Floating Production Storage and Offloading (FPSO) Market Size, Share, Trends, Growth and Forecast 2030

Floating Production Storage and Offloading (FPSO) Market By Type (Converted, New-build, and Redeployed), By Propulsion (Self-propelled and Towed), By Hull Type (Single Hull and Double Hull), By Application (Shallow Water, Deepwater, and Ultra-deep Water), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2023 - 2030

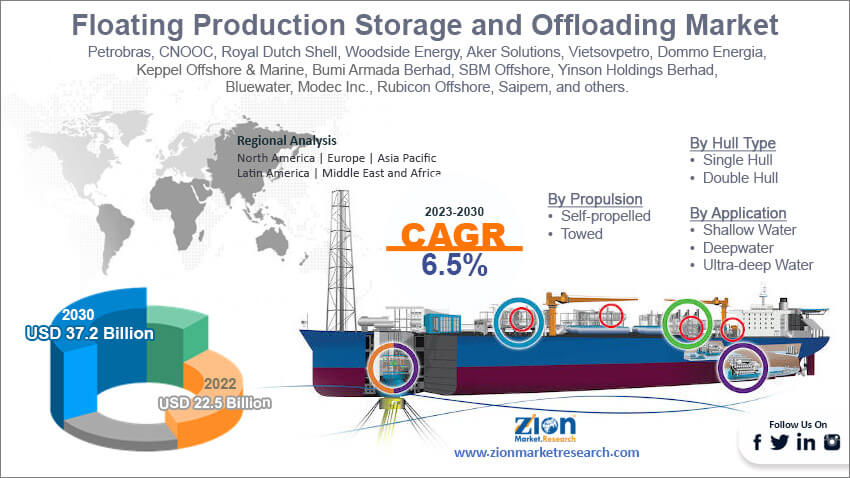

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 22.5 Billion | USD 37.2 Billion | 6.5% | 2022 |

Floating Production Storage and Offloading (FPSO) Industry Prospective:

The global Floating Production Storage and Offloading (FPSO) market size was worth around USD 22.5 billion in 2022 and is predicted to grow to around USD 37.2 billion by 2030 with a compound annual growth rate (CAGR) of roughly 6.5% between 2023 and 2030.

Floating Production Storage and Offloading (FPSO) Market: Overview

An offshore production facility known as floating production storage and offloading (FPSO) spaces produced hydrocarbon storage and processing machinery. Oil is handled and held at the storage facility until it is transferred to a large tanker for transportation and processing. This floating structure is a repurposed oil large transporter that resembles a ship and has onboard production and handling capabilities. Additionally, a large transporter using boats transports oil and gas from FPSOs to onshore locations. These vessels are used to extract or retrieve crude hydrocarbons from ocean bottoms, which are then processed at nearby preparation facilities.

Key Insights

- As per the analysis shared by our research analyst, the global Floating Production Storage and Offloading (FPSO) market is estimated to grow annually at a CAGR of around 6.5% over the forecast period (2023-2030).

- In terms of revenue, the global Floating Production Storage and Offloading (FPSO) market size was valued at around USD 22.5 billion in 2022 and is projected to reach USD 37.2 billion, by 2030.

- The growing offshore exploration and production of oil & gas is expected to drive the floating production storage and offloading market growth over the forecast period.

- Based on the type, the converted segment is expected to hold the largest market share over the forecast period.

- Based on the hull type, the double hull segment is expected to garner a significant revenue share over the projected timeframe.

- Based on region, North America is expected to dominate the market over the forecast period.

Request Free Sample

Request Free Sample

Floating Production Storage and Offloading (FPSO) Market: Growth Drivers

Increasing offshore oil & gas exploration and production drives the market growth

The development and production of offshore oil and gas resources is the main factor propelling the FPSO market. Exploration and development of offshore resources, particularly deepwater and ultra-deepwater, is on the rise as typical onshore assets become more difficult to reach. For instance, according to oilfield technology company SLB, offshore oil and gas exploration investment will increase by more than 20 percent in 2023. There are already more than 400 operating offshore rigs, according to SLB, and they are expected to rise by "low to mid-teens" in 2023 and "further double-digit growth" in 2024. SLB stated that the prognosis is still quite positive for the years after 2024. The business forecasts that over 30 nations will generate over $500 billion in worldwide final investment decisions (FIDs) between 2022 and 2025, of which over $200 billion may be attributed to deepwater exploration. If we compare the predicted offshore investment over this timeframe to that of 2016 to 2019, the total estimated surge would be 90%. Therefore, this is expected to drive the market growth over the forecast period.

Floating Production Storage and Offloading (FPSO) Market: Restraints

High capital investment impedes market growth

Capital is heavily invested in the floating production, storage, and offloading industry. Furthermore, a large amount of funding and a high initial expenditure are required for the construction and operation of the new floating production storage and offloading unit. The entire cost of the floating production storage and offloading vessel is made up of the costs associated with testing, operating, and deployment. Furthermore, floating production storage and offloading operators' return on investment is impacted by the rise in labor and material costs brought on by inflation. Consequently, during the projected period, this may limit the FPSO industry.

Floating Production Storage and Offloading (FPSO) Market: Opportunities

Growing number of contracts offer a lucrative opportunity for the market growth

The increasing number of contracts is expected to offer a lucrative opportunity for floating production storage and offloading market growth during the forecast period. For instance, in January 2023, Altera Infrastructure gave Aker Solutions a sizable contract to fully renovate the Petrojarl Knarr floating production, storage, and offloading vessel (FPSO), which will be repurposed at Equinor's Rosebank field development offshore the United Kingdom. The Altera-owned Petrojarl Knarr FPSO will be redeployed and used again as part of the development idea that has been chosen for the Rosebank field. The refurbishment will take place at the company's yard in Dubai, United Arab Emirates, and the work will be carried out under a joint venture (JV) with Drydocks World-Dubai. For the FPSO to be maintained in the field for 25 years without drydocking, a combination of work involving new construction, demolition, and life extension (hull, marine systems, and topsides) is needed under the Engineering, Procurement, and Construction (EPC) contract. Aker Solutions, in association with Citec Norway AS, ABB Norway AS, and OneSubsea Processing AS, will carry out the detailed design in Norway.

Floating Production Storage and Offloading (FPSO) Market: Challenges

Technological advancements and innovation pose a major challenge to market growth

Technological developments are what propel the sector ahead, but they can also provide difficulties. The floating production storage and offloading industry must strike a balance between innovation and the requirement for tested and reliable options when integrating new technology into FPSO designs, as doing so may involve significant monetary investments, posing a major challenge for the market growth over the projected timeframe.

Floating Production Storage and Offloading (FPSO) Market: Segmentation

The global Floating Production Storage and Offloading (FPSO) industry is segmented based on the type, propulsion, hull type, application, and region.

Based on the type, the global market is bifurcated into converted, new-build, and redeployed. The converted segment is expected to hold the largest market share over the forecast period. The segment expansion is attributed to its low initial outlay and quick procurement cycles. FPSOs that have been converted are floating production, storage, and offloading vessels that are made by modifying an existing transportation ship, usually a tanker that shuttles crude oil. It takes numerous weeks to transform a tanker into an FPSO. New-build FPSO, however, requires many years to construct. Thus, it is expected that the converted floating production storage and offloading market will grow significantly.

Based on the propulsion, the global market is bifurcated into self-propelled and towed.

Based on the hull type, the global floating production storage and offloading industry is bifurcated into single hull and double hull. The double hull segment is expected to garner a significant revenue share over the projected timeframe. This is explained by the distinctive feature of the double-hull design, which provides a specialized containment area and a decreased danger of oil spills. Double hull FPSOs are covered throughout by two or more outer waterproof layers that protect against moisture conditions, water leakage, and maritime pollution. Important market participants are also making more investments in double hull designs as a result of growing worries about water contamination brought on by tanker leaks of chemicals and oil into the ocean.

Based on the application, the global market is bifurcated into shallow water, deepwater, and ultra-deep water.

Floating Production Storage and Offloading (FPSO) Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Floating Production Storage and Offloading (FPSO) Market |

| Market Size in 2022 | USD 22.5 Billion |

| Market Forecast in 2030 | USD 37.2 Billion |

| Growth Rate | CAGR of 6.5% |

| Number of Pages | 225 |

| Key Companies Covered | Petrobras, CNOOC, Royal Dutch Shell, Woodside Energy, Aker Solutions, Vietsovpetro, Dommo Energia, Keppel Offshore & Marine, Bumi Armada Berhad, SBM Offshore, Yinson Holdings Berhad, Bluewater, Modec Inc., Rubicon Offshore, Saipem, and others. |

| Segments Covered | By Type, By Propulsion, By Hull Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Floating Production Storage And Offloading (FPSO) Market: Regional Analysis

North America is expected to dominate the market over the forecast period

North America is expected to dominate the floating production storage and offloading market over the forecast period. The market growth in the region is attributed to the growing deepwater exploration and production. FPSOs are often utilized in deepwater exploration and production activities. The Gulf of Mexico has seen increased interest in deepwater reserves, leading to the consideration of FPSOs for certain projects. For instance, according to the US Energy Information Administration, Offshore production has surged due to the Gulf of Mexico's recent robust output. The whole offshore output increased by 6.5% between 2005 and 2015. The Gulf of Mexico is predicted to witness an increase in output of around 0.1 million barrels per day (b/d) in 2016 and an additional 0.2 million b/d in 2017, due to the completion of several significant projects in 2016 and 2017. In contrast, it is anticipated that U.S. onshore output will decrease by 0.3 million b/d in 2017 and by 0.8 million b/d in 2016. Although deepwater projects are becoming more popular, the majority of offshore production occurs in shallow seas since they are less expensive and technically difficult. Companies find it more expensive and difficult to conduct exploratory drilling in deeper water, but as technology has advanced and shallower possibilities have run out, they are venturing into progressively deeper seas, especially in Brazil and the Gulf of Mexico. Thus, this is expected to drive the market growth in the region.

Floating Production Storage and Offloading (FPSO) Market: Competitive Analysis

The global Floating Production Storage and Offloading (FPSO) market is dominated by players like:

- Petrobras

- CNOOC

- Royal Dutch Shell

- Woodside Energy

- Aker Solutions

- Vietsovpetro

- Dommo Energia

- Keppel Offshore & Marine

- Bumi Armada Berhad

- SBM Offshore

- Yinson Holdings Berhad

- Bluewater

- Modec Inc.

- Rubicon Offshore

- Saipem

The global Floating Production Storage and Offloading (FPSO) market is segmented as follows:

By Type

- Converted

- New-build

- Redeployed

By Propulsion

- Self-propelled

- Towed

By Hull Type

- Single Hull

- Double Hull

By Application

- Shallow Water

- Deepwater

- Ultra-deep Water

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

An offshore production facility known as floating production storage and offloading (FPSO) spaces produced hydrocarbon storage and processing machinery. Oil is handled and held at the storage facility until it is transferred to a large tanker for transportation and processing. This floating structure is a repurposed oil large transporter that resembles a ship and has onboard production and handling capabilities. Additionally, a large transporter using boats transports oil and gas from FPSOs to onshore locations. These vessels are used to extract or retrieve crude hydrocarbons from ocean bottoms, which are then processed at nearby preparation facilities.

The demand for the Floating Production Storage Offloading (FPSO) Market has increased as a result of the rise in exploration activities brought on by the depletion of resources and the growth in deepwater and ultra-deepwater drilling, which necessitates the usage of FPSO to lower operating costs.

According to the report, the global floating production storage and offloading market size was worth around USD 22.5 billion in 2022 and is predicted to grow to around USD 37.2 billion by 2030.

The global Floating Production Storage and Offloading (FPSO) market is expected to grow at a CAGR of 6.5% during the forecast period.

The global Floating Production Storage and Offloading (FPSO) market growth is expected to be driven by North America. It is currently the world’s highest revenue-generating market due to the growing offshore exploration and production in the region.

The global Floating Production Storage and Offloading (FPSO) market is dominated by players like Petrobras, CNOOC, Royal Dutch Shell, Woodside Energy, Aker Solutions, Vietsovpetro, Dommo Energia, Keppel Offshore & Marine, Bumi Armada Berhad, SBM Offshore, Yinson Holdings Berhad, Bluewater, Modec Inc., Rubicon Offshore and Saipem among others.

The Floating Production Storage and Offloading (FPSO) market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

Choose License Type

List of Contents

Floating Production Storage and Offloading (FPSO)Industry Prospective:OverviewKey InsightsGrowth DriversRestraintsOpportunitiesChallengesSegmentationReport ScopeFloating Production Storage And Offloading (FPSO) Regional AnalysisCompetitive AnalysisThe global market is segmented as follows:By RegionHappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed

-market-size.png)