Fuel Cards Market Size, Share, Growth Analysis Report 2032

Fuel Cards Market By type (Branded, Merchant, and Universal), By application (Fuel refill, Parking, Vehicle service, Toll charge, and others): Global Industry Analysis, Size, Share, Growth, Trends, and Forecast, 2024-2032

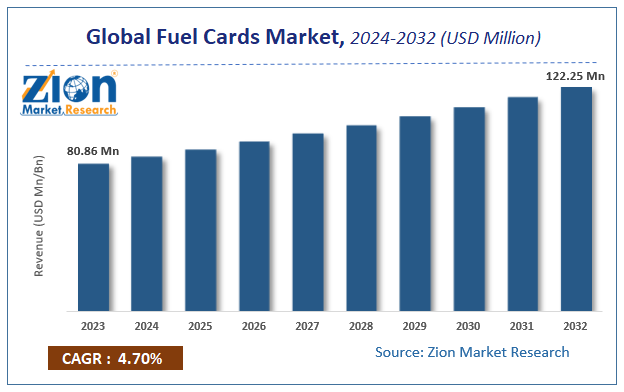

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 80.86 Million | USD 122.25 Million | 4.7% | 2023 |

Description

Fuel Cards Market Insights

The global Fuel Cards Market size was valued at USD 80.86 Million in 2023 and is predicted to reach USD 122.25 Million by the end of 2032. The market is expected to grow with a CAGR of 4.7% during the forecast period. The report analyzes the global Fuel Cards Market's growth drivers, restraints, and impact on demand during the forecast period. It will also help navigate and explore the arising opportunities in the Fuel Cards industry.

Global Fuel Cards Market: Overview

Fuel cards also termed fleet cards are the products of business that enable the drivers to purchase the fuel at the fuel station. It is similar to credit cards and works similarly. In addition to the fuel payment, the fuel cards are also used for the payment of maintenance of vehicles and other related expenses. To control and manage the consumption of fuel the fleets must keep a close watch on purchases of fuel. Fuel cards eliminate several manual tasks including the issuance of checks, submission of receipts, and auditing.

Global Fuel Cards Market: Growth Factors

Increasing demand for cashless fuel transactions, availability of a large number of value added services associated with fuel cards, and consolidation of the fragmented market are the major factors that are fostering the growth of the global fuel cards market. Additionally, the fuel cards enable the fleet managers to track the expenses of the fleet as well as its efficiency by tracking usage of fuel by the vehicles and real-time mileage. The fuel cards can also be used for repair, maintenance, replacement vehicle rental, cleaning, and many more. The fuel card also captures fuel product, odometer reading, fuel grades, tax information, driver ID, vehicle ID, and the quantity of fuel as well as details of the transactions which include spending amount, location, and time.

All these enhanced data captured by the fuel cards enable efficient administration of the fleet. Thus, there is a growing demand for fuel cards which in turn is spurring the growth of the global market. Moreover, factors such as the growing adoption of fuel cards for the payment at fuel stations, implementation of several programs that are beneficial for the customer, and growing number of the logistic industry are also contributing to the growth of the global market. Furthermore, the growing trend of digitalization and incorporation of IoT will lead to huge opportunities for the growth of the global fuel cards market during the forecast period. However, concerns regarding the security & privacy and volatile prices of oil are the factors that may restrain the growth of the global fuel cards market.

COVID-19 pandemic has severely affected almost all sectors across the world. Owing to the strict lockdown imposed by many governments there is an adverse impact on the transport and logistics sector which directly hampered the growth of the global market in the first quarter of the year 2020. However, banking and financial organizations are providing new digitals tools to customers that offer minimum contacts during the billing process. Banking institutes also offer additional discounts to the customers through fuel cards. Owing to such factors, fuel card market is expected to register a healthy growth rate in the COVID-19 pandemic situation. On the other side, rising online transactions to control the spread of infection may hamper the growth of the market over the forecast period.

Global Fuel Cards Market: Segmentation Analysis

The global fuel cards market is bifurcated based on type, application, and region.

Based on the type, the global fuel cards market is divided into a branded, merchant, and universal. Among these, universal card type is expected to dominate the segment over the forecast period.

Based on the application, the global fuel cards market is bifurcated into fuel refill, parking, vehicle service, toll charge, and others. Among these, the fuel refill segment is expected to dominate the application segment over the forecast period.

Fuel Cards Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Fuel Cards Market |

| Market Size in 2023 | USD 80.86 Million |

| Market Forecast in 2032 | USD 122.25 Million |

| Growth Rate | CAGR of 4.7% |

| Number of Pages | 193 |

| Key Companies Covered | Engen, FleetCor, Royal Dutch Shell, British Petroleum, First National Bank, Puma Energy, ExxonMobil, Oilibya, Wex Inc., and U.S. Bancorp, among others |

| Segments Covered | By type, By application and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Global Fuel Cards Market: Regional Analysis

North America is estimated to dominate the global fuel cards market followed by Europe. Factors such as the growing adoption of advanced payment options, growing preference for cashless transactions in the region, and presence of key players are expected to fuel the market growth in these regions over the forecast period. However, Asia Pacific is anticipated to be the most lucrative market during the forecast period. A large consumer base and growing investments by prominent market players in this region are expected to spur the fuel card market growth.

Global Fuel Cards Market: Competitive Players and Segments

Some of the major players operating in the global fuel cards market are

- Engen

- FleetCor

- Royal Dutch Shell

- British Petroleum

- First National Bank

- Puma Energy

- ExxonMobil

- Oilibya

- Wex Inc.

- and U.S. Bancorp, among others.

By Type

- Branded

- Merchant

- Universal

By Application

- Fuel refill

- Parking

- Vehicle service

- Toll charge

- others

Global Fuel Cards Market: Regional Segments

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

What Reports Provides

- Full in-depth analysis of the parent market

- Important changes in market dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional markets

- Testimonials to companies in order to fortify their foothold in the market.

Table Of Content

Choose License Type

FrequentlyAsked Questions

Increasing demand for cashless fuel transactions, availability of a large number of value added services associated with fuel cards and consolidation of the fragmented market are the major factors that are fostering the growth of the global fuel cards market. Furthermore, the growing trend of digitalization and incorporation of IoT will lead to huge opportunities for the growth of the global fuel cards market during the forecast period.

Some of the major players operating in the global fuel cards market are Engen, FleetCor, Royal Dutch Shell, British Petroleum, First National Bank, Puma Energy, ExxonMobil, Oilibya, Wex Inc., and U.S. Bancorp, among others.

North America is estimated to dominate the global fuel cards market followed by Europe. Factors such as the growing adoption of advanced payment options, growing preference for cashless transactions in the region, and present key players are expected to fuel the market growth in these regions over the forecast period.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed