Hopper Car Market Size, Share, Trends, Growth 2030

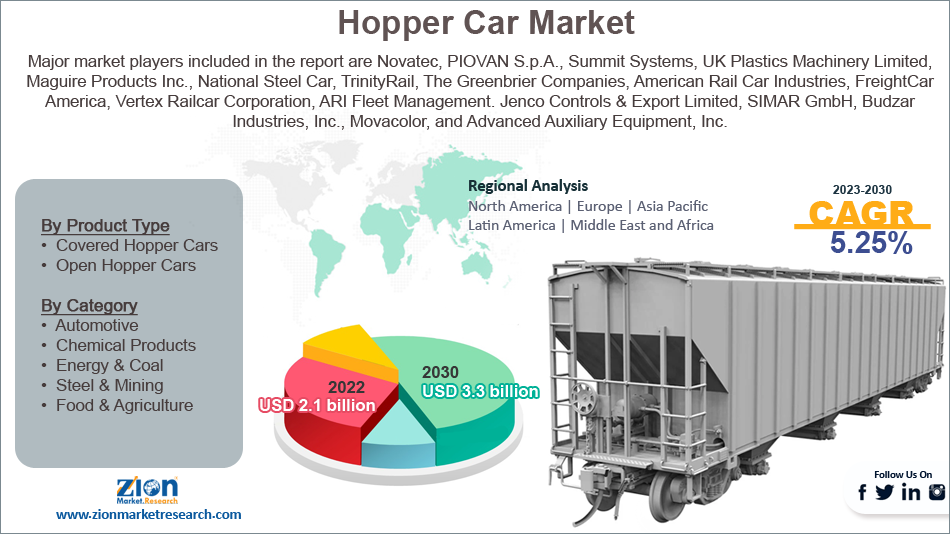

Hopper Car Market By Type (Covered Hopper Cars and Open Hopper Cars), By Application (Automotive, Chemical Products, Energy & Coal, Steel & Mining, and Food & Agriculture), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2023 - 2030

Hopper Car Industry Prospective:

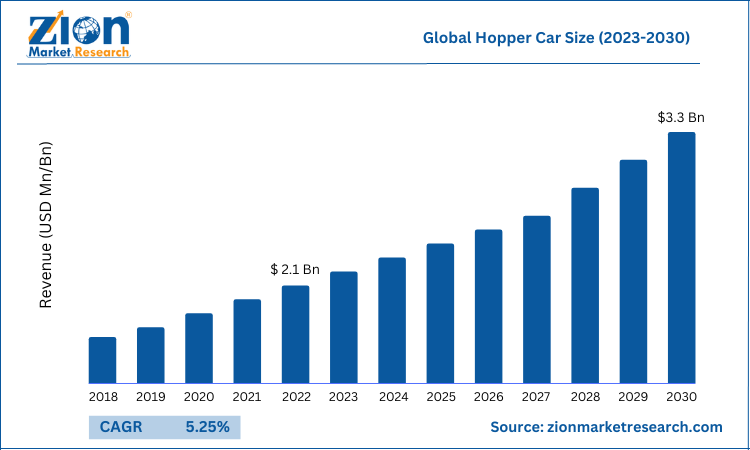

The global hopper car market size was worth around USD 2.1 Billion in 2022 and is further expected to grow to around USD 3.3 Billion by 2030 with a compound annual growth rate (CAGR) of approximately 5.25 percent over the forecast period.

The report analyzes the hopper car market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the hopper car market.

Hopper Car Market: Overview

The hopper car is a self-clearing enclosed railroad freight vehicle having sideways, fixed roofs, and ends, as well as unloading and loading holes at the roof and bottom. Covered hopper cars are meant to transport dry bulk cargoes, which can range from grain to sand and clay. The cargo is protected from the elements by the cover. If dry cement was combined with water in shipment, it would be difficult to unload, and grain would decay if exposed to rain. Furthermore, the diversified fleet of railcars transports a wide range of dry bulk goods. Some of these vehicles are dedicated to a single commodity, while others cater to a wide range of commodities. As a result, the hopper car fleet as a whole has distinct features, and their performance is influenced by independent business and financial considerations.

Key Insights

- As per the analysis shared by our research analyst, the global hopper car market is expected to grow annually at a promising CAGR of around 5.25% during the forecast period 2023-2030.

- In terms of revenue, the global hopper car market size was valued at around 2.1 billion in 2022 and is further expected to grow to around 3.3 billion by 2030.Hopper cars are specialized railcars used for transporting bulk commodities such as grain, coal, ores, aggregates, and other dry materials. They are designed with sloping floors and doors at the bottom for easy unloading of the cargo. The cargo is loaded from the top of the car, and gravity helps to distribute it evenly along the length of the car. Hopper cars come in different sizes and designs, depending on the type of material being transported, the distance of transportation, and the requirements of the customer.

- Based on type, the covered hopper cars segment is expected to grow at a rapid CAGR during the forecast period.

- Based on application, the food and agriculture segment held the dominating market share in 2022.

- Based on region, the North American region held the largest market share in 2022.

To know more about this report, Request a sample copy

COVID-19 Impact:

The COVID-19 impact on the global hopper car market is low to moderate. The market growth slowed due to a halt in the manufacturing (OEM) plants, which affected the sale of the new hopper car. Also, the budget constraints affected the overall sale in 2020 and 2021. However, the use of hopper cars increased during the pandemic period. This is majorly due to the supply of goods in emergencies. Nevertheless, the market is recovering from the pandemic impact and is expected to grow at a steady rate over the forecast period.

Hopper Car Market: Growth Drivers

Increased transportation demand for plastic polymers, fertilizers, and chemicals is likely to boost the market growth.

Demand for plastic polymers has increased double-fold due to their several applications in the automobile industry. These plastic monomers are polymerized into polymers and co-polymers via chemical reactions and catalysts, resulting in Polystyrene (PS), Polycarbonate (PC), Polyethylene (PE), PVC, PP, and other polymerized materials. These materials outperform their monomers in terms of characteristics and are exceptionally stable for molding and production.

Manufacturers have been driven to employ high-performance automobile plastics leading to advancements in recycling technologies. As a result, demand for hopper cars is predicted to increase to further boost the supply of such polymerized plastic across nations. Along with that, increased demand for bulk cargo such as fertilizer, grain, and chemicals that are required to be protected from exposure to the weather is also contributing to the expansion of the global hopper car market.

Hopper Car Market: Restraints

The availability of other cost-effective ways of transportation may hinder market growth.

Other ways of transport such as road and seaway offer better alternatives to transport the goods within the nation or overseas, also the cost of freight transfer through seaway is comparatively low and besides the large volume of cargo can be transferred through ships at less cost. Due to such reasons, many product manufacturers prefer to transfer their goods through the sea route. Considering the stats, the road is still the dominant mode of transport, its share in overall freight transport has reached nearly 45 percent. Whereas, the ship is the second most important mode of freight transport. All these factors may hamper the adoption of the hopper cars industry over the forecast period.

Hopper Car Market: Opportunities

An increase in the demand for new hoppers as a result of the surplus in car size is likely to increase the demand for hopper cars.

The slow construction market has restricted the need for small-cube hoppers used to transport cement and other building materials, as well as grain shipments by railways, resulting in a slight excess in the grain car fleet and fewer distillers of dried grains being sent by ethanol manufacturers (DDG). As a result of a little downturn in the ethanol business, fewer large covered hoppers were deployed than projected. Furthermore, rail traffic is predicted to remain modest in the next years, which is why hopper car manufacturers are improving the size of their hoppers to meet demand, which is expected to offer stable growth opportunities for the hopper car industry.

Hopper Car Market: Challenges.

Limitations with cargo weight and safety regulations are the major challenges for the market.

Every year railroad deals with more than thousands of uneven and overweight loaded hopper cars causing glitches for both shippers and railroads. Therefore, it is crucial to ensure the load does not exceed maximum load limits. A hopper car carrying more weight than it is designed for can cause a breakdown in the wheel assembly. Moreover, a loaded car weighing more than the rail line’s capacity can also cause the track to break down. These factors pose major challenges to the expansion of the global hopper car market.

Hopper Car Market: Segmentation

The global hopper car market is segregated based on type, application, and region.

Based on type, the market is bifurcated into covered hopper cars and open hopper cars. The covered hopper cars segment held a remarkable market share in 2022 and is further predicted to grow rapidly at the fastest CAGR during the forecast period.

The major reason for the growth of this segment is that the covered hopper cars are used to transport materials that require protection from the weather, such as grain, sugar, plastic pellets, and others. Thus, they have a roof to provide the necessary protection for different raw materials that cannot withstand the surrounding temperature or environment. In addition, an increase in the prevalence of climate change and extreme temperatures and climate in various countries due to global warming is further expected to drive the growth of the segment during the forecast period.

Based on application, the market is bifurcated into automotive, chemical products, energy & coal, steel & mining, and food & agriculture. The food and agriculture segment held the largest market share in 2022 and is further predicted to occupy a dominant market share and simultaneously grow at a rapid CAGR during the forecast period.

The growth of this segment is mainly because cars are mainly used to transport grain, wheat, corn, and other agricultural products. There has been an immaculate rise in global food demand which further contributes to the growth of the segment. In addition, a rise in agricultural production and growth in the economy of countries is further predicted to drive the growth of the segment during the forecast period.

Recent Developments

- In July 2021, EuroChem placed an order for 2,000 next-generation hopper cars for mineral fertilizers with United Wagon Company (UWC). This new deal, which covers maintenance services, underlines and enhances the two organizations’ long-standing collaboration.

- In March 2020, a deal was made between Togliattiazot, a Russian chemical company, and UWC for the provision of 200 hopper cars for the transport of mineral fertilizers. This is the company's first deal for the acquisition of a new generation of automobiles.

- In 2021, the Greenbrier Companies, a US-based publicly traded transportation manufacturing corporation announced the launch of its new covered hopper car model called the "Capstone". It features a longer, wider, and taller design for increased capacity. The Capstone can carry up to 5,430 cubic feet of cargo and has a lower tare weight than previous models.

- In 2020, GATX Corporation, a dominant railcar lessor, announced the launch of a new model of open-top hopper cars called the "RailLink". It features a hybrid aluminum-steel design for increased durability and reduced maintenance costs. The RailLink can carry up to 6,000 cubic feet of cargo and is designed for transporting heavy commodities such as aggregates and industrial minerals.

Hopper Car Market Report Scope:

| Report Attributes | Report Details |

|---|---|

| Report Name | Hopper Car Market Research Report |

| Market Size in 2022 | USD 2.1 Billion |

| Market Forecast in 2030 | USD 3.3 Billion |

| Compound Annual Growth Rate | CAGR of 5.25% |

| Number of Pages | 211 |

| Forecast Units | Value (USD Billion), and Volume (Units) |

| Key Companies Covered | Novatec, PIOVAN S.p.A., Summit Systems, UK Plastics Machinery Limited, Maguire Products Inc., National Steel Car, TrinityRail, The Greenbrier Companies, American Rail Car Industries, FreightCar America, Vertex Railcar Corporation, ARI Fleet Management. Jenco Controls & Export Limited, SIMAR GmbH, Budzar Industries, Inc., Movacolor, and Advanced Auxiliary Equipment, Inc. |

| Segments Covered | By Product Type, By Category, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East and Africa (MEA)North America, Europe, Asia Pacific (APAC), Latin America, Middle East and Africa (MEA) |

| Countries Covered | North America: U.S and Canada Europe: Germany, Italy, Russia, U.K, Spain, France, Rest of Europe APAC: China, Australia, Japan, India, South Korea, South East Asia, Rest of Asia Pacific Latin America: Brazil, Argentina, Chile The Middle East And Africa: South Africa, GCC, Rest of MEA |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Hopper Car Market: Regional Landscape

North America to maintain its dominant position in the global market

North America holds the dominant share in the global hopper car market. This is due to the increasing adoption of hopper cars in the United States. The country contributes nearly 85 percent of share in the regional market. The rail network in the United States is well-developed and employs advanced cargo carriers to maintain the quality and safety of the goods. Also, supporting government initiatives contributed to the early adoption of hopper cars in the country.

Asia Pacific is expected to offer significant opportunities for the expansion of the market over the forecast period. Emerging countries such as China and India have a large network of rail playing a crucial role in cargo transport. Moreover, rapidly expanding chemical, agriculture, food & beverage industries in these countries are expected to increase the demand for hopper cars over the forecast period.

Hopper Car Market: Competitive Landscape

Major market players included in the report are:

- Novatec

- PIOVAN S.p.A.

- Summit Systems

- UK Plastics Machinery Limited

- Maguire Products Inc.

- National Steel Car

- TrinityRail

- The Greenbrier Companies

- American Rail Car Industries

- FreightCar America

- Vertex Railcar Corporation

- ARI Fleet Management. Jenco Controls & Export Limited

- SIMAR GmbH

- Budzar IndustriesInc.

- Movacolor

- Advanced Auxiliary Equipment

The global hopper car market is segmented as follows:

By Product Type

- Covered Hopper Cars

- Open Hopper Cars

By Category

- Automotive

- Chemical Products

- Energy & Coal

- Steel & Mining

- Food & Agriculture

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The hopper car is a self-clearing enclosed railroad freight vehicle with having sideways, fixed roofs, and ends, as well as unloading and loading holes at the roof and bottom. Covered hopper cars are meant to transport dry bulk cargoes, which can range from grain to sand and clay. The cargo is protected from the elements by the cover.

The increased demand for bulk cargo such as fertilizer, grain, and chemicals that are required to be protected from exposure to the weather is also contributing to the expansion of the market.

According to the Zion Market Research report, the global hopper car market worth around 2.1 billion in 2022 and is further expected to grow to around 3.3 billion by 2030.

The global hopper car market is expected to grow rapidly at a CAGR of 5.25% during the forecast period.

North America holds the dominant share in the global hopper car market. This is due to the increasing adoption of hopper cars in the United States. The country contributes nearly 85 percent of the share in the regional market.

Major market players included in the report are Novatec, PIOVAN S.p.A., Summit Systems, UK Plastics Machinery Limited, Maguire Products Inc., National Steel Car, TrinityRail, The Greenbrier Companies, American Rail Car Industries, FreightCar America, Vertex Railcar Corporation, ARI Fleet Management. Jenco Controls & Export Limited, SIMAR GmbH, Budzar Industries, Inc., Movacolor, and Advanced Auxiliary Equipment, Inc.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed