel Market By Deck Type (Large Decks, Medium Decks, and Small Decks), By Trawlers (Freezer Trawlers, Wet-Fish Trawlers, Side Trawlers, Outrigger Trawlers, Factory Trawlers, and Stern Trawlers), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

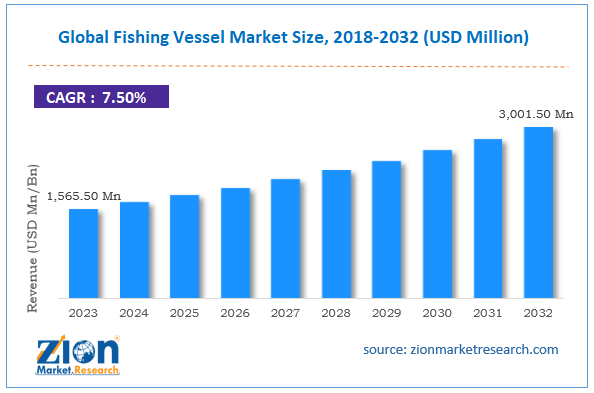

| USD 1,565.50 Million | USD 3,001.50 Million | 7.50% | 2023 |

Fishing Vessel Industry Prospective:

The global fishing vessel market size was worth around USD 1,565.50 million in 2023 and is predicted to grow to around USD 3,001.50 million by 2032 with a compound annual growth rate (CAGR) of roughly 7.50% between 2024 and 2032.

Fishing Vessel Market: Overview

A fishing vessel is a ship or boat specifically designed for catching fish and other forms of nektonic marine animals such as krills, shrimps, coleoids, and others in rivers, seas, or lakes. Over time, several types of fishing vessels have been developed for recreational, artisanal, and commercial fishing. Modern fishing vessels are available across sizes and dimensions depending on the fishing capacity of the fishing company or individual employing the vessel. However, certain features are available in almost all types of vessels for fishing. The common features include fishing traps, nets, and in some cases installations of smart and advanced technologies such as navigation and sonar systems. The fishing vessel chosen for the activity depends on the type of target fish.

For instance, longliners are considered more efficient in catching fish species such as swordfish and tuna. The fishing industry is registering several challenges due to the impact of overfishing on the marine environment and ecosystem. However, the cultural importance of fishing vessels in certain communities across the globe cannot be denied. During the forecast period, the industry for fishing vessels is expected to grow at a steady pace.

Key Insights:

- As per the analysis shared by our research analyst, the global fishing vessel market is estimated to grow annually at a CAGR of around 7.50% over the forecast period (2024-2032)

- In terms of revenue, the global fishing vessel market size was valued at around USD 1,565.50 million in 2023 and is projected to reach USD 3,001.50 million by 2032.

- The market is projected to grow at a significant rate due to the growing demand for fish in the HORECA industry.

- Based on deck type segmentation, the medium decks segment is expected to dominate the global market during the forecast period.

- Based on trawlers segmentation, the factory trawlers segment is growing at a high rate and is projected to dominate the global market.

- On the basis of region, North America is projected to swipe the largest market share.

Request Free Sample

Request Free Sample

Fishing Vessel Market: Growth Drivers

Growing demand for fish in the HORECA industry will lead to higher market growth

The global fishing vessel market is expected to grow due to the rising demand for fish in the hotel, restaurant, and cafe (HORECA) industry. The changing consumer lifestyle as well as an increase in the dining out culture where most people regularly prefer to consume food at commercial centers such as hotels and restaurants. The HORECA sector is one of the fastest-growing industries. In 2022, the global HORECA market was valued at over USS 1.9 trillion, and during the projection period, it is expected to deliver high results. Since COVID-19 travel restrictions have been lifted, more people are willing to travel domestically or internationally. This in turn further impacts the demand in the HORECA sector as most people traveling to new destinations are guaranteed to spend heavily on exploring local cuisines and food services.

The rise in disposable income as well as the growing consumer awareness level has further impacted the demand for fish and related products in the food service industry. Restaurants specializing in fish-based food are frequently experimenting with new offerings. In February 2024, the Corsaro brothers, the team behind the launch of Made in Italy and La Mia Mamma brands in London announced plans to expand their restaurant portfolio with the launch of a new unit based on the fish & bubbles concept. In June 2023, Cape Town in Africa registered the launch of a new seafood restaurant with principles based on sustainability.

Growing focus on sustainable fishing practices will create a higher demand for efficient fishing vessels

The fishing industry is a prominent sector providing livelihood to billions of people across the globe. The regional governments and environmental agencies are focusing on deploying sustainable fishing practices to ensure that the environmental integrity of marine ecosystems remains unhindered while the fishing industry continues to thrive. For instance, the Magnuson–Stevens Fishery Conservation and Management Act regulates and manages fisheries in the federal waters of the US. It covers areas of concern such as overfishing and rebuilding of overfished stocks. This trend is further encouraged by the adoption of improved technologies thus helping the global fishing vessel market grow.

Fishing Vessel Market: Restraints

High cost of fishing vessels is a growth-restricting attribute

The global industry for fishing vessels is expected to be restricted due to the high cost of fishing vessels. These vehicles are crafted with extreme precision. Additionally, the base materials used for the production of fishing vessels are equally expensive. Some of the common raw materials used in the production of fishing vessels are aluminum, steel, or composite materials. The cost of small fishing vessels is around USD 10,000. However, modern vessels can cost as high as USD 50,000. Moreover, the maintenance and operation of fishing vessels is reasonably high.

Fishing Vessel Market: Opportunities

Increasing focus on deep-sea fishing may generate high-growth opportunities

The global fishing vessel market is expected to generate high growth opportunities due to the growing focus on deep-sea fishing. In March 2023, the Indian government distributed fishing vessels designed for deep-sea exploration activities to 5 fishing cooperative societies. These vessels will allow fishing companies to explore an exclusive Economic Zone that extends 200 nautical miles beyond regional waters. In a recent event, researchers at the University of Queensland, Australia, co-led a project for the building of a robust and cost-effective pen that can be used in deep sea fishing thus helping meet the food demands of the growing population.

In addition to this, the increasing international collaboration between companies operating in the fishing industry will generate high growth possibilities for fishing vessels. In January 2024, Turkish investors were invited by Indonesia to participate in tuna farming in the Biak Numfor district of the Papua region. Indonesia plans to make the area a tuna export hub.

Rising launch of new fishing vessels will open new avenues for expansion

The increasing research & development (R&D) toward the production of high-tech fishing vessels will carve new avenues for further growth during the forecast period. The key areas of development are vessel safety, technological standpoint, and load-bearing capacity in rough waters.

In August 2023, Oman Pelagic announced the launch of a modern fishing vessel for tuna. The state–of–the–art unit will explore the Indian Ocean. It is 84 meters long and has a capacity of 1,800 cubic meters. In August 2023, Fisheries Development Oman (FDO) launched a new vehicle Acila to scout Oman waters and help the region in achieving economic growth.

Fishing Vessel Market: Challenges

Curbing environmental damage caused by fishing vessels will be a primary challenge

The global fishing vessel market is expected to be challenged by the environmental damage caused by the vessels. Fishing equipment runs on fuel thus putting the marine ecosystem at the risk of fuel leakage in case of equipment failure or damage. Moreover, the fishing industry is often criticized for overfishing thus leading to complete disruption of marine biology.

Fishing Vessel Market: Segmentation

The global fishing vessel market is segmented based on deck type, trawlers, and region.

Based on deck type, the global fishing vessel market is divided into large decks, medium decks, and small decks. In 2023, the highest revenue-generating segment was medium decks. These vessels are ideal for all fishing activities. They are easy to maneuver and deploy. They are also more affordable and easier to maintain. Most medium-dark fishing vehicles are 65 to 165 feet in length. The rising fishing activities in sea and lake regions are expected to drive the segmental demand.

Based on trawlers, the global fishing vessel market is segmented into freezer trawlers, wet-fish trawlers, side trawlers, outrigger trawlers, factory trawlers, and stern trawlers. In 2023, the highest demand was observed in the factory trawler segment. These units can handle high volumes of several types of fish. They are widely popular in industrial-scale fishing activities. Freezer trawlers also enjoy comprehensive popularity. They can cost between USD 10 million to over USD 90 million depending on the functional attributes.

Fishing Vessel Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Fishing Vessel Market |

| Market Size in 2023 | USD 1,565.50 Million |

| Market Forecast in 2032 | USD 3,001.50 Million |

| Growth Rate | CAGR of 7.50% |

| Number of Pages | 211 |

| Key Companies Covered | Eastern Shipbuilding Group, Nauta Shiprepair Yard, Wärtsilä, Kleven Maritime, Yangzijiang Shipbuilding, Piriou, Damen Shipyards Group, Vard Group, Astilleros Armon, Fincantieri, Astilleros Gondán, Maersk Supply Service, Rolls-Royce Marine, Freire Shipyard, Mitsubishi Heavy Industries, MacGregor, Hyundai Heavy Industries, Shipyard De Hoop, Austal, STX Offshore & Shipbuilding., and others. |

| Segments Covered | By Deck Type, By Trawlers, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Fishing Vessel Market: Regional Analysis

North America to be led by Canada and the United States during the forecast period

The global fishing vessel market will be led by North America during the projection period. Canada and the US are expected to deliver higher results in the coming years. These nations often deploy large fishing vessels for industrial fishing activities. In addition to this, North America is home to internationally popular fishing vessel manufacturers. Baffin Fisheries from Canada is expected to welcome the country’s largest fishing vessel in 2024. The vessel is named Inuksuk II and was launched in 2023 from Turkey. It is 18 meters wide and 80 meters in length.

In December 2023, Arctic Storm, a US-based fishing and processing company, launched a new vessel called Arctic Fjord. It is 328 feet long and is the country’s first pollock trawler built in the last 30 years. The growing demand for seafood in the North American market is expected to boost the use of small and medium-deck fishing vessels in the coming years. Asia-Pacific is expected to generate high revenue. China will lead the regional growth rate. The country has the largest fleet of fishing vessels. In 2022, it had more than 500,000 fishing vessels. The growing innovation in trawler design and capacity across players from Asian countries will fuel the regional market growth rate.

Fishing Vessel Market: Competitive Analysis

The global fishing vessel market is led by players like:

- Eastern Shipbuilding Group

- Nauta Shiprepair Yard

- Wärtsilä

- Kleven Maritime

- Yangzijiang Shipbuilding

- Piriou

- Damen Shipyards Group

- Vard Group

- Astilleros Armon

- Fincantieri

- Astilleros Gondán

- Maersk Supply Service

- Rolls-Royce Marine

- Freire Shipyard

- Mitsubishi Heavy Industries

- MacGregor

- Hyundai Heavy Industries

- Shipyard De Hoop

- Austal

- STX Offshore & Shipbuilding.

The global fishing vessel market is segmented as follows:

By Deck Type

- Large Decks

- Medium Decks

- Small Decks

By Trawlers

- Freezer Trawlers

- Wet-Fish Trawlers

- Side Trawlers

- Outrigger Trawlers

- Factory Trawlers

- Stern Trawlers

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

A fishing vessel is a ship or boat specifically designed for catching fish and other forms of nektonic marine animals such as krills, shrimps, coleoids, and others in rivers, seas, or lakes.

The global fishing vessel market is expected to grow due to the rising demand for fish in the hotel, restaurant, and cafe (HORECA) industry.

According to study, the global fishing vessel market size was worth around USD 1,565.50 million in 2023 and is predicted to grow to around USD 3,001.50 million by 2032.

The CAGR value of fishing vessel market is expected to be around 7.50% during 2024-2032.

The global fishing vessel market will be led by North America during the projection period.

The global fishing vessel market is led by players like Eastern Shipbuilding Group, Nauta Shiprepair Yard, Wärtsilä, Kleven Maritime, Yangzijiang Shipbuilding, Piriou, Damen Shipyards Group, Vard Group, Astilleros Armon, Fincantieri, Astilleros Gondán, Maersk Supply Service, Rolls-Royce Marine, Freire Shipyard, Mitsubishi Heavy Industries, MacGregor, Hyundai Heavy Industries, Shipyard De Hoop, Austal, and STX Offshore & Shipbuilding.

The report explores crucial aspects of the fishing vessel market including detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed