Crepe Paper Market Size, Share, Growth, Forecast 2030

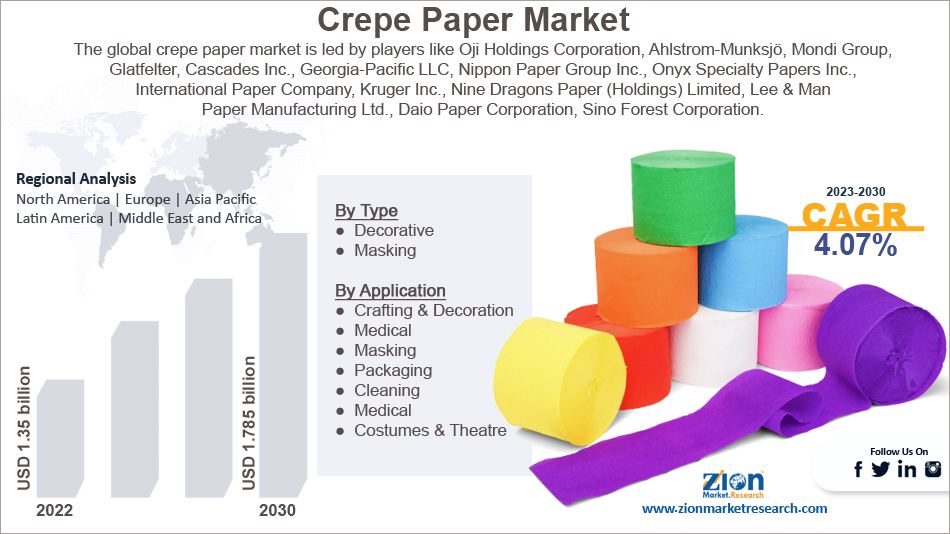

Crepe Paper Market By Type (Decorative and Masking), By Application (Crafting & Decoration, Medical, Masking, Packaging, Cleaning, Medical, and Costumes & Theatre), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2023 - 2030

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

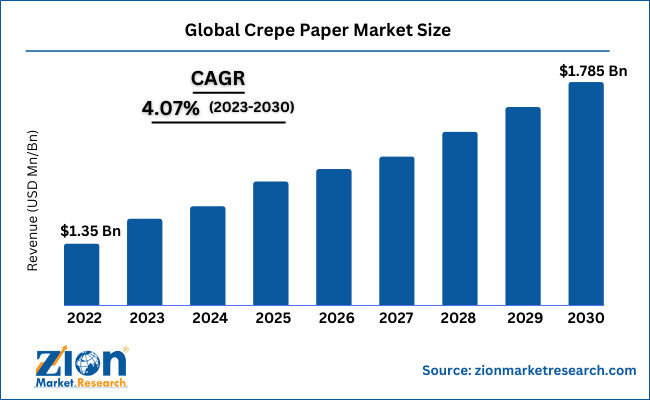

| USD 1.35 Billion | USD 1.78 Billion | 4.07% | 2022 |

Crepe Paper Industry Prospective:

The global crepe paper market size was worth around USD 1.35 Billion in 2022 and is predicted to grow to around USD 1.785 Billion by 2030 with a compound annual growth rate (CAGR) of roughly 4.07% between 2023 and 2030.

The report analyzes the global crepe paper market drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the crepe paper market.

Crepe Paper Market: Overview

The crepe paper industry is a segment of the larger paper and pulp industry and is driven by the growing sales of crepe paper which has a wrinkled and crinkled texture. Crepe paper is manufactured by a process called creping which involves stretching and compressing the paper fibers. This procedure causes the paper to contract leading to the creation of a crinkled texture. Crepe paper can be produced using a range of materials such as pulp, cotton, and synthetic fibers. It is available in multiple options in terms of thickness and color and has a variety of applications. For instance, decorative crepe paper is used in gift wrapping, crafting, and party decorations. The crepe paper industry is currently segmented based on type, application, and region with every segment being dominated by one specific sub-segment. During the forecast period, the industry is expected to encounter growth opportunities while having to deal with growth challenges.

Key Insights:

- As per the analysis shared by our research analyst, the global crepe paper market is estimated to grow annually at a CAGR of around 4.07% over the forecast period (2023-2030)

- In terms of revenue, the global crepe paper market size was valued at around USD 1.35 billion in 2022 and is projected to reach USD 1.785 billion, by 2030.

- The crepe paper market is projected to grow at a significant rate due to the growing demand for sustainable packaging solutions

- Based on type segmentation, decorative was predicted to show maximum market share in the year 2022

- Based on application segmentation, packaging was the leading application in 2022

- On the basis of region, North America was the leading revenue generator in 2022

Crepe Paper Market: Growth Drivers

Increasing demand for sustainable packaging solutions to propel market growth

The global crepe paper market is projected to grow owing to the increasing demand for sustainable packaging solutions. Crepe paper is an excellent alternative to traditional and more widely used packaging materials. They are biodegradable and recyclable which translates to higher sustainability in the long run. Traditional packaging solutions include cardboard and plastics. These components are not environment-friendly. Plastic is considered the worst pollutant in the packaging sector. As public awareness around irresponsible consumption habits is growing due to several factors, such as increased awareness-related initiatives by the government and other environmental agencies, the demand for crepe paper is likely to grow at a steady rate. Furthermore, the growing importance of attributes required for brand differentiation could lead to higher use of crepe paper that is available in several colors, shapes, and sizes.

Crepe Paper Market: Restraints

Increasing competition from alternatives to restrict market expansion

The global crepe paper industry is registering high competition from alternative packaging solutions. Although the end-users are showing more inclination toward sustainable packaging material, there is wide-scale availability of other environment-friendly materials, such as recycled paper and biodegradable plastics. They are the most cost-effective and readily available as compared to crepe paper. This could act as a significant barrier against growth during the forecast period.

Crepe Paper Market: Opportunities

Growing expansion in emerging economies to provide excellent growth opportunities

The global crepe paper industry players can expect higher growth opportunities from emerging markets or segments that remain unexplored. Countries like Africa and Asia have tremendous growth potential due to the increasing rate of disposable income and product awareness rate. In addition to this, the growing population of Asia marks a larger pool of consumers that can deliver more revenue. Furthermore, the growing emphasis by the government on sustainability could lead to higher importance and use of crepe paper as opposed to a traditional packaging in these countries.

Crepe Paper Market: Challenges

Raw material price volatility to challenge market growth

Raw materials used in the production of crepe paper include wood pulp or synthetic fibers. The cost associated with these materials is subject to a high volatility rate and any slight change in global supply chain dynamics can gravely impact the final product cost. The price is also susceptible to changes in other factors, such as weather patterns, and natural disasters. The profitability of crepe manufacturers remains under tremendous pressure in such situations making it difficult to forecast future trends.

Crepe Paper Market: Segmentation

The global crepe paper market is segmented based on type, application, and region.

Based on type, the global market segments are decorative and masking. In 2022, the highest growth was observed in the decorative segment since it is one of the largest types of application of crepe paper. They are used extensively for party decorations, gift wrapping, and crafting. Alternatively, masking paper has more applications in the painting and automotive industries where the paper is used as protecting surfaces during painting or other such applications. Moreover, decorative crepe paper is available in a wide variety of colors and patterns and hence appeals to a broader segment of consumers. According to the United States Department of Agriculture (USDA), in 2020, the United States alone produced close to 90.3 million metric tons of wood and paper products.

Based on application, the global crepe paper market segments are crafting & decoration, medical, masking, packaging, cleaning, medical, and costumes & theater. In 2022, the largest application of crepe paper was observed in the packaging segment since it is used to package a variety of products including electronics, food, and industrial goods. Crepe paper is further valued for its added advantages such as providing cushioning, protection, and support to fragile or delicate items during storage and transportation. As per rough calculations, producing 100 sheets of crepe paper with 20*26 inches dimension and weighing 17 grams per paper may require 1 kilogram of wood pulp.

Recent Developments:

- In July 2021, The Paper & Petal Studio announced the launch of a new range of colors for crepe paper. The company showcased the full range of colors on its website with each color being coded for better understanding. As per the company announcement, the new colors can be used in all types of settings including office space, nursery units, or weddings

- In January 2023, Andhra Paper Limited, India announced an investment of INR 2000 crore for the acquisition of paper board machinery which has a production capacity of 1,75,000 tonnes per annum (TPA). With the new addition, the pulp and paper board capacity of the company is expected to increase by 2,21,000 TPA and 1,56,000 TPA respectively

- In March 2023, Voith and Essity, the former being a technology company and the latter a hygiene and health firm, announced a partnership to develop a sustainable tissue production process

Crepe Paper Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Crepe Paper Market Research Report |

| Market Size in 2022 | USD 1.35 Billion |

| Market Forecast in 2030 | USD 1.785 Billion |

| Growth Rate | CAGR of 4.07% |

| Number of Pages | 219 |

| Key Companies Covered | Oji Holdings Corporation, Ahlstrom-Munksjö, Mondi Group, Glatfelter, Cascades Inc., Georgia-Pacific LLC, Nippon Paper Group Inc., Onyx Specialty Papers Inc., International Paper Company, Kruger Inc., Nine Dragons Paper (Holdings) Limited, Lee & Man Paper Manufacturing Ltd., Daio Paper Corporation, SCA Tissue North America LLC, Sino Forest Corporation, Twin Rivers Paper Company, Metsä Board Corporation, Stora Enso Oyj, Shandong Sun Paper Industry Joint Stock Co., Ltd., Domtar Corporation, Sappi Limited, Hokuetsu Corporation, UPM-Kymmene Corporation, Chenming Group, and Norske Skogindustrier ASA. |

| Segments Covered | By Type, By Application, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Crepe Paper Market: Regional Analysis

North America to continue its dominance over the global market

The global crepe paper market is expected to witness the highest growth in North America with the US and Canada leading the market. The regional segment is already mature and is showing excellent signs of growth. The increasing demand in the medical sector is of high significance to the regional industry since crepe paper is widely used for applications such as medical wrapping, bandages, and surgical gowns. As the region registers high investment in its existing advanced medical infrastructure, the demand for crepe paper along with other packaging solutions is likely to witness positive signs. In addition to this, the growing favor toward sustainable solutions in the packaging solution may lead to higher adoption of crepe papers. Furthermore, the sustainable and eco-friendly properties of these papers are likely to help them generate more demand.

Crepe Paper Market: Competitive Analysis

The global crepe paper market is led by players like:

- Oji Holdings Corporation

- Ahlstrom-Munksjö

- Mondi Group

- Glatfelter

- Cascades Inc.

- Georgia-Pacific LLC

- Nippon Paper Group Inc.

- Onyx Specialty Papers Inc.

- International Paper Company

- Kruger Inc.

- Nine Dragons Paper (Holdings) Limited

- Lee & Man Paper Manufacturing Ltd.

- Daio Paper Corporation

- SCA Tissue North America LLC

- Sino Forest Corporation

- Twin Rivers Paper Company

- Metsä Board Corporation

- Stora Enso Oyj

- Shandong Sun Paper Industry Joint Stock Co. Ltd.

- Domtar Corporation

- Sappi Limited

- Hokuetsu Corporation

- UPM-Kymmene Corporation

- Chenming Group

- Norske Skogindustrier ASA.

The global crepe paper market is segmented as follows:

By Type

- Decorative

- Masking

By Application

- Crafting & Decoration

- Medical

- Masking

- Packaging

- Cleaning

- Medical

- Costumes & Theatre

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The industry is a segment of the larger paper and pulp industry and is driven by the growing sales of crepe paper which has a wrinkled and crinkled texture.

The global crepe paper market is projected to grow owing to the increasing demand for sustainable packaging solutions.

According to study, the global crepe paper market size was worth around USD 1.35 billion in 2022 and is predicted to grow to around USD 1.785 billion by 2030.

The CAGR value of crepe paper market is expected to be around 4.07% during 2023-2030.

The global crepe paper market is expected to witness the highest growth in North America with the US and Canada leading the market.

The global crepe paper market is led by players like Oji Holdings Corporation, Ahlstrom-Munksjö, Mondi Group, Glatfelter, Cascades Inc., Georgia-Pacific LLC, Nippon Paper Group Inc., Onyx Specialty Papers Inc., International Paper Company, Kruger Inc., Nine Dragons Paper (Holdings) Limited, Lee & Man Paper Manufacturing Ltd., Daio Paper Corporation, SCA Tissue North America LLC, Sino Forest Corporation, Twin Rivers Paper Company, Metsä Board Corporation, Stora Enso Oyj, Shandong Sun Paper Industry Joint Stock Co., Ltd., Domtar Corporation, Sappi Limited, Hokuetsu Corporation, UPM-Kymmene Corporation, Chenming Group, and Norske Skogindustrier ASA.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed