Heavy-Duty Electric Vehicle Charging Infrastructure Market Size, Share, Trends, Growth and Forecast 2032

Heavy-Duty Electric Vehicle Charging Infrastructure Market By Charger Type (DC Charger and AC Charger), By Charging Method (Fast Charging and Slow Charging), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032-

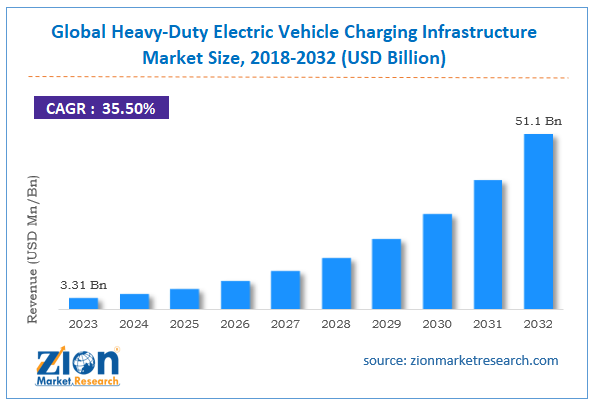

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

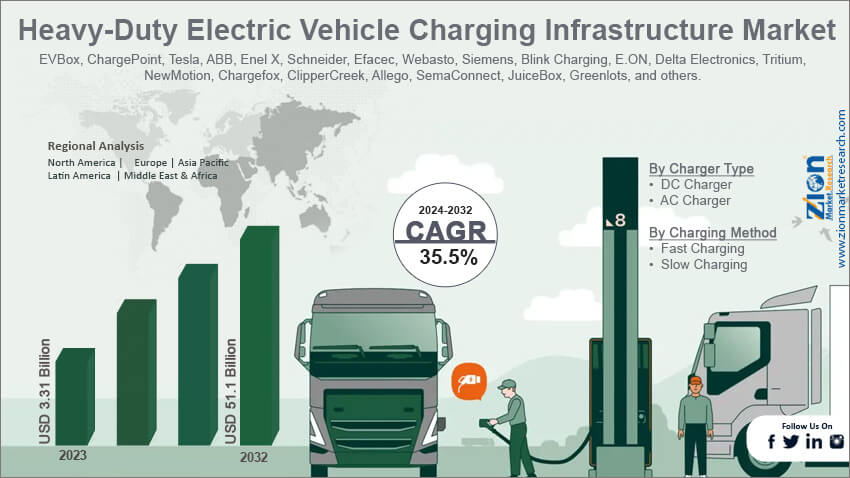

| USD 3.31 Billion | USD 51.1 Billion | 35.5% | 2023 |

Heavy-Duty Electric Vehicle Charging Infrastructure Industry Prospective:

The global heavy-duty electric vehicle charging infrastructure market size was worth around USD 3.31 billion in 2023 and is predicted to grow to around USD 51.1 billion by 2032 with a compound annual growth rate (CAGR) of roughly 35.5% between 2024 and 2032.

Heavy-Duty Electric Vehicle Charging Infrastructure Market: Overview

The facilities and equipment required to charge electric trucks, buses, and industrial vehicles are referred to as heavy-duty electric vehicle charging infrastructure. Heavy-duty EVs use more energy since their batteries are heavier than those of passenger automobiles. This infrastructure usually comprises high-capacity charging stations that can produce significant amounts of electricity to meet these demands. Strong EV charging infrastructure is necessary to use EVs in industries that demand high energy efficiency, such as freight, public transportation, and construction.

Key Insights

- As per the analysis shared by our research analyst, the global Heavy-Duty Electric Vehicle Charging Infrastructure market is estimated to grow annually at a CAGR of around 35.5% over the forecast period (2024-2032).

- In terms of revenue, the global heavy-duty electric vehicle charging infrastructure market size was valued at around USD 3.31 billion in 2023 and is projected to reach USD 51.1 million by 2032.

- The rising government initiatives are expected to drive the heavy-duty electric vehicle charging infrastructure industry over the forecast period.

- Based on the charger type, the DC Charger segment is expected to dominate the market over the projected period.

- Based on the charging method, the fast charging segment is expected to capture the largest market share over the projected period.

- Based on region, the Asia Pacific is expected to dominate the market during the forecast period.

Request Free Sample

Request Free Sample

Heavy-Duty Electric Vehicle Charging Infrastructure Market: Growth Drivers

Rising adoption of heavy-duty electric vehicles drives market growth

Governments across the globe are imposing stringent emission regulations, particularly in the transportation and logistics sectors to fight against climate change. Government initiatives such as grants, tax rebates, and subsidies for EV purchases and charging infrastructure are making strong charging solutions increasingly important.

Businesses are also increasingly utilizing electric vehicles and buses to save fuel-related operational costs, meet sustainability targets, and enhance their environmental effect. The requirement for charging infrastructure that can support large fleet operations is therefore increasing. All these factors will likely fuel the expansion of the heavy-duty electric vehicle charging infrastructure industry in years to come.

Heavy-Duty Electric Vehicle Charging Infrastructure Market: Restraints

High initial capital costs hinder market growth

Large upfront costs are associated with the establishment of heavy-duty EV charging infrastructure, especially high-power charging stations. Both governmental and commercial organizations may find the expenses of building, grid changes, and hardware (such as chargers and connectors) to be unaffordable. Heavy-duty automobiles require high-capacity charging systems that require a significant amount of electrical capacity.

Furthermore, the energy requirements of heavy-duty EV charging are high, requiring improvements to the current electrical system. It can be expensive to integrate renewable energy and storage systems, as well as to update grid infrastructure to accommodate the higher power loads. Thus, the high initial capital cost might hamper the growth of the heavy-duty electric vehicle charging infrastructure market.

Heavy-Duty Electric Vehicle Charging Infrastructure Market: Opportunities

The rising product launch offers a lucrative opportunity for market growth

The increasing product launch in the heavy-duty electric vehicle charging infrastructure sector offers a potential opportunity for the electric vehicle charging cable industry. For instance, in October 2023, with the launch of its megawatt charging system, Kempower is broadening its range of quick DC charging solutions. Megawatt charging systems, or MCSs, are specifically designed to charge electric trucks and are intended for larger power outputs exceeding 1 MW.

The company's high-power satellite with MCS liquid-cooled charging plug and two 600 kW Kempower Power Units serve as the foundation for Kempower's innovative charging solution. In the first quarter of 2024, the business will begin shipping the new Kempower Megawatt Charging System to Europe. The initial delivery of the Kempower MCS solution will have a total power of 1.2 megawatts.

Heavy-Duty Electric Vehicle Charging Infrastructure Market: Challenges

Limited charging infrastructure poses a major challenge to market expansion

Heavy-duty EVs need specific high-power charging facilities, which are currently few, in contrast to passenger EVs. Fleet operators find it difficult to complete the whole switch to electric cars when there isn't a universal, easily accessible network of charging stations, particularly on long-distance routes or in isolated industrial areas.

Furthermore, due to the complexity and expense required, the implementation of charging stations for heavy-duty vehicles is frequently slower. Market expansion may be slowed by delays in infrastructure deployment caused by regulatory approvals, site purchases, and construction schedules. Therefore, the lack of infrastructure might pose a major challenge to the heavy-duty electric vehicle charging infrastructure industry.

Heavy-Duty Electric Vehicle Charging Infrastructure Market: Segmentation

The global heavy-duty electric vehicle charging infrastructure industry is segmented based on charger type, charging method, and region.

Based on the charger type, the global heavy-duty electric vehicle charging infrastructure market is segmented into DC Charger and AC Charger. The DC Charger segment is expected to dominate the market over the projected period. Heavy-duty cars, which usually have greater battery capacities than light-duty vehicles, can be swiftly charged using DC chargers, which can produce power levels ranging from 150 kW to over 1,000 kW.

Many governments are providing incentives and subsidies, such as grants for the installation of DC fast chargers, to encourage the usage of electric vehicles and the construction of infrastructure. The use of heavy-duty EVs and the related infrastructure for charging them is also encouraged by emissions-reduction laws. Furthermore, DC chargers are become more reliable, efficient, and affordable as charging technology develops. Advances in power electronics and battery technology allow quicker and more dependable charging, which boosts customer acceptability and confidence.

Based on the charging method, the global heavy-duty electric vehicle charging infrastructure industry is bifurcated into fast charging and slow charging. The fast-charging segment is expected to capture the largest market share over the projected period. The fast charging technique is a speedy way to charge heavy-duty vehicles like buses and trucks.

The rapid charging technique enables heavy-duty vehicle drivers to recharge the battery in a substantially shorter time than the lengthy charging periods required by the slow. For heavy-duty electric cars, this charging method usually requires a DC charger to recharge the battery. It is projected that as the demand for heavy-duty electric vehicles rises internationally, the market for rapid charging methods will grow significantly. Major firms, including Siemens, Tesla Inc., ABB, and Kempower Oy, offer quick charging for heavy-duty electric vehicles.

Heavy-Duty Electric Vehicle Charging Infrastructure Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Heavy-Duty Electric Vehicle Charging Infrastructure Market |

| Market Size in 2023 | USD 3.31 Billion |

| Market Forecast in 2032 | USD 51.1 Billion |

| Growth Rate | CAGR of 35.5% |

| Number of Pages | 223 |

| Key Companies Covered | EVBox, ChargePoint, Tesla, ABB, Enel X, Schneider, Efacec, Webasto, Siemens, Blink Charging, E.ON, Delta Electronics, Tritium, NewMotion, Chargefox, ClipperCreek, Allego, SemaConnect, JuiceBox, Greenlots, and others. |

| Segments Covered | By Charger Type, By Charging Method, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Heavy-Duty Electric Vehicle Charging Infrastructure Market: Regional Analysis

Asia Pacific dominates the market over the projected period

The Asia Pacific is expected to lead the global heavy-duty electric vehicle charging infrastructure market growth. The growing demand for electric buses and the regional government's efforts to encourage the development of heavy-duty EVs, such as those in China, Japan, and India, are predicted to significantly boost the need for heavy-duty EV charging infrastructure in Asia-Pacific. Due to the increasing demand for charging infrastructure and the rising collaboration amongst local automakers, the market in this area is booming.

However, Europe is expected to grow at the highest CAGR in the heavy-duty electric vehicle charging infrastructure industry during the projected period. The growth of the industry in the area is attributed to favorable government initiatives. To achieve carbon neutrality by 2050, the European Union (EU) has implemented strict emissions limits and targets as part of the European Green Deal. By 2030, programs like the Fit for 55 package want to reduce emissions by at least 55%, which will encourage the use of electric heavy-duty vehicles and the infrastructure required for charging them.

Heavy-Duty Electric Vehicle Charging Infrastructure Market: Competitive Analysis

The global heavy-duty electric vehicle charging infrastructure market is dominated by players like:

- EVBox

- ChargePoint

- Tesla

- ABB

- Enel X

- Schneider

- Efacec

- Webasto

- Siemens

- Blink Charging

- E.ON

- Delta Electronics

- Tritium

- NewMotion

- Chargefox

- ClipperCreek

- Allego

- SemaConnect

- JuiceBox

- Greenlots

The global heavy-duty electric vehicle charging infrastructure market is segmented as follows:

By Charger Type

- DC Charger

- AC Charger

By Charging Method

- Fast Charging

- Slow Charging

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The facilities and equipment required to charge electric trucks, buses, and industrial vehicles are referred to as heavy-duty electric vehicle charging infrastructure. Heavy-duty EVs use more energy since their batteries are heavier than those of passenger automobiles. This infrastructure usually comprises high-capacity charging stations that can produce significant amounts of electricity to meet these demands. Strong EV charging infrastructure is necessary for the use of EVs in industries that demand high energy efficiency, such as freight, public transportation, and construction.

The heavy-duty electric vehicle charging infrastructure industry is rising due to several factors, including rapid investment in charging networks, rising government efforts, technological developments, the growing popularity of EVs, and others.

According to the report, the global heavy-duty electric vehicle charging infrastructure market size was worth around USD 3.31 billion in 2023 and is predicted to grow to around USD 51.1 billion by 2032.

The global heavy-duty electric vehicle charging infrastructure market is expected to grow at a CAGR of 35.5% during the forecast period.

The global heavy-duty electric vehicle charging infrastructure market growth is expected to be driven by the Asia Pacific. It is currently the world’s highest revenue-generating market due to the growing EV production.

The global heavy-duty electric vehicle charging infrastructure market is dominated by players like EVBox, ChargePoint, Tesla, ABB, Enel X, Schneider, Efacec, Webasto, Siemens, Blink Charging, E.ON, Delta Electronics, Tritium, NewMotion, Chargefox, ClipperCreek, Allego, SemaConnect, JuiceBox and Greenlots among others.

The heavy-duty electric vehicle charging infrastructure market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

Choose License Type

List of Contents

Infrastructure OverviewKey Insights Infrastructure Growth Drivers Infrastructure Restraints Infrastructure Opportunities Infrastructure Challenges Infrastructure Segmentation Infrastructure Report Scope Infrastructure Regional Analysis Infrastructure Competitive AnalysisThe global heavy-duty electric vehicle charging infrastructure market is segmented as follows:By RegionHappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed