High Net Worth Household Insurance Market Growth, Size, Share, Trends, and Forecast 2032

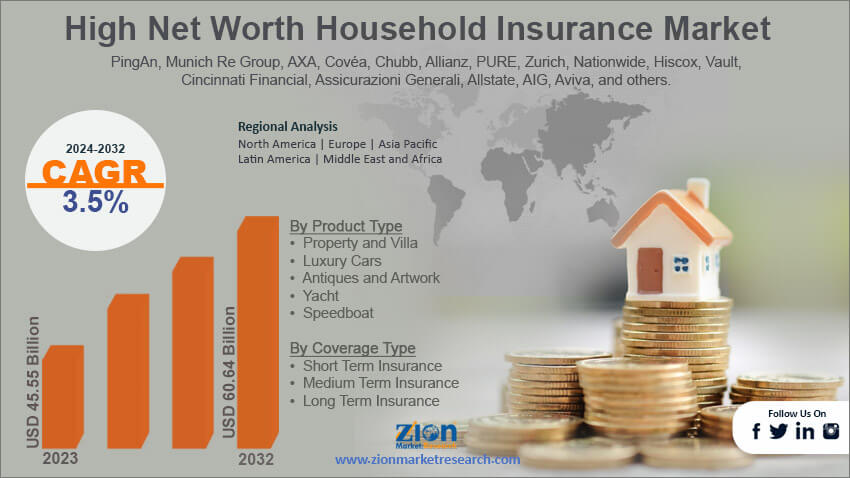

High Net Worth Household Insurance Market By Product Type (Property and Villa, Luxury Cars, Antiques and Artwork, Yacht and Speedboat and Others), By Coverage Type (Short Term Insurance, Medium Term Insurance and Long Term Insurance) and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

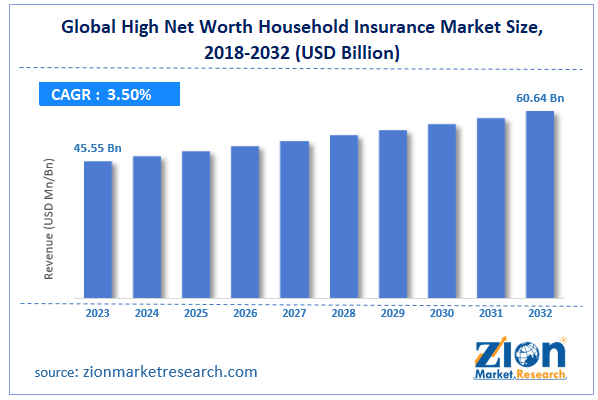

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 45.55 Billion | USD 60.64 Billion | 3.5% | 2023 |

High Net Worth Household Insurance Industry Prospective:

The global High Net Worth Household Insurance market size was worth around USD 45.55 billion in 2023 and is predicted to grow to around USD 60.64 billion by 2032 with a compound annual growth rate (CAGR) of roughly 3.5% between 2024 and 2032.

High Net Worth Household Insurance Market: Overview

High Net Worth Household Insurance also term as Affluent Insurance or High Net Worth (HNW) Insurance, is a unique insurance coverage created to cater to the particular needs of individuals who have big assets. This insurance is designed to secure valuable assets such as expensive houses, priceless belongings, and other items. This Insurance aims to guarantee complete security and financial stability in the case of unfavorable situations or natural catastrophes.

To make sure their coverage appropriately suits their needs, people with significant wealth must collaborate closely with knowledgeable insurance experts who comprehend the intricacies of high-net-worth insurance. The high net worth household insurance market is driven by several factors including growing property value, increased awareness of risk, demand for personalized services, growing chances of natural disasters and many others.

Key Insights

- As per the analysis shared by our research analyst, the global High Net Worth Household Insurance market is estimated to grow annually at a CAGR of around 3.5% over the forecast period (2024-2032).

- In terms of revenue, the global High Net Worth Household Insurance market size was valued at around USD 45.55 billion in 2023 and is projected to reach USD 60.64 billion, by 2032.

- The increasing product launch is expected to drive market growth during the forecast period.

- Based on the product type, the Property and Villa segment is expected to dominate the market during the forecast period.

- Based on the coverage Type, the Long Term Insurance segment is expected to grow at a rapid rate over the forecast period.

- Based on region, North America is expected to dominate the market over the projected period.

Request Free Sample

Request Free Sample

High Net Worth Household Insurance Market: Growth Drivers

Benefits of HNW drive market growth

A high-net-worth policy covers a wide variety of hazards, such as theft, fire, water, and accidental damage, unless they are expressly prohibited in the policy terms and conditions. This is in contrast to a normal house insurance policy, which only covers declared perils or dangers. Worldwide coverage is another feature that the majority of high-net-worth insurance offers, so personal belongings are protected no matter where they are in the globe. Those who travel frequently for work or who own numerous residences would particularly benefit from this. Thus, these benefits drive the market growth over the forecast period.

High Net Worth Household Insurance Market: Restraints

Cybersecurity risk and regulatory compliance impeding market growth

Due to their greater reliance on digital technology, high net worth individuals are more vulnerable to privacy breaches and cybersecurity attacks. It might be difficult to provide sufficient coverage for cyber hazards since these risks are always changing and insurers must keep up with new developments in this area. Furthermore, the insurance industry's regulatory landscape is dynamic. High Net Worth Household Insurance companies may find it difficult to comply with changing standards and adjust to new laws, particularly if these changes have an effect on the cost or nature of insurance policies. Thus, this is expected to hamper the industry's growth.

High Net Worth Household Insurance Market: Opportunities

Growing product launch offers a lucrative opportunity for market growth

The growing product launch is expected to offer a lucrative opportunity for market growth over the forecast period. For instance, in September 2023, through a strategic partnership with MS Transverse Insurance Group ("MS Transverse"), Millennial Specialty Insurance, LLC ("MSI"), an indirect subsidiary of BRP Group, Inc., and MS Transverse Insurance Group ("MS Transverse") have introduced a new homeowners program aimed at High-Net-Worth ("HNW") clients. Customers will have an opportunity to purchase specialized house insurance plans that provide special benefits that are sometimes absent from mass-market policies beginning this month. Among these improvements are:

- The ability to choose to insure houses up to $10 million in replacement value.

- Deductible options range from $10,000 to $1 million.

- Special claims assistance is Staffed by specialists knowledgeable in building bespoke homes.

- Coverage across the country, including the capacity to underwrite buildings in areas vulnerable to natural disasters.

Thus, this type of product launch supports market growth.

High Net Worth Household Insurance Market: Challenges

Dependency on investment returns poses a major challenge to market expansion

Insurers frequently invest the premiums they collect to create profits. However, volatility in the financial markets or an extended time of low interest rates can influence investment returns, impacting insurance firms' overall financial health and capacity to pay claims. Thus, this factor poses a major challenge for the market expansion.

High Net Worth Household Insurance Market: Segmentation

The global High Net Worth Household Insurance industry is segmented based on product type, coverage type and region.

Based on the product type, the global High Net Worth Household Insurance market is bifurcated into Property and Villa, Luxury Cars, Antiques and Artwork, Yacht and Speedboat and Others. The Property and Villa segment is expected to dominate the market during the forecast period. Homeowners can evaluate and reduce hazards related to their homes with the assistance of risk management services from insurers. This might involve security evaluations, fire safety protocols, and suggestions to improve the estate's general safety and robustness. Thus, these benefits drive the segment growth.

Based on the coverage type, the global High Net Worth Household Insurance industry is categorized into Short Term Insurance, Medium Term Insurance and Long Term Insurance. The Long Term Insurance segment is expected to grow at a rapid rate over the forecast period. Rate stability is a feature of long-term plans that gives policyholders the guarantee that their insurance rates will be largely the same for the duration of the policy. Budgeting and financial planning may benefit from this.

High Net Worth Household Insurance Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | High Net Worth Household Insurance Market |

| Market Size in 2023 | USD 45.55 Billion |

| Market Forecast in 2032 | USD 60.64 Billion |

| Growth Rate | CAGR of 3.5% |

| Number of Pages | 218 |

| Key Companies Covered | PingAn, Munich Re Group, AXA, Covéa, Chubb, Allianz, PURE, Zurich, Nationwide, Hiscox, Vault, Cincinnati Financial, Assicurazioni Generali, Allstate, AIG, Aviva, and others. |

| Segments Covered | By Product Type, By Coverage Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Regional Analysis

North America is expected to dominate the market over the projected period

North America is expected to dominate the market over the projected period. The market growth in the region is attributed to the increasing collaboration. For instance, in August 2020, Morgan Stanley declared that it will now provide Property & Casualty (P&C) insurance through a partnership with prominent insurance brokers HUB International, Marsh Private Client Services, and Willis Towers Watson. As an addition to Morgan Stanley's existing variety of insurance products, P&C insurance will be made accessible to its high net worth customers and their families to help reduce possible risks related to general liability and property loss.

HUB International, Marsh Private Client Services, and Willis Towers Watson will work together to support Morgan Stanley customers in identifying their risk exposures and offering asset protection strategies as part of this new agreement. The insurance brokers will make use of their extensive networks of devoted professionals and internal resources, as well as their close ties to a wide range of insurance firms.

High Net Worth Household Insurance Market: Competitive Analysis

The global High Net Worth Household Insurance market is dominated by players like:

- PingAn

- Munich Re Group

- AXA

- Covéa

- Chubb

- Allianz

- PURE

- Zurich

- Nationwide

- Hiscox

- Vault

- Cincinnati Financial

- Assicurazioni Generali

- Allstate

- AIG

- Aviva

The global High Net Worth Household Insurance market is segmented as follows:

By Product Type

- Property and Villa

- Luxury Cars

- Antiques and Artwork

- Yacht

- Speedboat

- Others

By Coverage Type

- Short Term Insurance

- Medium Term Insurance

- Long Term Insurance

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

High Net Worth Household Insurance also term as Affluent Insurance or High Net Worth (HNW) Insurance, is a unique insurance coverage created to cater to the particular needs of individuals who have big assets. This insurance is designed to secure valuable assets such as expensive houses, priceless belongings, and other items.

The high net worth household insurance market is driven by several factors including growing property value, increased awareness of risk, demand for personalized services, growing chances of natural disasters and many others.

According to the report, the global market size was worth around USD 45.55 billion in 2023 and is predicted to grow to around USD 60.64 billion by 2032.

The global High Net Worth Household Insurance market is expected to grow at a CAGR of 3.5% during the forecast period.

The global High Net Worth Household Insurance market growth is expected to be driven by North America. It is currently the world’s highest revenue-generating market due to the rising collaboration.

The global High Net Worth Household Insurance market is dominated by players like PingAn, Munich Re Group, AXA, Covéa, Chubb, Allianz, PURE, Zurich, Nationwide, Hiscox, Vault, Cincinnati Financial, Assicurazioni Generali, Allstate, AIG and Aviva among others.

The High Net Worth Household Insurance Market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed