Food Packaging Technology & Equipment Market Size, Share, Industry Analysis, Trends, Growth, 2030

Food Packaging Technology & Equipment Market By Application (Confectionery Products, Dairy & Dairy Products, Fruits & Vegetables, Convenience Foods, Poultry, Seafood, & Meat Products, and Others), By Material (Plastics, Metal, Paper & Paperboard, Glass & Wood, and Others), By Type (Biodegradable, Aseptic, Active, Controlled, Intelligent, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2023 - 2030

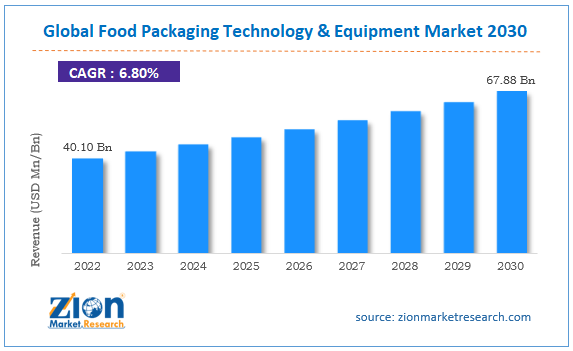

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 40.10 Billion | USD 67.88 Billion | 6.80% | 2022 |

Food Packaging Technology & Equipment Industry Prospective:

The global food packaging technology & equipment market size was worth around USD 40.10 billion in 2022 and is predicted to grow to around USD 67.88 billion by 2030 with a compound annual growth rate (CAGR) of roughly 6.80% between 2023 and 2030.

Food Packaging Technology & Equipment Market: Overview

Food packaging technology & equipment are used during the packaging process of food products. The equipment and technology used for protecting food products from external harm are a result of growing automation in the food and beverages (F&B) sector. With passing years, food packaging technology has evolved significantly since modern methods make use of modified atmosphere packaging (MAP) and oxygen scavengers that help in controlling the oxygen level that may come in contact with packaged food. In turn, this helps in preventing food oxidation and growth of all forms of harmful microorganisms thus improving product shelf life. Food packaging equipment, on the other hand, are pieces of machinery used for rapid packaging of food products. It is essential in achieving packaging optimization since bulk food products can be packaged in a shorter time as opposed to manual packaging. Several factors drive the global food packaging technology and equipment market growth and during the projection period, more revenue can be expected.

Key Insights:

- As per the analysis shared by our research analyst, the global food packaging technology & equipment market is estimated to grow annually at a CAGR of around 6.80% over the forecast period (2023-2030)

- In terms of revenue, the global food packaging technology & equipment market size was valued at around USD 40.10 billion in 2022 and is projected to reach USD 67.88 billion, by 2030.

- The food packaging technology & equipment market is projected to grow at a significant rate due to the increasing demand for packaged food products

- Based on application segmentation, convenience food was predicted to show maximum market share in the year 2022

- Based on type segmentation, biodegradable was the leading type in 2022

- On the basis of region, Asia-Pacific was the leading revenue generator in 2022

Request Free Sample

Request Free Sample

Food Packaging Technology & Equipment Market: Growth Drivers

Increasing demand for packaged food products to drive market growth

The global food packaging technology & equipment market is expected to grow owing to the increasing demand for packaged food products. This includes essential items such as grains, bakery items, snacks, cereals & breakfast food products, condiments & spices, frozen food, and every other possible edible article. The rising rate of urbanization with more people living hectic lifestyles is one of the primary drivers for higher consumption of packaged goods. A large section of the urban population does not have sufficient time to cook every meal of the day. In addition to this, packaged food does not take longer to cook especially frozen items or ready-to-eat meals which attracts more people who intend to spend less time cooking. Other factors such as increasing access to packaged food due to the launch and opening of several small to large-scale food retailers including supermarkets and hypermarkets, especially in emerging economies, have further pushed people toward packaged food products. A recent report indicated that nearly 70% of the American population consumes some form of processed food.

Rising introduction of new food packaging equipment to create higher sales

The burden on the food industry to provide sufficient food items to the rapidly expanding general population is reaching new levels with every passing year. This has resulted in growth in research & development leading to increasing launch of new food packaging equipment. In June 2022, Grace Food Processing & Packaging Machinery, a leading producer of snacks in the Indian market, launched its ‘Hot air GRACE pellet snack expander’ packaging equipment at the Snack & Bake Tec 2022 event. In August 2023, Ahlstrom, a manufacturer of fiber-based products, and The Paper People, a sustainable packaging provider collaborated to launch a sustainable packaging solution for frozen food.

Food Packaging Technology & Equipment Market: Restraints

High cost of equipment and technology to restrict market growth

The global market growth may be limited due to the high cost associated with food packaging equipment. In addition to this, the development of novel food packaging technology requires intensive research with massive resource allocation. This could create hurdles for new players to enter the food packaging technology and equipment industry while existing companies may struggle with managing profit margins, especially in the current volatile commercial market. Moreover, the food industry, in general, is evolving rapidly as consumers become more demanding in terms of not only the food they consume but also the outer packaging since most plastic-based solutions are harmful to the environment. This means that companies offering food packaging solutions have to stay in sync with changing industry trends further creating additional barriers against growth.

Food Packaging Technology & Equipment Market: Opportunities

Untapped potential in the food industry of emerging economies to create growth opportunities

Developing nations with significant increases in per capita income and spending capabilities have tremendous untapped potential in the food sector. As food companies continue to explore these untouched regions, the players operating in the good packaging technology & equipment industry can expect higher demand for new systems. In February 2023, Cargill India made an entry into the South Asian market with a total investment of USD 35 million by acquiring an existing edible oil manufacturing facility in the Andhra Pradesh region of India. In July 2023, Granarolo SpA, Italy’s leading milk group, entered the Chinese market. Currently, the company has launched 3 products catering to the feeding needs of children up to 3 years.

Growing interest in smart food packaging technology to open new avenues for expansion

The increasing adoption of new technology could help in delivering better results. This includes systems related to tracing and tracking, freshness indicators, tamper-evidence, quality sensors, and antimicrobial packaging. In August 2023, researchers from the South Korea-based Yonsei University were working on learning about the application of cellulose-based hydrogels in food packaging solutions as a key material. It could prove to improve the biocompatibility and biodegradability of the packaging material.

Food Packaging Technology & Equipment Market: Challenges

Impact of downtime or maintenance of equipment on production levels to challenge market growth

Since machines used for food packaging have to undergo maintenance and quality checks, these equipment are prone to longer downtime resulting in the halt packaging assembly line. This directly impacts business operations and is a crucial challenge for the global market players to overcome in addition to the health and safety concerns of the workers operating the machine.

Food Packaging Technology & Equipment Market: Segmentation

The global food packaging technology & equipment market is segmented based on application, material type, and region.

Based on application, the global market is divided into confectionery products, dairy & dairy products, fruits & vegetables, convenience foods, poultry, seafood & meat products, and others. The food packaging technology & equipment industry was dominated by the convenience foods segment in 2022 due to the increased sales of packaged and ready-to-eat food products. During the forecast period, the global ready-to-eat food industry is expected to grow at a CAGR of more than 6%. The segment was poultry, seafood, & meat products is projected to grow significantly due to the application of highly advanced packaging technology and equipment used to package these products as they are highly prone to quality and nutrient degradation if not stored properly.

Based on material, the global market is divided into plastics, metal, paper & paperboard, glass & wood, and others.

Based on type, the global food packaging technology and equipment market is divided into biodegradable, aseptic, active, controlled, intelligent, and others. The highest demand was observed for the biodegradable variant as the food industry continues to reduce its operational impact on the environment. Food and beverage manufacturers are slowly trying to eliminate the consumption of plastic for packaging purposes resulting in higher application of environment-friendly solutions. Government regulations and rules around packaging material and technology have further pushed segmental growth. In an industrial composting environment, biodegradable packaging typically breaks down in 3 to 6 months.

Food Packaging Technology & Equipment Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Food Packaging Technology & Equipment Market |

| Market Size in 2022 | USD 40.10 Billion |

| Market Forecast in 2030 | USD 67.88 Billion |

| Growth Rate | CAGR of 6.80% |

| Number of Pages | 226 |

| Key Companies Covered | Bühler Group, Tetra Pak, IMA S.p.A., Robert Bosch GmbH, Uhlmann Group, Multivac, Krones AG, Bemis Company Inc. (Amcor), Coesia Group, GEA Group AG, Barry-Wehmiller Companies Inc., Graphic Packaging Holding Company, Syntegon Technology, Ishida Co. Ltd, Mettler-Toledo International Inc., and others. |

| Segments Covered | By Application, By Material, By Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Food Packaging Technology & Equipment Market: Regional Analysis

Asia-Pacific to witness a higher growth rate during the forecast period

The global food packaging technology & equipment market will be led by Asia-Pacific during the forecast period. This is mainly due to the fast-growing Asian economies such as China and India. These nations are home to some of the highest revenue-generated F&B sectors. In 2019, China’s food and beverage industry was valued at more than USD 590 billion and registered a jump of around 8% from the revenue generated in 2018. Increasing regional population, rampant urbanization, and a growing number of food distributors are some of the leading reasons for higher regional growth.

In addition to this, developed nations such as Japan and South Korea have extensive food industries especially markets for packaged food products. Asian countries are the exporters of food grains such as sugar, wheat, and rice among other items. With increased demand in the international market for these products, the consumption levels related to food packaging technology and equipment have surged in recent times. North America is projected to deliver considerable results as the US continues to invest in research and innovation leading development of novel systems in the food packaging industry.

Food Packaging Technology & Equipment Market: Competitive Analysis

The global food packaging technology & equipment market is led by players like:

- Bühler Group

- Tetra Pak

- IMA S.p.A.

- Robert Bosch GmbH

- Uhlmann Group

- Multivac

- Krones AG

- Bemis Company Inc. (Amcor)

- Coesia Group

- GEA Group AG

- Barry-Wehmiller Companies Inc.

- Graphic Packaging Holding Company

- Syntegon Technology

- Ishida Co. Ltd

- Mettler-Toledo International Inc.

The global food packaging technology & equipment market is segmented as follows:

By Application

- Confectionery Products

- Dairy & Dairy Products

- Fruits & Vegetables

- Convenience Foods

- Poultry

- Seafood

- Meat Products

- Others

By Material

- Plastics

- Metal

- Paper & Paperboard

- Glass & Wood

- Others

By Type

- Biodegradable

- Aseptic

- Active

- Controlled

- Intelligent

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Food packaging technology & equipment are used during the packaging process of food products.

Which key factors will influence food packaging technology & equipment market growth over 2023-2030?

The global food packaging technology & equipment market is expected to grow owing to the increasing demand for packaged food products.

According to study, the global food packaging technology & equipment market size was worth around USD 40.10 billion in 2022 and is predicted to grow to around USD 67.88 billion by 2030.

The CAGR value of the food packaging technology & equipment market is expected to be around 6.80% during 2023-2030.

Which region will contribute notably towards the food packaging technology & equipment market value?

The global food packaging technology & equipment market will be led by Asia-Pacific during the forecast period.

The global food packaging technology & equipment market is led by players like Bühler Group, Tetra Pak, IMA S.p.A., Robert Bosch GmbH, Uhlmann Group, Multivac, Krones AG, Bemis Company, Inc. (Amcor), Coesia Group, GEA Group AG, Barry-Wehmiller Companies, Inc., Graphic Packaging Holding Company, Syntegon Technology, Ishida Co., Ltd, and Mettler-Toledo International Inc.

The report explores crucial aspects of the food packaging technology & equipment market including a detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

Choose License Type

List of Contents

Food Packaging Technology EquipmentIndustry Prospective:Food Packaging Technology Equipment OverviewKey Insights:Food Packaging Technology Equipment Growth DriversFood Packaging Technology Equipment RestraintsFood Packaging Technology Equipment OpportunitiesFood Packaging Technology Equipment ChallengesFood Packaging Technology Equipment SegmentationFood Packaging Technology Equipment Report ScopeFood Packaging Technology Equipment Regional AnalysisFood Packaging Technology Equipment Competitive AnalysisThe global food packaging technology equipment market is segmented as follows:By RegionHappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed