India Agriculture Micronutrients Market Size, Share, Analysis, Trends, Growth, 2032

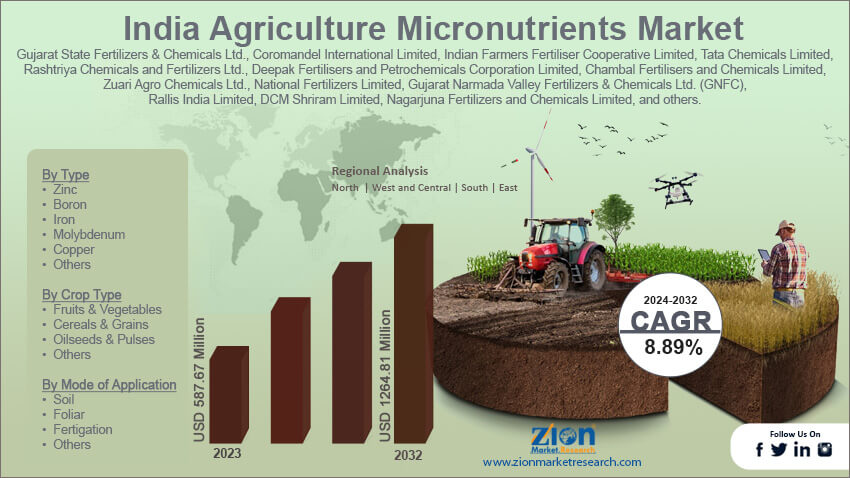

India Agriculture Micronutrients Market By Type (Zinc, Boron, Iron, Molybdenum, Copper, and Others), By Crop Type (Fruits & Vegetables, Cereals & Grains, Oilseeds & Pulses, and Others), By Form (Chelated and Non-Chelated), By Mode of Application (Soil, Foliar, Fertigation, and Others) and By Region- Country and State Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

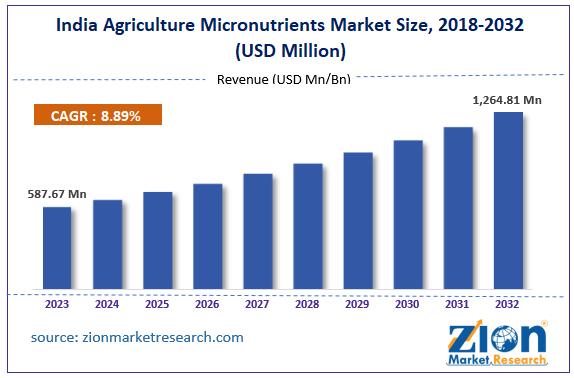

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 587.67 Million | USD 1264.81 Million | 8.89% | 2023 |

India Agriculture Micronutrients Industry Prospective:

India agriculture micronutrients market size was worth around USD 587.67 million in 2023 and is predicted to grow to around USD 1264.81 million by 2032 with a compound annual growth rate (CAGR) of roughly 8.89% between 2024 and 2032.

India Agriculture Micronutrients Market: Overview

Agriculture on farmland Plants need micronutrients, or trace levels of essential elements, to develop, thrive, and stay healthy overall. Micronutrients are the little amounts that plants require, in contrast to macronutrients like potassium, phosphorus, and nitrogen, which are required in trace amounts. In plants, they are not required for the majority of physiological functions, but they are for many. Agriculture uses agricultural micronutrients to compensate for soil deficiencies to ensure optimal crop development and yield. These micronutrients are typically included in the mixture of soil amendments, fertilizers, and foliar sprays. Any combination of these micronutrient deficiencies can lead to low agricultural yields, sick plants, and a decrease in nutrient-dense products.

Key Insights

- As per the analysis shared by our research analyst, India's agriculture micronutrients market is estimated to grow annually at a CAGR of around 8.89% over the forecast period (2024-2032).

- In terms of revenue, the India agriculture micronutrients market size was valued at around USD 587.67 million in 2023 and is projected to reach USD 1264.81 million, by 2032.

- The rising agriculture sector is expected to propel India agriculture micronutrients market growth over the projected period.

- Based on the type, the zinc segment is expected to dominate the market during the forecast period.

- Based on its crop type, the fruits & vegetables segment is expected to hold a significant market share over the forecast period.

- Based on its mode of application, the soil segment is expected to hold the largest market share over the projected period.

- Based on the region, South India is expected to dominate the market over the projected period.

Request Free Sample

Request Free Sample

India Agriculture Micronutrients Market: Growth Drivers

Increasing demand for effective fertilizers drives market growth

Amid increased agricultural activity to fulfill the demands of a growing population, agrochemicals and plant growth regulators are essential for improving crop output. This pattern leads to a rise in the use of plant hormones. Essential parts of fertilizers, micronutrients guarantee balanced nutrient supply for ideal plant growth. The demand for efficient fertilizers rises as a result of changing dietary choices driving the need for resource-intensive agricultural techniques. Grown on 6.66 million hectares, fruit production in India reached 99.07 million metric tons in 2019–20. Since micronutrients are essential for plant growth, the Indian market for agricultural micronutrients has grown dramatically.

India Agriculture Micronutrients Market: Restraints

Rising demand for organic fertilizer impedes market growth

The need for sustainable goods, such as organic fertilizers, has significantly increased in the agriculture industry in recent years. Because of their capacity to nourish plants and improve soil health, these fertilizers—which come in plant-, animal-, and mineral-based forms—have gained popularity. Micronutrient treatments must be carefully managed, even if they improve fertility and water flow. A cautious approach is necessary because overuse can cause imbalances. The growing demand for organic fertilizers could be a hindrance to India's agricultural micronutrient market's expansion.

India Agriculture Micronutrients Market: Opportunities

Rising product launch offers an attractive opportunity for market growth

The increasing product launch is expected to offer a lucrative opportunity to India's agriculture micronutrient industry over the projected period. For instance, in November 2023, a leading innovator in the fields of crop protection and nutrition, Insecticides (India) Limited (IIL), is leading the way in innovation once more. This time, they've unveiled four innovative solutions that are meant to revolutionize modern agriculture: Nakshatra, Supremo SP, Opaque, and Million. IIL underlines its commitment to advancing agricultural innovation, enabling farmers, and advancing the agricultural business by offering these four ground-breaking ideas.

India Agriculture Micronutrients Market: Challenges

High cost and lack of awareness pose a major challenge to market expansion

Micronutrient supplements and fertilizers can be costly for Indian small-scale and marginal farmers, who frequently have limited financial resources. The price of these goods may deter people from using them widely, particularly in rural places with less financial resources. Furthermore, many Indian farmers lack sufficient knowledge about the advantages of micronutrients and their correct application. This ignorance results in improper application or underutilization, which can cause inefficiencies and less-than-ideal crop yields. Therefore, the high cost and lack of awareness among farmers might be posing a major challenge to India agriculture micronutrients sector over the analysis period.

India Agriculture Micronutrients Market: Segmentation

India's Agriculture Micronutrients industry is segmented based on type, crop type, form, mode of application, and region.

Based on the type, India agriculture micronutrient market is bifurcated into zinc, boron, iron, molybdenum, copper, and others. The zinc segment is expected to dominate the market during the forecast period. The segment expansion is due to the growing knowledge of zinc's many roles in plant development and the global shortage of zinc in soils. This is a crucial vitamin that aids in the regulation of gene expression by helping to fold proteins and catalyzing over 100 different enzymes in human metabolism. Patients who suffer from malnutrition, inflammatory bowel disease, alcoholism, and malabsorption problems are more likely to experience zinc insufficiency. Non-specific symptoms of zinc deficiency include growth retardation, nail dystrophy, decreased immunity, diarrhea, baldness, glossitis, and hypogonadism in men. Zinc is the trace element that is most broadly distributed in the body, after iron. Because of this, governments all over the world are trying to increase the amount of agricultural products to lower their deficit. Thereby driving the segment expansion.

Based on crop type, India agriculture micronutrient industry is segmented into fruits & vegetables, cereals & grains, oilseeds & pulses, and others. The fruits & vegetables segment is expected to hold a significant market share over the forecast period. Growing rates of nutrient loss in crops grown for fruits and vegetables are the cause of the segment's expansion. In many rich and developing economies, there is a growing demand for crops based on fruits and vegetables as staples, and these crops are also receiving more fertilizer that contains micronutrients. Fruits and vegetables are now an essential component of every human diet, especially in light of the growing understanding of their nutritional benefits. Fruits and vegetables have become more attractive for export, which has raised output levels globally. This has made it necessary for micronutrient items to employ agricultural inputs effectively to fulfill export quality criteria. Global fruit and vegetable consumption has increased due to consumers' growing health consciousness. In addition, the goal of the world's fruit and vegetable production is to fulfill the increasing demand.

Based on form, India agriculture micronutrient market is segmented into chelated and non-chelated.

Based on the mode of application, India agriculture micronutrient industry is segmented into soil, foliar, fertigation, and others. The soil segment is expected to hold the largest market share over the projected period. The primary reasons for this segment's increasing market share are its easy and affordable application process, as well as its superior micronutrient outcomes compared to alternative treatment techniques. Additionally, the widespread use of traditional agricultural methods in the current farming system, the scarcity of resources, and the slow adoption of advanced fertilizer application techniques worldwide are the main reasons behind farmers from developing economies' growing preference for this method, which will fuel the market's overall growth over the forecast period.

India Agriculture Micronutrients Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | India Agriculture Micronutrients Market |

| Market Size in 2023 | 587.67 Mn |

| Market Forecast in 2032 | 1,264.81 Mn |

| Growth Rate | CAGR of 8.89% |

| Number of Pages | 214 |

| Key Companies Covered | Gujarat State Fertilizers & Chemicals Ltd., Coromandel International Limited, Indian Farmers Fertiliser Cooperative Limited, Tata Chemicals Limited, Rashtriya Chemicals and Fertilizers Ltd., Deepak Fertilisers and Petrochemicals Corporation Limited, Chambal Fertilisers and Chemicals Limited, Zuari Agro Chemicals Ltd., National Fertilizers Limited, Yara Fertilisers India Pvt. Ltd., BASF India Limited, Haifa Chemicals Ltd., UPL Limited, Aries Agro Limited, Nutrient Technologies India Private Limited, Greenstar Fertilizers Limited, Gujarat Narmada Valley Fertilizers & Chemicals Ltd. (GNFC), Rallis India Limited, DCM Shriram Limited, Nagarjuna Fertilizers and Chemicals Limited, and others. |

| Segments Covered | By Type, By Crop Type, By Form, By Mode of Application, and By Region |

| Regions Covered in India | North India, West and Central India, South India, and East India |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

India Agriculture Micronutrients Market: Region Analysis

South India is expected to lead the market over the forecast period

South India is expected to lead the India agriculture micronutrient market over the forecast period. The focus on high-value, diversified crops in South India drives the Indian agriculture micronutrient industry. The need for micronutrients to improve soil fertility and agricultural productivity is increased by the area's emphasis on horticulture, floriculture, and plantation crops. Farmers that prioritize sustainable agriculture see a significant increase in demand for micronutrients, particularly those that are in line with environmentally friendly techniques. As a result, South India plays a pivotal role in determining the dynamics of the country's broader agricultural micronutrients market.

India Agriculture Micronutrients Market: Competitive Analysis

India's agriculture micronutrients market is dominated by players like:'

- Gujarat State Fertilizers & Chemicals Ltd.

- Coromandel International Limited

- Indian Farmers Fertiliser Cooperative Limited

- Tata Chemicals Limited

- Rashtriya Chemicals and Fertilizers Ltd.

- Deepak Fertilisers and Petrochemicals Corporation Limited

- Chambal Fertilisers and Chemicals Limited

- Zuari Agro Chemicals Ltd.

- National Fertilizers Limited

- Yara Fertilisers India Pvt. Ltd.

- BASF India Limited

- Haifa Chemicals Ltd.

- UPL Limited

- Aries Agro Limited

- Nutrient Technologies India Private Limited

- Greenstar Fertilizers Limited

- Gujarat Narmada Valley Fertilizers & Chemicals Ltd. (GNFC)

- Rallis India Limited

- DCM Shriram Limited

- Nagarjuna Fertilizers and Chemicals Limited

India's agriculture micronutrients market is segmented as follows:

By Type

- Zinc

- Boron

- Iron

- Molybdenum

- Copper

- Others

By Crop Type

- Fruits & Vegetables

- Cereals & Grains

- Oilseeds & Pulses

- Others

By Form

- Chelated

- Non-Chelated

By Mode of Application

- Soil

- Foliar

- Fertigation

- Others

By Region

- North India

- West and Central India

- South India

- East India

Table Of Content

Methodology

FrequentlyAsked Questions

Agriculture on farmland Plants need micronutrients, or trace levels of essential elements, to develop, thrive, and stay healthy overall. Micronutrients are the little amounts that plants require, in contrast to macronutrients like potassium, phosphorus, and nitrogen, which are required in trace amounts. In plants, they are not required for the majority of physiological functions, but they are for many. Agriculture uses agricultural micronutrients to compensate for soil deficiencies to ensure optimal crop development and yield. These micronutrients are typically included in the mixture of soil amendments, fertilizers, and foliar sprays. Any combination of these micronutrient deficiencies can lead to low agricultural yields, sick plants, and a decrease in nutrient-dense products.

Some of the key drivers driving the India agriculture micronutrients market are rising agricultural technology improvements, growing awareness of micronutrient deficits in plants, and expanding benefits of micronutrients for promoting chlorophyll synthesis.

According to the report, India's agriculture micronutrients market size was worth around USD 587.67 million in 2023 and is predicted to grow to around USD 1264.81 million by 2032.

India's agriculture micronutrients market is expected to grow at a CAGR of 8.89% during the forecast period.

India's agriculture micronutrients market growth is driven by North India. It is currently the nation's highest revenue-generating market due to the rising demand for micronutrients.

India's agriculture micronutrients market is dominated by players like Gujarat State Fertilizers & Chemicals Ltd., Coromandel International Limited, Indian Farmers Fertiliser Cooperative Limited, Tata Chemicals Limited, Rashtriya Chemicals and Fertilizers Ltd., Deepak Fertilisers and Petrochemicals Corporation Limited, Chambal Fertilisers and Chemicals Limited, Zuari Agro Chemicals Ltd., National Fertilizers Limited, Yara Fertilisers India Pvt. Ltd., BASF India Limited, Haifa Chemicals Ltd., UPL Limited, Aries Agro Limited, Nutrient Technologies India Private Limited, Greenstar Fertilizers Limited, Gujarat Narmada Valley Fertilizers & Chemicals Ltd. (GNFC), Rallis India Limited, DCM Shriram Limited and Nagarjuna Fertilizers and Chemicals Limited among others.

India's agriculture micronutrients market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed