India Aerospace and Defense Market Size, Share, Analysis, Trends, Growth, Forecasts, 2032

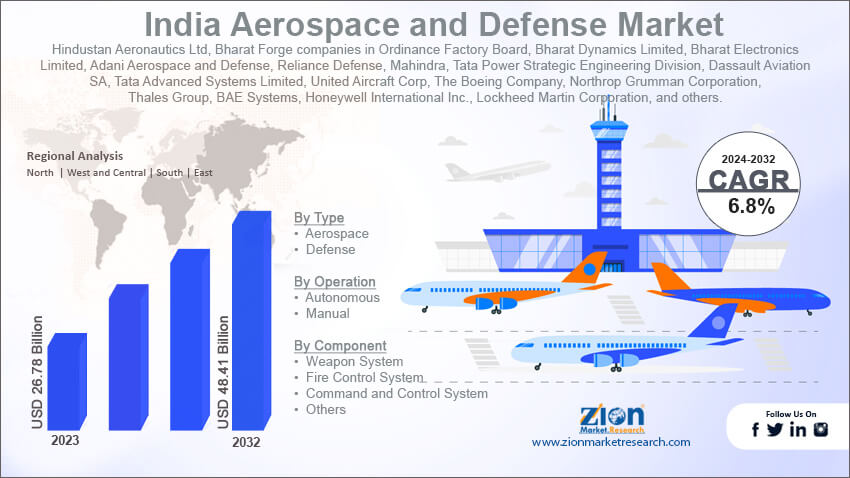

India Aerospace and Defense Market By Type (Aerospace and Defense), By Operation (Autonomous and Manual), By Component (Weapon System, Fire Control System, Command and Control System, and Others), and By Region- Country and State Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

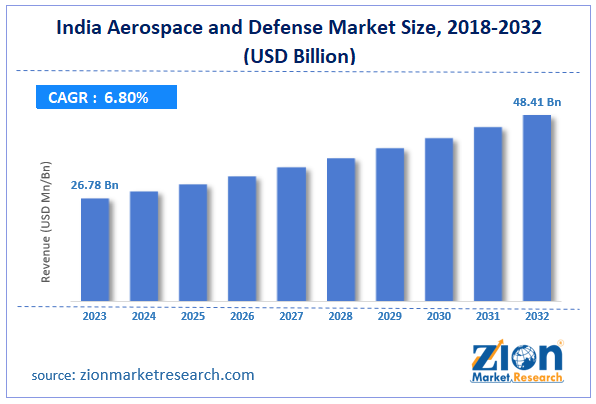

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 26.78 Billion | USD 48.41 Billion | 6.8% | 2023 |

India Aerospace and Defense Industry Prospective:

India's aerospace and defense market size was worth around USD 26.78 billion in 2023 and is predicted to grow to around USD 48.41 billion by 2032, with a compound annual growth rate (CAGR) of roughly 6.8% between 2024 and 2032.

India Aerospace and Defense Market: Overview

The industries that design, develop, construct, and maintain aircraft, satellites, missiles, and military systems are known as the aerospace and defense industries. These sectors are essential to national security, global economic growth, and technological innovation. The aerospace sector supports both military and civilian needs, even though national security and military might be the defense industry's top priorities. Many factors, including the growth in demand for air travel, technical advancements, greater space activities, military modernization, and expanding investment in this economic sector, have an impact on the aerospace and defense business.

Key Insights

- As per the analysis shared by our research analyst, India's aerospace and defense market is estimated to grow annually at a CAGR of around 6.8% over the forecast period (2024-2032).

- In terms of revenue, the India aerospace and defense market size was valued at around USD 26.78 billion in 2023 and is projected to reach USD 48.41 billion by 2032.

- The rising government initiative is expected to propel India aerospace and defense market growth over the projected period.

- Based on the type, the aerospace segment is expected to grow at the highest CAGR over the projected period.

- Based on the components, the weapon system segment is expected to dominate the market during the forecast period.

- Based on the region, North India is expected to dominate the market over the projected period.

Request Free Sample

Request Free Sample

India Aerospace and Defense Market: Growth Drivers

Rising government initiatives and policy support drive market growth

The aerospace and defense industries are among the many sectors where domestic manufacture is encouraged by the Indian government's "Make in India" campaign. The growth of indigenous capabilities has been facilitated by the enormous involvement and collaboration of global aerospace and defense corporations in this program. Furthermore, the DPP encourages the purchase of defense equipment from Indian businesses to support the growth of home defense production and lessen dependency on imports. India's US$ 74.7 billion defense spending in 2024 placed fourth in the world, according to IBEF data. India aims to export defense goods worth US$ 6.02 billion (Rs. 50,000 crore) by 2028–2029, ranking fourth in the world as of 2022. Thus, the aforementioned stats are expected to propel India aerospace and defense market during the projected period.

India Aerospace and Defense Market: Restraints

A complex regulatory environment impedes market growth

India's aircraft and defense industry is heavily regulated, with intricate licensing procedures that frequently cause delays. It can take a while to get the required licenses, permissions, and approvals, which hinders the industry's expansion and slows down project implementation. Furthermore, even though the government's offset policy aims to support domestic manufacturing, its complicated and strict implementation can occasionally operate as a barrier. It compels foreign companies to invest a specific percentage of the contract value in India. Thus, this is expected to impede India's aerospace and defense sector growth over the projected period.

India Aerospace and Defense Market: Opportunities

Rising expansion by key players offers an attractive opportunity for market growth

The growing expansion by the key market players is expected to drive the growth of India aerospace and defense industry during the analysis period. In December 2022, Collins Aerospace, a division of Raytheon Technologies Corp., formally opened its new Global Engineering and Technology Center (GETC) and Collins India Operations Center in Bengaluru as part of a sizable investment to expand its engineering, digital technology, and manufacturing operations in India. The new locations are a part of Raytheon Technologies' long-term expansion plan in India and around the world, which aims to optimize innovation and collaboration to provide cutting-edge solutions for clients and create more STEM-based employment opportunities in the nation.

India Aerospace and Defense Market: Challenges

Inadequate infrastructure poses a major challenge to market expansion

The government is putting a lot of effort into developing MRO (Maintenance, Repair, and Overhaul) infrastructure; however, it is still lacking in comparison to other countries. Because Indian airlines and defense services frequently depend on foreign MRO facilities, this results in greater prices and longer turnaround times. Additionally, India has a dearth of dedicated aerospace parks and Special Economic Zones (SEZs), which limits the expansion of the industry's capacity for exporting and manufacturing.

India Aerospace and Defense Market: Segmentation

India's aerospace and defense industry is segmented based on type, operation, component, and region.

Based on the type, India aerospace and defense market is bifurcated into aerospace and defense. The aerospace segment is expected to grow at the highest CAGR over the projected period. India's aviation market is one of the fastest-growing globally. Demand for airplanes is rising as a result of rising air travel, a growing middle class, and more cheap flights. Consequently, this increases earnings for aerospace producers, encompassing those who create commercial airplanes, their constituent parts, and associated amenities. In addition, Indian airlines are raising their fleet sizes in response to the increasing market demand. The aerospace industry is experiencing tremendous revenue growth due to the large orders that major carriers like IndiGo, Air India, and SpiceJet are making for new aircraft. Thereby driving the market growth.

Based on operation, India aerospace and defense industry is segmented into autonomous and manual.

Based on components, India aerospace and defense market is segmented into weapon system, fire control system, command and control system, and others. The weapon system segment is expected to dominate the market during the forecast period. India's growing defense budget makes it possible to purchase cutting-edge weaponry. The market for weapon systems is significantly influenced by the government's commitment to strengthening national security through significant defense spending. Furthermore, a substantial amount of the defense budget is also devoted to weapon system research and development, or R&D. Modern technologies are being developed as a result of this R&D emphasis, which is also boosting the expansion of the regional defense sector.

India Aerospace and Defense Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | India Aerospace and Defense Market |

| Market Size in 2023 | 26.78 Bn |

| Market Forecast in 2032 | 48.41 Bn |

| Growth Rate | CAGR of 6.80% |

| Number of Pages | 213 |

| Key Companies Covered | Hindustan Aeronautics Ltd, Bharat Forge companies in Ordinance Factory Board, Bharat Dynamics Limited, Bharat Electronics Limited, Adani Aerospace and Defense, Reliance Defense, Mahindra, Tata Power Strategic Engineering Division, Dassault Aviation SA, Tata Advanced Systems Limited, United Aircraft Corp, The Boeing Company, Northrop Grumman Corporation, Thales Group, BAE Systems, Honeywell International Inc., Lockheed Martin Corporation, and others. |

| Segments Covered | By Type, By Component, and By Region |

| Regions Covered in India | North India, West and Central India, South India, and East India |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

India Aerospace And Defense Market: Region Analysis

North India is expected to lead the market over the forecast period

North India is expected to lead the India aerospace and defense market over the forecast period. North India is a strategically important area for defense endeavors because it borders both China and Pakistan. Investments in military stations, monitoring systems, and defense infrastructure are motivated by the need to maintain strong security along these borders. Much of the forces of the Indian Army, including the units of major commands like the Northern Command and Western Command, are based in this region. Supporting military operations requires the availability of cutting-edge aerospace and defense systems. Furthermore, infrastructure development drives the market expansion. It is anticipated that the Uttar Pradesh Defense Industrial Corridor, which is a component of the greater effort to increase defense manufacturing in India, will provide a strong ecosystem for the aerospace and defense sectors in the area. The goal of this corridor is to draw in investments and promote partnerships between businesses in the public and private sectors. Thus, this is expected to drive India aerospace and defense sector.

India Aerospace and Defense Market: Competitive Analysis

India's aerospace and defense market is dominated by players like:

- Hindustan Aeronautics Ltd

- Bharat Forge companies in Ordinance Factory Board

- Bharat Dynamics Limited

- Bharat Electronics Limited

- Adani Aerospace and Defense

- Reliance Defense

- Mahindra

- Tata Power Strategic Engineering Division

- Dassault Aviation SA

- Tata Advanced Systems Limited

- United Aircraft Corp

- The Boeing Company

- Northrop Grumman Corporation

- Thales Group

- BAE Systems

- Honeywell International Inc.

- Lockheed Martin Corporation

India's aerospace and defense market is segmented as follows:

By Type

- Aerospace

- Defense

By Operation

- Autonomous

- Manual

By Component

- Weapon System

- Fire Control System

- Command and Control System

- Others

By Region

- North India

- West and Central India

- South India

- East India

Table Of Content

Methodology

FrequentlyAsked Questions

The industries that design, develop, construct, and maintain aircraft, satellites, missiles, and military systems are known as the aerospace and defense industries. These sectors are essential to national security, global economic growth, and technological innovation. The aerospace sector supports military and civilian needs, even though national security and military might be the defense industry's top priorities.

Several factors, including the growth in demand for air travel, technical advancements, greater space activities, military modernization, and expanding investment in this economic sector, drive the aerospace and defense market in India.

According to the report, India's aerospace and defense market size was worth around USD 26.78 billion in 2023 and is predicted to grow to around USD 48.41 billion by 2032.

India's aerospace and defense market is expected to grow at a CAGR of 6.8% during the forecast period.

India's aerospace and defense market growth is driven by North India. It is currently the nation's highest revenue-generating market due to the rising investment in infrastructure.

India's aerospace and defense market is dominated by players like Hindustan Aeronautics Ltd, Bharat Forge companies in Ordinance Factory Board, Bharat Dynamics Limited, Bharat Electronics Limited, Adani Aerospace and Defense, Reliance Defense, Mahindra, Tata Power Strategic Engineering Division, Dassault Aviation SA, Tata Advanced Systems Limited, United Aircraft Corp, The Boeing Company, Northrop Grumman Corporation, Thales Group, BAE Systems, Honeywell International, Inc. and Lockheed Martin Corporation among others.

India's aerospace and defense market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed