Green Tech Investments Market Size, Share, Analysis, Trends, Growth, 2032

Green Tech Investments Market By Component (Services and Solutions), By Technology (Blockchain, Internet of Things, AI, Digital Twin, Renewable Energy, and Cloud Computing), By Application (Green Building, Carbon Footprint Management, Forest Monitoring, Crop Monitoring, and Air & Water Pollution Monitoring), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032-

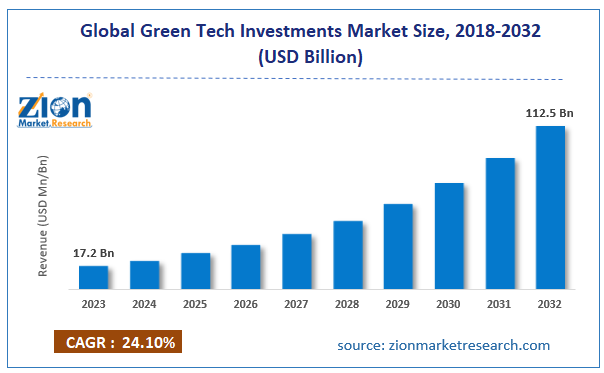

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 17.2 Billion | USD 112.5 Billion | 24.1% | 2023 |

Green Tech Investments Industry Prospective:

The global green tech investments market size was evaluated at $17.2 billion in 2023 and is slated to hit $112.5 billion by the end of 2032 with a CAGR of nearly 24.1% between 2024 and 2032.

Green Tech Investments Market: Overview

Green tech investments are witnessing notable expansion with both private and public sectors recognizing the requirement for sustainable financial practices. Reportedly, green technology is also referred to as cleantech and it includes innovations focusing on minimizing negative effects on environment. Moreover, green tech firms have exhibited strong growth potential and have garnered huge investments. For the record, key domains of green tech investments include sustainable farming, renewable energy, and electric vehicle sectors.

Key Insights

- As per the analysis shared by our research analyst, the global green tech investments market is projected to expand annually at the annual growth rate of around 24.1% over the forecast timespan (2024-2032)

- In terms of revenue, the global green tech investments market size was evaluated at nearly $17.2 billion in 2023 and is expected to reach $112.5 billion by 2032.

- The global green tech investments market is anticipated to grow rapidly over the forecast timespan owing to an increase in the allocation of funds in the renewable energy sector and focus on zero emissions by various organizations such as EU commission.

- In terms of component, the solutions segment is slated to register the highest CAGR over the forecast period.

- Based on technology, the renewable energy segment is predicted to contribute majorly towards segmental space in the upcoming years.

- Based on application, the carbon footprint management segment is predicted to dominate the segmental growth in the ensuing years.

- Region-wise, the North American green tech investments industry is projected to register the fastest CAGR during the projected timespan.

Request Free Sample

Request Free Sample

Green Tech Investments Market: Growth Factors

Growing environmental degradation & seasonal fluctuations have led to global market demand

Surging concerns related to climatic changes and damage to the environment have prompted the expansion of the global green tech investments market. Technological breakthroughs such as AI, blockchain, and IoT have increased the use of green technologies, thereby multiplying the expansion of the market globally. Additionally, an increase in the allocation of funds in the renewable energy sector and a focus on zero emissions by various organizations such as the EU Commission is anticipated to drive the growth of the market globally. Apart from this, customer preference towards sustainable products will propel the expansion of the market globally.

Green Tech Investments Market: Restraints

An increase in the initial capital investments for developing new technologies will hinder the global industry expansion by 2032

An increment in the upfront costs required for setting up electric vehicle charging stations and renewable energy units can obstruct the progress of the global green tech investments industry. Furthermore, changes in government laws can affect the profits of green tech ventures, thereby hindering industry growth.

Green Tech Investments Market: Opportunities

Surging renewable energy trends are predicted to open new growth avenues for the global market

Humungous demand for renewable energy and an increase in the acceptance of carbon management solutions are predicted to open new growth avenues for the global green tech investments market. Furthermore, supportive government laws focusing on promoting green energy along with minimizing carbon emissions have resulted in a prominent increase in green tech investments, thereby shaping the global market demand.

Green Tech Investments Market: Challenges

Low profitability has severely affected the growth of the global industry in recent years

Price pressure and reduction in profit marginality can severely impact the expansion of the global green tech investments industry. Few communities can resist green infrastructure development due to the resistance to changing attitudes of these communities, thereby severely affecting the global industry surge.

Green Tech Investments Market: Segmentation

The global green tech investments market is divided into component, technology, application, and region.

In terms of component, the green tech investments market across the globe is segmented into services and solutions segments. Apparently, the solutions segment, which amassed nearly 70% of the global market revenue in 2023, is projected to record the fastest CAGR in the coming years owing to the ability of green technologies to increase sustainability with the use of energy-efficient equipment, electric vehicles, renewable energy tools, and smart grid systems.

Based on the technology, the global green tech investments industry is segmented into blockchain, internet of things, AI, digital twin, renewable energy, and cloud computing segments. Apparently, the renewable energy segment, which led the global industry in 2023, is expected to contribute significantly towards the segmental surge in the upcoming years. This can be due to cost reductions due to the use of these technologies, government aid for using these technologies, and the use of these technologies in electric vehicles.

On the basis of application, the global green tech investments market is sectored into green building, carbon footprint management, forest monitoring, crop monitoring, and air & water pollution monitoring segments. Moreover, the carbon footprint management segment, which led the application segment in 2023, is predicted to dominate the segmental landscape in the forecast timeline. Furthermore, the segmental progression can be due to the enforcement of strict regulations focused on minimizing carbon emissions. Additionally, breakthroughs in AI, IoT, and data analytics will further steer the segmental growth.

Green Tech Investments Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Green Tech Investments Market |

| Market Size in 2023 | USD 17.2 Billion |

| Market Forecast in 2032 | USD 112.5 Billion |

| Growth Rate | CAGR of 24.1% |

| Number of Pages | 214 |

| Key Companies Covered | Enviance, Alphabet Inc., General Electric, Huawei Technologies Limited, Engie Impact, Microsoft Corporation, SunPower Corporation, IBM Corporation, SAP SE, Salesforce, Oracle Corporation, Siemens AG, Schneider Electric SE, Wolters Kluwer N.V., and others. |

| Segments Covered | By Component, By Technology, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Green Tech Investments Market: Regional Insights

Asia-Pacific is likely to maintain leading status in the global market over the projected time-interval

Asia-Pacific, which contributed about 45% of the global green tech investments market size in 2023, is likely to establish a number one position in the global market in the ensuing years. In addition, the regional market progression in the next couple of years can be attributed to an increase in the allocation of funds to green technologies in countries such as Japan and China. Furthermore, the presence of key players in these countries is likely to augment the growth of the market in the APAC zone. A flow in demand for solar panels for solar energy as well as wind turbines for wind energy has proliferated the size of the market in the region. A rise in industrialization in the emerging economies of Asia will prop up the market elevation in APAC in the ensuing years.

North American green tech investments industry is expected to account for the highest gains annually in the upcoming years. The progression of the industry in North America can be owing to a rise in investment in research & development activities related to the development of green products. Furthermore, customer awareness about benefits accrued due to the use of green technologies and rapid infrastructure growth in the U.S. aided by federal tax structure will spearhead the industry expansion in the sub-continent.

Green Tech Investments Market: Competitive Space

The global green tech investments market profiles key players such as:

- Enviance

- Alphabet Inc.

- General Electric

- Huawei Technologies Limited

- Engie Impact

- Microsoft Corporation

- SunPower Corporation

- IBM Corporation

- SAP SE

- Salesforce

- Oracle Corporation

- Siemens AG

- Schneider Electric SE

- Wolters Kluwer N.V.

The global green tech investments market is segmented as follows:

By Component

- Services

- Solutions

By Technology

- Blockchain

- Internet of Things

- AI

- Digital Twin

- Renewable Energy

- Cloud Computing

By Application

- Green Building

- Carbon Footprint Management

- Forest Monitoring

- Crop Monitoring

- Air & Water Pollution Monitoring

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Green tech investments are witnessing notable expansion, with both the private and public sectors recognizing the requirement for sustainable financial practices. Green technology is also referred to as cleantech, and it includes innovations focusing on minimizing negative effects on the environment.

The global green tech investments market's growth over the forecast period can be attributed to customer preference for sustainable products.

According to a study, the global green tech investments industry size was $17.2 billion in 2023 and is projected to reach $112.5 billion by the end of 2032.

The global green tech investments market is anticipated to record a CAGR of nearly 24.1% from 2024 to 2032.

North American green tech investments industry is set to register the fastest CAGR over the forecasting timeframe owing to a rise in the investment in research & development activities related to green product development. Furthermore, customer awareness about benefits accrued due to the use of green technologies and rapid infrastructure growth in the U.S. aided by the federal tax structure will spearhead the industry expansion in the sub-continent.

The global green tech investments market is led by players such as Enviance, Alphabet Inc., General Electric, Huawei Technologies Limited, Engie Impact, Microsoft Corporation, SunPower Corporation, IBM Corporation, SAP SE, Salesforce, Oracle Corporation, Siemens AG, Schneider Electric SE, and Wolters Kluwer N.V.

The global green tech investments market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTEL analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five force analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed