Generator Sales Market Size, Share, Trends, Growth 2030

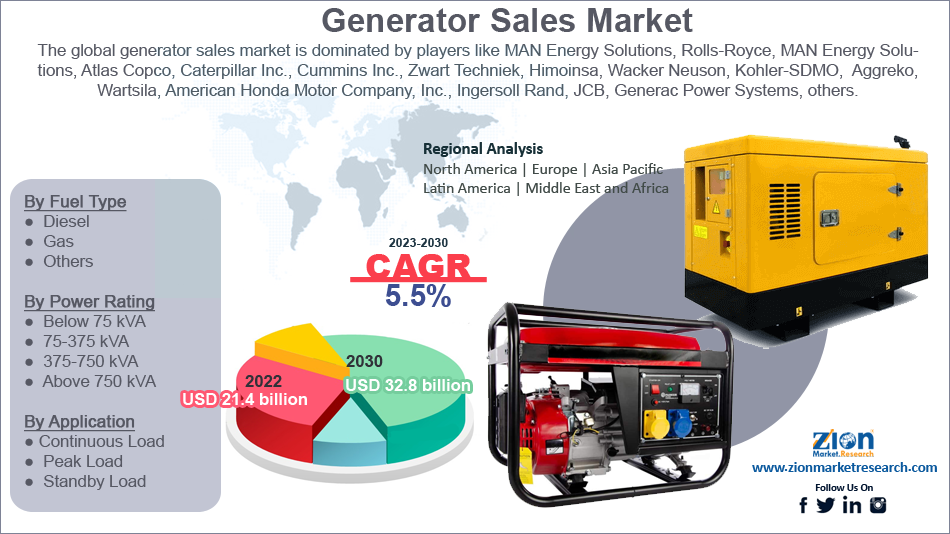

Generator Sales Market By Fuel Type (Diesel, Gas, and Others), By Power Rating (Below 75 kVA, 75-375 kVA, 375-750 kVA, and Above 750 kVA), By Application (Continuous Load, Peak Load, and Standby Load), By End User (Industrial, Commercial, and Residential) and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2023 - 2030

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 21.4 Billion | USD 32.8 Billion | 5.5% | 2022 |

Generator Sales Industry Prospective:

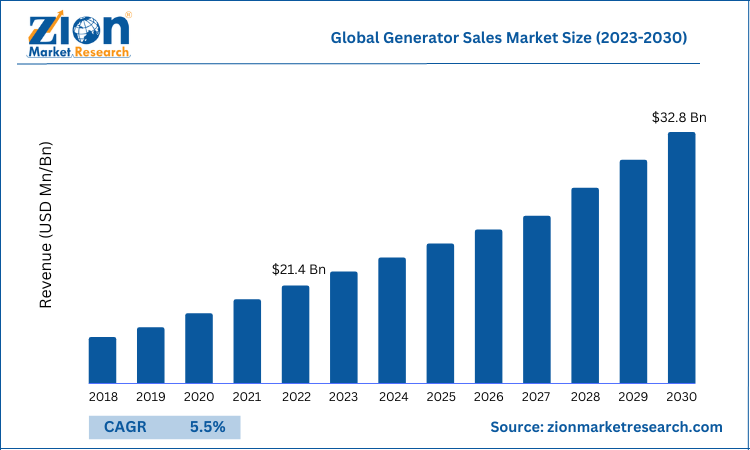

The global generator sales market size was worth around USD 21.4 Billion in 2022 and is predicted to grow to around USD 32.8 Billion by 2030 with a compound annual growth rate (CAGR) of roughly 5.5% between 2023 and 2030.

The report analyzes the global generator sales market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the generator sales market.

Generator Sales Market: Overview

A generator is a device that transforms mechanical energy into electrical energy for use in an external circuit with the aid of an electric motor. There is a sizable need for generator sales and service systems because of the quickly growing industrial sector. The need for a steady and dependable source of electricity has grown dramatically over the past several years, which has led to an increase in the sale of generators. In light of this, generators are considered a dependable way to give power backup in office buildings, data centers, and occasionally in emergency circumstances.

Key Insights

- As per the analysis shared by our research analyst, the global generator sales market is estimated to grow annually at a CAGR of around 5.5% over the forecast period (2023-2030).

- In terms of revenue, the global generator sales market size was valued at around USD 21.4 billion in 2022 and is projected to reach USD 32.8 billion, by 2030.

- Rising expenditures in developing new sophisticated industrial sector establishments and renovating existing setups are anticipated to boost the expansion of the generator sales market.

- Based on the fuel type, the diesel segment is expected to hold the largest revenue share in 2022.

- Based on the application, the standby load segment is expected to grow at the highest CAGR during the forecast period.

- Based on the end user, the industrial segment is expected to dominate the market during the forecast period.

- Based on region, the Asia Pacific is expected to hold the largest market share during the forecast period.

To know more about this report, Request a sample copy

Generator Sales Market: Growth Drivers

Growing infrastructural investment across the globe drives the market growth

One of the variables that might propel the global generator sales market ahead throughout the predicted period is rising infrastructure investment. Infrastructure spending may boost productivity across a range of industries and help the economy expand. Additionally, it is essential for local development. The market will have plenty of potential to expand as a result of the quick use of generators as backup electric power for infrastructure projects.

The US government announced plans to invest USD 2.25 trillion in April 2021 to upgrade its highways, levees, and other infrastructure. The generator sales market may benefit from enough growth potential as a result of these expenditures. Similarly, the Chinese government announced plans to invest USD 30 billion in March 2021 to upgrade Tibet's infrastructure, including new motorways and existing ones. Long-term, these expenditures may have further effects on the market expansion.

Generator Sales Market: Restraints

Stringent regulations imposed by the government limits the market growth

The government's increasingly strict environmental regulations to cut carbon emissions pose a significant obstacle to the generator sales industry expansion for generators. Environmental damage is caused by diesel generators. 1 liter of diesel used results in the production of 2.7 kg of carbon dioxide.

It also produces additional pollutants such as particulate matter and nitrogen oxides, in addition to carbon monoxide. Several governments have started different strategies and rules to decrease carbon footprints. For instance, the usage of cleaner alternatives to power generators will result from the European Union's climate neutrality targets by 2050. The aforementioned aspect will have a substantial influence on generator use, which will impede the market's expansion.

Generator Sales Market: Opportunities

Growing demand for generators from data centers provides a lucrative opportunity

One of the factors that might propel the global generator sales market during the forecast period is the rising need for generators for data centers. Data centers, which make it easier for users to access data rapidly, demand a lot of electricity for both their regular operations and for cooling the buildings in which they are housed. Approximately 1% of the world's power will be used by data centers in 2019, according to an estimate from the International Energy Agency. Additionally, operators of hyper-scale data centers spend millions of dollars on backup electric power sources to provide their customers with uninterrupted service, which will increase demand for generator sales.

Generator Sales Market: Challenges

Increasing adoption of energy storage technologies acts as a major challenge for the market expansion

Over the past several years, the energy storage business has experienced substantial growth. To speed up investments in battery storage for electric power systems in low- and middle-income countries, the World Bank Group has committed to investing USD 1 billion in a program in 2018. Additionally, market participants are investing in energy storage technologies. For instance, Greenko Energy Holdings invested around USD 1 billion in a brand-new battery storage business in 2020, which includes a proposal to manufacture lithium-ion batteries in India for use in large-scale power grid applications.

Generator Sales Market: Segmentation

The global generator sales industry is segmented based on fuel type, power rating, application, end user, and region.

Based on the product, the global market is bifurcated into diesel, gas, and others. The diesel segment is expected to hold the largest revenue share in 2022 and is expected to continue this pattern during the forecast period. Low maintenance costs, operations with high load, improved efficiency, and reliable operations may be credited for this. Diesel generator sales are also anticipated to increase due to features including easy transportation, storage, and rapid response to load variations.

On the other hand, the gas segment in the generator sales industry is expected to grow at a significant rate during the forecast period. The growth in the segment is attributed to the shift towards cleaner fuels. To cut emissions, developed nations including the US, Canada, the UK, Germany, France, the Netherlands, and Japan are accelerating the use of natural gas-based power production technology.

Based on the power rating, the generator sales industry is segmented into below 75 kVA, 75-375 kVA, 375-750 kVA, and above 750 kVA.

Based on the application, the global generator sales industry is divided into continuous load, peak load, and standby load. The standby load segment is expected to grow at the highest CAGR during the forecast period. Demand for backup gensets is rising as a result of expanding healthcare infrastructure and rising data center demand. Furthermore, the need for backup generators has increased as a result of severe weather and related power outages across the US. Electricity outages and the increasing need for continuous power during peak hours are predicted to boost the market for generators.

Based on the end user, the generator sales industry is segmented into industrial, commercial, and residential. The industrial segment is expected to dominate the market during the forecast period. As a backup during a power outage, the industrial sector depends on a dependable source of energy generation, such as a diesel generator, to avoid production risk.

The market for generator sales has been expanding as a result of factors including the absence of grid infrastructure in rural regions and government programs to promote infrastructure in emerging nations. Due to an increase in building activity globally, the construction industry consumed the most energy of any industrial sector. The rise of the construction industry has been attributed to important aspects such as expanding road construction projects, modifications to railway construction, and the development of metro rail systems. Thus, driving segmental growth.

Recent Developments:

- In January 2022, Honda revealed that it would soon start selling the brand-new EU32i portable generator with a newly created specialized engine (maximum output: 3.2kVA). Sales will start in the European zone, then they will spread to other parts of the world. The EU32i is suitable for precision equipment that requires high-quality electricity because it can deliver a consistent stream of high-quality electrical output with a smooth waveform.

- In April 2022, the acquisition of OK Generators by GenServe was announced by GenNx360 Capital Partners. GenServe is a portfolio company of GenNx360, a private equity firm located in New York that invests in industrial and middle-market business services providers. The acquisition of OK Generators significantly strengthens its presence in the South Florida market.

- In June 2021, Caterpillar Inc announced the addition of 12 new models to its rapidly expanding Cat® GC diesel generator set range. The new diesel generator set is intended primarily for fixed standby applications in the worldwide electrical contractor industry.

Generator Sales Market Report Scope:

| Report Attributes | Report Details |

|---|---|

| Report Name | Generator Sales Market Research Report |

| Market Size in 2022 | USD $21.4 Billion |

| Market Forecast in 2030 | USD $32.8 Bllion |

| Compound Annual Growth Rate | CAGR of 5.5% |

| Number of Pages | 190 |

| Forecast Units | Value (USD Billion), and Volume (Units) |

| Key Companies Covered | MAN Energy Solutions, Rolls-Royce, MAN Energy Solutions, Atlas Copco, Caterpillar Inc., Cummins Inc., Zwart Techniek, Himoinsa, Wacker Neuson, Kohler-SDMO, Inmesol S.L.U., Daihatsu Diesel Mfg. Co., Ltd., Aggreko, Wartsila, American Honda Motor Company, Inc., Ingersoll Rand, JCB, Generac Power Systems, FG Wilson, PRAMAC, John Deere, Briggs & Straton, Perfect Gas Generator, Kirloskar Electric Co. Ltd., Yanmar among others. |

| Segments Covered | By Fuel Type, By Power Rating, By Application, By End User, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East and Africa (MEA) |

| Countries Covered | North America: U.S and Canada Europe: Germany, Italy, Russia, U.K, Spain, France, Rest of Europe APAC: China, Australia, Japan, India, South Korea, South East Asia, Rest of Asia Pacific Latin America: Brazil, Argentina, Chile The Middle East And Africa: South Africa, GCC, Rest of MEA |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Generator Sales Market: Regional Analysis

The Asia Pacific is expected to hold the largest market share during the forecast period

The Asia Pacific is expected to hold the largest global generator sales market share over the forecast period. The growth in the region is attributed to rapid industrialization, growing construction activities, and rising expenditure on buildings and infrastructural projects.

For instance, according to the Department for Promotion of Industry and Internal Trade, foreign direct investment (FDI) totaled $ 26.17 billion and $ 26.30 billion between April 2000 and December 2021 in the construction development (townships, housing, built-up infrastructure, and construction development projects) and construction (infrastructure) activity sectors, respectively. Slightly more than 13% of the 81.72 billion dollars in overall FDI inflows in the fiscal year (FY) 2021 were attributable to infrastructure-related operations.

During the projection period, it is expected that India's infrastructure would rise at a compound annual growth rate (CAGR) of around 7%. Thus, the aforementioned facts supported the market expansion during the forecast period.

On the other hand, North America is expected to hold a substantial market share over the forecast period. The growth is mainly owing to being a high-income country, which allows the affordability of generators. Moreover, the growing investment in public buildings drives the market growth.

For instance, according to the United States Census Bureau, public construction investment in the United States increased from US$ 332.8 billion in 2019 to US$ 353.3 billion in June 2020. Furthermore, the key companies' strategic moves have also supported the market's expansion. For instance, Caterpillar Inc. announced in August 2020 that their 500 kW natural gas-fueled generator set for 60 Hz markets had received Stationary Emergency Certification from the United States Environmental Protection Agency (EPA). Caterpillar Inc. designs and manufactures a variety of generators and engines, including diesel and gas generators.

Generator Sales Market: Competitive Analysis

The global generator sales market is dominated by players like

- MAN Energy Solutions

- Rolls-Royce

- MAN Energy Solutions

- Atlas Copco

- Caterpillar Inc.

- Cummins Inc.

- Zwart Techniek

- Himoinsa

- Wacker Neuson

- Kohler-SDMO

- Inmesol S.L.U.

- Daihatsu Diesel Mfg. Co. Ltd.

- Aggreko

- Wartsila

- American Honda Motor Company Inc.

- Ingersoll Rand

- JCB

- Generac Power Systems

- FG Wilson

- PRAMAC

- John Deere

- Briggs & Straton

- Perfect Gas Generator

- Kirloskar Electric Co. Ltd.

- Yanmar

The global generator sales market is segmented as follows:

By Fuel Type

- Diesel

- Gas

- Others

By Power Rating

- Below 75 kVA

- 75-375 kVA

- 375-750 kVA

- Above 750 kVA

By Application

- Continuous Load

- Peak Load

- Standby Load

By End User

- Industrial

- Utilities/Power Generation

- Oil & Gas

- Chemicals & Petrochemicals

- Mining & Metals

- Manufacturing

- Others

- Commercial

- IT & Telecom

- Healthcare

- Data Centers

- Others

- Residential

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

A generator is a device that converts mechanical energy to electrical energy to use in an external circuit. This is done by an electric motor. It is a very useful device for electricity generation. The different types of mechanical energy include internal combustion engines, hand cranks, gas turbines, water turbines, and steam turbines. These can be converted into electrical energy through generators.

The generator sales market is a growing market owing to factors such as the amendment of norms and issuing of favorable regulations and policies regarding gas and diesel generators, increasing awareness about the environment, burgeoning urbanization in developing countries, and growing demand for IT facilities and data centers.

According to the report, the global market size was worth around USD 21.4 billion in 2022 and is predicted to grow to around USD 32.8 billion by 2030.

The global generator sales market is expected to grow at a CAGR of 5.5% during the forecast period.

The global generator sales market growth is expected to be driven by the Asia Pacific. It is currently the world’s highest revenue-generating market owing to rapid industrialization and growing infrastructural projects, especially in the countries like India and China.

The global generator sales market is dominated by players like MAN Energy Solutions, Rolls-Royce, MAN Energy Solutions, Atlas Copco, Caterpillar Inc., Cummins Inc., Zwart Techniek, Himoinsa, Wacker Neuson, Kohler-SDMO, Inmesol S.L.U., Daihatsu Diesel Mfg. Co., Ltd., Aggreko, Wartsila, American Honda Motor Company, Inc., Ingersoll Rand, JCB, Generac Power Systems, FG Wilson, PRAMAC, John Deere, Briggs & Straton, Perfect Gas Generator, Kirloskar Electric Co. Ltd., Yanmar among others.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed