Global TBR Tires Market Size, Share,Opportunities, Forecasts, 2028

Global TBR Tires Market By Application (Truck and Bus), By Sales Channel (OEM and Aftermarket), And By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2022 - 2028

| Market Size in 2021 | Market Forecast in 2028 | CAGR (in %) | Base Year |

|---|---|---|---|

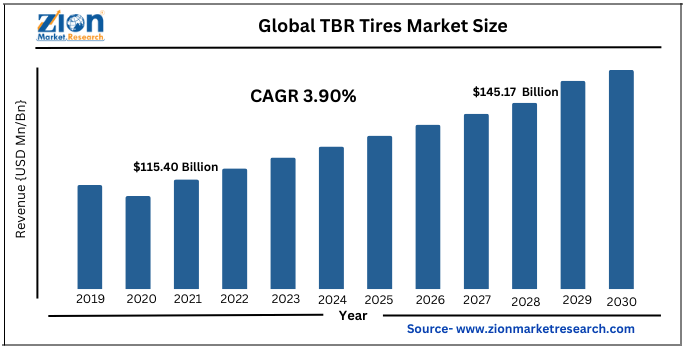

| USD 115.40 Billion | USD 145.17 Billion | 3.90% | 2021 |

TBR Tires Industry Perspective:

The global TBR tires market size was worth around USD 115.40 Billion in 2021 and is estimated to grow to about USD 145.17 Billion by 2028, with a compound annual growth rate (CAGR) of approximately 3.90 percent over the forecast period. The report analyzes the TBR tires market’s drivers, restraints/challenges, and their effect on the demands during the projection period. In addition, the report explores emerging opportunities in the TBR tires market.

TBR Tires Market: Overview

Radial Truck and Bus Tires (TBR) are designed for all types of heavy vehicles. TBR tires are designed primarily for off-road systems as they offer features such as high side adaptability, more ride comfort, less heat generation from the tires at high speeds, the ability to resist tire-related damage, and reduced fuel consumption through the better transmission of energy of vitality from machine to road. TBR tires are mainly used in two industries, trucking services, and public transport. The global radial tire market for trucks and buses (TBR) has grown significantly in recent years. Extensive road networks in many countries have boosted the production of trucks, buses, and other public transport vehicles, driving the demand for radial tires. The gradual increase in midsize truck production, R&D progress in the production of TBR tires, and initiatives by government agencies to strengthen the transportation sector are driving the growth of the global market. Bridge for trucks and buses (TBR). The higher cost of radial tires than conventional tires hinders development in the worldwide TBR tire market. The burgeoning e-commerce industry and increased transportation and logistics demand are lucrative opportunities for the global TBR tires market.

Key Insights

- Global TBR tires market is projected to grow at a CAGR of 3.90% from 2022 to 2028.

- The global TBR tires market size was worth around USD 115.40 billion in 2021 and is estimated to grow to about USD 145.17 billion by 2028

- The gradual increase in midsize truck production, R&D progress in the production of TBR tires, and initiatives by government agencies to strengthen the transportation sector are driving the global TBR tire market growth.

- By application, the truck segment dominated with accounted significant market share in 2021.

- By sales channel, the aftermarket segment accounted significant amount of market share in 2021.

- In 2021, Asia Pacific captured the largest revenue share of the global market.

TBR Tires Market: Growth Drivers

The increasing production of trucks aids the global market growth

The steady increase in the global production of midsize trucks has boosted the demand for TBR tires. The logistics and trucking sectors are expanding rapidly in Asia-Pacific, which has boosted demand for TBR tires in the region. The steady economic expansion following the 2008 financial crisis increased demand for trucks in developed and developing countries. Favorable trade agreements and the entry of commercial vehicle manufacturers in Latin America and Asia-Pacific have boosted demand for TBR tires. Increased consumer awareness about vehicle maintenance, adoption of fleet managers' tire monitoring systems, and expansion of dealer & retail outlets in rural areas will drive the global TBR tires market during the forecast period.

TBR Tires Market: Restraints

The fluctuation of raw material prices may hamper the global market growth

Tire manufacturers rely heavily on raw materials such as natural rubber and Brent oil. Leading producers like Bridgestone grow their own rubber and are better positioned to cope with rising commodity prices and tight supplies. Small tire manufacturers suffered high losses due to fluctuating input prices, which resulted in higher product costs and loss of competitive advantage.

TBR Tires Market: Opportunities

The increasing digital sales platform brings up several growth opportunities

Digital retail is gaining momentum, and tire manufacturers are investing in launching dedicated online portals in addition to selling tires on third-party marketplaces and digital stores. The COVID-19 pandemic has caused tire sales to skyrocket sensor-integrated innovative tires. TRB tires are gaining popularity as fleet owners' awareness of tire health and maintenance schedules increases to prevent vehicle breakdowns.

TBR Tires Market: Segmentation

The global TBR tires market is segregated based on type, application, and region.

By application, the market is divided into bus and truck. Among these, the truck segment dominated the global TBR tire market in 2021. Medium and heavy-duty trucks have higher volumes and contribute a higher share in volume—terrain vehicles. Trucks are widely used for transporting and transporting goods and have been widely adopted in every economy, contributing to the increase in demand for TBR tires.

By sales channel, the market is bifurcated into OEM and aftermarket. Over the forecast period, the aftermarket segment will hold the leading share of the global market. The tire replacement rate is increasing because consumers have raised their awareness of timely vehicle maintenance. Hence, the aftermarket segment is expected to hold a large share of the global market during the forecast period as its market share is increasing in developing countries.

Global TBR Tires Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | TBR Tires Market |

| Market Size in 2021 | USD 115.40 Billion |

| Market Forecast in 2028 | USD 145.17 Billion |

| Compound Annual Growth Rate | CAGR of 3.90% |

| Number of Pages | 255 |

| Forecast Units | Value (USD Billion), and Volume (Units) |

| Key Companies Covered | Bridgestone Corporation, MICHELIN, Continental AG, The Goodyear Tire & Rubber Company, China National Tire & Rubber Corporation, BKT Industries Limited, KUMHO Tire, Yokohoma Rubber Corporation, Sumitomo Rubber Industries Limited, Giti Tire, and Apollo Tires. |

| Segments Covered | By Application, By Sales Channel And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latian America, Middle East and Africa (MEA) |

| Countries Covered | North America: U.S and Canada Europe: Germany, Italy, Russia, U.K, Spain, France, Rest of Europe APAC: China, Australia, Japan, India, South Korea, South East Asia, Rest of Asia Pacific Latin America: Brazil, Argentina, Chile The Middle East And Africa: South Africa, GCC, Rest of MEA |

| Base Year | 2021 |

| Historical Year | 2016 to 2021 |

| Forecast Year | 2022 - 2028 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

TBR Tires Market: Regional Landscape

The expansion of regional and local market help the Asia Pacific dominate the global market

Asia-Pacific accounted for a large share of the global TBR tire market in 2021. Due to the growing domestic demand, China, India, Japan, and ASEAN have large domestic markets. Presence of a large number of truck & bus manufacturers and a large number of convoys of trucks & buses on the road are likely to drive the regional market growth. TBR tire manufacturers have many facilities in the region due to the availability of natural rubber and low production costs.

TBR Tires Market: Competitive Landscape

Some of the main competitors dominating the global TBR tires market include –

- Bridgestone Corporation

- MICHELIN

- Continental AG

- The Goodyear Tire & Rubber Company

- China National Tire & Rubber Corporation

- BKT Industries Limited

- KUMHO Tire

- Yokohoma Rubber Corporation

- Sumitomo Rubber Industries Limited

- Giti Tire

- Apollo Tires.

Global TBR tires market is segmented as follows:

By Application

- Truck

- Bus

By Sales Channel

- OEM

- Aftermarket

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The steady increase in the global production of midsize trucks has boosted the demand for TBR tires. The logistics and trucking sectors are expanding rapidly in Asia-Pacific, which has boosted demand for TBR tires in the region. The steady economic expansion following the 2008 financial crisis increased demand for trucks in developed and developing countries. Favorable trade agreements and the entry of commercial vehicle manufacturers in Latin America and Asia-Pacific have boosted demand for TBR tires. Increased consumer awareness about vehicle maintenance, adoption of fleet managers' tire monitoring systems, and expansion of dealer and retail outlets in rural areas will drive the market for radial truck and bus tires (TBR).

According to the Zion Market Research report, the global TBR tires market was worth about 115.40 (USD billion) in 2021 and is predicted to grow to around 145.17 (USD billion) by 2028 with a compound annual growth rate (CAGR) of about 3.90 percent.

Asia-Pacific accounted for a large share of the global TBR tire market in 2021. Due to the growing domestic demand, China, India, Japan, and ASEAN have large domestic markets. Presence of a large number of truck and bus manufacturers. And a large number of convoys of trucks and buses on the road. TBR tire manufacturers have many facilities in the region due to the availability of natural rubber and low production costs.

The main competitors dominating the global TBR tires market include Bridgestone Corporation, MICHELIN, Continental AG, The Goodyear Tire & Rubber Company, China National Tire & Rubber Corporation, BKT Industries Limited, KUMHO Tire, Yokohoma Rubber Corporation, Sumitomo Rubber Industries Limited, Giti Tire, and Apollo Tires.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed